CPEC Financing: Is Pakistan Being Ripped Off By China?

Is China ripping off its all-weather friend Pakistan by charging high interest rates on loans and exorbitant guaranteed returns on investments in China Pakistan Economic Corridor (CPEC) projects? That's a question that is being asked on a frequent basis by Pakistan's friends and foes alike. While friends of China-Pakistan ties are concerned about an undue burden on Pakistanis, the foes see CPEC as an opportunity to create a lot of fear, uncertainty and doubt about it and its benefits for Pakistan's economy and society. Who's right? Who's wrong? Why? Let's dive into it.

Claims by CPEC Detractors:

Many Western and Indian opponents claim that the cost of CPEC financing will be so high that Pakistan will not be able to bear it. They assert that China is attempting to catch Pakistan in a debt trap from which the country will not be able to escape, eventually turning it into a Chinese colony. The financing costs for Chinese loans and investments they claim are in high teens.

Misguided Pakistani Analysts' View:

Many well-meaning Pakistanis, including serious economists, seem to echo detractors' claims without any serious examination or comparison with prevailing bench-marks. They do not mention how similar projects in other parts of the world are financed and what sort of interest rates and return-on-equity are guaranteed.

CPEC Finance Rates vs Benchmarks:

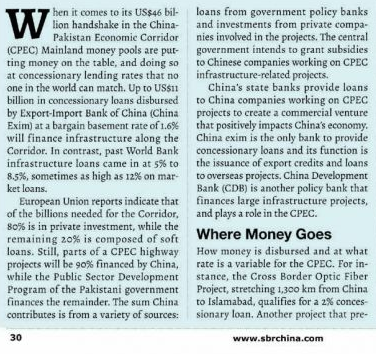

About two-thirds of Chinese CPEC funding is for power projects while one-third is for infrastructure projects like roads, rail lines and ports.

The Chinese soft loans for CPEC infrastructure projects carry an interest rate of just 1.6%, far lower than similar loans offered by the World Bank at rates of 3.8% or higher.

Chinese companies investing in Pakistan power sector are getting loans from Chinese banks at commercial interest rates. These loans will be repaid by the Chinese companies from their income from these investments, not by Pakistani taxpayers.

The rate of return guaranteed by Pakistan power regulators to the Chinese power companies is about 17%. Is it too high, as some claim? Let's compare it to the US market considered among the safest investments in the world.

Rate of Return in United States:

The average return on equity for almost 8,000 US firms is 14.49%. The power utility companies – with an average of 10.13% – are on the lower end of the spectrum because they are viewed as less risky investments.

In the United States, rate of return varies significantly from state to state, as each state regulator has exclusive authority to regulate utility operations as they choose.

In Advance Energy Economy (AEE) Power Portal database, which tracks ROE for over 100 investor-owned utilities across the country, the highest allowed ROE belongs to Alabama Power Co., at 13.75% while the lowest belongs to United Illuminating Co. (CT) at 9.15%.

Within the US states, Alabama being seen as relatively less safe for investment, offers 13.75% return. So why is it such a surprise to see Pakistani regulator offer Chinese investors a higher rate of return of 17%?

Growing Infrastructure Gap:

Development of physical infrastructure, including electricity and gas infrastructure, is essential for economic and social development of a country such as Pakistan. China-Pakistan Economic Corridor financing needs to be seen in the context of the large and growing infrastructure gap in Asia that threatens social and economic progress.

Rich countries generally raise funds for infrastructure projects by selling bonds while most developing countries rely on loans from international financial institutions such as the World Bank and the Asian Development Bank to finance infrastructure projects.

The infrastructure financing needs of the developing countries far exceed the capacity of the World Bank and the regional development banks such as ADB to fund such projects. A recent report by the Asian Development Bank warned that there is currently $1.7 trillion infrastructure gap that threatens growth in Asia. The 45 countries surveyed in the ADB report, which covers 2016-2030, are forecast to need investment of $26 trillion over 15 years to maintain growth, cut poverty and deal with climate change.

Summary:

China is financing CPEC projects at rates that are comparable to similar projects elsewhere. Chinese loans for infrastructure projects such as rails, roads and ports are at rates (2% or less) below those (3.8%) offered by the Asian Development Bank and the the World Bank. The rate of return on power project investments under CPEC is 17%, somewhat higher than the 13.75 offered by much safer US state of Alabama.

Development of physical infrastructure, including electricity and gas infrastructure, is essential for economic and social development of a country such as Pakistan. China-Pakistan Economic Corridor financing needs to be seen in the context of the large and growing infrastructure gap in Asia that threatens social and economic progress.

|

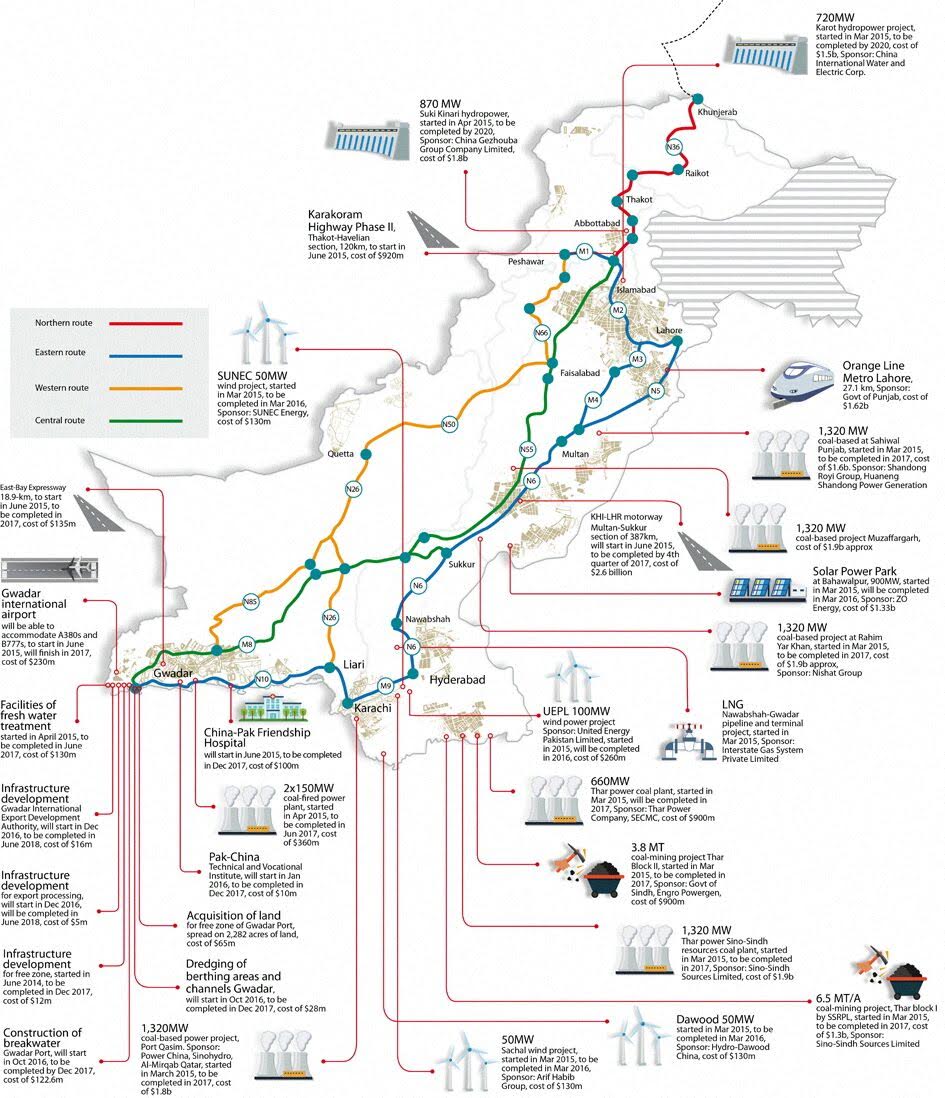

| CPEC Projects in Pakistan |

Claims by CPEC Detractors:

Many Western and Indian opponents claim that the cost of CPEC financing will be so high that Pakistan will not be able to bear it. They assert that China is attempting to catch Pakistan in a debt trap from which the country will not be able to escape, eventually turning it into a Chinese colony. The financing costs for Chinese loans and investments they claim are in high teens.

