Pakistan's Motorcycle Sales Soar With Expanding Middle Class

Pakistan's fiscal year 2015-16 saw production of motorcycles soar to a new high of over 2 million units. This represents a 16.5% surge from last year. At the same time, passenger cars and light trucks sales rose to over 200,000 in fiscal 2016, a 20% jump over the same period last year.

Motorcycle Sales:

Rising motorcycle sales in Asia's developing nations like Pakistan are seen as a barometer of expanding middle class. It is, in part, attributed to rising incomes and availability of bank financing at historic low interest rates in the country.

As many as 2,071,123 motorcycles were manufactured during July-June (2015-16) compared to 1,777,251 units during July-June (2014-15), according to the latest data released by Pakistan Bureau of Statistics (PBS) and reported by Pakistani media.

Car Sales:

In addition to the double digit increase in motorcycle sales, Pakistan also experienced 20% jump in sales of passengers cars, light commercial vehicles (LCVs), vans and jeeps. The total sales of local vehicles increased by 21% to 216,568 as compared to 179,953 units sold in FY15, according to industry data.

Auto Parts Industry:

Rising auto and motorcycle sales are helping boost Pakistan's auto parts industry as well. “We are getting orders and the pace is increasing,” said Sultan and Kamil International CEO Faisal Mahmood speaking to Pakistani media on the sidelines of the 12th Pakistan Auto Show 2016 held at the Lahore International Expo Centre. Mahmood’s company makes more than 350 automotive parts and exports to all major automobile markets in the world.

Other Growth Industries:

Among other industries seeing significant growth are pharmaceuticals (6.54%), cement (17.01%), chemicals (8.13%), non metallic mineral products (10.02%), fertilizers (13.81%), leather products (7.76%) and rubber products (7.16%), according to media reports.

Summary:

Pakistan's economic recovery is in full swing with double digit growth in multiple industries, including auto, pharma, chemicals, cement, fertilizers, minerals, etc. It is expected to pick up steam over the next several years with new investments on the back of China-Pakistan Economic Corridor related projects.

Related Links:

Haq's Musings

Growing Middle Class in Pakistan

Rising Energy Consumption

China-Pakistan Economic Corridor

Pakistan's Thar Desert Sees Development Boom

Gwadar vs Chabahar Ports

Motorcycle Sales:

Rising motorcycle sales in Asia's developing nations like Pakistan are seen as a barometer of expanding middle class. It is, in part, attributed to rising incomes and availability of bank financing at historic low interest rates in the country.

As many as 2,071,123 motorcycles were manufactured during July-June (2015-16) compared to 1,777,251 units during July-June (2014-15), according to the latest data released by Pakistan Bureau of Statistics (PBS) and reported by Pakistani media.

|

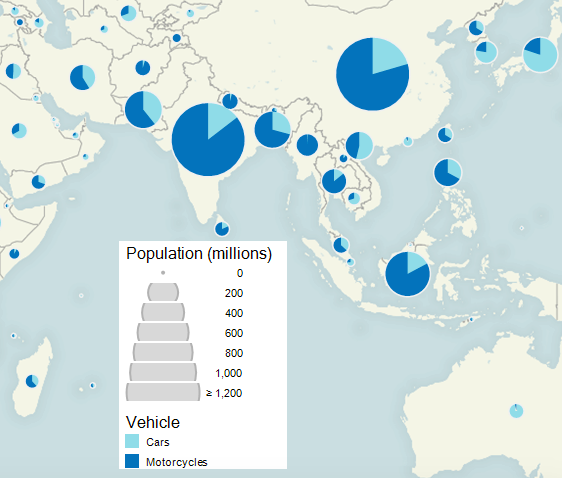

| Pakistan is the World's Sixth Largest Motorcycle Market |

Car Sales:

In addition to the double digit increase in motorcycle sales, Pakistan also experienced 20% jump in sales of passengers cars, light commercial vehicles (LCVs), vans and jeeps. The total sales of local vehicles increased by 21% to 216,568 as compared to 179,953 units sold in FY15, according to industry data.

Auto Parts Industry:

Rising auto and motorcycle sales are helping boost Pakistan's auto parts industry as well. “We are getting orders and the pace is increasing,” said Sultan and Kamil International CEO Faisal Mahmood speaking to Pakistani media on the sidelines of the 12th Pakistan Auto Show 2016 held at the Lahore International Expo Centre. Mahmood’s company makes more than 350 automotive parts and exports to all major automobile markets in the world.

Other Growth Industries:

Among other industries seeing significant growth are pharmaceuticals (6.54%), cement (17.01%), chemicals (8.13%), non metallic mineral products (10.02%), fertilizers (13.81%), leather products (7.76%) and rubber products (7.16%), according to media reports.

Summary:

Pakistan's economic recovery is in full swing with double digit growth in multiple industries, including auto, pharma, chemicals, cement, fertilizers, minerals, etc. It is expected to pick up steam over the next several years with new investments on the back of China-Pakistan Economic Corridor related projects.

Related Links:

Haq's Musings

Growing Middle Class in Pakistan

Rising Energy Consumption

China-Pakistan Economic Corridor

Pakistan's Thar Desert Sees Development Boom

Gwadar vs Chabahar Ports

Comments

Excerpt of Wall Street Journal interview with President of Yamaha Motors in Japan:

WSJ: What about in South Asia?

Mr. Yanagi: We want to expand business in Pakistan and Bangladesh as soon as possible. We had a production venture in Pakistan but we dissolved it five years ago. We are now planning to begin local production again, on our own this time.

In Bangladesh, we import motorcycles from our plant in India on a small scale, but we are studying now the best way of running operations because of rising tariff barrier there.

http://www.wsj.com/articles/SB10001424052702304520704579128733162622954

Since this interview was conducted in Oct 2013, Yamaha has set up a motorcycle plant that began production last year in Pakistan.

“The new investment from Yamaha will create jobs and bring new technologies,” said Yamaha Motor Company President Hiroyuki Yanagi, adding that, “Pakistan is all set to become one of the top global markets of motorcycles.

http://tribune.com.pk/story/876873/investment-yamaha-resumes-assembly-in-pakistan/

Atlas Honda Ltd. (AHL), the joint venture company that takes care of production and sales of Honda motorcycles in Pakistan, has two manufacturing plants – one in Karachi (in Southern Pakistan) and the other in Sheikhupura (in Northeastern Pakistan). The former produces 1.5 lakh units and the latter rolls out 6 lakh units per annum.

The capacity expansion will be carried out in the Sheikhupura plant, to equip the facility to produce 12 lakh units per year. The plan will be executed phase-wise, with the first part of the operation involving the installation of a new production line which will commence functioning in October 2016. Further stages over a three year period is planned to achieve the target of producing 1.2 million motorcycles a year.

The investment AHL will be making for this plant expansion process is approximately USD 50 million (INR 327.32 crores). About 1,800 jobs are estimated to be created.

http://indianautosblog.com/2015/11/honda-pakistan-double-motorcycle-production-capacity-201659

Visitors to AAD are being treated to the aerial prowess of the Pakistan Aeronautical Complex Mushshak, a light, robust primary flight trainer and utility aircraft, whose display includes deliberate spinning.

PAC (Hangar 7, Stand CE12) entered the field of maintenance, repair and overhaul (MRO) of aircraft in the early 1970s, as well as components of Chinese origin for the Pakistan Air Force. PAC subsequently moved towards MRO of Mirage III and V aircraft.

