Where's the Real Population "Disaster in the Making"? Pakistan or the West?

Multiple western newspaper headlines are screaming of a "disaster in the making" in Pakistan after the latest population census in the country. These headlines beg the following questions: Is Pakistan's total fertility rate of 2.62 children per woman a bigger disaster than the sub-replacement level of less than 2 children per woman in the West? Are the rapidly aging western societies and declining working population less of a disaster than Pakistan with its younger population and a growing percentage of it in the work force? To answer these questions, let's consider the following quote:

“So where will the children of the future come from? Increasingly they will come from people who are at odds with the modern world. Such a trend, if sustained, could drive human culture off its current market-driven, individualistic, modernist course, gradually creating an anti-market culture dominated by fundamentalism - a new dark ages.” ― Philip Longman, The Empty Cradle: How Falling Birthrates Threaten World Prosperity and What to Do About It

Fear of Population Bomb:

The above quote captures the true essence of the West's racist fears about what some of them call the "population bomb": East will dominate the West economically and politically for centuries if the growing colored populations of developing Asia and Africa turn the West's former colonies into younger and more dynamic nations with rising education and better living standards.

Much of the developed world has already fallen below the "replacement" fertility rate of 2.1. Fertility rates impact economic dynamism, cultural stability and political and military power in the long run.

Pakistan Population Growth:

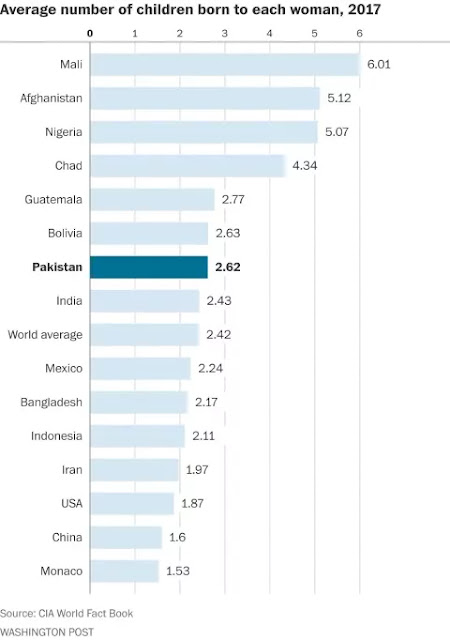

Pakistani women's fertility rates have declined significantly from about 4.6 in 2000 to 2.62 babies per woman in 2017, a drop of 43% in 17 years. It is being driven drown by the same forces that have worked in the developed world in the last century: increasing urbanization, growing incomes, greater participation in the workforce and rising education. Pakistan now ranks 65 among 108 countries with TFR of 2.1 (replacement rate) or higher.

The latest Census 2017 results show that Pakistan's population growth rate has declined to 2.34% between 1998 and 2017, down from 2.61% (from 1981 to 1998) and 3.4% (from 1961-81). Life expectancy has increased from about 62 years in 1998 to 66.5 years now. The total fertility rate has declined from 4.6 children per woman in 1998 to to 2.62 children per woman in 2017. At the same time, Pakistan's labor force is growing at a rate of 3.6% a year, faster than the 2.34% overall population growth. Given Pakistan's human capital growth in recent years, it is a welcome situation that is expected to produce significant demographic dividend for the country.

Labor Force Expansion:

Countries With Declining Populations:

115 countries, including China (1.55), Hong Kong (1.17), Taiwan (1.11) and Singapore (0.8) are well below the replacement level of 2.1 TFR. Their populations will sharply decline in later part of the 21st century along with the economic growth rates.

United States is currently at 1.87 TFR, below the replacement rate but still better than China and other developed nations mainly due to immigration. "We don't take a stance one way or the other on whether it's good or bad," said Mark Mather, demographer with the Population Reference Bureau. Small year-to-year changes like those experienced by the United States don't make much difference, he noted. But a sharp or sustained drop over a decade or more "will certainly have long-term consequences for society," he told Utah-based Desert News National.

Japan (1.4 TFR) and Russia (1.6 TFR) are experiencing among the sharpest population declines in the world. One manifestation in Japan is the data on diaper sales: Unicharm Corp., a major diaper maker, has seen sales of adult diapers outpace infant diapers since 2013, according to New York Times.

The Russian population grew from about 100 million in 1950 to almost149 million by the early 1990s. Since then, the Russian population has declined, and official reports put it at around 144 million, according to Yale Global Online.

Reversing Trends:

Countries, most recently China, are finding that it is far more difficult to raise low fertility than it is reduce high fertility. The countries in the European Union are offering a variety of incentives, including birth starter kits to assist new parents in Finland, cheap childcare centers and liberal parental leave in France and a year of paid maternity leave in Germany, according to Desert News. But the fertility rates in these countries remain below replacement levels.

Summary:

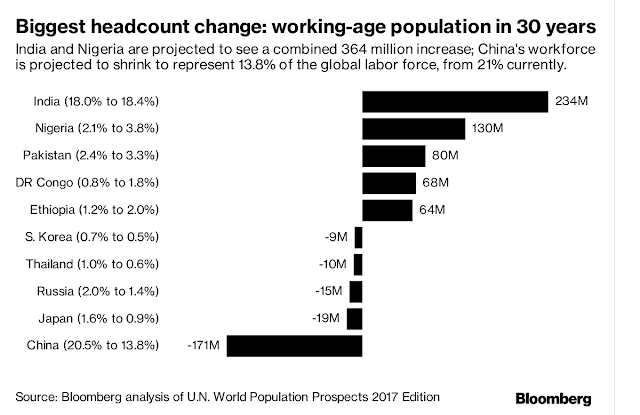

Overzealous Pakistani birth control advocates need to understand what countries with sub-replacement fertility rates are now seeing: Low birth rates lead to diminished economic growth. "Fewer kids mean fewer tax-paying workers to support public pension programs. An "older society", noted the late Nobel laureate economist Gary Becker, is "less dynamic, creative and entrepreneurial." Pakistan's labor force growth is forecast to be the 3rd biggest in the world after India's and Nigeria's, according to UN World Population Prospects 2017. Rising working age population and growing workforce participation of both men and women in developing nations like Pakistan will boost domestic savings and investment, according to Global Development Horizons (GDH) report. Escaping the low savings low investment trap will help accelerate the lagging GDP growth rate in Pakistan as will increased foreign investment such as Chinese investment in China-Pakistan Economic Corridor over the next several decades.

Here's a discussion on this and other subjects:

https://youtu.be/ucopTLFQdKY

Related Links:

Haq's Musings

Pakistan's Labor Force Expansion on Saving, Investments and GDP Growth

Pakistan's Population Growth: Blessing or Curse?

Pakistan's Expected Demographic Dividend

World Bank Report on Job Growth in Pakistan

Underinvestment Hurting Pakistan's GDP Growth

China-Pakistan Economic Corridor

Musharraf Accelerated Growth of Pakistan's Financial and Human Capital

Working Women Seeding a Silent Revolution in Pakistan

“So where will the children of the future come from? Increasingly they will come from people who are at odds with the modern world. Such a trend, if sustained, could drive human culture off its current market-driven, individualistic, modernist course, gradually creating an anti-market culture dominated by fundamentalism - a new dark ages.” ― Philip Longman, The Empty Cradle: How Falling Birthrates Threaten World Prosperity and What to Do About It

Fear of Population Bomb:

The above quote captures the true essence of the West's racist fears about what some of them call the "population bomb": East will dominate the West economically and politically for centuries if the growing colored populations of developing Asia and Africa turn the West's former colonies into younger and more dynamic nations with rising education and better living standards.

