World Bank Reports Big Jump in Living Standards of Poor Pakistanis

A November 2016 World Bank report says that Pakistan has successfully translated economic growth into the well-being of its poorest citizens. It says "Pakistan’s recent growth has been accompanied by a staggering fall in poverty".

Rising incomes of the poorest 20% in Pakistan since 2002 have enabled them to enhance their living standards by improving their diets and acquiring television sets, refrigerators, motorcycles, flush toilets, and better housing.

Another recent report titled "From Wealth to Well Being" by Boston Consulting Group (BCG) also found that Pakistan does better than India and China in translating GDP growth to citizens' well-being.

One particular metric BCG report uses is growth-to-well-being coefficient on which Pakistan scores 0.87, higher than India's 0.77 and China's 0.75.

Big Poverty Decline Since 2002:

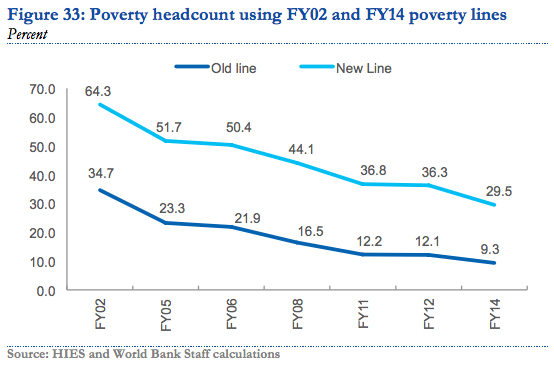

Using the old national poverty line of $1.90 (ICP 2011 PPP) , set in 2001, the percentage of people living in poverty fell from 34.7 percent in FY02 to 9.3 percent in FY14—a fall of more than 75 percent. Much of the socioeconomic progress reported by the World Bank since 2000 has occurred during President Musharraf's years in office from 2000-2007. It has dramatically slowed or stagnated since 2010.

Using the new 2016 poverty line of $3.50 (ICP 2011 PPP), 29.5 percent of Pakistanis as poor (using the latest available data from FY14). By back casting this line, the poverty rate in FY02 would have been about 64.3 percent.

Pakistan's new poverty line sets a minimum consumption threshold of Rs. 3,030 or $105 (ICP 2011 PPP) per person per month or $3.50 (ICP 2011 PPP) per person per day. This translates to between Rs. 18,000 and Rs. 21,000 per month for a household at the poverty line, allowing nearly 30% of the population or close to 60 million people to be targeted for pro-poor and inclusive development policies—thus setting a much higher bar for inclusive development.

Multi-dimensional Poverty Decline:

A UNDP report released in June 2016 said Pakistan’s MPI (Multi-dimensional poverty index) showed a strong decline, with national poverty rates falling from 55% to 39% from 2004 to 2015. MPI goes beyond just income poverty.

The Multidimensional Poverty Index uses a broader concept of poverty than income and wealth alone. It reflects the deprivations people experience with respect to health, education and standard of living, and is thus a more detailed way of understanding and alleviating poverty. Since its development by OPHI and UNDP in 2010, many countries, including Pakistan, have adopted this methodology as an official poverty estimate, complementing consumption or income-based poverty figures.

Rising Living Standards of the Poorest 20% in Pakistan:

According to the latest World Report titled "Pakistan Development Update: Making Growth Matter" released this month, Pakistan saw substantial gains in welfare, including the ownership of assets, the quality of housing and an increase in school enrollment, particularly for girls.

First, the ownership of relatively more expensive assets increased even among the poorest. In the bottom quintile, the ownership of motorcycles increased from 2 to 18 percent, televisions from 20 to 36 percent and refrigerators from 5 to 14 percent.

In contrast, there was a decline in the ownership of cheaper assets like bicycles and radios.

Housing quality in the bottom quintile also showed an improvement. The number of homes constructed with bricks or blocks increased while mud (katcha) homes decreased. Homes with a flushing toilet almost doubled in the bottom quintile, from about 24 percent in FY02 to 49 percent in FY14.