Misguided Pakistani Analysts' View:

Many well-meaning Pakistanis, including serious economists, seem to echo detractors' claims without any serious examination or comparison with prevailing bench-marks. They do not mention how similar projects in other parts of the world are financed and what sort of interest rates and return-on-equity are guaranteed.

CPEC Finance Rates vs Benchmarks:

About two-thirds of Chinese CPEC funding is for power projects while one-third is for infrastructure projects like roads, rail lines and ports.

The Chinese soft loans for CPEC infrastructure projects carry an interest rate of just 1.6%, far lower than similar loans offered by the World Bank at rates of 3.8% or higher.

Chinese companies investing in Pakistan power sector are getting loans from Chinese banks at commercial interest rates. These loans will be repaid by the Chinese companies from their income from these investments, not by Pakistani taxpayers.

The rate of return guaranteed by Pakistan power regulators to the Chinese power companies is about 17%. Is it too high, as some claim? Let's compare it to the US market considered among the safest investments in the world.

Rate of Return in United States:

The average return on equity for almost 8,000 US firms is 14.49%. The power utility companies – with an average of 10.13% – are on the lower end of the spectrum because they are viewed as less risky investments.

In the United States, rate of return varies significantly from state to state, as each state regulator has exclusive authority to regulate utility operations as they choose.

In Advance Energy Economy (AEE) Power Portal database, which tracks ROE for over 100 investor-owned utilities across the country, the highest allowed ROE belongs to Alabama Power Co., at 13.75% while the lowest belongs to United Illuminating Co. (CT) at 9.15%.

Within the US states, Alabama being seen as relatively less safe for investment, offers 13.75% return. So why is it such a surprise to see Pakistani regulator offer Chinese investors a higher rate of return of 17%?

Growing Infrastructure Gap:

Development of physical infrastructure, including electricity and gas infrastructure, is essential for economic and social development of a country such as Pakistan. China-Pakistan Economic Corridor financing needs to be seen in the context of the large and growing infrastructure gap in Asia that threatens social and economic progress.

Rich countries generally raise funds for infrastructure projects by selling bonds while most developing countries rely on loans from international financial institutions such as the World Bank and the Asian Development Bank to finance infrastructure projects.

The infrastructure financing needs of the developing countries far exceed the capacity of the World Bank and the regional development banks such as ADB to fund such projects. A recent report by the Asian Development Bank warned that there is currently $1.7 trillion infrastructure gap that threatens growth in Asia. The 45 countries surveyed in the ADB report, which covers 2016-2030, are forecast to need investment of $26 trillion over 15 years to maintain growth, cut poverty and deal with climate change.

|

| Pakistan Country Report in Shanghai Business Review Feb/March 2016 |

Summary:

China is financing CPEC projects at rates that are comparable to similar projects elsewhere. Chinese loans for infrastructure projects such as rails, roads and ports are at rates (2% or less) below those (3.8%) offered by the Asian Development Bank and the the World Bank. The rate of return on power project investments under CPEC is 17%, somewhat higher than the 13.75 offered by much safer US state of Alabama.

Development of physical infrastructure, including electricity and gas infrastructure, is essential for economic and social development of a country such as Pakistan. China-Pakistan Economic Corridor financing needs to be seen in the context of the large and growing infrastructure gap in Asia that threatens social and economic progress.

An unrelenting campaign of fear, uncertainty and doubt (FUD) about China-Pakistan Economic Corridor (CPEC) has been unleashed in the media in recent weeks. This strategy harkens back to the aggressive marketing techniques used by the American computer giant IBM in the 1970s to fight competition. Part of the motivation of those engaged in FUD against CPEC appears to be to check China's rise and Pakistan's rise with its friend and neighbor to the north. As in IBM's case, the greatest fear of the perpetrators of FUD is that CPEC will succeed and lift Pakistan up along with rising China. Their aim is to preserve and protect the current world order created by the Western Powers led by the United States at the end of the second world war. Pakistani government should respond to the FUD campaign against CPEC by countering it with facts and data and increasing transparency in how CPEC projects are being financed, contracted and managed.

Related Links:

Comments

https://www.voanews.com/a/china-calls-pakistan-cpec-fastest-and-most-effective-of-bri-projects/3951874.html

China says its large economic collaboration program with Pakistan has entered “the stage of early harvest", making it the “fastest and most effective" among all projects in Beijing’s Belt and Road Initiative, or BRI.

President Xi Jinping launched the China-Pakistan Economic Corridor, or CPEC, two years ago, during his landmark visit to Islamabad. Cooperation has since cemented decades-old relations between the traditionally close allies.

China is investing about $60 billion on a network of roads, railways, fiber optic cables, energy pipelines, industrial clusters and special economic zones in Pakistan.

The corridor will link China's western region of Xinjiang to the Pakistani port of Gwadar on the Arabian Sea, giving the Chinese region the shortest trade route to international markets.

China's acting ambassador to Islamabad, Lijian Zhao, says that 19 CPEC projects worth about $19 billion are either completed or in progress.

“CPEC, as a pilot and major project of BRI, is now the fastest and most effective project among all the projects under the BRI,” he told a seminar in Islamabad.

He described the cooperation as an “unprecedented undertaking” in the history of China-Pakistan relations.

Economic cooperation connected to CPEC has employed thousands of Pakistanis and officials anticipate tens of thousands more will be hired in the next few years.

Gwadar is in Pakistan's Baluchistan province, where deadly attacks on CPEC workers have taken place in recent months.

Some critics in Pakistan have raised concerns about the viability of CPEC, while others have questioned its implications for the country. But officials dismiss the skepticism as unfounded.

“Despite (the fact) there is this criticism and noises here and there, after this four years of hard work and joint efforts of both countries, the CPEC has not been affected by those noises. I can report to you that CPEC is going on very well on the ground,” said the Chinese envoy. He did not elaborate further.

Most of the CPEC projects are in Baluchistan. Pakistani officials allege rival India’s intelligence agency is behind the militant attacks in the province in an attempt to sabotage the Chinese investment.

---

“May I point out, unfortunately, our eastern neighbor (India) has publicly announced its opposition to CPEC. The grounds they give for their opposition are baseless,” Janjua noted.

She went on to denounce India’s opposition as “appalling” for a project that she said would bring development and prosperity to the people of Kashmir.

“China and Pakistan stand shoulder to shoulder in developing CPEC on the agreed time lines. We will continue to march ahead with complete determination, ignoring the negative voices and forcefully responding to any threat to CPEC,” said Janjua.

The Pakistani military has deployed thousands of security personnel to guard the projects and protect Chinese experts and workers.

China has also rejected reported U.S. concerns China plans to turn Gwadar into a Chinese naval base.

Major infrastructure projects being established in the Chinese-funded port of Gwadar include a Free Zone and a new international airport that will be operational by next year, officials say.

While new highways are being built and existing roads upgraded to link areas under CPEC, a coal fired power plant in the central city of Sahiwal has recently been completed, adding 1,320-megawatts of electricity to Pakistan's national grid.

A second 1,320-megawatt coal fired power plant in the southern port city of Karachi is expected to be inaugurated by November at an estimated cast of about $2 billion.

China is also focusing on upgrading Pakistan's railways, increasing average speeds to about 180 kilometers an hour from the current average of 80 kilometers an hour, said Chinese envoy Zhao.

One Lifebelt, One Road

China makes Pakistan an offer it cannot refuse

https://www.economist.com/news/special-report/21725101-leg-up-all-weather-friend-china-makes-pakistan-offer-it-cannot-refuse

MOVE OVER, DUBAI. Some day soon, cruise ships will disgorge frolicking pensioners not by the palm-fringed Persian Gulf but on the balmy Pakistan Riviera. From the muddy delta of the Indus to the barren Baloch coast, a twinkling constellation of attractions is set to rise: luxury hotels, water parks, golf courses, health spas, yacht harbours, night clubs, the works. To top it all, this “vacation product” will be developed in such a way that “Islamic culture, historical culture, folk culture and marine culture shall all be integrated.”

