CS Wealth Report 2016: Pakistanis 20% Richer Than Indians

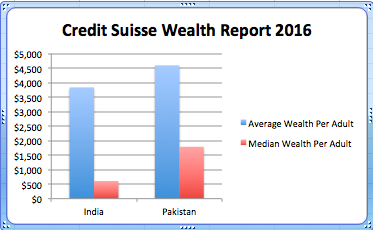

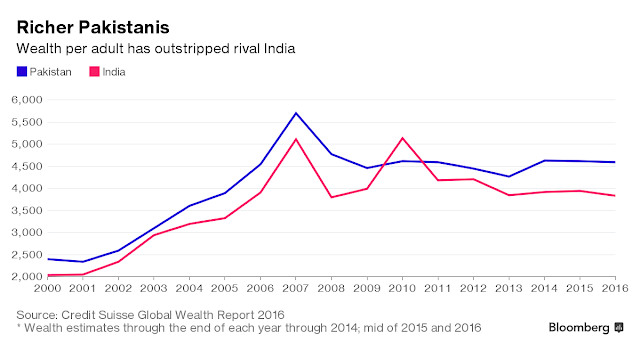

Average Pakistani adult is 20% richer than an average Indian adult and the median wealth of a Pakistani adult is 120% higher than that of his or her Indian counterpart, according to Credit Suisse Wealth Report 2016. Average household wealth in Pakistan has grown 2.1% while it has declined 0.8% in India since the end of last year.

Here are the key statistics reported by Credit Suisse:

Total Household Wealth Mid-2016 :

India $3,099 billion Pakistan $524 billion

Wealth per adult:

India Year End 2000 Average $2,036 Median $498.00

Pakistan Year End 2000 Average $2,399 Median $1,025

India Mid-2016 Average $3,835 Median $608

Pakistan Mid-2016 Average $4,595 Median $1,788

Average wealth per adult in Pakistan is $760 more than in India or about 20% higher.

Median wealth per adult in Pakistan is $1,180 more than in India or about 120% higher

Inequality:

Median wealth data indicates that 50% of Pakistanis own more than $1,180 per adult which is 120% more than the $608 per adult owned by 50% of Indians.

The Credit-Suisse report says that the richest 1% of Indians own 58.4% of India's wealth, second only to Russia's at 74.5%. That makes India the 2nd biggest oligarchy in the world.

The CS wealth data, particularly the median wealth figures, clearly show that Pakistan has much lower levels of inequality than India.

World Bank Report:

A November 2016 World Bank report says that Pakistan has successfully translated economic growth into the well-being of its poorest citizens. It says "Pakistan’s recent growth has been accompanied by a staggering fall in poverty".

Rising incomes of the poorest 20% in Pakistan since 2002 have enabled them to enhance their living standards by improving their diets and acquiring television sets, refrigerators, motorcycles, flush toilets, and better housing.

Another recent report titled "From Wealth to Well Being" by Boston Consulting Group (BCG) also found that Pakistan does better than India and China in translating GDP growth to citizens' well-being.

One particular metric BCG report uses is growth-to-well-being coefficient on which Pakistan scores 0.87, higher than India's 0.77 and China's 0.75.

Big Poverty Decline Since 2002:

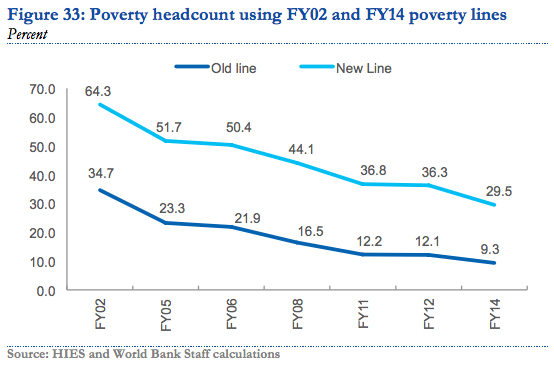

Using the old national poverty line of $1.90 (ICP 2011 PPP) , set in 2001, the percentage of people living in poverty fell from 34.7 percent in FY02 to 9.3 percent in FY14—a fall of more than 75 percent. Much of the socioeconomic progress reported by the World Bank since 2000 has occurred during President Musharraf's years in office from 2000-2007. It has dramatically slowed or stagnated since 2010.