In the field of aviation manufacturing, PAC progressed from the manufacture of the Mushshak and Super Mushshak aircraft for primary training to the Karakorum-8 (K-8) advanced jet trainer. The Super Mushshak is a powerful two-/three-seat trainer with a more advanced avionics package. The K-8 has a multi-role mission capability including air-to-air and air-to-ground weapon delivery.

Today, PAC has advanced technology to design and manufacture the multi-role JF-17 fighter aircraft and upgrade the avionics of fighter aircraft. The JF-17 Thunder is a new-generation single-seat multi-role light fighter with high manoeuvrability and beyond visual range capability. It has a long-range operational radius and advanced aerodynamic configurations.

The PAC contingent at AAD is headed by chairman Air Marshal Arshad Malik.

Closer to home, he has clubbed four nations of South Asia — Pakistan, Bangladesh, India and Sri Lanka. In general the future outlook for South Asia holds ‘Good’ and for Pakistan it looks ‘Very Good’. I started jumping on the couch after reading the outlook for Pakistan and for the rest of the time I was reading the book I was only interested as to what the future outlook holds for Pakistan in the eyes of most influential investor and thinker. But then the author has added a caution and it’s damn important that we read and comprehend this fine print in detail.

Pakistan’s economy is taking off and the future outlook till 2020 has been termed ‘Very Good’. The rationale used in building this argument is that our working age population is growing and that’s a very good sign for the economy. Inflation is under control which is increasing in the vicinity of 3 per cent but on the other hand GDP is growing at 4.5 per cent. Contrary to the populist demagogy, our debt level is pretty low in relation to comparative economies whereby debt to GDP is at 65 per cent. We have a decent manufacturing base with export economy and we are also investing in factories by opening industrial parks as elucidated in the China-Pakistan Economic Corridor (CPEC).

Our trade deficit is on the decline as our import bill is on the wane, thanks to lower oil prices in the international market. We are also not exporting commodities whose prices are plummeting in the international market. We would be getting a shot in the arm once the CPEC starts rolling out as China has committed to invest US$ 46 billion in infrastructure and power related projects in Pakistan over the next 20 years.

Sharma says that even if 50 per cent of this commitment materializes, it would be enough to provide us with the necessary infrastructure that will take us from a low-income to a middle-income country during the next five years.

Though hard to digest, the most influential writer and investor says that we don’t have stale leadership like Vladimir Putin of Russia and Recep Tayyip Erdogan of Turkey who have clung to power for more than a decade and are in their fourth terms. But then Nawaz Sharif is in his third term too.

A very important point the author highlights is that for a coup-prone country like ours, the military finally seems to have decided to concentrate on ensuring the internal as well as external security while staying clear of politics.

"As such-and assuming further improvement in energy supply and security, and likely recovery in cotton and other agriculture-the growth forecast for FY2017 is revised up to 5.2%", the report added.

--

The report added that a major impetus to growth in FY2017 and beyond would be the implementation of $46 billion program of infrastructure spending on roads, railways, pipelines and electric power in an economic corridor project linking Pakistan with the People's Republic of China (PRC), which was announced in April 2015.

Fast-tracking would enable several energy projects to come on stream in FY2018, the report added.

The government significantly strengthened macroeconomic fundamentals and advanced a comprehensive program of structural reform under a 3-year program with the IMF that ended in September 2016.

Inflation has been squashed to the low single digits, foreign reserves rebuilt, and the budget deficit markedly reduced.

---

The general government budget for FY2017 projects further reduction in the deficit to 3.8% of GDP achieved by adopting new revenue measures and streamlining current expenditure.

Tax revenues are projected to increase by half a percentage point, raising the ratio of tax to GDP to 12.8% by eliminating more tax concessions and exemptions, expanding the withholding system as part of administrative reform to widen the tax base, and raising some excise taxes and customs duties, the report added.

Inflation is now expected to average 4.7% in FY2017.

The upward revision takes into account expected oil price rises and stronger domestic demand in an increasingly supply constrained economy.

It is tempered by the prospect of a broad agricultural recovery and only modestly higher global food prices. The July 2016 Monetary Policy Statement covering the first 2 months of FY2017 kept policy rates unchanged as the central bank continues its cautious forward-looking approach, expecting to hold inflation within the range of 4.5%-5.5%.

The report observes that the current account deficit was expected to widen in FY2017 to about $5 billion, or 1.6 % of GDP, which is higher than forecast in March.

The revision reflects a somewhat greater increase in global oil prices than expected and continued expansion in other imports stemming from faster economic growth.

Exports are expected to perform better during the year, increasing by nearly 5% as a recovery in cotton production underpins an upturn in textile sales, and as global prices for non-oil commodities reverse from a sharp decline to a modest increase.

The report added that the mobilization of larger inflows into the capital and financial accounts had been central to the 3-year economic program with the IMF, and these flows are projected to increase to $6.5 billion in FY2017, mainly with more foreign direct investment and continuing sizeable official flows.

Thus, even with the projected widening of the current account deficit, the overall balance should remain in surplus, augmenting official reserves.

The corridor project with the China is expected to attract more foreign direct investment, and already in 2015 investors announced 40 greenfield projects worth a remarkable $19 billion, or 4 times the norm in recent years.

Moreover, the decision by Morgan Stanley Capital International to put Pakistan in its MSCI emerging market index, effective from May 2017, will likely spur equity portfolio inflows.

http://www.brecorder.com/top-news/pakistan/320097-adb-revises-up-pakistans-economic-growth-projection-for-2017.html

https://www.adb.org/sites/default/files/publication/197141/ado2016-update.pdf

http://www.dawn.com/news/1291204/atlas-hondas-new-facility-inaugurated

LAHORE: Takahiro Hachigo, President, CEO and Representative Director of Honda Motor Co Ltd Japan, on Thursday inaugurated new facility of Atlas Honda Ltd (AHL) in Sheikhupura to expand its motorbike production.

Speaking on the occasion, Mr Hachigo announced that Pakistan has now become the sixth largest motorcycle market in the world.

Saquib H. Shirazi, speaking on the occasion, said with the enhancement of the production capacity, Atlas Honda is now well poised to serve the expanding market.

AHL, Honda’s motorcycle production and sales joint venture in Pakistan, discussed its plans to carry out production enhancement in machining and other fields at the Sheikhupura plant during the next three years.

The annual assembly production capacity of AHL has now become 1.35 million units, with 150,000 units from the Karachi plant and 1.2 million units from the Sheikhupura plant.

Renault soon could start producing vehicles in Pakistan, a government official says.

The French automaker is negotiating with the government of the Southwest Asia country to build cars in a joint venture with Gandhara Nissan, Renault’s global partner, Miftah Ismail, chairman of Pakistan’s Board of Investment, tells WardsAuto.

Renault proposes initially investing $100 million to expand manufacturing capacity at the currently mothballed Ghandhara Nissan Motors plant in Karachi, which has not produced vehicles since 2010. The plant is located near the capital city’s deep-water port terminal, Port Qasim. Ismail says a Renault technical team visited the plant Nov. 3.

Renault proposes assembling 16,000 vehicles a year in three shifts at the site and raise annual production capacity to 50,000 per year in two phases. Should the project go ahead, Ismail says, the JV would build both SUVs and sedans at the site, with production starting as early as 2018.

A Renault spokesperson confirms the automaker’s interest in Pakistan production to WardsAuto, adding it also is in talks with Al Futtain, an industrial conglomerate based in the United Arab Emirates.