Dietary Improvements for the Poorest 20% in Pakistan:

Decline in poverty led to an increase in dietary diversity for all income groups.

For the poorest, the share of expenditure devoted to milk and milk products, chicken, eggs and fish rose, as did the share devoted to vegetables and fruits.

In contrast, the share of cereals and pulses, which provide the cheapest calories, declined steadily between FY02 and FY14. Because foods like chicken, eggs, vegetables, fruits, and milk and milk products are more expensive than cereals and pulses, and have lower caloric content, this shift in consumption also increased the amount that people spent per calorie over time.

For the poorest quintile, expenditure per calorie increased by over 18 percent between FY02 and FY14. Overall, this analysis confirms that the decline in poverty exhibited by the 2001 poverty line is quite credible, and that Pakistan has done remarkably well overall in reducing monetary poverty based on the metric it set some 15 years ago, says the World Bank.

Summary:

In spite of Pakistan's many challenges on multiple fronts, the country has successfully translated its GDP growth into the well-being of its poorest citizens. "Pakistan’s recent growth has been accompanied by a staggering fall in poverty", says a November 2016 World Bank report. An earlier report by Boston Consulting Group reached a similar conclusion.

Related Links:

Haq's Musings

Pakistan Translates GDP Growth to Citizens' Well-being

Rising Motorcycle Sales in Pakistan

Depth of Deprivation in India

Chicken vs Daal in Pakistan

China Pakistan Economic Corridor

Rising incomes of the poorest 20% in Pakistan since 2002 have enabled them to enhance their living standards by improving their diets and acquiring television sets, refrigerators, motorcycles, flush toilets, and better housing.

Another recent report titled "From Wealth to Well Being" by Boston Consulting Group (BCG) also found that Pakistan does better than India and China in translating GDP growth to citizens' well-being.

One particular metric BCG report uses is growth-to-well-being coefficient on which Pakistan scores 0.87, higher than India's 0.77 and China's 0.75.

Big Poverty Decline Since 2002:

Using the old national poverty line of $1.90 (ICP 2011 PPP) , set in 2001, the percentage of people living in poverty fell from 34.7 percent in FY02 to 9.3 percent in FY14—a fall of more than 75 percent. Much of the socioeconomic progress reported by the World Bank since 2000 has occurred during President Musharraf's years in office from 2000-2007. It has dramatically slowed or stagnated since 2010.

|

| Source: World Bank Report Nov 2016 |

Using the new 2016 poverty line of $3.50 (ICP 2011 PPP), 29.5 percent of Pakistanis as poor (using the latest available data from FY14). By back casting this line, the poverty rate in FY02 would have been about 64.3 percent.

Pakistan's new poverty line sets a minimum consumption threshold of Rs. 3,030 or $105 (ICP 2011 PPP) per person per month or $3.50 (ICP 2011 PPP) per person per day. This translates to between Rs. 18,000 and Rs. 21,000 per month for a household at the poverty line, allowing nearly 30% of the population or close to 60 million people to be targeted for pro-poor and inclusive development policies—thus setting a much higher bar for inclusive development.

Multi-dimensional Poverty Decline:

A UNDP report released in June 2016 said Pakistan’s MPI (Multi-dimensional poverty index) showed a strong decline, with national poverty rates falling from 55% to 39% from 2004 to 2015. MPI goes beyond just income poverty.

The Multidimensional Poverty Index uses a broader concept of poverty than income and wealth alone. It reflects the deprivations people experience with respect to health, education and standard of living, and is thus a more detailed way of understanding and alleviating poverty. Since its development by OPHI and UNDP in 2010, many countries, including Pakistan, have adopted this methodology as an official poverty estimate, complementing consumption or income-based poverty figures.