Using the new 2016 poverty line of $3.50 (ICP 2011 PPP), 29.5 percent of Pakistanis as poor (using the latest available data from FY14). By back casting this line, the poverty rate in FY02 would have been about 64.3 percent.

Pakistan's new poverty line sets a minimum consumption threshold of Rs. 3,030 or $105 (ICP 2011 PPP) per person per month or $3.50 (ICP 2011 PPP) per person per day. This translates to between Rs. 18,000 and Rs. 21,000 per month for a household at the poverty line, allowing nearly 30% of the population or close to 60 million people to be targeted for pro-poor and inclusive development policies—thus setting a much higher bar for inclusive development.

Multi-dimensional Poverty Decline:

A UNDP report released in June 2016 said Pakistan’s MPI (Multi-dimensional poverty index) showed a strong decline, with national poverty rates falling from 55% to 39% from 2004 to 2015. MPI goes beyond just income poverty.

The Multidimensional Poverty Index uses a broader concept of poverty than income and wealth alone. It reflects the deprivations people experience with respect to health, education and standard of living, and is thus a more detailed way of understanding and alleviating poverty. Since its development by OPHI and UNDP in 2010, many countries, including Pakistan, have adopted this methodology as an official poverty estimate, complementing consumption or income-based poverty figures.

Rising Living Standards of the Poorest 20% in Pakistan:

According to the latest World Report titled "Pakistan Development Update: Making Growth Matter" released this month, Pakistan saw substantial gains in welfare, including the ownership of assets, the quality of housing and an increase in school enrollment, particularly for girls.

First, the ownership of relatively more expensive assets increased even among the poorest. In the bottom quintile, the ownership of motorcycles increased from 2 to 18 percent, televisions from 20 to 36 percent and refrigerators from 5 to 14 percent.

In contrast, there was a decline in the ownership of cheaper assets like bicycles and radios.

Housing quality in the bottom quintile also showed an improvement. The number of homes constructed with bricks or blocks increased while mud (katcha) homes decreased. Homes with a flushing toilet almost doubled in the bottom quintile, from about 24 percent in FY02 to 49 percent in FY14.

Dietary Improvements for the Poorest 20% in Pakistan:

Decline in poverty led to an increase in dietary diversity for all income groups.

For the poorest, the share of expenditure devoted to milk and milk products, chicken, eggs and fish rose, as did the share devoted to vegetables and fruits.

In contrast, the share of cereals and pulses, which provide the cheapest calories, declined steadily between FY02 and FY14. Because foods like chicken, eggs, vegetables, fruits, and milk and milk products are more expensive than cereals and pulses, and have lower caloric content, this shift in consumption also increased the amount that people spent per calorie over time.

For the poorest quintile, expenditure per calorie increased by over 18 percent between FY02 and FY14. Overall, this analysis confirms that the decline in poverty exhibited by the 2001 poverty line is quite credible, and that Pakistan has done remarkably well overall in reducing monetary poverty based on the metric it set some 15 years ago, says the World Bank.

Summary:

In spite of Pakistan's many challenges on multiple fronts, the country has successfully translated its GDP growth into the well-being of its poorest citizens. "Pakistan’s recent growth has been accompanied by a staggering fall in poverty", says a November 2016 World Bank report. An earlier report by Boston Consulting Group reached a similar conclusion.

Related Links:

Haq's Musings

Pakistan's Middle Class Larger and Richer Than India's

Pakistan Translates GDP Growth to Citizens' Well-being

Rising Motorcycle Sales in Pakistan

Depth of Deprivation in India

Chicken vs Daal in Pakistan

China Pakistan Economic Corridor

|

| Source: Credit Suisse Wealth Report 2016 |

Here are the key statistics reported by Credit Suisse:

Total Household Wealth Mid-2016 :

India $3,099 billion Pakistan $524 billion

Wealth per adult:

India Year End 2000 Average $2,036 Median $498.00

Pakistan Year End 2000 Average $2,399 Median $1,025

India Mid-2016 Average $3,835 Median $608

Pakistan Mid-2016 Average $4,595 Median $1,788

Average wealth per adult in Pakistan is $760 more than in India or about 20% higher.

Median wealth per adult in Pakistan is $1,180 more than in India or about 120% higher

Inequality:

Median wealth data indicates that 50% of Pakistanis own more than $1,180 per adult which is 120% more than the $608 per adult owned by 50% of Indians.