Or so promises a prospectus, drafted for the Chinese government by the China Development Bank, that sets out a detailed vision of the China-Pakistan Economic Corridor (CPEC). Billed as a flagship of China’s $900bn One Belt, One Road initiative to build an Asia-wide infrastructure system tying China more firmly to its markets, CPEC promises to inject some $60bn of Chinese investment into Pakistan. More than half is earmarked for power generation, but there is plenty left over for roads, seaports, airports, fibre-optic cables, cement factories, agro-industry and tourism.

For a country that has struggled to nudge its capital-investment ratio to 15% of GDP—compared with around 30% for India and 28% for Bangladesh in recent years—this gush of Chinese money comes as a godsend. Not only does it promise to energise the economy and fix such problems as chronic power shortages; it represents a strategic insurance policy against India. China has long been Pakistan’s chief arms supplier, and has quietly provided diplomatic cover and technical aid for its nuclear programme. As Chinese officials are fond of saying, China is an “all-weather friend”—unlike America, which has lavished some $78bn in economic and military aid on Pakistan since independence, but periodically gets stingy when Islamabad fails to curb terrorists.

----------

India views China’s spreading footprints next door with dismay. Officials put on a brave face. The Chinese are naive, say some, and will end up getting stung by Pakistan’s generals just as the Americans did. Others hope that once China discovers how far Pakistan’s deep state is entwined with Islamist radical groups, it will show less patience than the Americans.

Privately, however, Indian officials worry that Pakistan’s new patron may play the same role as America once inadvertently did, or as Pakistan’s nuclear deterrent still does: to allow Pakistan to sustain the awkward status quo. “Indian leaders have always calculated that sooner or later Pakistan would have to seek a normal relationship with us,” says Ashok Malik of the Observer Research Foundation, a Delhi think-tank. “CPEC gives them a new narrative: it puts them in China’s sphere.”

China seems to be grabbing most of it (solar panels). “The US and Europe are taking measures to protect themselves against Chinese dumping. We (Indians) have instead offered them a direct train to the Indian market. The government must ring fence Indian firms to allow them to grow,” says Chaudhary.

Miles away in Delhi, Rakesh Kumar Yadav shows you another Chinese-flavoured world. He is the president of the Federation of Sadar Bazar Traders Association. The umbrella platform for The umbrella platform for 83 other associations with 35,000 wholesale traders does business worth over Rs 3,000 crore annually and employs at least 100,000 people directly and indirectly.

About a decade back, the traders often used to source products — toys, plastic buckets, idols of Indian gods, among others — from domestic manufacturers. In toys alone, Yadav knows many Indian manufacturers who employed 500-plus people and were their suppliers. “They have all shut down and now import from China. Cheaper and better Chinese imports have wiped out the domestic industry,” says Yadav.

On the border, India is trying to ward off Chinese aggression. In the cold Himalayan plateau, temperatures have shot up as an old political rivalry heats up. India and China are sparring over the Doklam tri-boundary area (the third country being Bhutan), near Chicken’s Neck which connects India’s north-eastern states to the rest of the country. Shrill calls for a boycott of Chinese goods are getting louder, with the Rashtriya Swayamsevak Sangh (RSS) and its affiliate, the Swadeshi Jagran Manch, ..

Read more at:

http://economictimes.indiatimes.com/articleshow/59611452.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

https://www.reuters.com/article/us-woodside-lng-idUSKBN1A50KT

MELBOURNE (Reuters) - A plan by top global liquefied natural gas (LNG) exporter Qatar to ramp up output will stall the expected growth of U.S. LNG exports, the head of Australia's Woodside Petroleum, operator of the country's biggest LNG plant, said.

Qatar surprised rivals this month when it lifted a self-imposed ban on development of the North Field, the world's biggest natural gas field, saying it would boost LNG output by 30 percent to 100 million tonnes a year in five to seven years.

That put it on course to it wrest back the title of the world's top LNG exporter from Australia, which is set to overtake Qatar in the next two years.

Woodside, operator of the North West Shelf project, said Qatar's plan showed the emirate shares its outlook for solid demand growth for LNG and gives importers like China, India, Pakistan and Bangladesh the supply certainty they need to lock in gas expansion plans.

"The Qataris will not take up all of the available market," Woodside Chief Executive Peter Coleman told Reuters in an interview on Thursday.

Qatar's expansion plan will compete directly with Woodside, which is looking to develop the Browse and Scarborough fields off Western Australia within the next decade - its so-called Horizon 2 projects - by processing gas through the North West Shelf plant or other existing facilities.

"On the challenge side, low cost will get into market, and that's what we're doing with our Horizon 2 projects. We're trying to make sure they're low cost, and they're well positioned, because we're targeting the Asian market," Coleman said.

Projects that will find it harder to compete will be those that need billions of dollars in new infrastructure and coal seam gas-to-LNG projects that need continuous capital spending to drill new wells, he said.

The International Energy Agency last week forecast the United States would become the world's second largest LNG exporter by the end of 2022, but Coleman said the Qatari expansion would stymie that growth.

"It'll keep a lid on U.S. expansions, because U.S. expansions are transportation-challenged," he said.

U.S. LNG flows largely into the Atlantic market, where it competes against pipeline gas from Russia and Norway.

https://worldview.stratfor.com/article/big-power-little-sri-lanka-india-china-rivalry

When it comes to this periphery, one particular concern for New Delhi is Sri Lanka's Hambantota deep sea port project. This new port and others at Gwadar in Pakistan, Chittagong in Bangladesh and Djibouti constitute the Indian Ocean leg of China's 21st Century Maritime Silk Road. And ever since construction began in Hambantota in 2008, China has taken on an increasingly prominent role in the project, which includes not only the $1.4 billion port but also an airport, numerous highways and an as-yet-unbuilt 15,000-acre industrial zone. Initially, Sri Lanka intended to build the project with massive Chinese loans and operate the port on its own, but it has confronted the difficulty of making the port profitable. Thus, in late 2016, Colombo announced a potential deal to trade an 85 percent stake in the project, which would include a 99-year lease on land there, to China Merchants Port Holdings in exchange for $1.1 billion in debt relief. Sri Lanka is $8 billion in debt to China, and over one-third of its government revenue goes to servicing that debt.

Domestic tensions over India's involvement in Trincomalee will only continue. And ultimately, the revised deal with China over Hambantota will not end competition over Sri Lanka and its ports. After the tumultuous conclusion of the Sri Lankan civil war in 2009, the country was left internationally isolated and at odds with India. New Delhi notably did not offer Colombo substantial assistance in defeating the Tamil Tigers, and Sri Lanka instead relied on Chinese, Pakistani and Iranian involvement. In the wake of these events, restoring a balance between patronage from India and other nations does not mean Colombo will be making a full tilt toward New Delhi. Moreover, India simply does not have the economic heft or state control of businesses needed to assist Sri Lanka in the way that China does.

On a broader scale, the regional rivalry between China and India grows ever stronger, as the two nations push for dominance over their shared border and India's various neighbors. But direct military confrontation between Beijing and New Delhi is extremely unlikely, and the tensions will instead play out in nearby countries. Bhutan, for example, has already been caught up in this rivalry with the ongoing Doklam Plateau crisis. East Africa, too, has become the target of an early stage Indo-Japanese attempt to counterbalance China's infrastructure initiatives. For its part, Sri Lanka appears to have used its political savvy to square the circle for now, but the country will no doubt remain involved in the affairs of India and China in the future. And while being sandwiched between two great powers can be a precarious position for a small nation like Sri Lanka, the country has proved itself adept at playing these powers off one another for its own benefit.

https://www.dawn.com/news/1345414

In a detailed look at the China-Pakistan Economic Corridor (CPEC), the International Monetary Fund (IMF) cautions that corridor projects will generate outflows of as much as $4.5 billion by 2024, while the export benefits of the projects “will likely accrue gradually over time”. Filling the gap in between could pose a policy challenge.