Much of the developed world has already fallen below the "replacement" fertility rate of 2.1. Fertility rates impact economic dynamism, cultural stability and political and military power in the long run.

|

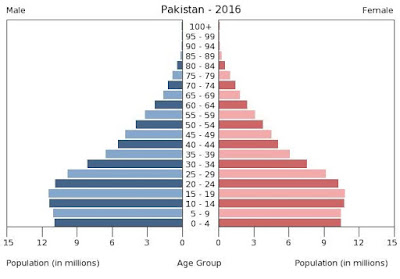

| Pakistan Population Pyramid by Age/Gender. Source: Theodora via CIA |

Pakistan Population Growth:

Pakistani women's fertility rates have declined significantly from about 4.6 in 2000 to 2.62 babies per woman in 2017, a drop of 43% in 17 years. It is being driven drown by the same forces that have worked in the developed world in the last century: increasing urbanization, growing incomes, greater participation in the workforce and rising education. Pakistan now ranks 65 among 108 countries with TFR of 2.1 (replacement rate) or higher.

The latest Census 2017 results show that Pakistan's population growth rate has declined to 2.34% between 1998 and 2017, down from 2.61% (from 1981 to 1998) and 3.4% (from 1961-81). Life expectancy has increased from about 62 years in 1998 to 66.5 years now. The total fertility rate has declined from 4.6 children per woman in 1998 to to 2.62 children per woman in 2017. At the same time, Pakistan's labor force is growing at a rate of 3.6% a year, faster than the 2.34% overall population growth. Given Pakistan's human capital growth in recent years, it is a welcome situation that is expected to produce significant demographic dividend for the country.

Labor Force Expansion:

Pakistan's labor force expansion is the 3rd biggest in the world after India and Nigeria, according to UN World Population Prospects 2017. Rising working age population and growing workforce participation of both men and women in developing nations like Pakistan will boost domestic savings and investments, according to Global Development Horizons (GDH) report. Escaping the low savings low investment trap will help accelerate the lagging GDP growth rate in Pakistan, as will increased foreign investment such as the Chinese investment in China-Pakistan Economic Corridor. Increased savings and investments will not only enlarge the nation's tax base but also help create more jobs for the expected new entrants into the work force as it did in 2000-2010, according to a World Report titled "More and Better Jobs in South Asia".

Pakistan's working age population in 15-64 years age bracket is expected to increase by 27.5 million people to 147.1 million in 10 years, according to Bloomberg News' analysis of data reported in UN World Population Prospects 2017. Pakistan's increase of 27.5 million is the third largest after India's 115.9 million and Nigeria's 34.2 million increase in working age population of 15-64 years old. China's working age population in 15-64 years age group will decline by 21 million in the next 10 years.

Pakistan's labor force growth will continue by adding 80 million workers n 30 years' time, third only to India's 234 million and Nigeria's 130 million additional workers in 15-64 years age group. China's work force will decline by 171 million workers in this time period.

Savings, Investment and GDP Growth:

Currently, about a third of Pakistan's population is below the age of 15, dependent on working age adults. This high ratio of dependent population results in low savings, low investment and consequent slower economic growth and sub-par socio-economic development.

Pakistan's national savings was about 10% of GDP in 1960s. It increased to above 15% in 2000s in Musharraf years, but declined afterwards. It is well below the savings rates in South Asia region with India's 30%, Bangladesh's 28%, and Sri Lanka's 24.5%.

Higher levels of inequality in India, Bangladesh and Sri Lanka account at least partially for their higher savings rates than Pakistan's because people in higher income groups tend to save more of what they earn. But the other probably more important reason for Pakistan's lower savings rate is the larger percentage of children under the age of 15 who do not work and depend on their parents' incomes.

Rising working age population and growing workforce participation of both men and women in Pakistan will boost domestic savings and investments, just as it has in other South Asian nations.

|

| Pakistan's Total Fertility Rate 2.62 Children Per Woman. Source: Washington Post |

|

| Source: World Bank Report "More and Better Jobs in South Asia" |

Pakistan's working age population in 15-64 years age bracket is expected to increase by 27.5 million people to 147.1 million in 10 years, according to Bloomberg News' analysis of data reported in UN World Population Prospects 2017. Pakistan's increase of 27.5 million is the third largest after India's 115.9 million and Nigeria's 34.2 million increase in working age population of 15-64 years old. China's working age population in 15-64 years age group will decline by 21 million in the next 10 years.

|

| Source: Bloomberg |

Pakistan's labor force growth will continue by adding 80 million workers n 30 years' time, third only to India's 234 million and Nigeria's 130 million additional workers in 15-64 years age group. China's work force will decline by 171 million workers in this time period.

|

| Source: Bloomberg |

Savings, Investment and GDP Growth:

Currently, about a third of Pakistan's population is below the age of 15, dependent on working age adults. This high ratio of dependent population results in low savings, low investment and consequent slower economic growth and sub-par socio-economic development.

|

| Source: State Bank of Pakistan |

Pakistan's national savings was about 10% of GDP in 1960s. It increased to above 15% in 2000s in Musharraf years, but declined afterwards. It is well below the savings rates in South Asia region with India's 30%, Bangladesh's 28%, and Sri Lanka's 24.5%.

|

| Source: State Bank of Pakistan |

Higher levels of inequality in India, Bangladesh and Sri Lanka account at least partially for their higher savings rates than Pakistan's because people in higher income groups tend to save more of what they earn. But the other probably more important reason for Pakistan's lower savings rate is the larger percentage of children under the age of 15 who do not work and depend on their parents' incomes.

Rising working age population and growing workforce participation of both men and women in Pakistan will boost domestic savings and investments, just as it has in other South Asian nations.

|

| Projected World Population. Source: Nikkei |

Countries With Declining Populations:

115 countries, including China (1.55), Hong Kong (1.17), Taiwan (1.11) and Singapore (0.8) are well below the replacement level of 2.1 TFR. Their populations will sharply decline in later part of the 21st century along with the economic growth rates.

United States is currently at 1.87 TFR, below the replacement rate but still better than China and other developed nations mainly due to immigration. "We don't take a stance one way or the other on whether it's good or bad," said Mark Mather, demographer with the Population Reference Bureau. Small year-to-year changes like those experienced by the United States don't make much difference, he noted. But a sharp or sustained drop over a decade or more "will certainly have long-term consequences for society," he told Utah-based Desert News National.

Japan (1.4 TFR) and Russia (1.6 TFR) are experiencing among the sharpest population declines in the world. One manifestation in Japan is the data on diaper sales: Unicharm Corp., a major diaper maker, has seen sales of adult diapers outpace infant diapers since 2013, according to New York Times.

|

| Median Age Map: Africa in teens, Pakistan in 20s, China, South America and US in 30s, Europe, Canada and Japan in 40s. |

The Russian population grew from about 100 million in 1950 to almost149 million by the early 1990s. Since then, the Russian population has declined, and official reports put it at around 144 million, according to Yale Global Online.

|

| Lancet Population Projection For Top 5 Countries |

Reversing Trends:

Countries, most recently China, are finding that it is far more difficult to raise low fertility than it is reduce high fertility. The countries in the European Union are offering a variety of incentives, including birth starter kits to assist new parents in Finland, cheap childcare centers and liberal parental leave in France and a year of paid maternity leave in Germany, according to Desert News. But the fertility rates in these countries remain below replacement levels.

Summary:

Overzealous Pakistani birth control advocates need to understand what countries with sub-replacement fertility rates are now seeing: Low birth rates lead to diminished economic growth. "Fewer kids mean fewer tax-paying workers to support public pension programs. An "older society", noted the late Nobel laureate economist Gary Becker, is "less dynamic, creative and entrepreneurial." Pakistan's labor force growth is forecast to be the 3rd biggest in the world after India's and Nigeria's, according to UN World Population Prospects 2017. Rising working age population and growing workforce participation of both men and women in developing nations like Pakistan will boost domestic savings and investment, according to Global Development Horizons (GDH) report. Escaping the low savings low investment trap will help accelerate the lagging GDP growth rate in Pakistan as will increased foreign investment such as Chinese investment in China-Pakistan Economic Corridor over the next several decades.