The Credit-Suisse report says that the richest 1% of Indians own 58.4% of India's wealth, second only to Russia's at 74.5%. That makes India the 2nd biggest oligarchy in the world.

The CS wealth data, particularly the median wealth figures, clearly show that Pakistan has much lower levels of inequality than India.

|

| Source: Bloomberg |

World Bank Report:

A November 2016 World Bank report says that Pakistan has successfully translated economic growth into the well-being of its poorest citizens. It says "Pakistan’s recent growth has been accompanied by a staggering fall in poverty".

Rising incomes of the poorest 20% in Pakistan since 2002 have enabled them to enhance their living standards by improving their diets and acquiring television sets, refrigerators, motorcycles, flush toilets, and better housing.

Another recent report titled "From Wealth to Well Being" by Boston Consulting Group (BCG) also found that Pakistan does better than India and China in translating GDP growth to citizens' well-being.

One particular metric BCG report uses is growth-to-well-being coefficient on which Pakistan scores 0.87, higher than India's 0.77 and China's 0.75.

Big Poverty Decline Since 2002:

Using the old national poverty line of $1.90 (ICP 2011 PPP) , set in 2001, the percentage of people living in poverty fell from 34.7 percent in FY02 to 9.3 percent in FY14—a fall of more than 75 percent. Much of the socioeconomic progress reported by the World Bank since 2000 has occurred during President Musharraf's years in office from 2000-2007. It has dramatically slowed or stagnated since 2010.

|

| Source: World Bank Report Nov 2016 |

Using the new 2016 poverty line of $3.50 (ICP 2011 PPP), 29.5 percent of Pakistanis as poor (using the latest available data from FY14). By back casting this line, the poverty rate in FY02 would have been about 64.3 percent.

Pakistan's new poverty line sets a minimum consumption threshold of Rs. 3,030 or $105 (ICP 2011 PPP) per person per month or $3.50 (ICP 2011 PPP) per person per day. This translates to between Rs. 18,000 and Rs. 21,000 per month for a household at the poverty line, allowing nearly 30% of the population or close to 60 million people to be targeted for pro-poor and inclusive development policies—thus setting a much higher bar for inclusive development.

Multi-dimensional Poverty Decline:

A UNDP report released in June 2016 said Pakistan’s MPI (Multi-dimensional poverty index) showed a strong decline, with national poverty rates falling from 55% to 39% from 2004 to 2015. MPI goes beyond just income poverty.

The Multidimensional Poverty Index uses a broader concept of poverty than income and wealth alone. It reflects the deprivations people experience with respect to health, education and standard of living, and is thus a more detailed way of understanding and alleviating poverty. Since its development by OPHI and UNDP in 2010, many countries, including Pakistan, have adopted this methodology as an official poverty estimate, complementing consumption or income-based poverty figures.

Rising Living Standards of the Poorest 20% in Pakistan:

According to the latest World Report titled "Pakistan Development Update: Making Growth Matter" released this month, Pakistan saw substantial gains in welfare, including the ownership of assets, the quality of housing and an increase in school enrollment, particularly for girls.

First, the ownership of relatively more expensive assets increased even among the poorest. In the bottom quintile, the ownership of motorcycles increased from 2 to 18 percent, televisions from 20 to 36 percent and refrigerators from 5 to 14 percent.

In contrast, there was a decline in the ownership of cheaper assets like bicycles and radios.

Housing quality in the bottom quintile also showed an improvement. The number of homes constructed with bricks or blocks increased while mud (katcha) homes decreased. Homes with a flushing toilet almost doubled in the bottom quintile, from about 24 percent in FY02 to 49 percent in FY14.

Dietary Improvements for the Poorest 20% in Pakistan:

Decline in poverty led to an increase in dietary diversity for all income groups.

For the poorest, the share of expenditure devoted to milk and milk products, chicken, eggs and fish rose, as did the share devoted to vegetables and fruits.

In contrast, the share of cereals and pulses, which provide the cheapest calories, declined steadily between FY02 and FY14. Because foods like chicken, eggs, vegetables, fruits, and milk and milk products are more expensive than cereals and pulses, and have lower caloric content, this shift in consumption also increased the amount that people spent per calorie over time.

For the poorest quintile, expenditure per calorie increased by over 18 percent between FY02 and FY14. Overall, this analysis confirms that the decline in poverty exhibited by the 2001 poverty line is quite credible, and that Pakistan has done remarkably well overall in reducing monetary poverty based on the metric it set some 15 years ago, says the World Bank.