“These considerations warrant policymakers’ attention to two priority areas in order to realise the transformational potential of Pakistan’s investment programme while maintaining external stability,” the IMF report says.

The first challenge is to ramp up export revenue and build foreign exchange buffers, which “will be important to cushion the period of increased BoP outflows”. Ramping up exports will require “improving competitiveness and the business climate” in order to realise the potential benefits from the increased energy supplies and transport infrastructure that the corridor projects will create.

The second big challenge is bringing “full cost recovery” in power distribution. “Routing the increased generation capacity through a loss-making distribution sector could result in faster accumulation of circular debt and fiscal costs, as well as undermine long-term financial sustainability of the new energy projects,” the report adds.

The report stops short of advocating a specific path for improving recoveries, but points towards greater private-sector participation in metering and recoveries while “maintaining a strong and enabling regulatory framework”. The language could be aimed at the government’s proposed reforms to the Nepra Act that seek to parcel out many of the powers the regulator currently enjoys to the federal and provincial governments and their departments.

The report also cautions against going too far down the road of granting incentives to certain categories of investor. It urges the government to “rationalise and limit tax incentives and exemptions [and] maintain uniformity of the tax regime with respect to all investments” and ensure that new external commitments are in line with expected balance of payments trends.

The report notes the positive impact that CPEC projects can have on Pakistan’s economy. It says the direct impact of corridor projects on GDP will go from $2bn in 2017 to $4bn by 2024. By that point in time, the indirect, second-round impacts could commence, which could be “significant” but “will depend on many other supportive factors.”

The report notes that the investments coming under the early-harvest scheme could close Pakistan’s power deficit as 8,600MW are envisaged to be commissioned under CPEC over the next seven to nine years, out of a total capacity expansion of 24,000MW currently in the investment plan. “[T]his expansion will help eliminate Pakistan’s deficit of about 6GW in 2016 to a surplus as early as end-2018.”

https://tribune.com.pk/story/1484291/cpec-provides-avenues-target-100b-chinese-agri-market/

The China-Pakistan Economic Corridor (CPEC) is a golden opportunity for overall development of this region and Pakistan should reorganise its agriculture sector to get a major slice of the $100 billion worth of agriculture produce imports by China, suggested Muhammad Mehmood, Punjab Agriculture Secretary.

Speaking at the launch of a study on “CPEC – Prospects & Challenges for Agriculture”, Mehmood pointed out that nearly one-fourth of the world’s population was living in China and most of its exports would be routed through Pakistan after the completion of CPEC. “Containers full of exportable surplus will be sent to various international markets, but on their return, these containers will be empty and we must capitalise on the opportunity to export our surplus agriculture produce to China,” he said.

Mehmood revealed that per capita income of China was increasing substantially, bringing a visible change in people’s lifestyle and food habits there. “Like other affluent societies, they also prefer rich and costly food and fruits,” he said, adding Pakistan could get maximum benefit of the emerging change.

“We are concentrating on high-value crops and a 10-year programme has been evolved to develop one lakh acres of land in the Potohar region for planting grape and other high-value crops.”

Major Chinese importers will also be invited to utilise this land for growing high-value fruits in addition to developing the agriculture processing industry on modern scientific lines.

“Its trickle-down effect will provide an opportunity to our farmers to upgrade their technologies and develop agriculture as a profitable business by shunning centuries-old practices,” Mehmood said.

He told the audience that foreign consultants had been engaged to analyse why Pakistan had not been able to get its due share in Chinese imports despite its friendly relations and close proximity.

He suggested that Pakistan should renegotiate the bilateral trade agreement and a meeting was expected in the current or next month. After that, “we would be in a position to decide which strategy is suitable for Pakistan to enhance its share in Chinese imports.”

Responding to a question about a research project on the China-Pakistan agricultural technical cooperation, the agriculture secretary insisted that the Punjab Agriculture Research Board was extending liberal grants to the viable projects planned by the public and private sectors.

“Initially, Rs259 million had been allocated for this purpose. The funding was immediately increased to Rs750 million and it would be further enhanced to Rs3 billion in the next three years,” he said.

He asked the Faisalabad Chamber of Commerce and Industry president to send the project to the research board where a group of experts would review its viability and approve the requisite grant.

Never has Pakistan been so wooed. The original promised dowry, of $46bn in Chinese grants and soft loans for infrastructure projects, has only grown, to $62bn. This munificence is dubbed the China-Pakistan Economic Corridor (CPEC), launched amid fanfare in 2015, on a visit to Pakistan by President Xi Jinping.

Most of the money is earmarked for power plants to improve Pakistan’s notoriously unreliable electricity supply. The rest is going on roads, railways, dams, industrial zones, agricultural enterprises, warehousing, pipelines and a deepwater port in the coastal settlement of Gwadar. Some of the promised money is bound not to materialise, and the claim by the interior minister, Ahsan Iqbal, of “benchmarking” Singapore and Hong Kong when turning remote, dusty Gwadar into a container-shipping hub speaks more of hope than experience. Yet over $14bn has already been spent. CPEC is very different from earlier schemes, when co-operation was promised only to run into the sands.

For Pakistan, the scale of ambition is unprecedented—a “game- and fate-changer” as overwrought locals put it. If CPEC gets electricity and goods flowing efficiently, then growth could jump by over two percentage points a year, by one estimate. Better yet, CPEC could shift the national narrative—too often dominated by coups, extremists and a chippy kind of nationalism—towards economic construction.

What is in it for China is often misunderstood, especially by Sinophobes in Delhi, Tokyo and Washington. They make much of the “corridor” in the plan, concluding that China’s chief aim is to gain access to the Indian Ocean, the better to encircle India. In fact, argues Andrew Small of the German Marshall Fund, an American think-tank, improving transport links through the mountainous neck of land that joins Pakistan to Xinjiang province in China’s far west is one of CPEC’s lesser aims. Yes, Gwadar, as a port on the Indian Ocean, interests the Chinese navy, but would have done so regardless of CPEC. Most of CPEC’s investments are aimed at improving Pakistan’s domestic economy.

China does have strategic motives, of course. A more dynamic Pakistan would certainly act as a counterbalance to the deepening security relationship between India and America, which also provides military aid to Pakistan. Then there is Islamist militancy, which spills back into Xinjiang; development might, as Li Keqiang, China’s prime minister, put it, “wean the populace from fundamentalism”. China needs new markets for its products, as well as new terrain for infrastructure and industrial projects. Most importantly, CPEC has become the main plank of Mr Xi’s ambitious “belt-and-road” initiative, whereby improved infrastructure will help to strengthen economic ties and thus spread China’s influence through Asia and beyond. As Mr Small points out, CPEC has to be seen to work for the broader scheme to seem both credible and appealing.

Even if CPEC is not the neo-imperialist exercise its critics make it out to be, it still has its flaws. The IMF warns that Pakistan may struggle to repay China’s loans, which could in turn prompt a balance-of-payments crisis. Pakistan’s central bankers have in the past deplored a lack of transparency surrounding CPEC contracts; suspicion abounds that Pakistani taxpayers have been shortchanged. And security is a problem. Just one example is the new Chinese-funded road to Gwadar, which runs through an area long gripped by insurgency in the remote, backward province of Balochistan. Mr Iqbal argues that the road and the development it is bringing will help extinguish the conflict. It might equally pour fuel on it, if locals feel excluded.

ISHRAT HUSAIN

https://www.dawn.com/news/amp/1357043

The Chinese have voiced concerns regarding negative CPEC talk, security and red tape.

Under its One Belt One Road Initiative announced in 2013, China is planning to invest more than $1 trillion in 60 countries all over the world to establish six different corridors. The receptivity in other countries to this proposal has been anything but enthusiastic; however, some Chinese friends are puzzled by the sceptical and negative reactions from certain quarters in Pakistan expressed in the media, particularly on social media. This comes to them as a surprise because of the long uninterrupted record of strong bilateral relations between the two countries that were not even affected by changes in political leadership in either country. CPEC is the first project of its kind to foster economic cooperation on a massive scale for building large infrastructural projects in Pakistan.