Here's a discussion on this and other subjects:

https://youtu.be/ucopTLFQdKY

Related Links:

Haq's Musings

Pakistan's Labor Force Expansion on Saving, Investments and GDP Growth

Pakistan's Population Growth: Blessing or Curse?

Pakistan's Expected Demographic Dividend

World Bank Report on Job Growth in Pakistan

Underinvestment Hurting Pakistan's GDP Growth

China-Pakistan Economic Corridor

Musharraf Accelerated Growth of Pakistan's Financial and Human Capital

Working Women Seeding a Silent Revolution in Pakistan

Comments

Some estimates like the ones from the World Bank and Population Research Bureau (PRB) are as high as 3.6.

Now the CIA estimated Pakistan's population at 201,995,540 as of July 2016.

That's really close to the 207 million Census 2017 population figure.

So I think the CIA pyramid is a pretty good starting point for TFR estimation.

It requires some work to figure out a reasonable TFR estimate using raw data from population pyramid.

Here's a rough calculation of total fertility rate in Pakistan that I have done:

Population of Women 15-50 years: 50 million

girls 15-19 10 million

women 20-24 10 million

women 25-29 9 million

women 30-34 7 million

women 35-39 5 million

women 40-44 4 million

women 45-49 4 million

Median age in the country: 23.4 years .... 104 million below this age

Let's assume these 104 million are children of 50 million women 15-50 years. Let's also assume 20 million of these women will have another 1.5 children per woman to add another 30 million children

So it's 134 million children among 50 million women

It works out to total fertility rate of 2.68 children per woman.

Based on data from https://www.cia.gov/library/publications/the-world-factbook/graphic...

and https://theodora.com/wfbcurrent/pakistan/pakistan_people.html

Half of India's population are millennials, under the age of 25 whereas two-thirds of the country's population is below the age of 35.

India's workforce is expected to increase to a billion people between the ages of 16 and 54.

The workforce is expected to derive from North India where Uttar Pradesh has a fertility rate of nearly 3 whilst its neighbouring state, Bihar boasts a fertility rate of 3.3. Taking into account Bihar's already 100 million population, the state is expected to contribute generously to the establishment of a leading workforce.

India's current demographic transition is occurring on a large scale.

Compared to China's generation mainly in their 50's who have removed their country from poverty to middle-status income, India's population in their 20's are expected to do the same.

Similarly, South Africa's increasing workforce have been trained and prepared for the workplace by Workforce Holdings this year. Independent Online reported in March that diversified services company, Workforce Holdings have trained nearly 15 000 individuals in preparation for the workplace.

The group provides a number of work-related services including temporary as well as permanent recruitment. 1 100 permanent staff are employed by Workforce Holdings and the company has 32 000 temporary contractors weekly.

Workforce Holdings is also listed on the AltX board of the JSE.

https://www.iol.co.za/business-report/india-may-soon-knock-out-chinas-workforce-11135871

Raghuram Rajan flags India's biggest worry that could cost Modi a win in 2019 elections: Slow Job Growth

http://economictimes.indiatimes.com/news/economy/policy/raghuram-rajan-flags-indias-biggest-worry-that-could-cost-modi-a-win-in-2019-elections/articleshow/60434472.cms

"Remember that we have what we call the population dividend. A million new people entering the labor force every month," Rajan said. "If we don’t provide these jobs that are required, you have a million dissatisfied entrants. And that could create a lot of social mischief."

Rajan is right in this aspect. India will have the world’s biggest labor force by 2027 and the millennial generation is crucial to anchor one of the fastest paces of economic growth. However, fresh employment opp ..

Under Modi, just over 10,000 jobs a month are being created instead, according to government figures from 2015.

Read more at:

http://economictimes.indiatimes.com/articleshow/60434472.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

https://www.samaa.tv/economy/2017/09/govt-not-going-imf-bailout-finance-division-spokesman/

The spokesman of the Finance Division gave following comments in response to the report:

The fact that Pakistan’s economic indicators are positive has been acknowledged internationally. Recently, the Asian Development Bank (ADB) stated that Pakistan enjoyed growth despite trade contraction.

The external sector which was under strain in the last two years due to falling exports and declining remittances has now started showing positive and impressive growth both in exports and remittances.

In August 2017, exports have witnessed a growth of 12.89 percent over the same period of 2016, while over previous month the exports are higher by 14.41 percent and imports are only 2.42 percent and during July-August, FY 2018 exports have registered a growth of 11.80 percent.

Similarly, workers’ remittances have shown a growth of 13.18% during July-August, FY 2018 and on month on month basis higher by 26.8 percent in August 2017.

These all bode well that pressure on current account will ease, going forward. The growth in FDI is also on upward trajectory. During July 2017, FDI posted a stellar growth of 162.8 percent.

With regard to taxation, it is to be noted that the share of direct taxes in total taxes has increased over the years.

In 1990-91 the direct taxes were just around 20% of total taxes, rose to 31.1 percent in 2004-05, 38.2 percent in 2012-13 and 39.1 percent in 2015-16.

In FY 2016-17 the share of direct taxes reached 40% and it has become the single largest tax collected by FBR.

The government is focused on further increasing the share of direct taxes through various policy and administrative reforms including broadening of tax base.

Substantial progress has been made to bring potential taxpayers in the tax net during the last four years. As a result of these efforts the number of income tax return filers which was around 766,000 for the tax year 2012 has risen to 1.26 million in the tax year 2016 and would further increase in coming years.

The reforms program has started paying dividends in shape of higher tax revenues, an efficient, modern, transparent and taxpayers’ friendly revenue organization.

The revenue collection has witnessed a substantial increase during last four years. The net collection increased from Rs 1,946 billion in 2012-13 to Rs 3,362 billion in FY 2016-17, registering an overall growth of around 73%.

In absolute terms revenue collection has been increased by Rs 1.4 trillion. The tax-GDP ratio of the country has reached 12.5 percent in FY 2016-17.

With regard to debt, the claim that PML(N) government borrowed record Rs 10.8 trillion is incorrect and based on incorrect projections. The actual increase in present Government’s 4 year tenure is around Rs 6.1 trillion.

Even if the year 2018 is added as projected, the total debt increase in 5 years is expected to remain around Rs 7.5 trillion until 2018. The statement is only intended to mislead the general public by propagating increase in total debt by Rs 10.8 trillion by the current government, which is based on mere projections and may include PSE debt and other external debt and liabilities as well, which are not part of total government debt.

Moreover, the contention of large borrowing from external sources is incorrect. Out of total debt, external debt proportion fell from 21.4 percent of GDP in 2013 to 20.6 percent of GDP in 2017. Against the total external debt, the largest component is multilateral and bilateral concessional debt, which constitutes around 85 percent.

External debt sustainability has increased manifold during the tenure of present government as recent debt sustainability analysis shows that external debt would remain on a downward trend over the medium term and staying well below the risk assessment benchmarks.

http://www.firstpost.com/business/indias-consumption-story-set-to-end-due-to-low-jobs-growth-investment-warns-ambit-4032625.html

The ongoing consumption demand that began in fiscal 2012 is unsustainable given the poor employment growth as private sector investments still remains a far cry, and this growth story may get hard stop soooner than later, warned a brokerage in a report.

According to Ambit Capital, despite the slowdown in income and employment growth between FY12 and FY17, private consumption continued to grow at a rapid pace, especially in categories like FMCG and passenger vehicles "showing resilience".

As per the brokerage, the rise of consumption growth over FY12 to FY17 has been driven by higher retail credit.

"As corporate credit demand waned over 2011-12 to 2106-17, both NBFCs and banks pushed retail credit aggressively. The retail credit-GDP ratio rose from 13 percent to 16 percent in 2016-17," Ambit said.