Summary:

In spite of Pakistan's many challenges on multiple fronts, the country has successfully translated its GDP growth into the well-being of its poorest citizens. "Pakistan’s recent growth has been accompanied by a staggering fall in poverty", says a November 2016 World Bank report. An earlier report by Boston Consulting Group reached a similar conclusion.

Related Links:

Haq's Musings

Pakistan's Middle Class Larger and Richer Than India's

Pakistan Translates GDP Growth to Citizens' Well-being

Rising Motorcycle Sales in Pakistan

Depth of Deprivation in India

Chicken vs Daal in Pakistan

China Pakistan Economic Corridor

Comments

Gross domestic product (GDP) INGDPQ=ECI clocked an annual 7.3 percent growth between July and September, faster than 7.1 percent in the previous quarter and higher than China's 6.7 percent.

That impressive headline figure, however, failed to mask the underlying weakness in Asia's third-largest economy.

Not only was the overall growth lower than expected, it was primarily driven by consumer and government spending. Contraction in capital investment deepened.

With Prime Minister Narendra Modi's decision this month to scrap 500 rupee and 1,000 rupee banknotes as part of a crackdown on tax dodgers and counterfeiters denting consumer spending, which makes up 55 percent of India's economy, the outlook for upcoming quarters is not encouraging.

In a country where most people are paid in cash, and buy what they need with cash, Modi's decision has removed 86 percent of the currency in circulation virtually overnight. His shock therapy has left companies, farmers and households suffering.

"Post-demonetization the situation is really grim whether you look at any sector or talk to people," said Devendra Kumar Pant, chief economist at India Ratings & Research.

KNOCK-ON EFFECTS

Economists agree the economy will take a hit this quarter and for several quarters to follow. But opinions on the scale of damage vary widely.

Finance Minister Arun Jaitley expects a minor impact lasting for a quarter or two. Private economists, however, reckon the impact would be felt through 2018.

The most optimistic forecasts suggest that India will finish this fiscal year in March with a respectable, but slightly lower, growth rate of 7.3 percent.

But the most pessimistic forecast, from Mumbai-based brokerage Ambit Capital, is for a precipitous drop to 3.5 percent growth.

Favourable prospects for 2017 wheat crop production

Planting of the 2017, mostly irrigated, ‘’rabi’’ (winter) wheat crop is currently underway and will continue until mid-December. Near-average irrigation water supplies in the main wheat-growing areas of Punjab and Sindh provinces are benefitting plantings and early crop development in these areas. However, below-normal rains hindered planting operations in the minor rainfed-producing ‘’barani areas’’, located in the northern parts of Punjab Province.

Current official forecasts put the 2017 wheat output at a record level of 26 million tonnes, 2 percent up from the 2016 bumper output. This forecast rests on expectations that adequate water availability in the main reservoirs will boost plantings, while the good supply of quality seeds, fertilizers and herbicides will increase average yields.

Above-average 2016 summer cereal crops estimated

Harvesting of the 2016 summer (monsoon) season maize and rice crops is almost complete. FAO estimates the 2016 paddy and maize outputs at 10.3 million tonnes and 5.2 million tonnes, respectively, slightly above the previous year’s production. This result follows generally favourable weather conditions during the cropping season, coupled with an adequate water supply for irrigation and good access to fertilizers and other basic inputs.

Rice exports to increase in 2016

FAO forecasts rice exports in 2016 at 4.4 million tonnes, representing a 7 percent increase from the 2015 level, thanks to competitively priced non-basmati supplies.

Wheat exports in the 2016/17 marketing year (May/April) are forecast to increase from the previous year’s low level to 800 000 tonnes, in line with the 2016 overall good output and large carryover stocks.

Prices of wheat and wheat flour strengthened in recent months

Prices of wheat and wheat flour, the country’s main staples, have strengthened in recent months, following seasonal patterns, but remained below their year-earlier levels owing to good availabilities following a bumper 2016 crop.

Food security conditions overall stable but concerns remain in Tharparkar District and northern Pakistan

Overall, the food supply situation is stable following two consecutive years of good harvests and large carryover stocks of the main staples. However, food security concerns remain in some areas, particularly in Tharparkar District and northern Pakistan.

