Pakistani Stock Market Still Offers Great Value After Stellar Performance in 2016

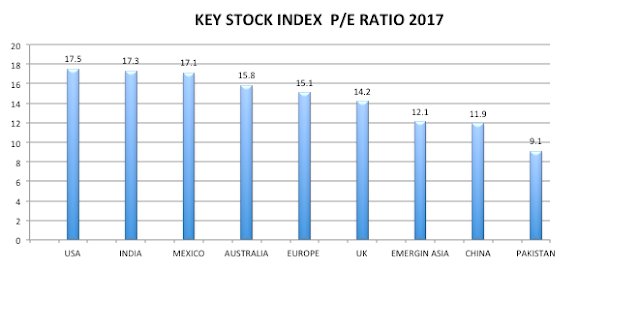

Pakistan's KSE-100 continues to offer attractive valuations for investors in 2017. Its equities are trading at a forward price-earnings ratio of just 9.1, according to Pakistani brokerage firm Arif Habib Limited.

Pakistani shares are on offer at a deep discount to the Indian shares trading at 17.3 price-earnings multiple. While India's stock market is among the world's most expensive, the Pakistani market is among the cheapest. Pakistani shares are now trading at 47.3% discount to Indian shares.

In spite KSE-100's major run up of 46% in 2016, far outpacing India's Sensex's 2.57% rise and MSCI emerging market's 8.42% increase, Pakistani equities (PE ratio 9.1) are still cheaper than Asian emerging markets (12.1) and China (11.9), according to published data.

Pakistani shares are now trading at 47.3% discount to Indian shares, 31% discount to Asia Emerging Market index and 23.5% discount to Chinese shares.

Consumer confidence index in Pakistan jumped five point from the prior quarter to reach 106 in Q4/2016, according to Nielsen’s global survey of consumer confidence for 63 countries released recently.

Here's an excerpt of Nielsen's report Africa/Middle East region that includes Pakistan:

"Consumer confidence in the Africa/Middle East region declined in the fourth quarter, falling four points to 83, the lowest level in more than three years. Confidence was highest in United Arab Emirates, which held steady from the third quarter at 108. Pakistan was the only country where consumer confidence moved in a positive direction, rising five points from the third quarter to 106, the highest score for the country since it was added to the survey in 2008."

The share of Pakistani respondents worried about job security dropped to 21%. 51% of Pakistanis said they are optimistic about better job opportunities in the next 12 months, according to the survey.

“The findings of the consumer confidence reflect a favorable atmosphere in Pakistan. The set of factors that influence the confidence levels of Pakistani consumers goes beyond economics and business, and is reflective of improved security conditions, increased energy availability and low inflation rates,” reported the survey.

“China-Pakistan Economic Corridor (CPEC) has also led to a higher activity in large-scale manufacturing and construction, opening more investment opportunities,” said Nielsen Pakistan Managing Director Quratulain Ibrahim, according to Pakistan's Express Tribune newspaper. “We hope to see this optimism among Pakistani consumers during the coming months.”

Pakistani banks have boosted lending to businesses and consumers. Large-scale manufacturing sector borrowed Rs. 225 billion in 2016, up from Rs 119 billion in 2015. Consumer loans have jumped from Rs. 29 billion in 2015 to Rs. 70 billion in 2016. Auto financing soared 32% to Rs 30.7 billion in 2016, according to the State Bank of Pakistan as reported by Daily Times.

Pakistani consumers and businesses are feeling increasingly confident with improved overall security, rising foreign and domestic investments and better employment prospects. They are earning, borrowing and spending more to further stimulate the economy thereby creating a virtuous cycle. Low oil prices and relatively subdued inflation are also helping. It's now up to Pakistan's political, economic and military leadership to maintain this growth momentum.

Related Links:

Haq's Musings

Pakistan's Economy and Security in 2016

Credit Suisse Global Wealth Report 2016

Pakistan's Middle Class Larger and Richer Than India's

Pakistan Translates GDP Growth to Citizens' Well-being

Rising Motorcycle Sales in Pakistan

Depth of Deprivation in India

Chicken vs Daal in Pakistan

China Pakistan Economic Corridor

Pakistani shares are on offer at a deep discount to the Indian shares trading at 17.3 price-earnings multiple. While India's stock market is among the world's most expensive, the Pakistani market is among the cheapest. Pakistani shares are now trading at 47.3% discount to Indian shares.

|

In spite KSE-100's major run up of 46% in 2016, far outpacing India's Sensex's 2.57% rise and MSCI emerging market's 8.42% increase, Pakistani equities (PE ratio 9.1) are still cheaper than Asian emerging markets (12.1) and China (11.9), according to published data.

Pakistani shares are now trading at 47.3% discount to Indian shares, 31% discount to Asia Emerging Market index and 23.5% discount to Chinese shares.

