Pakistan Seeing Strong Growth in Consumption of Energy, Cement and Steel

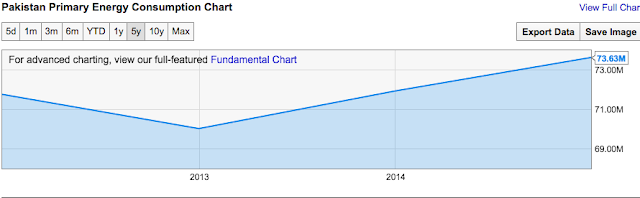

Pakistan's energy consumption grew by 5.7% in 2015, faster than the 5.2% increase in neighboring India that claims significantly faster GDP growth. Primary energy consumption growth in a country is often seen as a strong indicator of its GDP growth. Ever since the advent of the industrial age, energy has become increasingly important as a driver of farms, factories, communication, transportation, construction, retail and other sectors of the economy. In addition to energy, other important economic indicators include cement and steel consumption, auto sales and air travel which are also growing significantly faster in Pakistan than in India.

Primary Energy Consumption:

According to British Petroleum Statistical Review of World Energy released in June 2016, the primary energy consumption in Pakistan rose to 78.2 million ton oil equivalent (MTOE) in 2015, compared with 73.2 MTOE in 2014 confirming greater economic activity. It was the third fastest growth in energy consumption in Asia. Only the Philippines (9.7%), Vietnam (9.6%) and Bangladesh (8.7%) saw faster growth than Pakistan's.

Domestic Cement Demand:

All-Pakistan Cement Manufacturers’ Association reported cement industry sold 33 million tons in domestic market in fiscal year 2015-16, posting a robust growth of 17.01 per cent compared to the 28.2 million tons sales during the same period in 2015.

Local Auto Production:

Domestic auto production in Pakistan jumped by 21.57 percent (vs 2.58% growth in India) in fiscal 2016 compared to fiscal 2015, according to data from Pakistan Automobile Manufacturers Association. The data collected by Pakistan Bureau of Statistics (PBS) noted that as many as 168,363 jeeps and cars were manufactured during July-May (2015-16) while 138,490 units were produced last year(July-May 2014-15).

Rising Steel Demand:

Pakistan is experiencing 30% growth in steel imports, according to the State Bank of Pakistan. Local steel production is about 6 million tons. In addition, Pakistani imports of steel this year could surpass $2 billion as China-Pakistan Economic Corridor CPEC-related projects ramp up.

Air Travel Growth:

Pakistan air travel market is among the fastest growing in the world. IATA (International Air Transport Association) forecasts Pakistan domestic air travel will grow at least 9.5% per year, more than 2X faster than the world average annual growth rate of 4.1% over the next 20 years. The Indian and Brazilian domestic markets will grow at 6.9% and 5.4% respectively.

Pakistan saw 23% growth in airline passengers in 2015, according to Anna Aero publication. Several new airports began operations or expanded and each saw double digit growth in passengers. However, Gwadar Airport growth of 73% was the fastest of all airports in Pakistan.

The top 12 airports all saw large double digit increases. Multan grew 64%, Quetta 62% and Faisalabad +61% all climbing one place as a result of all of them seeing a growth of over 60%. Turbat Airport in Balochistan is the newest airport to reach the top 12 in terms of traffic.

Mobile Broadband Uptake:

Mobile broadband subscriptions have rocketed from zero to over 30 million in just two years since 3G/4G service rollout in Pakistan. Rapid growth is continuing with over 1 million new subscribers are signing up for 3G and 4G services every month. An equal or larger number of smartphones are are being sold.

Summary:

A whole series of indicators from auto and steel to manufacturing and construction and telecom services are confirming that economic growth is accelerating in Pakistan. Among the reasons for this growth are significantly improved security situation, political stability and soaring Chinese foreign direct investment (FDI) in CPEC related energy and infrastructure projects. These indicators are attracting investors who have already made Pakistan Stock Exchange the hottest shares market in Asia. KSE-100, Pakistan's main shares index, is up 18% year-to-date compared to 6% increase in India's BSE-30 index. The challenge for Pakistan is to continue to improve security and political stability to reassure investors of superior returns from their investments in the country.