The automaker’s application follows a September visit to France by a delegation of Pakistani government and business officials led by Finance Minister Ishaq Dar, who urged Renault and rival automaker PSA Peugeot Citroen to consider investing in Pakistan. Dar discussed the government’s new industrial policy regarding the automobile sector, which includes waiving duties on imported assembly plant equipment for foreign automakers locating in the country.

The new policy, in effect since March, envisions doubling yearly production of cars, vans, utility vehicles and light-commercial vehicles to 429,000 units over the next five years. Automakers active in Pakistan in 2015 manufactured 146,024 cars and 82,889 trucks of all types, according to WardsAuto data.

Pakistan wants to diversify a car market currently dominated by Toyota, Honda and Suzuki, whose locally assembled cars are sold at relatively high prices but lag behind imported vehicles in terms of quality and specifications, government officials contend. Customers have complained about having to make payments up-front for new vehicles, then wait up to four months for delivery. Consumer activists note quick delivery often carries a 15% surcharge.

The Ministry of Industries and Production says only 13 of 1,000 Pakistanis own or operate a car, Southwest Asia’s lowest rate of penetration. But with the economy expanding at its fastest pace in eight years – growth in 2016 could reach 4.7%, according to the World Bank – interest rates at a 42-year low, the Pakistan rupee’s stability against the U.S. dollar and an inflation rate of 5.2% and falling, officials believe their country successfully can attract major industrial investors.

South Korean automaker Kia has expressed interest in producing cars within Pakistan, according to Pakistan brokerage firm BIPL Securities.

A delegation from German automaker Volkswagen visited Pakistan in August 2015 and held talks with government officials. However, company spokesman Christoph Adomat told reporters that while “Volkswagen is constantly evaluating market opportunities on a worldwide basis (but) there are no decisions for an investment (by) Volkswagen side in Pakistan.”

Car sales in Pakistan – limited exclusively to Toyota, Honda and Suzuki – totaled 145,820 in 2015, up 32.9% from prior-year, WardsAuto data shows. Deliveries of 78,427 light trucks – all but 912 of them Suzukis or Toyotas – were up 135.3% year-on-year.

http://www.brecorder.com/supplements/88/118454/

Pakistan is an emerging market for Automobile and Allied Industry. The Industry plays an important role within the large-scale manufacturing sectors in spurring economic growth having enormous investment opportunities with positive growth of 23.3% FY 2016. Pakistan is among the 40 automobile producing countries and 4 of the top 10 global car makers have plants in Pakistan.

The history of Pakistan's Automotive Industry is one of the oldest in the Asian countries. The Industry started semi knockdown production of trucks (Bedford) in 1949 by (General Motors, which marked the start of the Industry's history after the independence from British India. From this year onwards the Industry has not shown steady growth and thus lags behind and is overtaken by other countries in Asia such as China. Thailand and India which entered in the market in 1980s, consequently its positioning in the global market is also questioned.

The automobile industry in Pakistan includes companies involved in the production/assembling of passenger cars, light commercial vehicles, trucks, buses, tractors and motorcycles. The auto spare parts industry is an allied of the auto industry. The auto & allied industry form a major manufacturing sector in Pakistan.

Car sales hit to 180,079 units in 2015-2016 as compared to 151,134 units in 2014-2015, followed by a jump in truck sales to 5,550 units from 4,111 and bus sales to 1,017 from 569 units. The impressive figures of 2015-16 were backed by 50,000 units of Suzuki Bolan and Ravi sold under Punjab Taxi Scheme.

It is believed that car sales will grow at 5-year (2016-20) compound annual growth rate (CAGR) of 12 Pc due to improving law and order situation in the country, rising auto financing owing to 42-year low interest rates and increasing disposable income.

However, in the real substance, automobiles and the auto sector mean much more than this. It represents mobility, transportation and communication. It represents an industry that has a strong impact on a dozen other sectors may it be steel, vending, petrol or even employment. Hence auto sales reflect not only the basic human desire for mobility but these are also an important economic indicator. For the development of Automobile Sector Pakistan has many positive factors such as low cost of labor and access to entire Central Asia Market, but at the same time it has to address many shortcomings. Our Academia still has to look into the fact that here is not any public institute which offers majors in Automobile engineering. Moreover transfer of technology and local manufacturing of vehicle components are minimal. Although, the Automotive Parts industry has shown an active growth in the last many years and a variety of automotive parts have been developed locally but still the full implantation of deletion program has not yet been achieved due to vested interests of Vehicle Assemblers resulting the shortage of technology transfer in the vendor industry.

Pakistan has the 6th largest population while 50% of the total population is below 30 years in age. There are 90 million young potential consumers demand for cars and other passenger vehicles is being increased day by day but existing auto manufacturers and assemblers are unable to match the demand. In Automobile Sector such as buses, LCVs, trucks and jeeps & cars registered growth of 81.95%, 68.53%, 41.68% and 29.73%, respectively FY 2016. The only decline witnessed in the production of tractors which declined by 38.63%. After the oil & petroleum sector, auto industry sector in Pakistan is the second largest taxpayer in the country.

http://tribune.com.pk/story/1310741/optimistic-loads-limited-ceo-just-bullish-pakistans-auto-sector/

Munir Bana advised many of his employees to buy the company’s shares as date of the book-building portion of the IPO neared. Many of them hesitated, but some of them opted to buy a personal stake in the auto part maker’s expansion plan.

Weeks later, many regretted their decision and those who bought the shares wished they had invested more.

After all, the share price of Loads Limited – the last listing on the Pakistan Stock Exchange in 2016 – jumped over 100% within a few weeks of trading. It is currently priced at Rs56.76 after starting on Rs34 and has also handed out 10% bonus shares and Rs1 as dividend to its shareholders.

“Our employees were hesitant to enter the stock market, but when I insisted many of them bought the company’s shares,” said Bana, the CEO of Loads Limited, one of the leading auto part makers in the country.

“Those who did not buy or purchase just a few shares now regret (their decision).”

Before offering 50 million shares through the IPO, the company first offered 2.5 million shares to its employees to engage them in the company’s future aggressive investment plans. The company eventually managed to raise Rs1.7 billion, an amount the company is now using for expansion of its production capacity.

Loads makes radiators, exhaust systems, mufflers, sheet metal components among other parts, and its clients include more than a dozen national and multinational companies engaged in the production of motorcycles, cars and heavy vehicles manufacturers.

Bullish on future growth

Bana, a Chartered Accountant, believes two developments have been positive triggers for the local auto industry — the China-Pakistan Economic Corridor (CPEC), a $55-billion investment and loan package that envisages changing the way China conducts trade, and the Automotive Development Policy (ADP) 2016-21 announced in March 2016.

Industry experts believe the auto sector would be a major beneficiary of CPEC, given the corridor’s vision of upgrading Pakistan’s road and highways network.

Officials say the country would need heavy vehicles not only during the construction phase, but also after the infrastructure projects are completed.

“New entrants and new models, as well as the increase in heavy vehicles, all speak for themselves,” he said.

https://www.wsj.com/articles/pakistans-middle-class-soars-as-stability-returns-1485945001

Pakistan, often in the headlines for terrorism, coups and poverty, has developed something else in recent years: a burgeoning middle class that is fueling economic growth and bolstering a fragile democracy.

The transformation is evident in Jamil Abbas, a tailor of women’s clothing whose 15 years of work has paid off with two children in private school and small luxuries like a refrigerator and a washing machine.

For companies like the Swiss food maker Nestlé SA, such hungry consumers signal a sea-change.