In Tharparkar District (southeastern Sindh Province) and the surrounding areas of Sindh Province, a below-average drought-affected cereal production for the third consecutive year, coupled with losses of small animals, especially sheep and goats, has aggravated food insecurity and caused acute malnutrition.

Food insecurity has been exacerbated by the lingering negative impact of the 2015 floods; the provinces of Sindh, Punjab and Khyber Pakhtunkhwa were most affected. Official assessments reported the loss of lives and severe damage to housing, infrastructure and agriculture. Households in northern parts of the country have also not fully recovered from the impact of the earthquake in October 2015.

The Federally Administered Tribal Areas (FATA) and Khyber Pakhtunkhwa, located in northern Pakistan, are still affected by the return process after the large scale displacement (312 000 families or around 1.9 million people) due to insurgency in FATA. According to OCHA estimates, as of October 2016, over 1.3 million refugees remained displaced in northern Pakistan. These populations rely mainly on humanitarian assistance, including food aid, healthcare and other necessities.

After first selling India’s cash ban as a strike against corruption, Prime Minister Narendra Modi has since pushed a tantalizing side benefit.

The move to eradicate 500 rupee ($7.3) and 1,000 rupee notes, representing 86 percent of currency in circulation, would also force hundreds of millions of cash-dependent Indians to use more online payments and bank accounts. That could be a key growth driver in years to come, boosting tax receipts as the black economy is turned white and increasing bank deposits that can be used for lending.

“There is no reason we cannot move towards a cashless India,” Modi said Nov. 27, reinforcing Finance Minister Arun Jaitley’s earlier assertion that the cash ban “will take India towards a cashless economy."

But on the streets in New Delhi, it’s not quite turning out that way.

Deepak Kumar, a 22-year-old security guard who earns 7,500 rupees a month, tried to open an account with a New Delhi branch of the State Bank of India after receiving his salary in old notes. The bank refused, telling him to return in January, he said.

“They said we’re only looking after our customers, we don’t have time to add new customers,” Kumar said, adding he wouldn’t try to open an bank account again. “This cashless thing is good for big people, but for small people like us, it doesn’t mean anything."

Such anecdotes are fueling doubts the demonetization move will lead to a substantial shift to online or mobile payments, particularly among the vast population of poor Indians who lack the necessary bank accounts.

India’s Cash Chaos by the Numbers: Guide to Banknote Revamp

Cash dependent

Problem is, while e-commerce is booming, India remains one of the most cash-dependent countries in the world.

Just over half of the nation’s adults have bank accounts, a precursor to using digital payments. Roughly 98 percent of all transactions are in cash, with 11 percent of consumers using a debit card in 2015, while most retailers don’t accept cards.

In the days after Modi’s Nov. 8 announcement, digital payment companies such as Paytm Mobile Solutions Pvt. Ltd. lauded the move in newspaper ads and said digital payments usage was up. But most new customers will likely be wealthier urbanites, said Saksham Khosla, a research analyst at the Carnegie Endowment for International Peace India.

“I’m very doubtful that this will lead to any meaningful financial inclusion," Khosla. "It does seem a little tacked on. They’re trying to find more and more uses for demonetization than may have originally been intended."

Flip-Flops: U-Turns Blight Modi’s Cash Ban, Leaving Indians Outraged

Part of the problem is the poor penetration of banks in India’s villages -- there are only 18 ATMs per 100,000 citizens in India, according to the World Bank, compared to 129 in Brazil. Additionally, just 22 percent of Indians use the Internet “at least occasionally” and only 17 percent have a smartphone, according to a Pew Research Center report.

http://www.forbes.com/sites/wadeshepard/2016/12/10/indias-central-bank-denied-its-big-payday-as-demonetization-flops/2/#398ca80c26aa

Theoretically, by having a large amount of canceled banknotes going unredeemed the Indian government could essentially pocket the balance, which was estimated to be as high as 21% of the currency being recalled — or roughly $45 billion.

“Now it is not being explicitly stated — and in some cases they are going to deny it — but if a certain amount of cash does not come back then the central bank no longer has to account for that money,” said Arpan Nangia, the head of the India desk for HSBC’s commercial banking division. “So, for example, if a billion dollars does not come back then it's like a billion dollar profit for the central bank.”

Unfortunately for Modi and India’s central bank, this payday never materialized. As of now, over 82.5% of the recalled notes have been turned in, and it is estimated that by the time the redemption period is over on December 30th essentially all nullified notes will have been collected — white and black alike.