Rising Living Standards of the Poorest 20% in Pakistan:

According to the latest World Report titled "Pakistan Development Update: Making Growth Matter" released this month, Pakistan saw substantial gains in welfare, including the ownership of assets, the quality of housing and an increase in school enrollment, particularly for girls.

First, the ownership of relatively more expensive assets increased even among the poorest. In the bottom quintile, the ownership of motorcycles increased from 2 to 18 percent, televisions from 20 to 36 percent and refrigerators from 5 to 14 percent.

In contrast, there was a decline in the ownership of cheaper assets like bicycles and radios.

Housing quality in the bottom quintile also showed an improvement. The number of homes constructed with bricks or blocks increased while mud (katcha) homes decreased. Homes with a flushing toilet almost doubled in the bottom quintile, from about 24 percent in FY02 to 49 percent in FY14.

Dietary Improvements for the Poorest 20% in Pakistan:

Decline in poverty led to an increase in dietary diversity for all income groups.

For the poorest, the share of expenditure devoted to milk and milk products, chicken, eggs and fish rose, as did the share devoted to vegetables and fruits.

In contrast, the share of cereals and pulses, which provide the cheapest calories, declined steadily between FY02 and FY14. Because foods like chicken, eggs, vegetables, fruits, and milk and milk products are more expensive than cereals and pulses, and have lower caloric content, this shift in consumption also increased the amount that people spent per calorie over time.

For the poorest quintile, expenditure per calorie increased by over 18 percent between FY02 and FY14. Overall, this analysis confirms that the decline in poverty exhibited by the 2001 poverty line is quite credible, and that Pakistan has done remarkably well overall in reducing monetary poverty based on the metric it set some 15 years ago, says the World Bank.

Summary:

In spite of Pakistan's many challenges on multiple fronts, the country has successfully translated its GDP growth into the well-being of its poorest citizens. "Pakistan’s recent growth has been accompanied by a staggering fall in poverty", says a November 2016 World Bank report. An earlier report by Boston Consulting Group reached a similar conclusion.

Related Links:

Haq's Musings

Pakistan Translates GDP Growth to Citizens' Well-being

Rising Motorcycle Sales in Pakistan

Depth of Deprivation in India

Chicken vs Daal in Pakistan

China Pakistan Economic Corridor

Comments

Pakistan's oil consumption from July 2016 to February 2017 jumped 13% year on year, owing to lower petroleum product prices and higher economic activity, driven by GDP growth, foreign investment and greater political stability.

Pakistan's economy expanded 4.2% in 2016, foreign investment has continued to grow -- attracted by the multi-billion dollar China-Pakistan Economic Corridor project -- and improvements in the country's security front, following the government's efforts to combat terrorism, have also led to economic gains and additional investment.

Oil sales during the first eight months of the current fiscal year rose 13% year on year to 16.67 million mt, according to data from oil marketing companies and the Pakistan's Oil Companies Advisory Committee. Pakistan's fiscal year runs from July to June.

Motor gasoline sales increased to 4.36 million mt, up 20% year on year, while demand for high speed diesel increased 15% to 5.46 million mt, the data showed.

"Sales of both products moved north due to significantly lower prices and lower availability of compressed natural gas in the transport sector," said Muhammad Saad Ali, research analyst with Karachi-based brokerage Inter Market Securities.

The price of Pakistan's motor gasoline peaked in October 2013 at Rupees 114 ($1.1)/liter compared with Rupees 73/liter currently, while high speed diesel was at Rupees 117/liter versus the current price of Rupees 82/liter.

Sales of furnace oil also increased to 6.21 million mt from July 2016 to February 2017, up 10% year on year, driven by higher consumption by the power generation sector amid lower water levels and weak hydroelectric production.

CONSUMPTION OUTLOOK

Looking ahead, Pakistan's oil products demand is expected to see substantial growth over the next three years because of rising per capita income, higher automotive sales and growing foreign investment, according to data from energy experts and analysts.