“Pakistan is entering the hot zone,” said Bruno Olierhoek, Nestlé’s CEO for Pakistan, saying the country appears to be at a tipping point of exploding demand. Nestlé’s sales in Pakistan have doubled in the past five years to $1 billion.

Although often overshadowed by giant neighbors India and China, Pakistan is the sixth most-populated country, with 200 million people. And now, major progress in the country’s security, economic and political environments have helped create the stability for a thriving middle class.

An unpublished study last year that measured living standards, from Pakistani market research firm Aftab Associates, found that 38% of the country is middle class, while a further 4% is upper class. That’s a combined 84 million people—roughly equivalent to the entire populations of Germany or Turkey.

Such households are likely to have a motorcycle, color TV, refrigerator, washing machine and at least one member who has completed school up to the age of 16, the study found. Official figures show that the proportion of households that own a motorcycle soared to 34% in 2014 from 4% in 1991, and a washing machine to 47% from 13% over that same period. These trends are also attracting international business.

In December, Royal FrieslandCampina NV, a Dutch dairy company, paid $461 million to buy control of Engro Foods, a Pakistani packaged milk producer in a country where most milk is sold unpasteurized from open milk containers.

“What we see is consumer spending is rising and a middle class coming up,” said Hans Laarakker, Engro’s new chief executive.

Late last year, China’s Shanghai Electric Power agreed to pay $1.8 billion for a majority of Karachi’s electric supply company; Turkish electrical appliance maker Arçelik paid $258 million for a Pakistani appliance maker, Dawlance, saying Pakistan has an “increasingly prosperous working and middle class”; and French car maker Renault SA said it was seeking to set up a plant in Pakistan.

Meanwhile, during the past three years, deaths from terrorist attacks have fallen by two-thirds, as the army battles jihadists. Economic growth reached an eight-year high of nearly 5% in the past financial year, and China has begun a multibillion-dollar infrastructure investment program. The Karachi stock market rose 46% last year and continues to soar.

------

In the developing world, the ability to purchase durable goods such as motorcycles—which itself can lead to new opportunities in employment, education and leisure—is generally viewed as an indicator of a middle class lifestyle. Motorcycle purchases soared in Pakistan to 2 million a year now from 95,000 in 2000, leading Honda Motor Co. to double its production capacity there. Buyers of Honda’s cheapest motorcycle typically earn between just $200 and $300 a month, which would put them well below the poverty line in the West, but here that gives them disposable income.

“All these big companies globally, if they’re not looking at Pakistan, need to look at Pakistan, because it’s a huge consumption economy emerging,” said Saquib Shirazi, chief executive of Honda’s Pakistan joint venture.

When Naeem Khan went into his local automobile dealer in Karachi to replace his five-year-old taxi with a rickshaw, he was not expecting to leave with a brand new air-conditioned car instead.

But after getting a financing package that was cheaper than he expected, Mr Khan became one of an increasing number of Pakistanis who have recently bought vehicles they previously only dreamt of owning.

The national surge in sales has prompted three global carmakers to commit in the past few months to starting production in Pakistan, potentially doubling the number of foreign carmakers in the country.

“The dealer told me it was the right time to get a loan to buy a car,” says Mr Khan. “Five years ago he said he would have told me to buy a second-hand car or a rickshaw, but today I could afford to buy a new car.”

Pakistan’s car market is still small, and dominated by the three Japanese brands that have local manufacturing plants: Toyota, Honda and Suzuki. The trio made all but seven of the country’s domestically manufactured cars in 2015-16, according to the Pakistan Automotive Manufacturers’ Association, though the figures are just a fraction of their total global car sales.

In the past, analysts say, manufacturers have been put off by the country’s relative poverty, as well as political instability and concerns about security.

But in the past few months, France’s Renault and both Hyundai of South Korea and its affiliate Kia have announced they will soon start assemblies in Pakistan, in partnership with local companies. It marks a return for Kia and Hyundai, which left in the previous decade when their local partner suffered financial problems.

The new and returning entrants are being drawn in by several factors.

The first is both the scale of the potential market in a country of 200m people, as well as the rate at which it is already growing. In 2012-13, carmakers sold 118,830 cars in Pakistan. By 2015-16, that had risen 52 per cent to 181,145.

Analysts say the surge has left Toyota, Honda and Suzuki struggling to meet demand with their customers sometimes forced to wait as long as five months before their cars are delivered.

Yong Sohn, general manager at the Hyundai group, says: “Population and growth-wise, Pakistan is very promising.”

Renault declined to talk about its plans while it is in negotiation with local partners.

Part of the reason for the rise in car sales is that Pakistanis are getting richer. Between 2010 and 2015, the amount each person earned per year rose from $4,370 to $5,320 as measured in gross national income per capita at purchasing power parity.

------

That trend is expected to continue, partly helped by China’s plans to invest more than $52bn in Pakistan’s infrastructure under the “One Belt, One Road” project. Hyundai forecasts that, consequently, car sales in Pakistan will hit 300,000 a year by 2020.

Just as importantly, say analysts, has been the corresponding fall in interest rates. Since September 2000, the rate at which banks can borrow from the Pakistan central bank has fallen from 13 per cent to 6.25 per cent.

Saleem Memon, who sells finance packages for carsin central Karachi, says: “A few years ago, customers sometimes paid 16 or 17 per cent in annual interest rates. Now, if they are lucky, they can get a good deal for around 11 per cent.”

Another factor drawing carmakers to Pakistan is that security has begun to improve thanks to a two-year campaign by the army. Mr Khan remembers days when he and other taxi driverswere routinely stopped at gunpoint by armed extortionists. “The streets are now safe and people feel comfortable driving till late at night,” he says.

Third, the government has drawn up policies aimed at attracting carmakers, such as cutting the duties applicable to parts shipped from abroad and making it easier to find a site to build a plant.

Pakistan's oil consumption from July 2016 to February 2017 jumped 13% year on year, owing to lower petroleum product prices and higher economic activity, driven by GDP growth, foreign investment and greater political stability.

Pakistan's economy expanded 4.2% in 2016, foreign investment has continued to grow -- attracted by the multi-billion dollar China-Pakistan Economic Corridor project -- and improvements in the country's security front, following the government's efforts to combat terrorism, have also led to economic gains and additional investment.

Oil sales during the first eight months of the current fiscal year rose 13% year on year to 16.67 million mt, according to data from oil marketing companies and the Pakistan's Oil Companies Advisory Committee. Pakistan's fiscal year runs from July to June.

Motor gasoline sales increased to 4.36 million mt, up 20% year on year, while demand for high speed diesel increased 15% to 5.46 million mt, the data showed.

"Sales of both products moved north due to significantly lower prices and lower availability of compressed natural gas in the transport sector," said Muhammad Saad Ali, research analyst with Karachi-based brokerage Inter Market Securities.

The price of Pakistan's motor gasoline peaked in October 2013 at Rupees 114 ($1.1)/liter compared with Rupees 73/liter currently, while high speed diesel was at Rupees 117/liter versus the current price of Rupees 82/liter.

Sales of furnace oil also increased to 6.21 million mt from July 2016 to February 2017, up 10% year on year, driven by higher consumption by the power generation sector amid lower water levels and weak hydroelectric production.

CONSUMPTION OUTLOOK

Looking ahead, Pakistan's oil products demand is expected to see substantial growth over the next three years because of rising per capita income, higher automotive sales and growing foreign investment, according to data from energy experts and analysts.