Although realising that there are some external forces hostile to this initiative, Chinese analysts and participants are concerned about what they see as the misrepresentation of facts by many Pakistanis. It is not obvious to them as to what purpose is served by raising doubts and fears about CPEC in the minds of the Pakistani population. The aspersions being cast on the motives of the Chinese, such as the analogy with the East India Company or Pakistan becoming a satellite of China, are very unnerving: external detractors of CPEC pick up these reports and after bundling them as ‘risks’ of CPEC to Pakistan, disseminate them widely.

The Chinese argue that the IPPs have been a policy instrument for investment in Pakistan’s energy sector for a very long time. When the country was facing serious energy shortages no one else came to Pakistan’s rescue and invested in the sector. Now that China has come forward with a planned investment of $35 billion or 70 per cent of the total CPEC allocation under the same policy, questions are being raised.

Had it involved extraction of natural resources from Pakistan for the benefit of the Chinese, this criticism would have been justifiable. On the contrary, the benefits of this investment would be exclusively appropriated by Pakistan’s industries and households that would no longer face load-shedding while the country would record a 2pc annual rise in GDP growth.

Chinese state-owned companies, designated by the Chinese government based on their expertise and experience, are executing the projects with loans provided by government-owned banks on concessional terms both in tenor and pricing. In several projects, Chinese and Pakistani companies have entered into joint ventures. The repatriation of profits and debt-servicing in foreign exchange arising out of these obligations would become possible after an increase in the volume of exports as a result of the Chinese-Pakistani joint ventures relocating their industries to the Gwadar Free Economic Zone and the nine industrial zones to be established under CPEC.

In the opinion of some, the negative feelings can have unintended adverse consequences for the personal security of Chinese nationals working on these projects, particularly in some sensitive areas of Balochistan. Some elements unhappy with the Pakistani state and government and possibly acting at the behest of foreign powers hostile to CPEC appear to have created conditions in which the murders and kidnappings of Chinese nationals that were almost non-existent have begun to take place. Our interlocutors were grateful for the new division being raised by the Pakistan Army for protection of the Chinese; but the security risk is raising premiums for relocation to some of the vulnerable areas.

https://www.thenews.com.pk/print/231356-Long-term-plans-to-be-finalised-in-50th-CPEC-review-meeting

The long term Pakistan-China cooperation plan (2015-2030) will be finalised in the 50th China-Pakistan Economic Corridor (CPEC) 'review meeting' scheduled to be held today (Thursday) under the chair of Ahsan Iqbal, federal minister for planning and interior, a statement said on Wednesday.

“The meeting will finalise the long term plan in consultation with federal ministries and provincial governments, while ministry of railways will brief the meeting about the upcoming financing plan for the up-gradation of Mainline-1 (ML-1) from Peshawar to Karachi will be discussed,” the ministry said in the statement.

The ministry added that Pakistan and China were in the process of finalising the financing plan of $8.5 billion for the ML-1, whereas the next joint working group (JWG) meeting was expected to be held probably next month as the financing plan for the track was also expected to be finalised by November this year.

“Admitting the requirement for having overriding institutional framework to execute $46 billion China-Pakistan Economic Corridor (CPEC) under long term plan till 2030, Beijing and Islamabad have also agreed to build model industrial parks, each in all provinces, with Chinese financing of multimillion dollars,” the ministry said.

Moreover, it said that it was also under consideration to build model cities along the bank of Indus River, having a range of 300 kilometers, but it was yet to be seen as to how this ambitious plan was going to be finalised in a synergised manner.

“Officials from Chinese Embassy at Islamabad probably Chinese Ambassador, Chinese companies and officials from ministry of planning, line ministries and provincial governments would participate in the meeting,” the ministry said. It further said the forum would review progress on the ongoing projects including schedule and agenda of the next JWGs of energy, transport infrastructure, planning, and Gwadar. “It will further review the progress on consortium of business schools and Pakistan Academy of Social Sciences,” the statement said.

https://www.geo.tv/latest/159391-pakistan-exported-commodities-worth

The country earned US$ 512.3 million by exporting different food commodities during the first two months of the current financial year as compared the earnings of the corresponding period of last year.

During the period from July to August 2017, food group exports from the country increased by 30.6 percent as compared the exports of the same period of last year.

According to the data of Pakistan Bureau of Statistics, since the last two months exports of rice grew by 40 percent as around 428,993 metric tons of rice worth US$ 223.97 million were exported.

The rice exports, during first two months of last financial year, were recorded at 3810,861 metric tons, which were worth US$ 159.54 million, it added.

Meanwhile, the exports of basmati rice grew by 10.35 percent and about 59,433 metric tons of basmati rice, worth US$ 62.741 million, were exported as compared the exports of 59,192 metric tons, valuing US$ 56.857 million, in the same period, last year.

The exports of rice other than basmati also witnessed an increase of 58.98 percent, around 369.580 metric tons of rice costing US$ 161.198 million exported as compared to the exports of 251,669 metric tons worth US$ 102.888 million last year.

From July-August, 2017-18, fruit and vegetable exports increased by 8.74 percent and reached at 56,280 metric tons worth of US$ 20.58 million against the exports of 73,751 metric tons of US$ 18.88 million of the same period last year, it added.

The other commodities which witnessed an increase in their exports during the period under review include fish and fish production, which increased by 19.63 percent, wheat and sugar increased by 100 percent respectively.

It may be recalled here that imports of the food commodities into the country also witnessed an increase of 27.18 percent and about US$ 1.123 billion was spent on the import of different food items to fulfill the domestic requirements.

https://tribune.com.pk/story/1506672/pakistans-exports-china-will-r...

Chinese Ministry of Commerce Vice Minister Wang Shouwen said on Thursday that after conclusion and implementation of the second phase of China-Pakistan Free Trade Agreement (CPFTA), Pakistan will be able to expand its exports to China with the help of low tariff rates and attract more Chinese investment in the next five years.

“In the next five years, China will import products worth $8 trillion and once the second phase of our FTA is concluded and implemented, Pakistan will be able to expand its exports to China due to low tariff rates. In addition, Pakistan will also be able to attract more investment from China,” he said. He was speaking at the opening session of the eighth meeting of the second phase of FTA negotiations held at the Chinese Ministry of Commerce.

He said China was a huge market and home to 1.3 billion people and its domestic consumption was booming, adding economic and trade cooperation was the anchor and propeller of relations between China and Pakistan.

“In recent years, our cooperation has developed remarkably and benefited many enterprises and people in both the countries,” he added.

Terming CPFTA one of the earnest FTAs of China, he said it had played a significant role in promoting Sino-Pakistan cooperation and made China Pakistan’s largest trading partner.

He was of the view that the first phase of the FTA had given a lot of impetus to the economic and trade ties.

“However, with the trade liberalisation level of only 36%, there is still a huge space for both sides to raise the current level,” he said. “I believe a relatively high level of liberalisation will promote common development and provide benefits for more people of our countries.”

The vice minister said the leadership of the two countries attached great importance to the FTA negotiations. A statement of Chinese President Xi Jinping during his visit to Pakistan in April 2015 clearly pointed out that both sides had decided to speed up negotiations on the second phase of FTA, he added.

While reciprocating the warm feelings of the Chinese official, Federal Commerce Secretary Younus Dagha said, “China is now Pakistan’s major trading partner with volume of trade reaching an all-time high at $16 billion in 2016-17 from $4 billion in 2006-07.”

“However, keeping in view the respective sizes of the two economies, the gains for both sides should be equal,” he emphasised. Following the FTA, Pakistan’s trade deficit with China has widened markedly, surging from $2.9 billion in 2006-07 to $12.7 billion in 2016-17. Last year, Pakistan’s global imports grew 18.5% while exports edged down 1.6%.

He said imports from China alone accounted for 36% of Pakistan’s global non-oil imports.