How the black market was able to take such large amounts of black money and redeem it via the demonetization program is not yet fully understood. Some theories have it that large amounts of previously inactive bank accounts were utilized or money was laundered via various tax-exempt entities. India’s Enforcement Directorate is currently investigating bank branches throughout the country.

However, India also offered an amnesty program for black market players, where the government would accept illicit cash at a 50% tax, and how much of the recovered notes were part of this program is currently unknown.

That said, all the “black money” that Modi and Company were attempting to wipe out may never have existed in the first place. Prior to this recent wave of demonetization, various studies have indicated that only 6% or so of India’s black market wealth is actually kept in cash. In 2012, India’s Central Board of Direct Taxes came out and publicly advised against demonetization on the grounds that most of country’s illicit wealth is kept in real estate, bullion, and jewelry — not in 500 and 1,000 rupee banknotes.

https://www.givingwhatwecan.org/post/2016/05/giving-and-global-inequality/

Pakistan: Median Income per capita: $1204.50, Median Household Income: $6,022.50 Mean (Average) per capita $4,811.31

India Rural: Median per capita $930.75 Median Household $4,653.75 Mean (Average) per capita $5,700.72

India Urban: Median per capita $1295.75 Median Household $6,478.75 Mean(Average) per capita: $5,700.72

http://www.cgdev.org/blog/world-bank-poverty-statistics-lack-median-income-data-so-we-filled-gap-ourselves-download-available

The richest 1% of Indians hold 58% of the country’s total wealth, according to Oxfam India.

The stark inequality in India is worse than the global data put out by the organization, which show that the richest 1% have more than 50% of the total world wealth, Oxfam said.

The anti-poverty advocacy group released a report, “An Economy for the 99%” this week to coincide with the meeting of some of the world’s wealthiest business leaders and most powerful policymakers in Davos, Switzerland.

It said recently improved data on the distribution of wealth, particularly in countries like India and China, indicate that the poorest half of the world has less wealth was previously thought. Oxfam singled out India repeatedly in the report.

It said that companies are increasingly driven to pay higher returns to their shareholders. In India, the amount of profits corporations share with shareholders is as high as 50% and growing rapidly, the report said.

The report said the annual share dividends paid by from Zara’s parent company to Amancio Ortega – the world’s second richest man – are equal to around 800,000 times the annual wage of a worker employed by a garment factory in India.

Oxfam said that the combined wealth of India’s 57 billionaires is equivalent to that of the country’s poorest 70%.

“India is hitting the global headlines for many reasons, but one of them is for being one of the most unequal countries in the world with a very high and sharply rising concentration of income and wealth,” Nisha Agarwal, chief executive of Oxfam said in a statement.

Oxfam said India should introduce an inheritance tax and raise its wealth levies as well as increasing public spending on health and education. It said it should end the era of tax havens and crack down on rich people and corporations avoiding tax.

http://www.bbc.com/news/world-asia-india-41198638#

New research by French economists Lucas Chancel and Thomas Piketty, author of Capital, the 2013 bestselling book on capitalism and increasing inequality, clearly points to this conclusion.

They studied household consumption surveys, federal accounts and income tax data from 1922 - when the tax was introduced in India - to 2014.

The data shows that the share of national income accruing to the top 1% of wage earners is now at its highest level since Indians began paying income tax.

The economists say the top 1% of the earners captured less than 21% of the total income in the late 1930s, before dropping to 6% in the early 1980s and rising to 22% today. India, in fact, comes out as a country with one of the highest increase in top 1% income share concentration over the past 30 years," they say.

To be sure, India's economy has undergone a radical transformation over the last three decades.

Up to the 1970s, India was a tightly regulated, straitlaced economy with socialist planning. Growth crawled (3.5% per year), development was weak and poverty endemic.

Some easing of regulation, decline in tax rates and modest reforms led to growth picking up in the 1980s, trundling at around 5% a year. This was followed by some substantial reforms in the early 1990s after which the economy grew briskly, nudging close to double digits in the mid-2000s.

Growth has slowed substantially since then, but India still remains one of the fastest-growing economies in the world. The ongoing slowdown - growth was 5.7% in the April-June quarter, the slowest pace in three years - largely triggered by feeble demand, a controversial cash ban, declining private investment and weak credit growth, is a cause for concern.