"We believe that oil marketing companies' sales will increase in the backdrop of active transportation activity owing to projects near the China-Pakistan Economic Corridor, rising auto-financing loans and higher per capita income," said Ayesha Fayyaz, research analyst at Karachi-based brokerage Shajar Capital Ltd.

Gasoline demand is expected to increase to 10.9 million mt in the fiscal year ended June 30, 2020, from 5.8 million mt in the year ended June 2016.

The forecast is well above earlier estimates made by Pakistan's Oil Companies Advisory Committee, expecting gasoline demand to reach 8.78 million mt by 2019-20.

"Motor gasoline and high speed diesel sales will continue to be driven by improving macroeconomic factors, and rising sales of cars, bikes and rickshaws," analyst Umair Naseer of Karachi-based Topline Securities said.

"Under CPEC, there will be construction of road infrastructure and industrial units. This, we believe, will lead to an increase in transportation activity and higher gasoline and diesel demand," Naseer added.

The outlook seems less promising for furnace oil, Fayyaz said.

"We are conservative about the volumetric growth in furnace oil due to the expansion of the LNG and hydroelectric power sectors," she said.

http://oilprice.com/Latest-Energy-News/World-News/Indias-2016-Oil-Demand-Jumps-11-To-Record-Highs.html

India’s economic growth and rising income pushed up vehicle sales and fuel demand last year, with oil consumption soaring 11 percent to the highest on record, according to oil ministry data.

India’s oil products consumption increased to 196.5 million tons last year from 177.5 million tons in 2015, with transport fuels gasoline and diesel making up more than half of the country’s oil products consumption. The increase was driven by rising income, which is encouraging people to buy more passenger cars, scooters and three-wheelers. In addition, the road transportation sector is also growing fast.

Gasoline demand jumped 12 percent last year while consumption of diesel increased by 5.6 percent.

FGE expects oil prices this year at between $50 and $60 per barrel, which is expected to drive “robust growth in transport and consumer fuels in India,” the analyst noted.

In September of 2016, India’s Petroleum Minister Dharmendra Pradhan said that he expected the demand for crude oil in the country to rise in excess of 11 percent for 2016, thanks to “better monsoon rains” and growth in economic activity. In 2015, India recorded an increase of 11 percent in the consumption of oil, versus projections for a rate of 7-8 percent. Year 2016 should see a higher increase, Pradhan said in September of 2016.

According to an India Energy Outlook by the International Energy Agency (IEA), demand for oil in India is expected to grow at the fastest pace through 2040, compared to any other region or country. Demand for oil is seen rising by 6 million bpd to reach 9.8 million bpd in 2040.

https://www.thenews.com.pk/print/195925-Indus-Motor-Company-unveils-Rs4bln-investment-plan-to-expand-production

Indus Motor Company Limited (IMC), a country’s leading automaker, on Saturday unveiled four billion rupees investment plan to expand its annual production capacity by 200,000 units in a bid to capitalise on the growing consumer demand.

Currently, IMC holds an annual production capacity of 54,800 units, which are sold under the brand name of Toyota. The planned capacity enhancement would bring the production to 75,000 vehicles a year.

“Pakistan’s auto industry future looks very promising,” IMC Chief Executive Officer Ali Asghar Jamali told media at its third auto workshop.

“I am hopeful that Pakistan will be producing 500,000 cars per year by 2022,” Jamali said.

The demand for local as well as used cars has exponentially been growing for the last three years due to overall improvement in the macroeconomic activities.

Despite being a world’s biggest densely-populated country, Pakistan has, however, not seen rapid motorisation. The country has only 16 cars per 1,000 people. By 2020 the ratio is likely to reach 20 cars per 1,000.

Industry experts are expecting a fast growth in car sales due to growing and young middle-class in the country.

The experts said the country is the third largest growing economy in emerging market and it could benefit from the ongoing $57 billion worth of China-Pak Economic Corridor (CPEC) projects.

IMC recorded five percent drop in sales during the July-February period of 2016/17, but in light commercial vehicle -- vans and jeeps – sales of Toyota Fortuner increased to 568 during the period from 368 units in the corresponding period.

Analyst Sohaib Subzwari at Taurus Securities Limited attributed the fall in sales to “strong demand for Honda Civic and operational issues restricting production.”

Subzwari, however, said the growing construction and road network development activities on account of CPEC would contribute to growth in volumes of heavy and light commercial vehicles.

In July-February, IMC emerged as the second leading player by number of sold vehicles. Pak Suzuki was the first, while Honda was the third.

The government recently announced auto policy 2016-21 containing a number of incentives for Greenfield and Brownfield projects in the country’s Japanese-dominated auto market.

IMC started its operation as a joint venture of House of Habib of Pakistan, Toyota Motor Corporation and Toyota Tsusho Corporation of Japan in 1989.

Analysts said auto industry generally feels comfortable about the new auto policy, which they say has provided a solid road map to the investors to plan investment for a long period.

On premium (own money) and black marketing, Jamali said the government should impose Rs100,000 as a levy per car if the first owner sells it within six months of the purchase. “This will eliminate the middleman and investors who create artificial shortage of cars in the market,” he added.

Car manufacturers said import of used cars poses the biggest threat to the local industry’s survival.

“We purchase local parts of Rs150 million on every working day, which becomes Rs40 billion per year,” said IMC executive.

Pakistan imports more than 46,500 used cars in a year, around 15 percent of the total car sales of 283,000 units in 2016.

Aamir Allawalla, ex-chairman of Pakistan Association of Automotive Parts and Accessories Manufacturers (Paapam) said import of five-year old used vehicles dented the industry as it led to shutdown of several plants.

“New variants to be introduced by local players in the next years would, however, give a tough competition to the imported cars,” Allawalla said.

He said local industry wants long-term auto policies to get return on their investment and in order to avert ‘sudden shocks’. A huge investment in the sector has been planned, he added.

Atlas Honda is the market leader in the Pakistani motorcycle industry with over 65 per cent market share. Atlas Honda motorcycle industry showed a phenomenal jump from 1 million motorcycles a year in 2000-01 to currently 2 million a year .This is an evidence of dramatic change in consumer behavior in Pakistan.

In the past year over 1.5 million motorcycles were produced in the country out of which most were of 70cc engine capacity. A phenomenal growth has been observed in 100cc, 125cc and above segments with a growth trend of around 34 per cent and 20 per cent respectively. A decline in production of around 10 per cent is seen in the most popular 70cc motorcycles.

Due to Honda's 100 per cent motorcycle localisation and the prices of it being reasonable in the domestic market, the new international markets like South Africa and Iran are being explored. Already it has gained foreign markets like Bangladesh and Sri Lanka.

Local assembly of motorcycles started in 1964 when Atlas Group put up assembly facilities in Karachi to assemble Honda motorcycles before that the market was haunted by Japanese brands Honda, Yamaha and Suzuki.

The market experienced a major breakthrough in the late 1990's with the advent of assemblers. At present, there are around 100 assemblers in the country. Out of these around 81 are active assemblers. The popular 70cc brand still carries more than 80 per cent of the market share. The Honda Japan recently declared Pakistan as a hub for 70cc technology in the region.

From the years 2007 till 2011, the Honda motorcycle's price has gone up from Rs 58000 to Rs 68500. According to the Senior Managing Director of Honda Motor Company Japan, T Oyama, Pakistan will be amongst the top five countries in the world which will produce and export high quality motorcycles in the coming next few years.

Atlas Honda has achieved a lot of success in Pakistan and with its high sales and production; it will bring a boom to Pakistan's economy in an impressive way. Atlas Honda has invested $35 million this year alone in Pakistan and increased its motorcycle production capacity to 750,000 per year. Pakistan has one of the largest motorcycle consumer markets and it exports to regional buyers too.