"We believe that oil marketing companies' sales will increase in the backdrop of active transportation activity owing to projects near the China-Pakistan Economic Corridor, rising auto-financing loans and higher per capita income," said Ayesha Fayyaz, research analyst at Karachi-based brokerage Shajar Capital Ltd.

Gasoline demand is expected to increase to 10.9 million mt in the fiscal year ended June 30, 2020, from 5.8 million mt in the year ended June 2016.

The forecast is well above earlier estimates made by Pakistan's Oil Companies Advisory Committee, expecting gasoline demand to reach 8.78 million mt by 2019-20.

"Motor gasoline and high speed diesel sales will continue to be driven by improving macroeconomic factors, and rising sales of cars, bikes and rickshaws," analyst Umair Naseer of Karachi-based Topline Securities said.

"Under CPEC, there will be construction of road infrastructure and industrial units. This, we believe, will lead to an increase in transportation activity and higher gasoline and diesel demand," Naseer added.

The outlook seems less promising for furnace oil, Fayyaz said.

"We are conservative about the volumetric growth in furnace oil due to the expansion of the LNG and hydroelectric power sectors," she said.

In January, LSM output edged up 1.08 percent over the same month last year and rose 2.78 percent as compared to December 2016. Iron and steel production was also the highest (28.02pc) among all the main industries in January, closely followed by engineering products (27.69pc).

Engineering sector’s output, however, slid 0.54 percent in July-January, while textile sector – having the largest weight in the LSM basket – registered the lowest 0.29 percent growth during the period. Textile output marginally increased 1.23 percent in January.

The PBS data showed that electronics sector was the second after iron and steel in terms of growth in the seven months with 13.49 percent, followed by non-metallic products (7.78pc), pharmaceutical (7.57pc), automobiles (6.91pc), paper and paper board (6.61pc), food, beverages and tobacco (4.79pc) and rubber products (0.38pc).

The sectors, which posted decline in production in July-January FY17, included wood products (95.82pc), followed by leather products (17.54pc), chemicals (2.13pc) and coke and petroleum (0.67pc).

The LSM’s quantum indices are based on data from Oil Companies Advisory Committee (OCAC), ministry of industries and provincial bureau of statistics. Ministry of industries, which logs production stats of 36 items, recorded 3.78 percent increase during the July-January period of 2016/17.

The ministry recorded the highest production growth in tractors’ output. Total 25,983 were manufactured during the period, up 79.42 percent over the corresponding period last year. The second significant percentage growth (54.93pc) was recorded in production of trucks, followed by billets/ingots (29.65pc), buses (26.19pc), sugar (22.25pc) and motorcycles (20.09pc). Mills produced 2.893 million tonnes of sugars in July-January FY17 as compared to 2.366 million tonnes in the corresponding period of FY16.

Provincial bureau of statistics, which measures outputs of 65 products across the country, registered 3.48 percent rise in the period under review. Production of deep freezers jumped 52.64 percent to 53,509 units, followed by electric fans (27.94pc), refrigerators (22.59pc), woolen and carpet yarn (18.91pc), electric bulbs (16.37pc) and electric meters (15.71pc).

OCAC, which calculates production of 11 petroleum products, registered a marginal 0.29 percent increase in outputs. Production of liquefied petroleum gas rose 10.49 percent to 276.687 million litres. Motor spirits’ output soared 8.66 percent to 1.438 billion litres. Jute batching oil production increased 5.68 percent, followed by jet fuel oil (3.83pc) and high speed diesel (1.67pc).

Diesel oil production, however, fell 44.51 percent in July-January FY17 over the corresponding period of FY16, followed by solvant naptha (18.78pc), kerosene oil (13.27pc) and lubricating oil (2.49pc).

https://www.thenews.com.pk/print/192907-LSM-posts-348-percent-growth-in-July-January

Demand in two countries surges just as sales slow elsewhere in Asia

SADACHIKA WATANABE and JUN ENDO, Nikkei staff writers

https://asia.nikkei.com/Business/Trends/Philippines-Pakistan-help-motorcycle-makers-avoid-the-skids

The Philippines and Pakistan have become bright spots in Asia's motorcycle market, helping to offset slowdowns in other key countries.