And the need for fast-paced growth, according to Nobel Prize winning economist Amartya Sen, is "far from over since India, after two decades of rapid growth, is still one of the poorest countries in the world".

From their latest work on income inequality, Lucas Chancel and Thomas Piketty contend that there has been a "sharp increase in wealth concentration from 1991 to 2012, particularly after 2002". Also, they conclude, India has only been really shining for the top 10% of the population - roughly 80 million people in 2014 - rather than the middle 40%.

The economists plan to release the first World Inequality Report, produced by a network of more than 100 researchers in December, where they will compare India's inequality with other countries and suggest ways to tackle it.

Striking transition

They agree that unequal growth over a period of time is not specific to India, but market economies are not bound to be unequal. India's case is striking in the fact that it is the country with the highest gap between the growth of the top 1% and that of the full population. Incomes of those at the very top have actually grown at a faster pace than in China.

The economists contend that the growth strategy pursued by successive governments has led to a sharp increase in inequality. China also liberalised and opened up after 1978, and experienced a sharp income growth as well as a sharp rise in inequality. This rise was however stabilised in the 2000s and is currently at a lower level than India.

In Russia, the move from a communist to a market economy was "swift and brutal" and today has a similar level of inequality to India.

"This shows that there are different strategies to transit from a highly regulated economy to a liberalised one. In the arrays of possible pathways, India pursued a very unequal way but could probably have chosen another path," Dr Chancel told me.

Indian inequality higher than Pakistan, China, Bangladesh; 92% adults' net worth less than $10,000; of 0.5% plus $100,000

http://www.counterview.net/2017/11/indian-inequality-higher-than-pak-china.html

Giving a scary picture of inequalities in India, the recently-released “Global Wealth Report 2017”, published by Credit-Suisse, a Swiss multinational financial services holding company, headquartered in Zurich, has said that India’s 92% of adults “have net worth less than USD 10,000”, while “a small fraction of the population (just 0.5% of adults) has a net worth over USD 100,000.”

While the 0.5% adult population of India “translates into 4.2 million people” because of its huge population, the report says, “By our estimates, 1,820 adults have wealth over USD 50 million, and 760 have more than USD 100 million.”

A further breakup of wealth among the top echelons reveals that 10% of the adult population has 73.3% of wealth, 5% has 64.1% of wealth, and 1% has 45.1% of wealth.

In absolute numbers, the report says, as of mid-2017, 770,089,000 adult individuals have a wealth range of under USD 10,000, 60,116,000 have a wealth range between USD 10,000 and 100,000, 4,158,000 have wealth range between USD 100,000-1 million, and 245,000 individuals have wealth more than USD 1 million.

Pointing out that “while wealth has been rising in India, not everyone has shared in this growth”, the report’s data show that India’s Gini index – an internationally recognized, most commonly used measure of inequality, with 100% representing maximal inequality – is found to be 83%. By comparison, Pakistan’s Gini index is 52.6%, Bangladesh’s 57.9%, Sri Lanka’s 66.5%, Nepal’s 67.3%, and China’s 78.9%

https://www.economist.com/news/briefing/21734382-multinational-businesses-relying-indian-consumers-face-disappointment-indias-missing-middle …

https://twitter.com/haqsmusings/status/951542797483499520

For all the talk of wanting to tap the middle class, no firm moving into India thinks it is targeting the middle of the income distribution. India’s mean GDP per head is just $1,700, and 80% of the population makes less than that. Adjust for purchasing-power parity by factoring in the cheaper cost of goods and services in India and you can bump the mean up to $6,600. But that is less than half the figure for China (see chart 2) and a quarter of that for Russia. What is more, foreign companies have to take their money out of India at market exchange rates, not adjusted ones.

Defining the middle class anywhere is tricky. India’s National Council of Applied Economic Research has used a cut-off of 250,000 rupees of annual income, or about $10 a day at market rates. Thomas Piketty and Lucas Chancel of the Paris School of Economics found in a recent study that one in ten Indian adults had an annual income of more than $3,150 in 2014. That leaves only 78m Indians making close to $10 a day.

Meagre market

Even adjusting for the lower cost of living, that is hardly a figure to set marketers’ heartbeats racing. The latest iPhone, which costs $1,400 in India, represents five month’s pay for an Indian who just makes it into the top 10% of earners. And such consumers are not making up through growing numbers what they lack in individual spending power. The proportion making around $10 a day hardly shifted between 2010 and 2016.