Related Links:

Haq's Musings

Politcal Stability Returns to Pakistan

Auto and Cement Demand Growth in Pakistan

Pakistan's Red Hot Air Travel Market

China-Pakistan Economic Corridor FDI

Mobile Broadband Subscriptions and Smartphone Sales

Pakistan in MSCI Emerging Market Index

|

| Pakistan Primary Energy Consumption Trend (Source: British Petroleum) |

Primary Energy Consumption:

According to British Petroleum Statistical Review of World Energy released in June 2016, the primary energy consumption in Pakistan rose to 78.2 million ton oil equivalent (MTOE) in 2015, compared with 73.2 MTOE in 2014 confirming greater economic activity. It was the third fastest growth in energy consumption in Asia. Only the Philippines (9.7%), Vietnam (9.6%) and Bangladesh (8.7%) saw faster growth than Pakistan's.

Domestic Cement Demand:

All-Pakistan Cement Manufacturers’ Association reported cement industry sold 33 million tons in domestic market in fiscal year 2015-16, posting a robust growth of 17.01 per cent compared to the 28.2 million tons sales during the same period in 2015.

Local Auto Production:

Domestic auto production in Pakistan jumped by 21.57 percent (vs 2.58% growth in India) in fiscal 2016 compared to fiscal 2015, according to data from Pakistan Automobile Manufacturers Association. The data collected by Pakistan Bureau of Statistics (PBS) noted that as many as 168,363 jeeps and cars were manufactured during July-May (2015-16) while 138,490 units were produced last year(July-May 2014-15).

Rising Steel Demand:

Pakistan is experiencing 30% growth in steel imports, according to the State Bank of Pakistan. Local steel production is about 6 million tons. In addition, Pakistani imports of steel this year could surpass $2 billion as China-Pakistan Economic Corridor CPEC-related projects ramp up.

Air Travel Growth:

Pakistan air travel market is among the fastest growing in the world. IATA (International Air Transport Association) forecasts Pakistan domestic air travel will grow at least 9.5% per year, more than 2X faster than the world average annual growth rate of 4.1% over the next 20 years. The Indian and Brazilian domestic markets will grow at 6.9% and 5.4% respectively.

Pakistan saw 23% growth in airline passengers in 2015, according to Anna Aero publication. Several new airports began operations or expanded and each saw double digit growth in passengers. However, Gwadar Airport growth of 73% was the fastest of all airports in Pakistan.

The top 12 airports all saw large double digit increases. Multan grew 64%, Quetta 62% and Faisalabad +61% all climbing one place as a result of all of them seeing a growth of over 60%. Turbat Airport in Balochistan is the newest airport to reach the top 12 in terms of traffic.

Mobile Broadband Uptake:

Mobile broadband subscriptions have rocketed from zero to over 30 million in just two years since 3G/4G service rollout in Pakistan. Rapid growth is continuing with over 1 million new subscribers are signing up for 3G and 4G services every month. An equal or larger number of smartphones are are being sold.

Summary:

A whole series of indicators from auto and steel to manufacturing and construction and telecom services are confirming that economic growth is accelerating in Pakistan. Among the reasons for this growth are significantly improved security situation, political stability and soaring Chinese foreign direct investment (FDI) in CPEC related energy and infrastructure projects. These indicators are attracting investors who have already made Pakistan Stock Exchange the hottest shares market in Asia. KSE-100, Pakistan's main shares index, is up 18% year-to-date compared to 6% increase in India's BSE-30 index. The challenge for Pakistan is to continue to improve security and political stability to reassure investors of superior returns from their investments in the country.

Related Links:

Haq's Musings

Politcal Stability Returns to Pakistan

Auto and Cement Demand Growth in Pakistan

Pakistan's Red Hot Air Travel Market

China-Pakistan Economic Corridor FDI

Mobile Broadband Subscriptions and Smartphone Sales

Pakistan in MSCI Emerging Market Index

Comments

Pakistan received a major boost in its endeavor to expand renewable energy infrastructure as Canada agreed to set up large-scale solar power projects in one of the country’s provinces.

According to media reports, the Canadian government recently signed an agreement with the government of Balochistan to set up 1 GW of solar capacity in the province.

The agreement was signed by the Baloch government itself, under special powers received through the Pakistan constitution.

As per the agreement, a Canadian company will set up 20 solar power projects of 50 MW capacity each. The projects are expected to be distributed across the province. A Canadian delegation is expected to visit Pakistan soon to finalize the various project locations.

Pakistan has seen a sharp increase in foreign investment in its renewable energy sector. Led by China, Pakistan’s renewable energy sector has seen increased interest from European governments and companies.