Dagha underlined the need for sending positive signals to the people of both countries that benefits of the China-Pakistan Economic Corridor (CPEC) and CPFTA would be shared equitably and that the economy of Pakistan would be a major beneficiary.

Confessing to the Converted

By LANDON THOMAS JR.FEB. 19, 2006

https://www.nytimes.com/2006/02/19/business/yourmoney/confessing-to-the-converted.html

In an early scene that sets the tone for the book, he describes being seduced by a mysterious Catherine Zeta-Jones look-alike who called herself Claudine Martin and supposedly worked at Main. In an interview, he said she plied him with cocaine, red wine and ultimately herself. "We are a small exclusive club," she says in the book. "Your job is to encourage world leaders to become part of a vast network that promotes U.S. commercial interests. In the end, those leaders become ensnared in a web of debt that ensures their loyalty."

In the book, Mr. Perkins recounts the nine years in which he worked for Main in the 1970's. From Ecuador to Panama, Iran to Saudi Arabia, the mission was the same: working in league with government agencies, Mr. Perkins claimed that he inflated the economic growth forecasts of these countries and smoothed the way for the billions in loans that they took on. Ultimately, he said, the funds were recycled to the United States as these countries became clients of big American engineering, construction and manufacturing companies, including Bechtel, Halliburton, Boeing and others.

BUT in his telling, Mr. Perkins was constantly haunted by the feeling that he was in effect a hit man -- paid officially by his employer, Main Inc., but under the more oblique sway of the government and intelligence agencies. The son of a conservative New England family, he whips himself for having succumbed to pleasures of the flesh as well as the lure of money, influence and power.

In 1980, Mr. Perkins quit his job at Main. For much of the next two decades, he worked as a consultant, entrepreneur and specialist on the culture and practices of indigenous people of Latin America. After the terror attacks of Sept. 11, 2001, he said, he felt that it was time to tell his story. After being turned down by bigger publishers, Berrett-Koehler took a chance and published the book in 2004. A best seller in hardcover, despite few mainstream book reviews, the book has sold as many as 5,500 copies a week in paperback.

Mr. Perkins invests much of the story with earnest, pulpy touches. He writes of himself drinking beers and listening to Jimmy Buffett under magenta skies with beautiful women, meeting with disfigured dissidents in shantytowns outside of Tehran and absorbing the whispered warnings about the United States' imperial designs from Latin American leaders.

Michael M. Thomas, a former investment banker and novelist of Wall Street manners, says a book's success will often be determined more by its voice than its subject. And for now, Mr. Perkins's message of conspiracy carries the perfect pitch for many readers -- no matter how fantastic his conclusions may be.

"The odd side of our character is that we believe that dark powers are arranged against us -- call it the Da Vinci codes of finance," Mr. Thomas said. "But really, I never heard of anybody being assassinated for lack of taking a loan."

Indeed, for all the book's success, Mr. Perkins has faced numerous questions about the veracity of some of his dreamier contentions. Earlier this month, for example, the State Department released a brief report called "Confessions -- or Fantasies -- of an Economic Hit Man" that took issue with one of Mr. Perkins' primary assertions: that the National Security Agency, with a wink and a nod, was aware of and may even have approved Mr. Perkins's hiring at Main.

PRETORIA (Reuters) - African countries running up debt they won’t be able to pay back, including to China, should not expect to be bailed out by western-sponsored debt relief, the United States’ top Africa diplomat warned.

The International Monetary Fund and World Bank began the Heavily Indebted Poor Countries (HIPC) Initiative in 1996 to help the world’s poorest countries clear billions of dollars worth of unsustainable debt.

But Africa is facing another potential debt crisis today, with around 40 percent of low-income countries in the region now in debt distress or at high risk of it, according to an IMF report released a year ago.

“We went through, just in the last 20 years, this big debt forgiveness for a lot of African countries,” said U.S. Assistant Secretary of State for Africa for African Affairs Tibor Nagy, referring to the HIPC program.

“Now all of a sudden are we going to go through another cycle of that? ... I certainly would not be sympathetic, and I don’t think my administration would be sympathetic to that kind of situation,” he told reporters in Pretoria, South Africa, late on Sunday.

Under Donald Trump’s administration, the United States has criticized China for pushing poor countries into debt, mainly through lending for large-scale infrastructure projects. It has warned those nations risk losing control of strategic assets if they can’t repay the Chinese loans.

Sri Lanka formally handed over commercial activities in its main southern port in the town of Hambantota to a Chinese company in 2017 as part of a plan to convert $6 billion of loans that Sri Lanka owes China into equity.

U.S. officials have warned that a strategic port in the tiny Horn of Africa nation of Djibouti could be next, a prospect the government there has denied.

From 2000 to 2016, China loaned around $125 billion to the continent, according to data from the China-Africa Research Initiative at Washington’s Johns Hopkins University School of Advanced International Studies.

And a number of African countries form part of China’s $126 billion Belt and Road Initiative to link China by sea and land through an infrastructure network with southeast and central Asia, the Middle East, Europe and Africa.

China has rejected criticism of its lending in Africa. And debt campaigners point to the fact that much of Africa’s current debt load consists of commercial debt to western financial institutions or Eurobonds, which are more expensive to service than Chinese loans.

“All of these countries are sovereign states, so it’s for them to decide who they want to trade with,” Nagy said. “We feel we have an obligation to point out to them when we believe they are getting into severe economic difficulties.”

https://www.thestar.com.my/news/regional/2020/04/10/china-pakistan-economic-corridor-to-be-enhanced-in-2nd-phase-says-pakistani-official

The China-Pakistan Economic Corridor (CPEC) is making steady progress, and its scope will be further enhanced in the second phase, the chairman of the CPEC Authority in Pakistan said.

The industrial development, agriculture, food security, science and technology, and tourism will be the major sectors in the second phase of the multi-billion-dollar project, Chairman Asim Saleem Bajwa said in a tweet on Wednesday.

Many projects focusing on infrastructure and energy sectors in the first phase of CPEC have been completed and are already operational, and work on the second phase is underway.

Talking to Xinhua, Vaqar Ahmed, joint executive director at the Sustainable Development Policy Institute, an Islamabad-based think tank, said the foreign direct investment by Chinese companies in the special economic zones under CPEC, is expected to be the major contributor to the uplift of Pakistan's economy in the post COVID-19 scenario.

The process of formation of joint ventures between the private sectors of the both countries has already been initiated, and will get a further boost when things got back to normal after the disease is defeated.

COVID-19 economic hit gives China little choice but to help cash-strapped allies

https://asia.nikkei.com/Spotlight/Belt-and-Road/Pakistan-request-opens-door-for-Belt-and-Road-project-debt-relief

Pakistan's economy is taking a hit due to the COVID-19 crisis. According to the latest country report by the Economist Intelligence Unit, Pakistan's GDP is set to contract by 1.6 percent in the 2019-20 fiscal year. Concerned about worsening economic conditions, the government on Saturday eased coronavirus lockdown restrictions, even as the total number of infections crossed the 30,000 mark with 661 deaths.

In response, Pakistan has also requested that G-20 countries provide debt relief, which could potentially result in the deferment of $1.8 billion in obligations for a year, Hafeez Shaik, a government adviser, was quoted as saying after a Ministry of Finance meeting. Pakistan has also secured a loan of $1.386 billion from the International Monetary Fund and another of $305 million from the Asian Development Bank.

In such a context, Krzysztof Iwanek, head of the Asia Research Centre at War Studies University in Warsaw, argues that Beijing agreeing to payment delays would give Pakistan short-term financial breathing room.

But Iwanek cautions against expecting significant debt relief from China. "[Beijing] may cancel some of [the] lesser value [loans] and allow Islamabad to defer some of the payments, at best, " he told Nikkei.

The German Marshall Fund's Small, meanwhile, said that China accepting Pakistan's request would underscore the reality that it can't aggressively push the CPEC projects. "[China] has largely figured out the terms of what a slimmed-down CPEC would look like and the current situation doesn't make it easier to deal with any of the continued obstacles," Small said.