However, it noted the "current bout of consumption growth appears unsustainable mainly because consumption boom has uniquely been accompanied by a contraction in the investment-GDP ratio" to 7 percent during FY12 to FY17, while the ratio for consumption-GDP is 3 percent.

"Cross-country evidence suggests that only consumption booms that are accompanied by an increase in investments tend to be sustainable as this is a tangible proof of jobs being created and/or efficiency improving," it said where the averages of these have been 4 percent each.

The report also noted that the current retail credit-funded consumption binge is likely to experience a "hard stop" sooner than later on basis of various trends, including a plunge in consumer confidence to a four-year low during the first quarter of the current fiscal.

Besides, households' savings ratio at an 18-year low and retail NPA problems have begun to emerge particularly in the housing finance segment, are also factors which could effect retail credit-funded consumption, Ambit said.

By Dr. Selim Raihan, Professor, Department of Economics, University of Dhaka, Bangladesh, and Executive Director, South Asian Network on Economic Modeling (SANEM).

http://www.thedailystar.net/opinion/economics/are-we-entering-jobless-growth-phase-south-asia-1459387

The relationship between economic growth and employment is an important issue in economics discourse. Promotion of inclusive growth also requires economic growth processes to be employment friendly. The measure that captures the employment effect of economic growth is the "employment elasticity" of economic growth, which is the ratio of percentage change in employment to the percentage change in real gross domestic product (GDP).

We have calculated the employment elasticity with respect to the change in real GDP for the South Asian countries for three different periods from 2001 to 2015. There are mixed patterns among the South Asian countries. During 2001 and 2005, Maldives had the largest employment elasticities (1.39) and Sri Lanka had the lowest one (0.08). India, with a share of 75 percent of the total population in South Asia, had the employment elasticity of only 0.38, one of the lowest in South Asia. Two other large countries, Pakistan and Bangladesh, had employment elasticities of 0.70 and 0.77 respectively.

For the period of 2006-2010, India experienced a drastic fall in employment elasticity to only 0.03 despite the fact that the average GDP growth rate of India increased from 6.6 percent (2001-2005) to more than 8 percent (2006-2010). Over these periods, Bangladesh also had a similar experience where employment elasticity declined from 0.77 to 0.4 in the wake of a rising average GDP growth rate from 5 to 6 percent. While Afghanistan, Maldives, and Nepal also experienced a decline, Pakistan and Sri Lanka could increase the elasticities.

Over the recent period between 2011 and 2015, Bangladesh experienced a further fall in the employment elasticity to 0.28, while India's improvement is meagre (from 0.03 to only 0.09). Despite the slower economic growth rates during this period, Afghanistan, Maldives, Nepal, and Pakistan could increase their employment elasticities. Sri Lanka had a further fall in employment elasticity to only 0.14. During this period, India had the least employment elasticity among all South Asian countries.

The aforementioned analysis points to the concern that two major South Asian countries, India and Bangladesh, experienced a substantial reduction in employment elasticities throughout the periods of high economic growth. While during 2001 and 2005, the annual average job creation in Bangladesh and India were 1.6 million and 11.3 million respectively, in 2011-2015, such numbers declined to 1 million and 3.2 million for Bangladesh and India respectively. Most of the other South Asian countries experienced either volatile, or slow or stagnant economic growth, and therefore, despite a rise in employment elasticities, the actual employment generation in these countries had not been substantial. It is also important to mention that while SDG 8 talks about ensuring "decent" jobs for all, South Asian countries are seriously lagging far behind. In most of the South Asian countries, there are persistent employment challenges such as lack of economic diversification, poor working conditions, low productivity and a high degree of informality. This is reflected by the fact that among the top five countries in the world with very high proportion of informal employment in total employment, four are from South Asia (Bangladesh, India, Nepal, and Pakistan).

http://www.independent.co.uk/news/uk/politics/not-his-finest-hour-the-dark-side-of-winston-churchill-2118317.html

Many of his colleagues thought Churchill was driven by a deep loathing of democracy for anyone other than the British and a tiny clique of supposedly superior races. This was clearest in his attitude to India. When Mahatma Gandhi launched his campaign of peaceful resistance, Churchill raged that he "ought to be lain bound hand and foot at the gates of Delhi, and then trampled on by an enormous elephant with the new Viceroy seated on its back." As the resistance swelled, he announced: "I hate Indians. They are a beastly people with a beastly religion." This hatred killed. To give just one, major, example, in 1943 a famine broke out in Bengal, caused – as the Nobel Prize-winning economist Amartya Sen has proved – by the imperial policies of the British. Up to 3 million people starved to death while British officials begged Churchill to direct food supplies to the region. He bluntly refused. He raged that it was their own fault for "breeding like rabbits". At other times, he said the plague was "merrily" culling the population.

Skeletal, half-dead people were streaming into the cities and dying on the streets, but Churchill – to the astonishment of his staff – had only jeers for them. This rather undermines the claims that Churchill's imperialism was motivated only by an altruistic desire to elevate the putatively lower races.

Hussein Onyango Obama is unusual among Churchill's victims only in one respect: his story has been rescued from the slipstream of history, because his grandson ended up as President of the US. Churchill believed that Kenya's fertile highlands should be the preserve of the white settlers, and approved the clearing out of the local "blackamoors". He saw the local Kikuyu as "brutish children". When they rebelled under Churchill's post-war premiership, some 150,000 of them were forced at gunpoint into detention camps – later dubbed "Britain's gulag" by Pulitzer-prize winning historian, Professor Caroline Elkins. She studied the detention camps for five years for her remarkable book Britain's Gulag: The Brutal End of Empire in Kenya, explains the tactics adopted under Churchill to crush the local drive for independence. "Electric shock was widely used, as well as cigarettes and fire," she writes. "The screening teams whipped, shot, burned, and mutilated Mau Mau suspects." Hussein Onyango Obama never truly recovered from the torture he endured.

https://www.bloomberg.com/news/articles/2017-09-24/-no-need-to-panic-says-india-s-jaitley-as-firms-defer-spending

Companies are going to be ‘hard nosed’ about spending: L&T CFO

Economy decelerated to 5.7% last quarter, slowest since 2014

Asia’s third-largest economy expanded at the slowest pace in three years in the quarter ended June 30 as Prime Minister Narendra Modi’s move to ban 86 percent of the nation’s cash and the country’s biggest tax reform disrupted businesses. Meanwhile loan growth is languishing near the lowest level since 1992 as companies struggling with bad debt and idle capacity await evidence of a pick up in demand before they buy machinery or hire more workers.

“Private sector is going to be hard nosed when it comes to committing investment,” Larsen’s Shankar Raman said in an interview at the sidelines of the forum on Friday. “We have already committed investment and have not seen returns flow through, so no board in their right mind will like to sanction further investment, unless there is a viable business plan around it.”

Indian factories were running at about 74 percent of capacity in October-December, business sentiment in manufacturing worsened in the April-June period and consumer confidence dipped in June. The Nikkei India Composite PMI Output Index contracted for a second month in August, a report showed earlier this month.

"We have to push for more reforms. We have to set our house in order," Niti Aayog’s Kant said at the forum. “Government alone cannot create infrastructure. Private sector participation is a must.”

The government’s revenue may be threatened in the coming months by the new goods and services tax, implemented July 1. The reform -- one of India’s biggest since the economy opened to foreigners in 1991 -- was a win for Jaitley and promises to unite India’s 1.3 billion people into a massive common market.

However, early hiccups include confusion about the method of filing receipts and the multi-layered tax structure, which contrasts with a single rate in most countries. Businessmen are also claiming hefty tax credits, which could drain government finances.

"I am concerned that after GST and cash ban, which were seen as reforms by investors, India is now seen to be slipping fiscally" said Priyanka Kishore, lead Asia analyst at Oxford Economics, Singapore.