Foreign investors poured $3 billion over the last year into the renewable energy sector in Pakistan, officials from the Alternative Energy Development Board (AEDB) have said. The largely untapped resource potential and a feed-in tariff regime has made renewable energy an attractive investment avenue.

Earlier this year, the AEDB reported that as many as 35 solar PV projects are currently at various stages of development. These projects will have a cumulative installed capacity of 1,111 MW.

But the pace of growth has slowed in recent months, with sales increasing at a meagre 6-7 per cent (most carmakers have had far worse depressing sales growth). As if that wasn't worrying enough, a couple of setbacks have further dampened industr ..

Read more at:

http://economictimes.indiatimes.com/articleshow/53424330.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

Rotary conducts trainings for Lady Health Workers (LHWs) on cell phone reporting at its Rotary Resource Center in Nowshera, Khyber Pakhtunkhwa. “I was the only female at the time the program started, and I’ve been involved for the past eight years,” says health worker Malkabalees. Today, Rotary has trained more than 500 LHWs.

Specific codes are assigned to various maternal, newborn and child health indicators (pregnancies, deliveries, newborn deaths, maternal deaths, etc) and immunization indicators (immunizations administered, refusals, missed children, etc).

Community midwives and female health workers collect the data, and send it using specific codes to a server through SMS. Government and polio eradication leaders use the data to assess trends and gaps in the program.

Lady Health Worker Malkabalees teaches a fellow health worker to report a refusal, and enter the reason (e.g. religious, fear, lack of understanding). Rotary and its partners use this data to create strategies to combat refusals, such as involving religious leaders to educate their communities about the importance and safety of the vaccine.

Islamabad: The Chinese investors have showed keen interest in the Pakistan's steel, energy, cement and other sectors for investment and

joint ventures.

A delegation of Chinese investors representing various companies including Zonergy Company Limited and Hebei Weilang Import and Export Group Co., Limited visited Islamabad Chamber of Commerce and Industry, said a press release issued on Tuesday.

The delegation said China-Pakistan Economic Corridor has generated lot of interest in Chinese investors and purpose of their visit was to study the potential of Pakistani market for investment and business collaboration.

Zonergy Company Limited (ZONERGY) was China's national high-tech enterprise which was providing resource integration services for customers in new energy and energy-saving, environmental protection industries, while it was now looking at Pakistan as a prospective country for investment and JVs.

Hebei Weilang Import and Export Group was a large-scale professional enterprise engaged in manufacturing of bicycles and offering 100 kinds of products in 10 classes including BMXs, frames, forks, BB axles, front and rear axles, brake cables and baskets to clients in Europe, the US, Australia, the Middle East, Africa, Southeast Asia and other areas. The Group was interested to explore Pakistani market for setting up bicycle plant.

While speaking, Acting President ICCI Sheikh Pervez said CPEC was a game changer for Pakistan and stressed that more Chinese investors should come to Pakistan to participate in this flagship project of historic cooperation between the two countries.

He said there was huge potential of investment in many sectors of Pakistan's economy including energy, construction, steel, marble, infrastructure development, mining, oil & gas exploration, engineering, IT and others areas while CPEC was poised to open new horizons of investment opportunities between China and Pakistan. He said China has good expertise and advanced technology while Pakistan offered attractive incentives to foreign investors. He urged that Chinese investors should harvest the investment friendly policies of the current regime by enhancing investment and joint ventures in Pakistan.

One particular measure BCG uses is growth-to-well-being coefficient on which Pakistan scores 0.87, higher than India's 0.77 and China's 0.75.

http://www.bcgtelaviv.com/documents/file122227.pdf

A high-profile report prepared by the Boston Consulting Group, US, has suggested that India may have progressed well in the economic indicator (which consists of income, economic stability and employment), and investment (instructure, health and education), but its progress in sustainability (income equality, civil society, governance and environment) remains below world average.

Rating 162 countries across the world, though without ranking them, the report finds that in the overall economic progress, India's score is 45.6 (on a scale of 100), higher than the world average of 43.2; in progress in investment, the score is 54.6, with the world average being 40.1; but in progress in sustainability, its score is 50.4, below the world average of 54.4 per cent.

The report, which seeks to analyze data up to 2014-end, finds that, among BRICS countries (Brazil, Russia, India, China and South Africa), in all three indicators of progress -- economics, investment and sustainability -- China performs better than India, at 60.1, 69.1 and 52.3 respectively.