Consumer confidence index in Pakistan jumped five point from the prior quarter to reach 106 in Q4/2016, according to Nielsen’s global survey of consumer confidence for 63 countries released recently.

|

| Source: Nielsen |

Here's an excerpt of Nielsen's report Africa/Middle East region that includes Pakistan:

"Consumer confidence in the Africa/Middle East region declined in the fourth quarter, falling four points to 83, the lowest level in more than three years. Confidence was highest in United Arab Emirates, which held steady from the third quarter at 108. Pakistan was the only country where consumer confidence moved in a positive direction, rising five points from the third quarter to 106, the highest score for the country since it was added to the survey in 2008."

The share of Pakistani respondents worried about job security dropped to 21%. 51% of Pakistanis said they are optimistic about better job opportunities in the next 12 months, according to the survey.

“The findings of the consumer confidence reflect a favorable atmosphere in Pakistan. The set of factors that influence the confidence levels of Pakistani consumers goes beyond economics and business, and is reflective of improved security conditions, increased energy availability and low inflation rates,” reported the survey.

“China-Pakistan Economic Corridor (CPEC) has also led to a higher activity in large-scale manufacturing and construction, opening more investment opportunities,” said Nielsen Pakistan Managing Director Quratulain Ibrahim, according to Pakistan's Express Tribune newspaper. “We hope to see this optimism among Pakistani consumers during the coming months.”

Pakistani banks have boosted lending to businesses and consumers. Large-scale manufacturing sector borrowed Rs. 225 billion in 2016, up from Rs 119 billion in 2015. Consumer loans have jumped from Rs. 29 billion in 2015 to Rs. 70 billion in 2016. Auto financing soared 32% to Rs 30.7 billion in 2016, according to the State Bank of Pakistan as reported by Daily Times.

Pakistani consumers and businesses are feeling increasingly confident with improved overall security, rising foreign and domestic investments and better employment prospects. They are earning, borrowing and spending more to further stimulate the economy thereby creating a virtuous cycle. Low oil prices and relatively subdued inflation are also helping. It's now up to Pakistan's political, economic and military leadership to maintain this growth momentum.

Related Links:

Haq's Musings

Pakistan's Economy and Security in 2016

Credit Suisse Global Wealth Report 2016

Pakistan's Middle Class Larger and Richer Than India's

Pakistan Translates GDP Growth to Citizens' Well-being

Rising Motorcycle Sales in Pakistan

Depth of Deprivation in India

Chicken vs Daal in Pakistan

China Pakistan Economic Corridor

Comments

Rogers said that in addition to GST, he has also been tracking the Indian market, the best performer among the world’s 10 largest stock markets thus far in 2017. “Yes, I am impressed, and I see that the markets are at an all-time high, currency is going up—they are making new highs without me, and that does not make me happy.”

Keen as he is to enter India, Rogers says he will wait because it doesn’t make sense to enter a market when it is on a high. “I don’t want to jump on to a moving train. When you jump on to a moving train, you’ll get hurt.”

http://www.livemint.com/Money/jH7oortdw0GvOodZvQhgTO/Jim-Rogers-changes-his-mind-on-India-again-says-he-missed-t.html

https://www.bloomberg.com/news/articles/2017-04-12/indian-stock-optimism-is-all-hype-to-goldman-sachs-s-rajiv-jain

Scant evidence to justify growth, earnings optimism, he says

‘The non-performing loan situation is pretty unnerving’

Rajiv Jain can’t understand Indian stock bulls.

There’s scant evidence to justify the optimism over the country’s growth outlook and company earnings, said the former star asset manager at Vontobel Holding AG who now manages funds for Goldman Sachs Group Inc.

The nation’s shares and currency are also overvalued, said Jain, whose Goldman Sachs GQG Partners International Opportunities Fund has returned 9.3 percent this year to beat 91 percent of its peers.

The S&P BSE Sensex Index has advanced 11 percent this year, the most among Asian emerging-market gauges after the Philippine Stock Exchange Index.

Jain, who oversees around $2.5 billion from Fort Lauderdale, Florida, spoke in a phone interview:

Why the negativity on Indian stocks?

“India is the single most expensive market globally. It’s more expensive than the U.S. The currency is also overvalued, and earnings estimates have been declining the most among any market this year.”

“Top-down, from a political perspective, it looks good, but I think from a bottom-up, company-wise scenario, it’s not good at all in terms of where the general banking system is, where credit growth is, where the yield curve is.”

“People are usually either too pessimistic or too optimistic on India” and they’re too optimistic at the moment, he said.

How’s the macroeconomic backdrop looking?

“The non-performing loan situation in India is pretty unnerving. Non-performing loans are running at 12 to 13 percent, which is higher than the Chinese.”

“What could go wrong, for example, if oil goes higher? That will be a negative and the current-account deficit will get worse, not better, from this level if the currency stays there. Interest rates are already low. I don’t know how they will go lower from here.”

“Indian credit growth is down 5 to 6 percent. That’s the lowest in decades. The only engine firing is retail lending.”

“Interest rates are low and they should head higher as inflation ticks up during the second half. Job creation in IT services could slow meaningfully from here. Cement sales declined over the last 12 months for example. Real estate markets are still pretty slow, but paint companies are selling at 35 to 40 times earnings.”