Like the Philippines, Pakistan is providing some much-needed vroom. Sales are rising by double digits in the South Asian country, which has a population of nearly 200 million but gross domestic product per capita of $1,500 -- half the Philippines' figure.

Improved security is giving consumers more confidence to buy motorbikes. Sales surged 18.9% last year, to 1.43 million units, according to industry figures. Auto researcher Fourin estimates the market was actually 1.8 million to 2 million, factoring in imports by Chinese manufacturers.

Honda plans to double its motorcycle production capacity in Pakistan in the 2015 to 2018 period. It is already capable of turning out 1 million motorbikes.

Yamaha Motor, which dissolved its local joint venture in 2008, built a new plant to re-enter Pakistan in 2015. Motorcycles with 70cc engines are selling well, and Yamaha aims to buff its brand with a 125cc model.

Despite a population of 100 million, the Philippines' motorbike market is less than half that of Vietnam, which is home to 90 million people. The wealthy tend to own cars, while low-income earners typically get around on Jeepneys and other public transportation in urban areas.

But a couple of Japanese bike manufacturers -- Honda Motor and Yamaha Motor -- have sought to change that with scooters featuring automatic transmissions. Their marketing drives, coupled with rising income levels, are giving sales more zip.

By Shahbaz Rana

https://tribune.com.pk/story/2011528/1-pml-n-govt-lifted-6-2-population-poverty/

Pakistan has lifted 6.2% of its population out of acute poverty during five-year term of Pakistan Muslim League-Nawaz (PML-N), as the number of people living in multidimensional poverty stood at 38.3% in 2018, states a new report of the United Nations Development Programme (UNDP).

The incidence of multidimensional poverty in Pakistan is 38.3% but the intensity is considerably higher at 51.7%, according to the new Multidimensional Poverty Index (MPI) that is based on data of up to fiscal year 2017-18. The report was released on Wednesday.

Jointly developed by the UNDP and the Oxford Poverty and Human Development Initiative (OPHI) at the University of Oxford, the 2019 global MPI offers data for 101 countries, covering 76 per cent of the global population.

The report shows that over one-third of children in Pakistan under the age of 5 years were malnourished and suffering from intra-household inequality. The UNDP has defined the intra household inequality as deprivation in nutrition where one child in the household is malnourished and other is not.

Overall, in South Asia 22.7% of children under age 5 experience intra household inequalities in deprivation in nutrition, says the report.

The 38.3% of the people living in multidimensional poverty by end of 2017-18 suggests the previous government managed to reduce acute poverty in the country. The UNDP report shows that in 2012-13, 44.5% of the population lived in acute multidimensional poverty.

The intensity of poverty also reduced from 52.3% in 2013 to 51.7% in 2018.

The PML-N government had achieved average 4.8% economic growth rate during its five years term, although it missed the annual targets. Rather than income and wealth alone, the MPI uses broader measures to determine poverty based on access to healthcare, education and the overall standard of living, thus giving a more detailed understanding of poverty.

The report notes that Kenya and Pakistan have a similar incidence of multidimensional poverty but inequality in education in Pakistan is twice that of Kenya. The 41.3% of the population was deprived of education – a startling figure that underscores the need to heavily invest in humans.

In order to ensure that Pakistan does not cut the spending on health and education, the International Monetary Fund (IMF) has introduced an indicative target in the programme.

The UNDP notes that Pakistan reduced deprivations in six out of ten indicators. About 27.6% of the total population still lacked access to health related facilities. Nearly one-third of the population did not have access to better standards of living.

Out of the total population, about 21.5% was suffering from severe multidimensional poverty. In addition to 38.3% of the population that lived in multidimensional poverty, another nearly 13% were vulnerable to the poverty.