Another gauge is whether people can afford the more basic material goods they crave. For Indians, that typically means a car or scooter, a television, a computer, air conditioning and a fridge. A government survey in 2012 found that under 3% of all Indian households owned all five items. The median household had no more than one. How many of them will be anywhere near able to buy an iPhone or a pair of Levi’s if they cannot afford a TV set?

To get in the top 1% of earners, an Indian needs to make just over $20,000. Adjusted for purchasing-power parity, that is a comfortable income, equating to over $75,000 in America. But in terms of being able to afford goods sold at much the same price across the world, whether a Netflix subscription or Nike trainers, more than 99% of the Indian population are in the same league as Americans that count as below the poverty line (around $25,000 for a family of four), points out Rama Bijapurkar, a marketing consultant.

The top 1% of Indians, indeed, are squeezing out the rest. They earn 22% of the entire income pool, according to Mr Piketty, compared with 14% for China’s top 1%. That is largely because they have captured nearly a third of all national growth since 1980. In that period India is the country with the biggest gap between the growth of income for the top 1% and the growth of income for the population as a whole. At the turn of the century, the richest 10% of Indians made 40% of national income, about the same as the 40% below them. But far from becoming a middle class, the latter’s share of income then slumped to under 30%, while those at the top went on to control over half of all income (see chart 3).

Norway remains the world's most inclusive advanced economy, while Lithuania again tops the list of emerging economies, the World Economic Forum said.

https://www.ndtv.com/business/india-ranks-much-below-china-pakistan-on-wefs-inclusive-development-index-1803140

http://www3.weforum.org/docs/WEF_Forum_IncGrwth_2018.pdf

Davos: India was today ranked at the 62nd place among emerging economies on an Inclusive Development Index, much below China's 26th position and Pakistan's 47th.

Norway remains the world's most inclusive advanced economy, while Lithuania again tops the list of emerging economies, the World Economic Forum (WEF) said while releasing the yearly index here before the start of its annual meeting, to be attended by several world leaders including Prime Minister Narendra Modi and US President Donald Trump.

The index takes into account the "living standards, environmental sustainability and protection of future generations from further indebtedness", the WEF said. It urged the leaders to urgently move to a new model of inclusive growth and development, saying reliance on GDP as a measure of economic achievement is fuelling short-termism and inequality.

India was ranked 60th among 79 developing economies last year, as against China's 15th and Pakistan's 52nd position.

The 2018 index, which measures progress of 103 economies on three individual pillars -- growth and development; inclusion; and inter-generational equity -- has been divided into two parts. The first part covers 29 advanced economies and the second 74 emerging economies.

The index has also classified the countries into five sub-categories in terms of the five-year trend of their overall Inclusive Development Growth score -- receding, slowly receding, stable, slowly advancing and advancing.

Despite its low overall score, India is among the ten emerging economies with 'advancing' trend. Only two advanced economies have shown 'advancing' trend.

Among advanced economies, Norway is followed by Ireland, Luxembourg, Switzerland and Denmark in the top five.

Small European economies dominate the top of the index, with Australia (9) the only non-European economy in the top 10. Of the G7 economies, Germany (12) ranks the highest. It is followed by Canada (17), France (18), the UK (21), the US (23), Japan (24) and Italy (27).

The top-five most inclusive emerging economies are Lithuania, Hungary, Azerbaijan, Latvia and Poland.

Performance is mixed among BRICS economies, with the Russian Federation ranking 19th, followed by China (26), Brazil (37), India (62) and South Africa (69).

Of the three pillars that make up the index, India ranks 72nd for inclusion, 66th for growth and development and 44th for inter-generational equity.

The neighbouring countries ranked above India include Sri Lanka (40), Bangladesh (34) and Nepal (22). The countries ranked better than India also include Mali, Uganda, Rwanda, Burundi, Ghana, Ukraine, Serbia, Philippines, Indonesia, Iran, Macedonia, Mexico, Thailand and Malaysia.

Although China ranks first among emerging economies in GDP per capita growth (6.8 per cent) and labour productivity growth (6.7 per cent) since 2012, its overall score is brought down by lacklustre performance on inclusion, the WEF said. It found that decades of prioritising economic growth over social equity has led to historically high levels of wealth and income inequality and caused governments to miss out on a virtuous circle in which growth is strengthened by being shared more widely and generated without unduly straining the environment or burdening future generations.