On China Pakistan Economic Corridor (CPEC), he said that it is important project that would help connect Iran, Turkey, Central Asian States and Afghanistan etc. He said that to get good result from CPEC, good transportation system is a must for the movement of trading goods.

http://nation.com.pk/business/13-Apr-2017/inefficiencies-in-transport-sector-costs-economy-6pc-of-gdp

https://www.bloomberg.com/politics/articles/2017-04-20/pakistan-court-orders-further-probe-against-sharif-in-graft-case

Pakistan’s top court ordered further investigation into corruption charges against Prime Minister Nawaz Sharif, for now taking off the immediate prospect of a potential disqualification as his government continues efforts to boost an economy hit for years by power outages and terrorism.

In a three-two split decision by the five-member bench, the Supreme Court ordered a “joint investigation team” to probe allegations that Sharif and his children brought foreign assets illegally, Justice Asif Saeed Khosa, said in Islamabad, the capital, on Thursday. The investigative unit should submit its report within 60 days, he said.

“A special bench will be constituted to look into the matter after the final report and whether the prime minister’s disqualification can be considered,” Khosa said.

Making his verdict as hundreds of riot police and paramilitary troops were deployed within a five kilometer (3.1 mile) radius of the court, Khosa concluded the hearing of petitions by opposition leader and former cricket star, Imran Khan, who brought the case against Sharif and his family before elections next year. Immediately after the ruling the nation’s benchmark stock index advanced as much as 4 percent, the largest jump in more than two years, before paring gains to 2.4 percent at the close of trading.

The court took up the case in November following a report by the International Consortium of Investigative Journalists showed Sharif’s three children either owned or have signing rights to authorize transactions of four offshore companies in the British Virgin Islands. Those holdings were alleged to have been used to make property purchases in London. Sharif’s political opponents doubted the premier’s family obtained those assets legally.

The decision eases an immediate political crisis for Sharif ahead of the 2018 national vote amid opposition calls for him to step down. After the release of the report based on leaked documents of Panama-based law firm Mossack Fonsecca in April, Sharif had pledged to resign if charges were proved.

Sharif’s government will probably now “go ahead and complete its term,” Burzine Waghmar, a member of the Centre for the Study of Pakistan at the School of Oriental and African Studies in London, said by phone. “The administration will ride” the investigation out.

https://etfdailynews.com/2017/05/30/pakistan-etf-pak-in-focus-as-country-regains-em-status/

The re-entry into the emerging market block after nine years was made possible by the country’s improving liquidity and growth. Pakistan lost this position in late 2008, following a period of market turmoil that halted trading for months in the Karachi exchange.

Pakistan is the first country to get the frontier-to-emerging promotion after Qatar and the United Arab Emirates several years ago. MSCI will add Pakistan to the Emerging Market Index effective May 31, at the market close, with a weight of just 0.2% (read: Can Emerging Market ETFs Retain Their Mojo in 2017?).

The reclassification is making investors bullish about Global X MSCI Pakistan ETF (PAK – Free Report) – the ETF targeting Pakistani equity markets. The fund will likely lure a wider class of investors thereby injecting huge amounts of money into the country. In fact, the fund is on track for the biggest monthly inflow since its inception two years ago. The ETF has gathered $11.8 million in capital so far this month, propelling its asset base to $48.5 million. According to Bloomberg, the bearish bets have also fallen to the lowest level since December. Over $1 million short positions have been cut over the past six weeks.

PAK in Focus

The product offers exposure to 43 Pakistani equities by tracking the MSCI All Pakistan Select 25/50 Index. The top two firms – Habib Bank and Lucky Cement – dominate the fund returns with a double-digit exposure each. Other firms hold less than 7.2% of the assets. From a sector look, financials and materials occupy the top two positions at 33% and 28%, respectively, followed by energy (18%).

The ETF is expensive relative to many emerging market funds, charging 91 bps in fees and expenses. Additionally, it trades in small volumes of about 35,000 shares resulting in additional cost in the form of wide bid/ask spread.

PAK has been outperforming the broad emerging funds, returning investors 33.5% over the past one-year period compared with gains of 29% for (EEM – Free Report) . It has a Zacks ETF Rank of 3 or ‘Hold rating with a Medium risk outlook, suggesting more room for upside (read: Pakistan ETF Hits New 52-Week High).

The outperformance is likely to continue given the country’s GDP growth, falling poverty, and bourgeoning middle class. After falling to below 4% growth in 2008, Pakistan GDP growth hit a 10-year high of 5.28% for fiscal year 2016–17. However, terrorist attacks, bombings, other incidents of violence and brutal state retaliation continue to weigh on the country’s growth and the ETF performance.

The Global X MSCI Pakistan ETF (NYSE:PAK) was unchanged in premarket trading Tuesday. Year-to-date, PAK has gained 7.49%, versus a 8.13% rise in the benchmark S&P 500 index during the same period.

PAK currently has an ETF Daily News SMART Grade of A (Strong Buy), and is ranked #39 of 77 ETFs in the Emerging Markets Equities ETFs category.