Nearly one out of every three citizens did not have access to cooking fuel – a ratio that was 38.2% in 2013. About one-fifth did not have access to sanitation, which was less than 29.4% ratio in 2013. Nearly 8% population lacked access to clean drinking water –better than 9.1% in 2013.

The indicators on school attendance and child mortality were also improved but these were still not very impressive. 27% of the population lacked access to nutrition, which was 32.4% five years ago. The child mortality rate went down from 8.7% to 5.9%.

Farzana Naheed Khan

and Shaista Akram

https://uog.edu.pk/downloads/journal/9_Sensitivity_of_Multidimensional_Poverty_Index_in_Pakistan_PJSI_98-108.pdf

Abstract

The study estimates multidimentional poverty in Pakistan following Alkire-Foster methodology.

The analysis is based on Pakistan Social and Living Standard Measurement Survey 2004-05 and

2014-15. The study adopts expert opinion weights, frequency-based weights and equal weights for

the provision of estimates of MPI at national and provincial levels. The results show that the

estimates of MPI range from 14% to 20% at national level and these estimates are quite sensitive

to the choice of weights. Whereas, equal weights always underestimate the magnitude of poverty.

Moreover, the inter-temporal analysis of poverty reveals that the intensity of poverty has lower

contribution in the reduction of multidimensional poverty in Pakistan. Therefore, the deprived

regions of the country should be focused separately (especially the deprived districts of

Balochistan) to target poverty. Besides, the regional allocation of resources can be made

according to the intensity of poverty. The study concludes that the measurement of poverty is a

complex phenomenon and it is quite sensitive to the choice of weights. So, the researcher should

be careful about the choice of weighting scheme while providing estimates of multidimensional

poverty.

----------------------

The Table 2 shows the estimates of MPI for the PSLM 2004-05 and PSLM 2014-15. The study

has adopted expert opinion weights for the computation of MPI while these weights are taken from

Pakistan Economic Survey (2016).

a The multidimensional poverty estimates show that 28.8% of

the population was multidimensionally poor according to the PSLM 2004-05 while 19% of the

population is multidimensionally poor according to the PSLM 2014-15. The Table 2 also shows

that rural poverty is a critical issue in Pakistan as reported MPI is higher for rural areas of Pakistan

as compared to the urban areas of Pakistan for both data sets. This result is consistent with the

earlier poverty studies for Pakistan (Naveed and Ali, 2012; Sallauddin and Zaman, 2012; Pakistan

Economic Survey, 2016).

https://tribune.com.pk/story/2202912/2-punjab-leads-household-income/

The monthly income of all quintiles increased in the range of 5% to 22% and the major surge was recorded in the income of the lowest two quintiles, which appeared to be beneficiaries of the government’s economic policies.

The lowest quintile’s average monthly income stood at Rs23,192, higher by Rs3,450 or 17.5% and sufficient to finance the expenses.

The second-lowest quintile’s income stood at Rs29,049, which was 22% or Rs5,223 more than the previous year’s income and also higher than the pace of increase in expenses.

The middle-income group saw a 12% increase in its income to Rs31,373. The higher middle-income group’s average monthly income increased to Rs37,643, showing 11.8% growth.

The average monthly income of the highest income group was estimated at Rs63,544, higher by 5.1%, still short of matching the growth in expenses.

By Riaz Riazuddin former deputy governor of the State Bank of Pakistan.

https://www.dawn.com/news/1659441/consumption-habits-inflation

As households move to upper-income brackets, the share of spending on food consumption falls. This is known as Engel’s law. Empirical proof of this relationship is visible in the falling share of food from about 48pc in 2001-02 for the average household. This is an obvious indication that the real incomes of households have risen steadily since then, and inflation has not eaten up the entire rise in nominal incomes. Inflation seldom outpaces the rise in nominal incomes.