To read more about the impact of GST on companies, click here

Any deterioration in public finances risks the wrath of rating companies such as S&P Global Ratings, which last week downgraded China for the first time since 1999 citing soaring debt. India carries the lowest investment grade rating and a cut to junk status could force some investors to dispose their Indian assets.

"How do you maintain the balancing act between continuing to spend in an economy, continue to maintain your banks and support them, and how do you maintain standard of fiscal prudence?" Jaitley said. "And this is the challenge we are facing."

Jaitley also needs funds to inject fresh capital into India’s struggling banks. The lenders are sitting on $191 billion of souring debt. Under-provisioned banks are also unwilling to lend more, which means investment by private companies may shrink this year.

Jaitley has said he expected strong banks to take over weaker ones especially in the state-run sector. Earlier this year, the government gave the Reserve Bank of India greater powers to go after defaulters and recover loans through a new bankruptcy code.

"We are looking at both consolidation and strengthening," Jaitley said, without providing a timeline.

http://opinion.inquirer.net/107391/reviving-indias-economy

In the second quarter of 2017, India’s growth rate fell to 5.7 percent. It is now tied with Pakistan — behind China, Malaysia, and the Philippines — on the list of major economies for which The Economist provides basic economic data. Neighboring Bangladesh, which is not on that list, is now growing at over 7 percent per annum (and Bangladesh’s per capita income now exceeds Pakistan’s).

Given the Indian economy’s massive size and extensive global linkages, its growth slowdown is a source of serious concern both domestically and around the world. But it is not too late for India to reverse the trend. The key is to carefully craft policies that address both short- and long-term challenges.

In the short term, policymakers must address declining demand for Indian products among domestic consumers and in export markets. All signs point to falling consumer and business spending. India’s index of industrial production only grew by a meager 1.2 percent in July, compared to 4.5 percent a year earlier. Output of consumer durables fell by 1.3 percent; a year earlier, it grew by 0.2 percent.

Meanwhile, annual export growth has fallen in recent years to just 3 percent, compared to 17.8 percent in 2003-2008, India’s rapid-growth phase. This is partly a result of a stronger rupee, which has raised the price of Indian goods in foreign markets.

But there is another potential driver of the sharp rise in imports: people may be over-invoicing, in order to shift money abroad. This could indicate that big traders expect a

correction in the rupee’s exchange rate.

This should worry the Indian authorities — and spur them into action. To mitigate the rupee’s appreciation, thereby boosting external demand, the Reserve Bank of India (RBI) must be given greater policy space and autonomy.

My advice would be for the RBI to lower interest rates further, thereby aligning India’s monetary policy more closely with that of the world’s other major economies. While the current tendency toward very low interest rates is not ideal from a global perspective, the fact is that as long as India remains an outlier, it will encourage the so-called carry trade, which artificially drives up the rupee’s value.

The bigger challenge facing India will be to nurture and sustain rapid growth in the long run. It is worth considering the efforts of another major emerging economy: China.

China’s government has identified specific economic sectors to boost. India can adopt a similar approach, with health and education being two particularly promising sectors.

Despite its success, India’s medical tourism industry still has plenty of untapped potential. The income earned from such tourism could help the country shore up its own health system, ensuring that all Indians — including the poor and especially children, among whom malnourishment remains rampant—have access to quality healthcare.

-------------

Yet India’s investment-to-GDP ratio is now slipping, from over 35 percent in the last eight years to below 30 percent today. This can be explained partly by an increase in risk aversion among banks, which are concerned about nonperforming assets. Falling business confidence may also be a factor.

If India implements policies that boost short-term growth, while laying the groundwork for long-term performance, confidence should rise naturally. Once investment picks up, India will be able to recapture its past rapid growth — and sustain it in the coming years. That outcome would benefit not just India, but the entire global economy. –Project Syndicate

Read more: http://opinion.inquirer.net/107391/reviving-indias-economy#ixzz4tf0wqljS

Follow us: @inquirerdotnet on Twitter | inquirerdotnet on Facebook

While foreign savings are important in financing the

saving-investment gap, the most reliable source of

funds for investment in a country is its own saving –

Pakistan’s record in this aspect is also not encouraging.

National savings as percent of GDP were around 10

percent during 1960s, which increased to above 15

percent in 2000s, but declined afterward (Figure 7).

Pakistan’s saving rate also compares unfavorably with

that in neighboring countries: last five years average

saving rate in India was 31.9 percent, Bangladesh 29.7

percent, and Sri Lanka 24.5 percent.

Similarly, domestic savings (measured as national

savings less net factor income from abroad) also

declined from about 15 percent of GDP in 2000s, to

less than 9 percent in recent years (see Box 1 for methodology of measuring savings). Domestic savings are

imperative for sustainable growth, because inflow of income from abroad (remittances and other factor

income) is uncertain due to cyclical movements in world economies, exchange rates, and external shocks.

http://www.sbp.org.pk/publications/staff-notes/SavingInvestmentStaffNote-Jan-16.pdf

https://www.ft.com/content/daf5dc40-17e8-11e8-9e9c-25c814761640?segmentId=778a3b31-0eac-c57a-a529-d296f5da8125

https://www.dawn.com/news/1454833

An estimated 15,000 babies will be born in Pakistan on New Year’s day, accounting for 4 per cent of all babies born today globally, Unicef, the United Nations agency for children announced on Tuesday.

Of the 395,072 babies who will be born around the world on January 1, a quarter will be born in South Asia.

Internationally, half of these births are estimated to take place in eight countries, with Pakistan at fourth place.

Unicef estimates that babies born on Jan 1 in each country will come to:

69,944 in India

44,940 in China

25,685 in Nigeria

15,112 in Pakistan

13,256 in Indonesia

11,086 in the US

10,053 in Congo

8,428 in Bangladesh

It is expected that the year's first baby will be delivered in Fiji in the Pacific, while the United States will deliver the last.

Sydney will welcome an estimated 168 babies; Tokyo, 310; Beijing, 605 babies; Madrid, 166, and New York City, some 317 babies.

Around the world on the first day of 2019, families will welcome countless Alexanders, Ayeshas, Zixuans and Zainabs. But in several countries, many babies will not even be named as they won’t make it past their first day.

In 2017, about 1 million babies died the day they were born, and 2.5m died in just their first month of life.

Among those children, most died from preventable causes such as premature birth, complications during delivery, and infections like sepsis and pneumonia, a violation of their basic right to survival.

"This New Year's Day, let’s all make a resolution to fulfil every right of every child, starting with the right to survive," said Aida Girma, the Unicef representative in Pakistan.

"We can save millions of babies if we invest in training and equipping local health workers so that every newborn is born into a safe pair of hands."

2019 marks the 30th anniversary of the adoption of the Convention on the Rights of the Child, which Unicef will be commemorating with worldwide events throughout the year.

Under the convention, among other things, governments have committed to taking measures to save every child by providing good quality health care.

Over the past three decades, the world has seen remarkable progress in child survival, cutting the number of children worldwide who die before their fifth birthday by more than half.

But there has been slower progress for newborns. Babies dying in the first month account for 47pc of all deaths among children under five.

Unicef’s 'Every Child Alive' campaign calls for immediate investment to deliver affordable, quality health care solutions for every mother and newborn.

These include a steady supply of clean water and electricity at health facilities, the presence of a skilled health attendant during birth, ample supplies and medicines to prevent and treat complications during pregnancy, delivery and birth as well empowering adolescent girls and women who can demand better quality of health services.

The cooperation framework agreement provides that “specified skilled workers” who pass a required examination and a basic Japanese-language comprehension test will be eligible for employment in Japan, according to a press release by the embassy.