For foreign investors registered with the State Bank of Pakistan, the return on equity (ROE) ‘will be 12pc prospectively’. For local investors, the ROE will be changed to 17pc in rupee terms without dollar indexation. “In recalculating the return, the equity approved by the National Electric and Power Regulatory Authority (Nepra) on commercial operation date in dollar shall be converted into rupee at an exchange rate of Rs145 for prospective calculation”, according to an MoU seen by Dawn.

-------------

A senior government official told Dawn that about half of the 12 IPPs set up under the 2002 power policy and an association representing about two dozen WPPs had already signed memorandums of understanding (MoUs) with a negotiation team led by former federal secretary Babar Yaqoob Fateh Muhammad while others are expected to follow suit within 15 days.

These do not include the IPPs under 1994 policy, China-Pakistan Economic Corridor, public sector plants of generation companies, hydropower and nuclear power projects which claim over 75 per cent of the capacity payments.

Since most of the IPPs remained unutilised for almost nine months last year and are on the last leg of their terms, the total savings would amount to about 5pc of the total energy purchases that last year stood at about Rs775 billion or about Rs35-40bn, the official explained.

The understanding followed principles from government side that power purchase agreements are sacrosanct, the IPPs would not be subjected to media trial and there would be no investigations or arm twisting. However, evidence was put on the table to suggest that on a case to case basis, investments had been exaggerated, equity overstated and machinery over-invoiced and taxes underpaid and hence mutually agreed changes in existing contractual relationship.

Seen this way, China’s internationalization—as laid out in programs such as the Belt and Road Initiative—is not simply a pursuit of geopolitical influence but also, in some tellings, a weapon. Once a country is weighed down by Chinese loans, like a hapless gambler who borrows from the Mafia, it is Beijing’s puppet and in danger of losing a limb.

The prime example of this is the Sri Lankan port of Hambantota. As the story goes, Beijing pushed Sri Lanka into borrowing money from Chinese banks to pay for the project, which had no prospect of commercial success. Onerous terms and feeble revenues eventually pushed Sri Lanka into default, at which point Beijing demanded the port as collateral, forcing the Sri Lankan government to surrender control to a Chinese firm.

The Trump administration pointed to Hambantota to warn of China’s strategic use of debt: In 2018, former Vice President Mike Pence called it “debt-trap diplomacy”—a phrase he used through the last days of the administration—and evidence of China’s military ambitions. Last year, erstwhile Attorney General William Barr raised the case to argue that Beijing is “loading poor countries up with debt, refusing to renegotiate terms, and then taking control of the infrastructure itself.”

As Michael Ondaatje, one of Sri Lanka’s greatest chroniclers, once said, “In Sri Lanka a well-told lie is worth a thousand facts.” And the debt-trap narrative is just that: a lie, and a powerful one.

Our research shows that Chinese banks are willing to restructure the terms of existing loans and have never actually seized an asset from any country, much less the port of Hambantota. A Chinese company’s acquisition of a majority stake in the port was a cautionary tale, but it’s not the one we’ve often heard. With a new administration in Washington, the truth about the widely, perhaps willfully, misunderstood case of Hambantota Port is long overdue.

The city of Hambantota lies at the southern tip of Sri Lanka, a few nautical miles from the busy Indian Ocean shipping lane that accounts for nearly all of the ocean-borne trade between Asia and Europe, and more than 80 percent of ocean-borne global trade. When a Chinese firm snagged the contract to build the city’s port, it was stepping into an ongoing Western competition, though one the United States had largely abandoned.

It was the Canadian International Development Agency—not China—that financed Canada’s leading engineering and construction firm, SNC-Lavalin, to carry out a feasibility study for the port. We obtained more than 1,000 pages of documents detailing this effort through a Freedom of Information Act request. The study, concluded in 2003, confirmed that building the port at Hambantota was feasible, and supporting documents show that the Canadians’ greatest fear was losing the project to European competitors. SNC-Lavalin recommended that it be undertaken through a joint-venture agreement between the Sri Lanka Ports Authority (SLPA) and a “private consortium” on a build-own-operate-transfer basis, a type of project in which a single company receives a contract to undertake all the steps required to get such a port up and running, and then gets to operate it when it is.

The Canadian project failed to move forward, mostly because of the vicissitudes of Sri Lankan politics. But the plan to build a port in Hambantota gained traction during the rule of the Rajapaksas—Mahinda Rajapaksa, who served as president from 2005 through 2015, and his brother Gotabaya, the current president and former minister of defense—who grew up in Hambantota. They promised to bring big ships to the region, a call that gained urgency after the devastating 2004 tsunami pulverized Sri Lanka’s coast and the local economy.

The narrative wrongfully portrays both Beijing and the developing countries it deals with.

By Deborah Brautigam and Meg Rithmire

https://www.theatlantic.com/international/archive/2021/02/china-debt-trap-diplomacy/617953/

The notion of “debt-trap diplomacy” casts China as a conniving creditor and countries such as Sri Lanka as its credulous victims. On a closer look, however, the situation is far more complex. China’s march outward, like its domestic development, is probing and experimental, a learning process marked by frequent adjustment. After the construction of the port in Hambantota, for example, Chinese firms and banks learned that strongmen fall and that they’d better have strategies for dealing with political risk. They’re now developing these strategies, getting better at discerning business opportunities and withdrawing where they know they can’t win. Still, American leaders and thinkers from both sides of the aisle give speeches about China’s “modern-day colonialism.”

------------

China, we are told, inveigles poorer countries into taking out loan after loan to build expensive infrastructure that they can’t afford and that will yield few benefits, all with the end goal of Beijing eventually taking control of these assets from its struggling borrowers. As states around the world pile on debt to combat the coronavirus pandemic and bolster flagging economies, fears of such possible seizures have only amplified.

Seen this way, China’s internationalization—as laid out in programs such as the Belt and Road Initiative—is not simply a pursuit of geopolitical influence but also, in some tellings, a weapon. Once a country is weighed down by Chinese loans, like a hapless gambler who borrows from the Mafia, it is Beijing’s puppet and in danger of losing a limb.

The prime example of this is the Sri Lankan port of Hambantota. As the story goes, Beijing pushed Sri Lanka into borrowing money from Chinese banks to pay for the project, which had no prospect of commercial success. Onerous terms and feeble revenues eventually pushed Sri Lanka into default, at which point Beijing demanded the port as collateral, forcing the Sri Lankan government to surrender control to a Chinese firm.

The Trump administration pointed to Hambantota to warn of China’s strategic use of debt: In 2018, former Vice President Mike Pence called it “debt-trap diplomacy”—a phrase he used through the last days of the administration—and evidence of China’s military ambitions. Last year, erstwhile Attorney General William Barr raised the case to argue that Beijing is “loading poor countries up with debt, refusing to renegotiate terms, and then taking control of the infrastructure itself.”

As Michael Ondaatje, one of Sri Lanka’s greatest chroniclers, once said, “In Sri Lanka a well-told lie is worth a thousand facts.” And the debt-trap narrative is just that: a lie, and a powerful one.

Our research shows that Chinese banks are willing to restructure the terms of existing loans and have never actually seized an asset from any country, much less the port of Hambantota. A Chinese company’s acquisition of a majority stake in the port was a cautionary tale, but it’s not the one we’ve often heard. With a new administration in Washington, the truth about the widely, perhaps willfully, misunderstood case of Hambantota Port is long overdue.

The city of Hambantota lies at the southern tip of Sri Lanka, a few nautical miles from the busy Indian Ocean shipping lane that accounts for nearly all of the ocean-borne trade between Asia and Europe, and more than 80 percent of ocean-borne global trade. When a Chinese firm snagged the contract to build the city’s port, it was stepping into an ongoing Western competition, though one the United States had largely abandoned.

By Indrajit Samarajiva

Last month, protesters breached the presidential residence and prime minister’s office, and it was the one thing that felt good. Along with thousands of ordinary Sri Lankans, I got to see inside these colonial-era fortresses for the first time. It was spontaneous, safe and respectful. Couples went on dates there; parents brought their kids. I saw people singing in the president’s house, a mother dancing with her toddler, people swimming in the pool. I walked around a hall lined with plaques bearing the names of British colonizers, which seamlessly became the names of our own presidents.