Coming back to eating habits, our main food spending is on milk. Of the total spending on food, about 25pc was spent on milk (fresh, packed and dry) in 2018-19, up from nearly 17pc in 2001-01. This is a good sign as milk is the most nourishing of all food items. This behaviour (largest spending on milk) holds worldwide. The direct consumption of milk by our households was about seven kilograms per month, or 84kg per year. Total milk consumption per capita is much higher because we also eat ice cream, halwa, jalebi, gulab jamun and whatnot bought from the market. The milk used in them is consumed indirectly. Our total per person per year consumption of milk was 168kg in 2018-19. This has risen from about 150kg in 2000-01. It was 107kg in 1949-50 showing considerable improvement since then.

Since milk is the single largest contributor in expenditure, its contribution to inflation should be very high. Thanks to milk price behaviour, it is seldom in the news as opposed to sugar and wheat, whose price trend, besides hurting the poor is also exploited for gaining political mileage. According to PBS, milk prices have risen from Rs82.50 per litre in October 2018 to Rs104.32 in October 2021. This is a three-year rise of 26.4pc, or per annum rise of 8.1pc. Another blessing related to milk is that the year-to-year variation in its prices is much lower than that of other food items. The three-year rise in CPI is about 30pc, or an average of 9.7pc per year till last month. Clearly, milk prices have contributed to containing inflation to a single digit during this period.

Next to milk is wheat and atta which constitute about 11.2pc of the monthly food expenditure — less than half of milk. Wheat and atta are our staple food and their direct consumption by the average household is 7kg per capita (84kg per capita per year). As we also eat naan from the tandoors, bread from bakeries etc, our indirect consumption of wheat and atta is 41kg per capita. Our total consumption of wheat and atta is about 125kg per capita per year. Our per person per day calorie intake has risen from about 2,078 in 1949-50 to 2,400 in 2001-02 and 2,580 in 2020-21. The per capita per day protein intake in grams increased from 63 to 67 to about 75 during these years. Does this indicate better health? To answer this, let us look at how we devour ghee and sugar. Also remember that each person requires a minimum of 2,100 calories and 60g of protein per day.

Undoubtedly, ghee, cooking oil and sugar have a special place in our culture. We are familiar with Urdu idioms mentioning ghee and shakkar. Two relate to our eating habits. We greet good news by saying ‘Aap kay munh may ghee shakkar’, which literally means that may your mouth be filled with ghee and sugar. We envy the fortune of others by saying ‘Panchon oonglian ghee mei’ (all five fingers immersed in ghee, or having the best of both worlds). These sayings reflect not only our eating trends, but also the inflation burden of the rising prices of these three items — ghee, cooking oil and sugar. Recall any wedding dinner. Ghee is floating in our plates.

"The analysis first looks at the most common deprivation profiles across 111 developing countries (figure 1). The most common profile, affecting 3.9 percent of poor people, includes deprivations in exactly four indicators: nutrition, cooking fuel, sanitation and housing.7 More than 45.5 million poor people are deprived in only these four indicators.8 Of those people, 34.4 million live in India, 2.1 million in Bangladesh and 1.9 million in Pakistan—making this a predominantly South Asian profile "

https://hdr.undp.org/system/files/documents/hdp-document/2022mpireportenpdf.pdf

Also note in this UNDP report that the income poverty (people living on $1.90 or less per day) in Pakistan is 3.6% while it is 22.5% in India and 14.3% in Bangladesh.

Living standards (Cooking fuel Sanitation Drinking water Electricity Housing Assets) of the poor in Pakistan (31.1%) are better than in Bangladesh (45.1%) and India (38.5%).

Pakistan fares worse in terms of education (41.3%) indicators relative to Bangladesh (37.6%) and India (28.2%).

In terms of health, Pakistan ( 27.6%) fares better than India (32.2%) but worse than Bangladesh (17.3%).

In terms of population vulnerable to poverty, Pakistan (12.9%) does better than Bangladesh (18.2%) and India (18.7%)