It said Pakistan is among the countries from which Japan is looking to hire skilled workers, having already inked similar memoranda with Bangladesh, Cambodia, Indonesia, Mongolia, Nepal, the Philippines, Sri Lanka, Thailand, Uzbekistan and Vietnam.

The embassy also mentioned new statuses of residence created by the Japanese government for specific skilled workers, which became effective on April 1, and that the nation expects to hire 340,000 such laborers from across the world over the next five years.

The signing ceremony was witnessed by Kentaro Sonoura, a special adviser on foreign affairs to Prime Minister Shinzo Abe. Pakistani Prime Minister Imran Khan conveyed his appreciation of the deal in a meeting with Sonoura.

------------------

Study Forecasts World Population to Peak in 2064

If you feel like the world is getting busier, it’s not just you- the planet’s population has been rising for as many years as we’ve been keeping track.

The United Nations projected that the world’s population could reach 11 billion people by 2100, a figure that was not called into question until a new report from the University of Washington was published this year.

The report detailed how access to education and contraceptives lowered reproductive rates in places where women were given access to both. On average, women with higher levels of education and access to contraceptives had less than 1.5 children.

If women’s rights continue to expand around the globe, the University of Washington report estimated that the global population would peak in 2064 at 9.7 billion before declining to 8.8 billion in 2100.

By 2100, the study predicts that India (1093 million), Nigeria (709 million), China (732 million), USA (335 million), and Pakistan (248 million) will be the top five most populated countries. Source: Vollset et al., 2020.

https://www.geographyrealm.com/study-forecasts-world-population-to-peak-in-2064/

By Andy Chia The Daily Jul 28, 2020 0

2 min to read

https://www.dailyuw.com/news/article_d378920c-d07b-11ea-b63d-3f3c06a3b477.html

Today, the world population is around 7.7 billion, and overpopulation is still of concern for governments and economists interested in understanding how countries will change due to age structure, which can alter health care, environmental, and economic needs.

Throughout history, there has been alarmism among some that overpopulation would lead to famine, wars, and epidemics.

To address this problem, population models, which are based on fertility, migration, and mortality rates, have become a promising tool for planning a country’s response to fluctuating populations.

According to a report published by the UW’s Institute for Health Metrics and Evaluation (IHME), the global population will continue to rise through the 21st century, peaking at 9.73 billion in 2064 before declining to 8.79 billion in 2100.

“Our findings suggest that the decline in the numbers of working-age adults alone will reduce GDP growth rates that could result in major shifts in global economic power by the century’s end,” the IHME said in a statement.

This decline in population has already led to shifts in certain countries, like Japan, which has seen an increase in labor force participation of 65- to 69-year-olds from 15.3% to 20.8% over a 25-year period.

For other areas, like Sub-Saharan Africa, population growth has remained relatively high, which has increased labor forces and created a higher GDP over time. However, these fertility rates have and will continue to decline, creating an inverted population pyramid that radically alters the way people live in those countries.

“When you have an inverted pyramid, younger people will need to take care of a greater number of older people that retire and will pay for their expenditures,” Dr. Ali Mokdad, health metric sciences professor, said. “The impact will affect economic growth and how well people will be taken care of.”

While the downsides of declines in the population are partially offset by the introduction of automation, these countries will still require other solutions to combat the potential decrease in economic production.

“Immigration can help some countries maintain their working age populations and support economic growth even in the face of declining fertility rates,” said the IHME. “Countries that turn to immigration will need to strategize on how to welcome and support immigrants and embrace growing diversity in their populations, as well as ensure that migrants’ home countries also benefit.”

The decreasing population size and fertility also signify a rising education level in many parts of the world. Contraceptive access and education for women were considered major factors that will lead to declines in fertility rate across all nations

In order to sustain and increase GDP over time, countries need to take into account how women’s rights and education are being supported. Within countries that are trying to encourage fertility, the report cautions any challenges made to reproductive freedoms and rights.

“Education for women means not only a better quality of life for herself, but her family,” Mokdad said. “We could do more to support the rights of women to benefit everyone.”

https://twitter.com/haqsmusings/status/1507741000378187777?s=20&t=UgybLKwTEj7ybz3yT2XauQ

Cai Fang, a member of the People’s Bank of China’s monetary policy committee, said it is ‘entirely possible’ that the world’s largest population will peak in 2022

Yicai reported that seven out of the 16 provinces that have so far disclosed birth data saw negative population growth in 2021

China’s population is likely to peak this year, a central bank adviser said, with several provinces already reporting declines in the population growth rate.

Cai Fang, a member of the People’s Bank of China’s monetary policy committee, said it is “entirely possible” that the world’s largest population will peak in 2022, according to a report in the 21st Century Business Herald.

Separately, Yicai reported that seven out of the 16 provinces that have so far disclosed birth data saw negative population growth in 2021.

With a declining labour force already acting as a constraint on the supply side of the economy, a shrinking population will become a new restriction on the demand side, Cai said late on Friday.

A mismatch between demand and supply would curb economic growth, he said.

One way to boost demand is by granting migrant workers who work in the city residency permits, known as a hukou, Cai said, predicting the move alone could grow total consumption by 30 per cent.

A hukou is a household registration document all Chinese citizens must have that controls access to public services based on the birthplace of the holder. Migrant workers will hold hukou from their hometowns, meaning that they will have very limited rights to public services in any other city that they move to for work.

China should also take concrete measures to support household income growth, Cai said, to cope with the new demographic changes.

China had a population of 1.4126 billion at the end of last year, with the growth rate rising at the slowest pace since the 1950s.

The number of babies born in China in 2021 was 10.62 million, down from 12 million in 2020, according to the National Statistics Bureau.

Populations in the provinces of Jiangsu and Hubei, as well as in the Inner Mongolia, autonomous region, dropped for the first time in recent decades, according to the Yicai report.

The biggest decline was in Heilongjiang, where the population fell by 0.51 per cent last year, it said.

Adding to the trend, a separate Yicai report said the number of marriages in 2021 hit the lowest since records began in 1986. The 7.6 million registrations last year was 56.6 per cent of the peak reached in 2013, it said.

A social media post in early March claiming that India had become the world’s most populous country created a storm in China.

The post claimed India’s population had hit 1.415 billion and was widely shared on social media, adding to rocky relations between Beijing and New Delhi and concerns over domestic growth hurdles in China, while also fuelling discussions about a host of social issues.

Demographic issues have been a hot topic in China since last year, when the once-a-decade census found the national fertility rate was alarmingly low.

“The 2022 State of World Population Report brings to the fore the silent crises of unintended pregnancy with one in seven such cases worldwide occurring in India. In spite of safe, modern, and reversible contraceptives, the most popular method is female sterilisation with its acceptance at 38%,” said Andrea Wojnar, UNFPA India Representative and Bhutan Country Director. “Sterilisation can’t delay or space pregnancies, which is important for preventing unintended or mistimed pregnancies, especially in the young population. What is also a concern is that 67% of abortions have been termed unsafe putting women and young girls at risk. This is a wake-up call.” According to the National Family Health Survey-5 (2019-21) report on adolescent fertility, women in the 15-19 age group have a ratio of 43 births per 1,000 women, which is a decline from NFHS-4 ratio of 51 per 1,000. More than 23% women aged 20-24 were married before attaining the age 18 (NFHS-5)

Globally, life expectancy reached 72.8 years in 2019, an increase of almost nine years since 1990

https://www.wsj.com/articles/worlds-population-projected-to-reach-8-billion-today-11668508623

The population of the planet is set to hit eight billion Tuesday, according to projections from the United Nations that forecast the number will grow to 8.5 billion by 2030 as life expectancy rises.

Globally, life expectancy reached 72.8 years in 2019, an increase of almost nine years since 1990, the U.N.’s population division said, though it fell to 71.0 years in 2021 as a result of the Covid-19 pandemic. In the least developed nations, life expectancy lagged behind the global average by seven years in 2021, driven by high levels of maternal and child mortality, violence, conflict and AIDS.