The production capacity will be increased to one million units in the next few years with an estimated cost of an additional $50 million. This collaboration between Atlas Group Pakistan and Honda Japan is amongst the oldest in joint venture history of Honda Motor Company anywhere in the world, and together Atlas Honda Ltd. has brought about the drive for motorcycle industry in Pakistan.

Observing from recent growth in motorcycle sales in the 100cc and other categories, Pak Suzuki Motors Company has launched a new model of 110cc motorcycle. The company says it is keen to cater to the growing market of higher engine specification motorcycles. The launch price of the GD-110 has been set at Rs99, 999. The bike employs a 4-Stroke CDI engine which complies with Euro II emission standards.

Pak Suzuki remains the dominant player in Pakistan's four-wheelers market with over 60 per cent of the market. However, its share in the motorcycles market is just less than 2 percent.

http://www.thefinancialdaily.com/NewsDetail/172818.aspx

https://tribune.com.pk/story/1390278/honda-atlas-launches-br-v-pakistan-heres-everything-need-know/

Honda Atlas launched its first locally produced subcompact Sports Utility Vehicle (SUV) on Friday, comprising 45% local components, stated the company.

The Bold Runabout Vehicle (BR-V) – which seats seven people – costs about Rs2.23 million and Rs2.33 million for its i-VTEC and i-VTEC S variants, respectively. It features a 1.5litre engine.

According to the company, the low price is courtesy local components used in the manufacturing. Additionally, through this price, Honda is looking to boost its sales by attracting existing as well as new customers who are willing to enter the SUV family.

“SUVs in Pakistan are too costly and are mostly out of range for many customers,” said Honda Atlas Cars Pakistan Limited General Manager Sales and Marketing Nadeem Azam. “With the price range we are offering, about 90% of customers can now afford the new variants, which will attract new as well as existing customers of other companies too.”

The company is also looking to tap rural as well as urban markets with the newly-launched SUV. “We are confident that BR-V will strongly appeal to the urban and rural customers and accelerate our growth while strengthening our brand presence in the country,” said Honda Atlas Cars Pakistan Limited President and CEO Toichi Ishiyama. “Pakistan is a key market for Honda and as part of our business expansion; we are focusing on increasing our customer base and will be bringing a lot of new and innovative products in the future.”

https://tribune.com.pk/story/1407581/local-auto-sales-stay-buoyant-volumes-rise-14/

Local automobile sales, including light commercial vehicles (LCVs) and jeeps, in the first 10 months (Jul-Apr) of the current fiscal year totalled 176,937 units, up 14% compared to 154,949 units (excluding Punjab taxi scheme sales of 29,150 units) in the same period of previous year, according to data released by the Pakistan Automotive Manufacturers Association (Pama).

Auto industry seeks tax relief at retail stage

“Car sales remained robust and are expected to touch 270,000 units (including 60,000 imported cars) by the end of fiscal year in June 2017,” Topline Securities commented on Thursday.

Philippines, Pakistan help motorcycle makers avoid the skids

Demand in two countries surges just as sales slow elsewhere in Asia

SADACHIKA WATANABE and JUN ENDO, Nikkei staff writers

https://asia.nikkei.com/Business/Trends/Philippines-Pakistan-help-m...

The Philippines and Pakistan have become bright spots in Asia's motorcycle market, helping to offset slowdowns in other key countries.

Like the Philippines, Pakistan is providing some much-needed vroom. Sales are rising by double digits in the South Asian country, which has a population of nearly 200 million but gross domestic product per capita of $1,500 -- half the Philippines' figure.

Improved security is giving consumers more confidence to buy motorbikes. Sales surged 18.9% last year, to 1.43 million units, according to industry figures. Auto researcher Fourin estimates the market was actually 1.8 million to 2 million, factoring in imports by Chinese manufacturers.

Honda plans to double its motorcycle production capacity in Pakistan in the 2015 to 2018 period. It is already capable of turning out 1 million motorbikes.

Yamaha Motor, which dissolved its local joint venture in 2008, built a new plant to re-enter Pakistan in 2015. Motorcycles with 70cc engines are selling well, and Yamaha aims to buff its brand with a 125cc model.

Despite a population of 100 million, the Philippines' motorbike market is less than half that of Vietnam, which is home to 90 million people. The wealthy tend to own cars, while low-income earners typically get around on Jeepneys and other public transportation in urban areas.

But a couple of Japanese bike manufacturers -- Honda Motor and Yamaha Motor -- have sought to change that with scooters featuring automatic transmissions. Their marketing drives, coupled with rising income levels, are giving sales more zip.

https://tribune.com.pk/story/1478567/locally-assembled-car-sales-accelerate-july/

Sales of locally assembled vehicles, including jeeps and light commercial vehicles, jumped to 19,577 units in July 2017, up 41% compared to 13,932 units in the same month of 2016, according to latest data released by the Pakistan Automotive Manufacturers Association (PAMA).

A Topline Securities’ report said the numbers were in line with its estimates. The apparently large difference in monthly sales may be attributed to reduced working days in July 2016 because of Eid holidays, the report said.

Pakistan could soon see these electric cars on its roads

Sales of Pak Suzuki Motor Company increased 37% year-on-year (YoY) in July 2017 due to strong demand for Wagon-R, up 77%.

With the introduction of a new model, sales of Cultus rose 66% YoY while Ravi sales were up 41%, which also supported the company’s growth.

Honda outperformed its peers in vehicle sales, posting 113% growth due to successful introduction of a new Civic model and new sports utility vehicle (SUV) BR-V.

Indus Motor sold 4,618 units in July 2017, up 11% YoY. The company’s focus remained on production of higher-margin Fortuner, which recorded a stellar growth of 543%.

Moreover, buyers were postponing their purchase of Toyota Corolla, waiting for the face-lift model, which has arrived now.

Truck and bus sales of PAMA member companies in July 2017 remained strong, growing 13% YoY. The trend is expected to continue, fuelled by the China-Pakistan Economic Corridor (CPEC) led growth, higher road connectivity, lower financing rates and enforcement of the axle load limit per truck on highways by the National Highway Authority.

Two and three-wheel vehicle sales for July 2017 grew strongly by 42% YoY due to rising disposable income of the lower middle class, the report added.

Why Pakistan should switch to hybrid cars

Tractor sales continued to exhibit an upward trajectory with sales growing by 125% YoY in July 2017.

Lower general sales tax, improved crop yield due to Punjab government’s Kisan Package and continuation of fertiliser subsidy to improve farmers’ purchasing power contributed to the strong tractor sales.

Moreover, in the provincial budget for fiscal year 2018, the Sindh government has set aside Rs2 billion in subsidy on tractor purchases by farmers.

Similarly, production and sales in May 2017 were 90,800 and 93,060 units while in August 2017 it was 95,200 and 91,599 units.

United Auto Motorcycle also made new records as its production and sales surged to 35,555 and 36,084 in August 2017 in comparison to its previous record in November 2016 of 32,773 units.

In July-Aug 2016-17 the sales by UAM were 49,464 while this year during same period UAM sales increased to 67,023 units.

Moreover, statistics by Pakistan Automotive Manufacturers Association confirmed that Road Prince Bike Assembler also made record production of 23,650 units in Aug 2017 compared to its last record of 19,508 units in October 2016.