At the prime minister’s office, someone played the piano and a shirtless man draped in a Sri Lankan flag slept on a couch. Four guys had set up a game of carrom and were flicking the discs around. A child joyfully cartwheeled across the lawn outside, and a community kitchen served rice to anyone that was hungry. It was a beautiful sight in a space where elites had nibbled on canapes before, surrounded by armed guards. It felt hopeful.

But what had briefly felt like true democracy didn’t last. Parliament merely replaced President Rajapaksa with one of his cronies, Ranil Wickremesinghe, who has been prime minister a handful of times but lost his parliamentary seat in 2020. He has turned the military on demonstrators and arrested protesters and trade unionists. It’s all been “constitutional,” eroding faith in the whole liberal democratic system.

Sri Lanka — like so many other countries struggling for solvency — remains a colony with administration outsourced to the International Monetary Fund. We still export cheap labor and resources, and import expensive finished goods — the basic colonial model. The country is still divided and conquered by local elites, while real economic control is held abroad. The I.M.F. has extended loans to Sri Lanka 16 times, always with stringent conditions. They just keep restructuring us for further exploitation by creditors.

And as much as the West blames Chinese predatory lending, only around 10 to 20 percent of Sri Lanka’s foreign debt is owed to China. The majority is owed to U.S. and European financial institutions, or Western allies like Japan. We died in a largely Western debt trap.

Other countries face the same peril. Around 60 percent of low-income nations and 30 percent of middle-income ones are in debt distress or at high risk of it. Pakistan, Bangladesh, Tunisia, Ghana, South Africa, Brazil, Argentina, Sudan — the list of those in trouble is growing rapidly. An estimated 60 percent of the world’s workforce has lower real incomes than before the pandemic, and the rich countries offer little to no help.

But big economies are suffering too. Europe faces energy uncertainty, Americans are struggling to fill their tanks, the United States may already be in recession, its asset bubble threatens to pop, and British families face food worries.

It’s going to get worse: The I.M.F. just warned that the likelihood of a global recession is mounting. As economies collapse, Western loans simply won’t get repaid and poor nations will crash out of the dollar system that props up Western lifestyles. Then, even Americans won’t be able to money-print their way out of trouble. It’s already begun. Sri Lanka has started settling loans in Indian rupees while India is buying Russian oil in rubles. China may buy Saudi oil with yuan.

The Sri Lankan uprising that threw out our leaders is called the Aragalaya. It means “struggle.” It’s going to be a long one, and it’s spreading across the world.

@Kanthan2030

In the last six years, China has lent $185 billion in emergency loans to developing nations. That’s more than the IMF.

Multipolar world where poor countries are not the mercy of one system. 👋🏻👇🏽

Also an important fact is that the majority of the loans are happening in Yuan

“Lender of last resort” — Bloomberg

https://twitter.com/Kanthan2030/status/1640918548720812033?s=20

-------

https://www.bloomberg.com/news/newsletters/2023-03-28/global-economy-latest-china-is-lender-of-last-resort-to-emerging-markets

Creditor-in-Chief

Is China finally living up to its responsibility as the world’s second-largest economy? Or is it setting up a rival system of global governance as the relationship between Beijing and Washington gets sourer by the day?

Those are the questions raised – once again, the cognoscenti might say – by a new paper that lays out the growing role of China as a lender of last resort to countries in economic peril, of which there is now a growing list.

Among the findings of a new paper that my colleague Tom Hancock and I report on here:

From 2000-21, the People’s Bank of China and state-owned banks sent $240 billion to governments in the developing world in what amounted to emergency loans.

The bulk of that came in 2016-21, when 22 countries got some $185 billion, according to what the researchers were able to document.

That total surpassed the $144 billion that IMF data shows its members having drawn from the Washington-based lender during that time.

The research — by Sebastian Horn of the World Bank, Brad Parks of the William & Mary AidData project, former World Bank chief economist Carmen Reinhart and Christoph Trebesch of Germany’s Kiel Institute for the World Economy — is part of a growing body of work looking at Chinese lending.

https://twitter.com/bilalgilani/status/1677391745112477696?s=20

Bilal I Gilani

@bilalgilani

CPEC projects are creating 192,000 jobs, generating 6,000MW of power, building 510 km (316 miles) of highways, and expanding the national transmission network by 886 km (550 miles),” Foreign Ministry spokesman Wang Wenbin told reporters in Beijing."

Associated Press of Pakistan: On July 5, Prime Minister Shahbaz Sharif while addressing a ceremony to mark a decade of signing of the China-Pakistan Economic Corridor (CPEC), said that CPEC has been playing a key role in transforming Pakistan’s economic landscape. He also said that the mega project helped Pakistan progress in the region and beyond. What is your response?

Wang Wenbin: The China-Pakistan Economic Corridor (CPEC) is a signature project of China-Pakistan cooperation in the new era, and an important project under the Belt and Road Initiative. This year marks the 10th anniversary of the launch of CPEC. After ten years of development, a “1+4” cooperation layout has been formed, with the CPEC at the center and Gwadar Port, transport infrastructure, energy and industrial cooperation being the four key areas. Projects under CPEC are flourishing all across Pakistan, attracting USD 25.4 billion of direct investment, creating 192,000 jobs, producing 6,000 megawatts of electric power, building 510 kilometers of highways and adding 886 kilometers to the core national transmission network. CPEC has made tangible contribution to the national development of Pakistan and connectivity in the region. China and Pakistan have also explored new areas for cooperation under the framework of CPEC, creating new highlights in cooperation on agriculture, science and technology, telecommunication and people’s wellbeing.

China stands ready to work with Pakistan to build on the past achievements and follow the guidance of the important common understandings between the leaders of the two countries on promoting high-quality development of CPEC to boost the development of China and Pakistan and the region and bring more benefits to the people of all countries.

https://www.fmprc.gov.cn/eng/xwfw_665399/s2510_665401/2511_665403/202307/t20230706_11109401.html

https://www.voanews.com/a/top-china-official-visits-pakistan-marking-cpec-milestone/7204256.html

Chinese Foreign Ministry spokesman Wang Wenbin told reporters in Beijing earlier this month that CPEC projects "are flourishing all across Pakistan," making a "tangible contribution" to the national development of the country and to regional connectivity.

But critics say many projects have suffered delays, including several much-touted industrial zones that were supposed to help Pakistan enhance its exports to earn much-needed foreign exchange.

The country's declining dollar reserves have prevented Islamabad from paying Chinese power producers, leading to strains in many ties.

Pakistan owes more than $1.26 billion (350 billion rupees) to Chinese power plants. The amount keeps growing, and China has been reluctant to defer or restructure the payment and CPEC debts. All the Chinese loans – both government and commercial banks – makeup nearly 30% of Islamabad's external debt.

Some critics blame CPEC investments for contributing to Pakistan's economic troubles. The government fended off the risk of an imminent default by securing a short-term $3 billion International Monetary Fund bailout agreement this month.

Security threats to its citizens and interests in Pakistan have also been a cause of concern for China. Militant attacks have killed several Chinese nationals in recent years, prompting Beijing to press Islamabad to ensure security measures for CPEC projects.

Diplomatic sources told VOA that China has lately directed its diplomats and citizens working on CPEC programs to strictly limit their movements and avoid visiting certain Pakistani cities for security reasons.

"They [Chinese] believe this security issue is becoming an impediment in taking CPEC forward," Senator Mushahid Hussain, the chairman of the defense committee of the upper house of the Pakistani parliament, told VOA in an interview earlier this month.

"Recurring expressions of concern about the safety and security of Chinese citizens and investors in Pakistan by top Chinese leaders indicate that Pakistan's promises of 'foolproof security' for Chinese working in Pakistan have yet to be fulfilled," said Hussain, who represents Prime Minister Shehbaz Sharif's ruling party in the Senate.