Since the 1960s, when the global number of people first hit three billion, it has taken a little over a decade to cross each new billion-person milestone. The U.N.’s latest projection is that the eight billionth living person will be born on Nov. 15.

The rate of population expansion will only continue to rise if fertility rates remain high, the U.N. said. In 2021, the average fertility worldwide stood at 2.3 births a woman over a lifetime, having fallen from about five births a woman in 1950, it said. In 2020, the global population growth rate fell under 1% a year for the first time since 1950.

Two-thirds of the global population lives in a country or area where fertility is below 2.1 births a woman, the U.N. said, roughly the level required for a steady-state population in the long term in situations where mortality is low.

The U.N. predicts that the global population will peak at around 10.4 billion during the 2080s and remain around that level until the start of the next century. Another forecast has it peaking at 9.67 billion in 2070, before a slow decline.

The most populous regions are in Asia, the U.N. said, with China and India—each more than 1.4 billion strong—the main contributors to the populace. India’s population is expected to surpass China’s at some point next year, according to the U.N.

Beyond the balance of births and deaths, a significant driver of population growth is immigration. Over the next few decades, the U.N. forecasts, migration will be the sole driver of population growth in high-income countries.

https://www.dawn.com/news/1721023/pakistan-population-growing-at-annual-rate-of-19pc-un

As the world population has reached eight billion, the United Nations Population Fund (UNFPA) says population is growing in Pakistan at an average annual rate of 1.9 per cent, and nearly 3.6 children are born to a woman on average in the country.

UNFPA said in a press release issued here on Monday that Pakistan is among the eight countries where more than half of the increase in global population leading up to 2050 will be concentrated. The other countries are DR Congo, Egypt, Ethiopia, India, Nigeria, the Philippines and Tanzania.

According to UNFPA, half of the population that made up the increase from seven billion in 2011 to eight billion now is from Asia.

It says that eight billion population figure is a milestone for humanity and a moment of reflection. It is time for Pakistan to take stock of the situation and act on the issue.

The UN body says that merely focusing on numbers alone may not present the complete picture. It is time to look beyond the numbers and keep counting for evidence-based decisions. The solution is not more or fewer people but more on equal access to opportunities for the people.

“The power of choice can move demographic and development indicators naturally in the right direction. Rights-based family planning campaign that involves service, advocacy, and social norm components can change the scene to show economic development in terms of levels of welfare and ensure gifted natural resources to sustain for a longer time,” UNFPA Representative in Pakistan, Dr Luay Shabaneh, said.

Pakistan’s national population narrative, based on three interlinked principles of rights, responsibilities and balance, has set the direction suitable for the country.

The UNFPA says that family planning should be driven by informed choice and underlines the state’s responsibility to fulfil all citizens’ rights to information and services they need to make and act on informed choices.

Pakistan is among a few countries that have a detailed population policy and programme roadmaps at federal and provincial levels.

It is time, the UNFPA says, to translate these plans into actions and all stakeholders must join hands to accelerate the implementation of these policies and programmes.

Although the global family of eight billion has come a long way in terms of welfare and development with better health systems, the progress has not been enjoyed equally.

Socioeconomic inequalities are widespread across provinces and regions. Access to health care, rights, and quality of life vary among various population groups.

The universal lesson is that societies that invest in their people, in their rights and choices, take on the road to the prosperity and peace everyone wants and deserves.

India is expected to surpass China as the world’s most populous nation by next year

https://www.blogger.com/comment.g?blogID=8278279504304651957&postID=9114803736752675245

The world added a billion people in the last 12 years. UNFPA said that as the world adds the next billion to its tally of inhabitants, China’s contribution will be negative.

“India, the largest contributor to the 8 billion (177 million) will surpass China, which was the second largest contributor (73 million) and whose contribution to the next billion will be negative, as the world's most populous nation by 2023,” UNFPA said.

The UN said that it took about 12 years for the world population to grow from 7 to 8 billion, but the next billion is expected to take about 14.5 years (2037), reflecting the slowdown in global growth.

World population is projected to reach a peak of around 10.4 billion people during the 2080s and is expected to remain at that level until 2100.

For the increase from 7 to 8 billion, around 70 per cent of the added population was in low-income and lower-middle-income countries.

For the increase from 8 to 9 billion, these two groups of countries are expected to account for more than 90 per cent of global growth, the UN said.

Between now and 2050, the global increase in the population under the age 65 will occur entirely in low income and lower-middle-income countries, since population growth in high-income and upper-middle income countries will occur only among those aged 65 or more, it said.

The World Population Prospects 2022, released in July this year said that India’s population stands at 1.412 billion in 2022, compared with China’s 1.426 billion.

India is projected to have a population of 1.668 billion in 2050, ahead of China’s 1.317 billion people by the middle of the century.

According to UNFPA estimates, 68 per cent of India’s population is between 15-64 years old in 2022, while people aged 65 and older were seven per cent of the population.

The report had said that the global population is growing at its slowest rate since 1950, having fallen under 1 per cent in 2020.

The world’s population could grow to around 8.5 billion in 2030 and 9.7 billion in 2050.

China is expected to experience an absolute decline in its population as early as 2023, the report had said.

At the launch of the report in July, Under-Secretary-General for Economic and Social Affairs Liu Zhenmin had said that countries where population growth has slowed must prepare for an increasing proportion of older persons and, in more extreme cases, a decreasing population size.

“China provides a clear example. With the rapid ageing of its population due to the combined effects of very low fertility and increasing life expectancy, growth of China’s total population is slowing down, a trend that is likely to continue in the coming decades," Liu said.

The WHO pointed out that China has one of the fastest growing ageing populations in the world.

“The population of people over 60 years in China is projected to reach 28 per cent by 2040, due to longer life expectancy and declining fertility rates," the WHO said.

In China, by 2019, there were 254 million older people aged 60 and over, and 176 million older people aged 65 and over.

In 2022, the two most populous regions were both in Asia: Eastern and South-Eastern Asia with 2.3 billion people (29 per cent of the global population) and Central and Southern Asia with 2.1 billion (26 per cent).

China and India, with more than 1.4 billion each, accounted for most of the population in these two regions.

More than half of the projected increase in the global population up to 2050 will be concentrated in eight countries: the Democratic Republic of the Congo, Egypt, Ethiopia, India, Nigeria, Pakistan, the Philippines and the United Republic of Tanzania.

Countries of sub-Saharan Africa are expected to contribute more than half of the increase anticipated through 2050, the report added.

https://www.pewresearch.org/fact-tank/2022/07/21/global-population-projected-to-exceed-8-billion-in-2022-half-live-in-just-seven-countries/

China has the world’s largest population (1.426 billion), but India (1.417 billion) is expected to claim this title next year. The next five most populous nations – the United States, Indonesia, Pakistan, Nigeria and Brazil – together have fewer people than India or China. In fact, China’s population is greater than the entire population of Europe (744 million) or the Americas (1.04 billion) and roughly equivalent to that of all nations in Africa (1.427 billion).

As recently as 2015, half the world’s population was concentrated in just six countries – the same as above, with the exception of Nigeria, which was then the seventh most populous country and has since passed Brazil to move into sixth place. Recent population growth, however, has been faster in the rest of the world than in these nations, meaning that the top six now hold slightly less than half (49%) of the world’s people. Including Brazil’s 215 million people puts the world’s seven most populous countries at 51.7% of the global population.