Other than this sale of Honda Civic/City, Suzuki Swift and Toyota surged from 5,295, 689 and 8,250 units during July-August 2016 to 7,766, 722 and 8,657 units this August 2017. Sales of Suzuki Cultus and Suzuki WagonR climbed up from 2,190 and 2,352 units to 3,670 and 4,137 units. Similarly, Suzuki Mehran and Suzuki Bolan sales increased from 5,676 and 2,865 units to 6,826 and 3,224 this August 2017. Trucks, Jeeps, Vans, Tractors sales also showed a considerable rise from the previous year.

CPEC played a significant role in high sales of trucks and other vehicles.

https://www.researchsnipers.com/bike-makers-break-previous-production-sales-records-pakistan/

https://tribune.com.pk/story/1553317/2-pm-abbasi-welcomes-volkswagens-entry-pakistan/

Prime Minister Shahid Khaqan Abbasi has welcomed on Wednesday Volkswagen’s decision to invest and undertake business ventures in Pakistan, assuring the world’s largest automaker of complete facilitation and support from the government.

Talking to Volkswagen Board of Management member Joseph Baumert, who met him at the PM Office, Abbasi highlighted strengths of Pakistan’s economy and credited investor-friendly policies for an “economic turnaround” in the last four years.

Abbasi said that both local and foreign investors had huge incentives to invest and reap benefits from a fast-growing economy as a result of the improved security situation.

The auto sector development also comes as a huge relief for a hungry Pakistani market long dominated by three Japanese players who face continuous capacity constraints. With the government recently imposing further regulatory duty on the import of new and used vehicles, the stage seems set for new entrants.

In the past year, Lucky has announced a joint venture with Kia Motors, while Hyundai Motor Company also plans to set up a car assembly plant with textile group Nishat Mills.

Meanwhile, Abbasi said that due to improved and enhanced road networks as a result of the China-Pakistan Economic Corridor (CPEC) project and greater spending on communication infrastructure, Pakistan offers great opportunities to international automobile companies to fill in the existing demand-supply gap through local production.

The premier also highlighted various features of the Auto Policy 2016-2021 which offers tax and other incentives to new entrants to enable introduction of new brands, develop market share, create distribution and after-sales service networks besides a parts-manufacturing base.

Abbasi expressed hope that Volkswagen would provide quality vehicles of international standards.

Baumert also expressed hope for a successful business venture in Pakistan. Other officials including Volkswagen’s head of overseas production Andreas Sprindler, head of Asia Pacific, Oliver Glaser, International Policy Foreign and Governmental Relations Klaus – Bo Steindorff and head of CKD Yuri Konushin, Premier Systems CEO Syed Arshad and Board of Investment secretary were present.

Pakistan's National Logistics Cell has signed a MoU with Daimler AG to assemble Mercedes-Benz Trucks in the country. With the upcoming China-Pakistan Economic Corridor (CPEC) and a new network that links Pakistan's seaports in Gwadar and Karachi with Northern Pakistan, this new plant will boost Commercial Vehicle sales in Pakistan.

German Automaker, Daimler AG has signed a memorandum of understanding (MoU) with The National Logistics Cell (NLC), Pakistan to set up a manufacturing unit of Mercedes‐Benz trucks in Pakistan. In a statement released by NLC, the company confirms that Daimler AG will locally assemble Mercedes-Benz Trucks in Pakistan and marks a major shift in the logistics and transportation industry’s preference towards European manufacturers.

News report further confirms that Major General Mushtaq Faisal, the director general, and Zia Ahmed, Chief Executive Officer of Pak NLC Motors signed the MoU on behalf of NLC. On behalf of Mercedes-Benz Trucks, Klaus Fischinger, head of the executive committee, and Dr Ralf Forcher, head of sales, were present to sign the MoU.

Major General Faisal further said that this is a historic moment for Pakistan’s commercial vehicle industry. A report on Tribune further quotes him saying “The local assembly of Mercedes‐Benz trucks would prove as a strategic opportunity that would leverage the modernisation of Pakistan’s logistics industry,” said the official. Pakistan government has promised to give more incentives in its Auto Development Policy 2016-21 and these locally-assembled Mercedes-Benz trucks would be sold at competitive prices.

This is also a huge move for Pakistan with the China-Pakistan Economic Corridor (CPEC) coming up, Daimler seems to have invested at the right time to make the most of Pakistan's logistics movement to China.

In an IANS report, Dr Ralf Forcher, head of sales at Mercedes‐Benz Special Trucks was quoted saying "Pakistan’s infrastructure and construction sectors have registered significant growth in recent years, giving a boost to the logistics industry that, in turn, means increased demand for commercial vehicles."

The demand for Commercial vehicles in Pakistan is set to go up with CPEC and a new network that links Pakistan's seaports in Gwadar and Karachi with Northern Pakistan.

https://www.brecorder.com/2018/07/10/427589/third-times-the-charm/

Cars are getting pricier again. For the third time since December when the currency first started to take its downward spiral, local automakers have raised prices. Whereas Suzuki raised prices by as much as Rs30,000, Toyota raised prices between Rs50,000 to Rs1.9 million for some of its imported vehicles. Honda, on the other hand, raised prices by up to Rs100,000. The Rupee to US Dollar depreciation continued well into July – falling by nearly 15 percent since December. Against the Japanese Yen, the Rupee fell by 17 percent during this period.

The price-hikes have been associated to high costs of manufacturing – not only rising costs for Completely Knocked Down (CKD) kits; but also locally-manufactured auto parts. According to data reported by Pakistan Bureau of Statistics (PBS), cost of CKD imports for motorcars went up by 21 percent between July-May 2018 whereas sales during the period rose by 16 percent.

Existing OEMs and auto-part makers are still dependent on imported CKD kits, functional parts, and commodities like iron, steel, aluminum, plastic etc. which are mostly imported. In an interview with BR Research, the Chairman of PAAPAM, Iftikhar Ahmed shared his estimates for localization in the cars segment, putting Suzuki’s at more than 70 percent, Toyota more than 55 and Honda around 51 percent. On average, he believes localization should be around 60-61 percent for all the three OEMs.

This means, nearly 40 percent of the content is still of imported value.

BR Research’s own calculations suggest localization levels during FY17 for an average car manufactured in the country may be 51 percent – (read “The Fault in our Cars”, published Feb 6, 2018) – whereas share of imported content in car prices would be around 22 percent. The rest is sales tax and customs duties. If imports become expensive, tax collected is also higher. Moreover, for cars with strong demand like Wagon-R or the more sophisticated SUVs or cross-over SUVs like Toyota Fortuner or Honda BR-V, localization is not a lot. This means, OEMs have no choice but to raise prices to keep their margins intact.

--------

https://www.brecorder.com/2018/02/06/397319/the-fault-in-our-cars/

The sector has had three major Japanese car makers, who started off by producing 33,000 units back in 1996, growing to the peak of 176,000 units in 2007, and since laid low. Now the volumes are hitting 200,000 cars and are expected to go up with the culmination of the new auto policy with at least three more players entering the field (Read “The Year of Cars”, Jan 29, 2018).

There is no doubt that the three Original Equipment Manufacturers (OEMs) have invested in Pakistan. Recently, Indus Motors expanded capacity worth Rs4 billion. Honda invested Rs240million to expand its press and paint shops. The sector provides direct and indirect jobs to over 2 million people.

There is a large parts manufacturing industry that runs parallel to the primary industry. Technology transfer has also happened with the support of carmakers. Vendors have signed technical agreements with prominent counterparts abroad to increase capabilities. Indus Motors Chief, Ali Jamali told BR Research that Toyota in Pakistan buys 126 million parts from local vendors every day. Seems like a huge number! But let’s consider another huge number.