Brazil performs better in economic progress (52.7) and sustainability (54.7), but in investment it doesn't do so well (46.4). Russia does worse than India in economic and investment progress (43.6 and 39.9 respectively), but better in sustainability (53.1).

Among India's neighbours Sri Lanka does better than India in economic progress and investment, but it fails to do as well in sustainability (51.2, 53.6 and 49.6 respecively). Pakistan is way behind India in economic progress and investment, yet it is a little ahead in sustainability (37.1 34.4 and 51.3 respectively).

Nepal may be behind India in economic progress (41.8 per cent), it is way ahead of India two other indicators, investment and sustainability (61.0 and 55.4). And Bangladesh is ahead of India in economic progress (47.7), but it is behind India in investment and sustainability (51.9 and 43.8 respectively).

http://www.counterview.net/2016/07/indias-below-average-progress-in.html

The brightest spotlight belongs to the two-day Asia Pacific Regulators Roundtable which took place in Islamabad. More than 45 participants from the regulatory and other ICT authorities of over 20 countries took part. These countries represent nearly 50% of the world’s population.

The significance of the event lies in the fact that it was after a long gap of around eight years that such a gathering of ICT luminaries took place in Pakistan. These dignitaries have been avoiding coming to Pakistan, not only due to security reasons, but also because for quite a few years nothing really significant happened in the sector.

The roundtable was inaugurated by no less a person than Houlin Zhao, Secretary General of ITU, the UN body responsible for ICTs in the member states.

He emphasised the incredible potential of ICTs to improve development outcomes in the developing world, in particular through small and medium-size entrepreneurs in the IT sector – something very valid in the Pakistani context.

----

In her address to the regional telecom regulators, IT Minister Anusha Rahman gave some upbeat pieces of news, saying Pakistan would soon come up with an effective OTT policy framework and would introduce 5G technology by 2020.

The latter news got a supporting shout from Zong which is reportedly asking for trial of 5G spectrum.

Right after the Asia-Pacific Regulators Roundtable, the three-day ITU-PTA International Training Programme commenced. In this programme, the PTA arranged training of experts from regional countries.

At the inauguration, the ITU secretary general shared that the ITU was looking to sponsor more professional training programmes in Pakistan.

The programme included a session on the ICTs for persons with disabilities, where such persons were actually invited to come on stage and participate so that IT professionals could better understand and try to meet their needs through IT applications. As the training was coming to an end, the ITU secretary general was performing the ground-breaking of the National Incubation Centre. It is funded by the National ICT R&D Fund, which has also risen from a long hibernation of sorts.

The incubation centre will be run by the largest mobile operator of the country, Mobilink, together with its service delivery partner Team Up, which has industry veterans like Zouhair Khaliq and Parvez Abbasi working for it. Further collaboration will be coming from VimpelCom’s ‘Make Your Mark’ programme and Lums Centre for Entrepreneurship.

IT exports

The Pakistan Software Export Board (PSEB) has more good news to share. Not only IT exports have jumped two-fold in the last three years – from $1.4 billion to $2.8 billion – but also the number of companies registered with the PSEB has grown from around 300 to 1,100.

The IT minister claimed that the government is striving to touch the $6 billion IT export mark by 2020.

During this time period, the regulatory approvals for Mobilink-Warid merger also got out of the way.

According to a statement of the CEO of VimpelCom, the owner of Mobilink, the company now plans to invest $1 billion over the next five years which will also create 5,000 jobs in the country. As luck would have it, during the same time period, Telenor, the second largest mobile operator, finally got the 10 MHz spectrum in the 850 band, after winning the latest mobile broadband spectrum auction. There are so many relatively smaller developments that it is difficult to recount all of them. Personally for me, the best news was what the IT minister revealed on PTV.

http://tribune.com.pk/story/1153034/limelight-pakistan-icts-emerging-world-map/

With an investment of 46 billion U.S. dollars and scores of infrastructure projects, the ongoing construction of the China-Pakistan Economic Corridor (CPEC) is undoubtedly one of the largest endeavors now taking place on the planet.

Roads, energy projects, industrial parks and the Gwadar port are all included in the basket, satisfying Pakistan's immediate needs as well as helping the south Asian country get back on its feet after years of anti-terror campaigns wrecked its economy.