In the UN’s “medium” scenario for future population growth – its middle-of-the-road estimate – the global population is expected to reach 9.7 billion in 2050 and 10.4 billion in 2100. Growth is expected to be concentrated in sub-Saharan Africa, where an estimated 29% of all the world’s births happened last year. The 2021 total fertility rate in sub-Saharan Africa, 4.6 births per woman, is double the global average of 2.3 births per woman and triple the average in Europe and Northern America (1.5) and in Eastern and South-Eastern Asia (also 1.5).

https://tribune.com.pk/story/2386332/pakistan-amidst-an-eight-billion-planet

Diving deeper into the quality of life, data reveals that the population of the planet lives longer than Pakistanis; life expectancy stood at 73 years, more than seven years of the average life expectancy in Pakistan. As a result of the decline in fertility and increased life expectancy due to good health systems and care, nations are aging faster. Globally, about 10 per cent of the population is above 65 years compared with 4.4 per cent of Pakistanis who die at an earlier pace. Finally, migration characterised global population dynamics in the last decade. About 281 million people (3.5 per cent) live outside their country of birth compared with a slightly higher rate in Pakistan, where 9 million or about 4 per cent, live outside the country.

Having the above-mentioned statistical outlook, one can imagine the burden of population growth on the economy, welfare and future generations. This becomes more challenging if we consider pandemics, climate change and existing poverty levels. More so, the current economic forecast impacting global food security accompanied by increasing energy prices and other essential goods and services.

In these concerning circumstances, one logically asks what is next and what can/should be done. While there is no obvious prescription for this situation, pathways are clear. In fact, history has a rich institutional memory of successes and failures.

Focusing on the number of Pakistan’s population alone distracts us from the real challenge. The demographic trend is not solely bad or good, but building demographic resilience is critical to sustainable development. The reproductive health and rights of women and girls are key enablers in building societies that thrive amid demographic changes. Across Pakistan, there are stark differences in people’s lifespans, access to healthcare, rights and quality of life. Issues like climate change and unequal access to healthcare disproportionately impact the most vulnerable, including women and girls.

This is a hallmark of demographic resilience that involves the ability to understand and anticipate demographic trends and empowers federal and provincial governments to provide their citizens with the skills, tools and opportunities they need to thrive. Population growth can reflect lower mortality rates and increased fertility because of health, education and human rights achievements. The solution is not more or fewer people but more and equal access to opportunities for these people. Pakistan can harness opportunities for economic growth in the expanding population by investing in education and health.

To improve the quality of life in the context of the global next billion people, Pakistan must strive to ensure all people have access to family planning services such as contraceptives, accompanied by quality maternal healthcare services and accurate and easily accessible information about their sexual and reproductive health and rights.

https://www.pbs.gov.pk/sites/default/files/population/publications/pds2020/pakistan_demographic_survey_2020.pdf

Total Fertility Rate (TFR)

Total Fertility Rate (TFR) is the summary measures of current fertility level. It indicates the number of

children to be born to a woman during her reproductive span of life, if she were to pass through all her

childbearing years conforming to the age-specific fertility rates of a given year. The advantage of this

measure is that it is less influenced by the age structure of the population. TFR is the most useful

indicator of fertility because it gives the best pictures of how many children women are currently

having. The TFR depicted by the PDS 2020, PDHS 2017-18 and PSLM- 2018-19 is given in Table No.

3.2. TFR in urban areas is lower than that in rural areas in all surveys.

---------

Life Expectancy

The Life Expectancy at birth is a summary measure Index that is obtained from a life table. It shows the

average number of years that persons can expect to live from the time of birth if they experience

currently prevailing age specific death rates throughout their life. The expectation of life at birth is

independent of the age structure of a population and therefore provides a more reliable index for

international comparisons of the level of mortality and social and economic condition of a country. The

Life Table of PDS-2020 for the year 2020 depicts that the expectancy of life at birth in Pakistan is 65

years; it is 64.5 for males and 65.5 for females. The life expectancy increases for age 1-4 both for males

and females i.e., 70.6 and 72 respectively and 71.3 overall.

------------------

Infant Mortality Rate has been declining in

Pakistan but it is still high. Infant Mortality Rates are much higher in rural areas 59 than in urban areas

50, where better Neo-Natal and Post-Natal facilities are available. Male Infant Mortality Rate is 58

which is higher than female Infant Mortality Rate 55 in all areas.

Table 3.8: Infant Mortality Rate PDHS 2017-18, PSLM-2018-19 and PDS-2020

Table 3.9: Infant Mortality Rate by Urban-Rural Residence and Sex PDS-2020

Neo-Natal and Post-Neo-Natal Mortality Rates

Mortality during the first year of life is divided into two main period’s i.e. Neo-natal Mortality

occurring within the first month and, Post-Neonatal Mortality occurring during the remaining 11

months. This distinction is useful as the causes as well as the levels of mortality are quite different in

these two periods. Table 3.10 shows that mortality within the first month after birth is very high in

2020. Like Crude Death Rates and Infant Mortality Rates, the PDS-2020 data indicates that the NeoNatal Mortality in rural areas is higher than in the urban areas.

Table 3.10: Neo-Natal and Post Neo-Natal Mortality Rates PDHS 2018-19 and PDS-2020

Area PDHS-2017-18 PSLM-2018-19 PDS-2020(2018-20)

Pakistan 62 60 56

Fewer people might mean slower growth in China, which will be felt by the U.S. and beyond.

“They’ve now become, you know, the center of the global manufacturing superhighway and are typically the largest contributor to growth every year,” said Scott Kennedy with the Center for Strategic and International Studies in Washington D.C.

Chinese officials often credit the so-called one-child policy for preventing over 400 million births, but some analysts say China’s population would have declined regardless.

“It’s just simply a rule across all countries, that as you urbanize, and as you get a more educated female population that enters the workforce, fertility numbers fall,” Kennedy said.

-------

The number of Chinese workers is already declining; according to the World Bank, in 2001, China had 10 workers to support one retiree.

“In 2020, that was down to five working folks for each retiree and by 2050 it’ll be down to two,” Kennedy said.

He believes China still has time to offset the effects of population decline, including by boosting productivity, increasing the retirement age and lifting restrictions on people from rural areas to freely settle in cities with their families.

“I don’t think the problem has become so severe that demography is destiny, and China is destined to radically slow down and its chances of becoming an economic superpower breaking out of the middle income trap have been dashed,” Kennedy said.

“[But] these are pretty significant challenges.”

------

28-year-old Joy Yu’s parents each had three siblings. As they were growing up in the 1970s, the Chinese government started to limit the number of babies born.

Government statistics show on average a woman in China went from having about three babies in the late 1970s to just one.

Four decades on, China’s leaders are asking women to have three children again, which doesn’t sit well for Yu, an only child.

“For me to give birth to three children, my future husband must be rich enough to make sure I can live well without a job. This is a big challenge,” Yu said.

Last year, China’s population dropped for the first time in six decades by 850,000. That still leaves the country with 1.41 billion people but if the decline continues, there will be multiple impacts on the economy.

China began enforcing birth limits in the late 1970s when the country was poor and there were too many mouths to feed.

In a Chinese propaganda film called the Disturbance of Gan Quan Village, the birth restrictions were justified on economic grounds.

“We should put our energy into getting rich rather than keep having children,” says one woman in the film.

She’s sitting among a group of women picking corn kernels off the cob. “Aren’t we getting poorer with each child we have,” she says. The rest of the group nods in agreement.

Chinese leaders enforced, sometimes brutally, the so-called one-child policy in 1979, just as the country was coming out of the tumultuous Cultural Revolution.

“The post-[Chairman] Mao leadership thought that economic development would be the new basis for the party’s political legitimacy and based on pseudo-scientific and demographic projections, limiting birth to one child per married heterosexual couple,” said Yun Zhou, an assistant professor of sociology at the University of Michigan.

There were exceptions. Some ethnic minority groups could have up to three children. People from rural areas could try for a second child if their first-born was not a boy. Later, if both parents had no siblings they could have two children. Starting in 2016, China raised the birth limit for everyone to two children, but there was no sustained baby bump.