Import bill for Completely Knocked Down (CKD) kits has grown from $268 million in FY09 to $673 million in FY17, according to data retrieved from Pakistan Bureau of Statistics (PBS). That’s more than Completely Built Unit (CBU) imports. This means, the imported content to manufacture one unit of car, on average, has remained between $3,000 to $4,000 through the years. With such a huge import burden for manufacturing, have we truly substituted imports?

http://disq.us/t/36u4mye

SEOUL, South Korea—Kumho Tire Co. Inc. has agreed to provide tire manufacturing technology to a Pakistani battery producer that is planning to branch into tire production.

At a Sept. 27 ceremony in Seoul, Kumho signed a 10-year technology-transfer agreement with Century Engineering Industries (Pvt.) Ltd. covering technologies "required to manufacture 28 tire products for passenger and commercial vehicles."

Based in Karachi, Pakistan, Century Engineering—d.b.a Phoenix Batteries—is a car-battery manufacturer that aims to build a tire plant with a capacity of 5 million units.

Under the deal, Kumho Tire will receive $5 million for the supplied technology as well as royalties equal to 2.5 percent of Century's annual sales for 10 years, the South Korean company said in a statement.

The scope of the agreement covers design, quality control, training as well as manufacturing process.

Century Engineering has as yet not disclosed other details about its plans for tire production, including the site and timetable.

The domestic production of tractors during fiscal year 2017-18 witnessed growth of 33.20 percent as compared the production of the corresponding period of last year.

During the period from July-June, 2017-18 about 71,894 tractors were manufactured as compared to the 53,975 tractors of same period of last year.

On month on month basis, the local production of tractors also grew by 15.21 percent as it was recorded at 3,926 units in June 2017 to 4,523 units in June 2018. according the Quantum Index Number of Large Scale Manufacturing.

It may be recalled that the overall Large Scale Manufacturing Industries (LSMI) of the country witnessed growth of 5.38 percent during the year 2017-18 compared to last year.The LSMI Quantum Index Numbers (QIM) was recorded at 147.07 points during July-June (2017-18) against 139.55 points during July-June (2016-17), showing growth of over 5.38 percent.

Meanwhile the production of trucks witnessed growth of 5.76 percent by going up from the output of 608 units in June 2017 to 643 units in June 2018.

The production of trucks also increased from 7,712 units last year to 9,187 units, showing growth of 19.13 percent while the production of tractors increased by 33.20 percent, from 53,975units to 71,894 units.

On year-on-year basis, the production of jeeps and cars increased by 40.90 percent during the month of June 2018 against the output of June 2017. During the period under review, Pakistan manufactured 16,234 jeeps and cars during June 2018 against the production of 11,522 units during June 2017.

During last financial year, the production of light commercial vehicles (LCVs) witnessed an increase of 19.74 percent in production during the period under review by growing from 24,265 units last year to 29,055 LCVs during 2017-18.

Bilal I Gilani

@bilalgilani

From just 3 million motorcycles 15 year ago , we now have over 22 million motorcycles

Ppl had disposable income to afford this

Much of these motorcycle are used for rural to urban mobility

Motorcycles r environmentally less harmful than cars ( ideal is public transport)

https://twitter.com/bilalgilani/status/1496406817794056194?s=20&t=EOfusXP1cOjYlIWztngEZA

Bilal I Gilani

@bilalgilani

Poverty picture based on World Bank data

Don't believe the gloom spreaders

If you have one foot in US , every day you try to justify your exit by dissing Pakistan

Facts belie your gloom story

Long way to go but Pakistan is progressing

https://twitter.com/bilalgilani/status/1496405609096351746?s=20&t=5RWyuRFkBRfeFG_Djqk90Q

(Graph shows poverty declining from 64% in 2001 to 40% in 2008 and 21.9% in 2018

@bilalgilani

Pakistan produced 2.4 million motorcycles last year

200k in a month 8000 in a day 1000 every hour

https://twitter.com/bilalgilani/status/1535717946273804299?s=20&t=kWjUCwUx68n1wKxf9W8siw

--------------

Bilal I Gilani

@bilalgilani

In one decade motorcycle on road increases from 5 million to 25 million !

https://twitter.com/bilalgilani/status/1535718216215011328?s=20&t=lRW-xQXmWcEf7sY6zn6ajg

https://dailytimes.com.pk/974390/paapam-opens-pakistans-largest-automotive-expo-2022-in-lahore/

Pakistan Auto Show 2020 Chief Organizer and PAAPAM former chairman Syed Nabeel Hashmi said “Pakistan Auto Show 2022 is setting new benchmarks and trends for the automotive industry. Today, this mega event attracts more than 100,000 visitors from all over Pakistan and internationally. Over 200 international buyers and well over 100 international visitors will be attending the largest auto show in Pakistan.” The government needs to prepare long-term plans and support industries accordingly. The Chairman of Pakistan Association of Automotive Parts & Accessories Manufacturers (PAAPAM) – Capt. (R) Muhammad Akram stated that: People are passionate about seeing the latest revolutionary technologies being deployed in Pakistan. Some of the participants this year include global automobile brands, along with spare-parts manufacturers, component suppliers, Original Equipment Manufacturers (OEM vendors), automobile traders, investors, buyers and enthusiasts, who want to expand their business networks and gain more information about the innovations and products in this sector.” The inaugural day at the show, saw an overwhelming response from industry stakeholders, international large-scale buyers and diverse consumer segments, as the Pakistan Auto Show features; cars, tractors, trucks, buses, 4X4, motorcycles, three wheelers and exotic cars, while promoting a wide array of advanced technologies and solutions, including; engines, casting, forging, sheet metals, jigs and fixtures, along with electronics, car-paints, tools, tires, batteries, plastic parts, rubber parts and accessories.

------------

Automobile Sector Has Key Importance In Economy: Secretary

https://www.urdupoint.com/en/business/automobile-sector-has-key-importance-in-econo-1542558.html

LAHORE, (UrduPoint / Pakistan Point News - 31st Jul, 2022 ) :Provincial Industries and Commerce Department Secretary Dr Ahmed Javed Qazi said on Sunday that automobile industryenjoyed a key position in the national economy, and effective steps were being taken to increase its share in the GDP and get its proper share in the global market.

This sector, he added, was providing opportunities to value-added exports; therefore, the Punjab government was providing all possible support for development of this industry.

Addressing an industrial symposium, organised by the Pakistan Association of Automotive Parts & Accessories Manufacturers (PAAPAM) here at the Expo Center, he said 10 special economic zones were functional in the province, while recommendations had been sent to the Federal government for three new special economic zones. "There are vast opportunities for domestic and foreign investors in these special economic zones. There are also 24 small industrial estates for investors in the province," he added.

Qazi said that the University of Engineering and Technology (UET) Lahore was contributing much to promote automobile and engineering sector and the Punjab Tianjin University of Technology, Mir Chakar Khan University, Dera Ghazi Khan, and Rasool University Mandi Bahauddin were producing high-quality technologists; however, there was a need to strengthen the linkages between academia and industry.

The secretary said that such seminars prove helpful in policy-making process, assuring the recommendations that came out at the symposium would be considered by the relevant departments. He said that holding an auto show was a welcome step as 153 local and international exhibitors were participating in the event, factories making cars, tractors and motorcycles, apart from factories making auto-parts have set up their stalls.