Three years after the initiative on the construction of CPEC was jointly announced by China and Pakistan, Xinhua has learned that the project is yielding its early fruits as new roads and power plants have put Pakistan's growth in the first gear.

------------

Located 20 km east of Pakistan's largest city of Karachi, the Bin Qasim power plant is one of the pioneer and flagship projects of CPEC planned to begin operating at the end of next year.

For the coal-fired plant built by PowerChina, the Chinese construction company commissioned to undertake the construction of the project, two 660-megawatt generator units will be installed, which would generate 1,320 megawatts of electricity per year, more than a quarter of the 4,500-5,000 megawatts of power shortage estimated for the year 2012.

"With three more plants like this one, Pakistan would have no more energy woes," said Chen Enping, a manager at PowerChina.

----

For Sher Afzart, a shop owner in northern Pakistan's Hunza Valley, the Karakorum Highway is what he owes his livelihood to.

The two-lane highway, originally built by the Chinese in the 1970s and recently renovated by China Road and Bridge Corporation, connects Kashgar, a commercial hub in northwest China's Xinjiang Uigur Autonomous Region, and Pakistan.

Afzart can save days on trips to Kashgar to buy goods as the road cuts through the Karakorum mountains. There is a steady flow of business as thousands of Chinese workers labor around Hunza.

Following the completion of the Karakorum Highway renovation project, more business opportunities are created, Afzart said.

"With the convenience of road traffic, I'm thinking of opening branches in Islamabad and even in cities farther south," he said.

The Karakorum Highway is just one of the roads that falls under CPEC. The M-4 National Motorway, a strategic artery in central Pakistan, is also being paved by the Chinese.

-----------------

The Gwadar port, located in the southern coast of Pakistan, is where CPEC meets the Indian ocean. From here resources can commence their journey onto the hinterlands of Pakistan and western China, and Chinese and Pakistani products can be shipped out to every corner of the world.

Viewed from above, the port is like an anchor protruding into the emerald waters, forming two natural bays that are as deep as 14.5 m, making them perfect harbors.

After the CPEC cooperation program was launched in 2013, a plan was developed in the following years to comprehensively transform the fishing town into a modern metropolis complete with industrial zones, a harbor and recreational zones.

Gwadar Port Authority Chairman Dostain Jamaldini has big ambitions for the port, eyeing Dubai, which is just across the Arabian Sea, as a model.

Near future plans for the port area include the construction of a Free Trade Zone, a Special Economic Zone, a coastal expressway, an international airport and a pipeline linking Iran, which are all part of the CPEC plan remodelling the town which will be the hinge of the corridor.

"Pakistan is ready to offer the most generous terms for companies investing in the port," Jamaldini said, "We believe the favorable policies and the superb location of the port will soon attract the interest of investors worldwide."

Inside the gates, the never-ending sectors and undulating roads, the scarce traffic and abundant space can be extremely disorienting. If you are a first-time visitor, you can be forgiven for thinking this expansively designed neighbourhood is Islamabad’s actual twin city, and Rawalpindi just an unplanned appendage.

Driving on Bahria Town’s carpeted tarmac is a fairly docile affair after negotiating the violent potholes and sadistically narrow roads that pervade most of Pakistan. The sculptures of farm animals dotting the roundabouts stay mercifully in place, unlike the free roaming cattle outside. These are merely the fringe benefits of buying an accommodation in what could easily be called Pakistan’s most self-sufficient and luxurious gated community.

There is a riding range for those who have always felt congested city streets do not offer enough galloping room for horses. There is a golf course for those who have never been particularly fond of stirrups and there is a cinema with reclining sofas for those who don’t even like walking. There are health clubs, hospitals, playgrounds and even a cricket stadium in Phase 8, a phase bigger than the first six phases combined. So large, in fact, that it’s possible to take a wrong turn while traversing it and end up in New York somehow. For, beyond an avenue lined with palm trees, there is a Statue of Liberty looking just as confused about being there as you might be about seeing her. There is also an imitation Eiffel Tower on the other end of the same phase. Because, well, why not?----

While Bahria Town has expanded to other cities (the one in Lahore has been functional for a while and construction has started in Karachi and Nawabshah, and is expected to start soon in Hyderabad and Peshawar), the one next to Rawalpindi/Islamabad is still the oldest and most densely populated. It claims to be housing 100,000 people as of now.

Early residents remember it largely being a jungle even 10 years back. The visual trajectory from green to grey has been rapid; one week there would be four-legged creatures running around and the next week four-wheeled vehicles.

Realtors say they primarily deal with business people or retired civil and military officials. The former because they don’t need to hit a nine-to-five job in city centres — which can be a very long commute from Bahria Town; the latter because they get service benefits which they can use or sell to buy a house in this enclave. Selling a service allotment in Islamabad, for instance, will comfortably pay for a house in Bahria Town. Property is cheaper this far away from a city — which is the entire point.

Property dealers also say they run offices abroad; Bahria Town, too, has its corporate offices in the United States, the United Kingdom and the United Arab Emirates. Expatriate Pakistanis who have accumulated a certain amount of wealth, have gotten used to a certain standard of living and now wish to keep a house in their country of origin, are inevitably attracted to Bahria Town’s lavish infrastructure and the uninterrupted supply of electricity.

http://tribune.com.pk/story/1156572/3g4g-users-doubled-29-53m-fy16/

The number of users on mobile-phone internet networks – 3G/4G – has doubled to 29.53 million in the fiscal year ended June 30 as the country moves ahead on adopting broadband technology after the spectrum auction.

The Pakistan Telecommunication Authority (PTA) reported Friday that the number of 3G/4G subscribers has reached 29.53 million in June 2016, up from 14.6 million in July 2015.

3G/4G users up 3.74%, but growth slowing

“The availability of low-cost smartphones and aggressive roll-out of apps has made this possible,” said Parvez Iftikhar, an expert on information and communication technology.

The availability of social networking apps like Whatsapp and Facebook has played a significant role in attracting huge traffic on mobile internet.

Iftikhar added that introduction of 3G/4G internet services in Pakistan in 2014 has apparently helped boost the economy at length. “But to measure the real impact of 3G/4G on the economy, we need to conduct independent studies,” he said.

He said that the establishment of a number of technology incubators in the country was one example of boost to the economy through such cellular networks. Incubators have produced a number of startups, while many of them kept growing their businesses to larger scale.

Beware Pakistani mobile internet users

According to Iftikhar, the launch of online shopping portals, internet banking and roll-out of mobile money transfer by almost all cellular companies have also helped attract higher traffic on 3G/4G networks.

Besides, federal and provincial governments were also utilising mobile broadband for uplift of health, education and agriculture sectors.

PTA said that total broadband subscribers grew 92% to 32.41 million in fiscal year 2016 from 16.88 million in the previous fiscal year 2015.

The authority added that total teledensity recovered to 70.94% in FY16 from 62.9% in FY15. It peaked at 78.89% in FY14. The suspension of millions of mobile phone SIMs in the aftermath of biometric verification had reversed the growth in FY15.

Teledensity alone for cellular mobile regained to 69.12% in FY16 from 60.7% in FY15, PTA added.

The number of total mobile phone users, including non 3G/4G users, grew by 16% to 133.24 million in FY16 from 114.65 million in FY15, it added.

Sagheer Wattoo, a spokesperson at the federal ministry of information technology, credited the rapid growth in 3G/4G subscribers to the introduction of Telecommunications Policy 2015 last year.

High-speed internet: Broadband subscriptions near 30 million mark

“The policy note has made possible the sharing {cross use of} infrastructure and spectrum by telcos,” he said, adding this has resulted into attracting more subscribers.

“The growth in 3G/4G subscriber base was less than 3% before the current government in the centre came in power in 2013. This rate has accelerated to over 19% now,” he said.

While 3G/4G mobile internet has catered to the nation’s demand for high-speed internet, it is just not viable for everyone; especially for businesses and power users who need to consume high volumes of data at very high speeds.

There’s a reason the west has resorted to FTTH and that’s mainly due to its reliability, consistency and capacity to control higher data speeds.

While FTTH in Pakistan is comparatively a new phenomenon, mainly due to its limited coverage, things have started to change now.

Storm Fiber, a Cybernet company, is offering its FTTH services in Lahore and Karachi at unbelievable prices.

For example, you can enjoy 30Mbps for just Rs. 3,999. This price includes cable TV and fixed line as well as a value addition.

Not to mention, this speed of 30Mbps is valid for both uploads as well as for downloads.

Storm Fiber said that these prices are excluding taxes, but there’s no limit on download/upload and customers can enjoy true unlimited data connections throughout the month.

Up until a year ago, the shipping industry was ordering ships in droves. This year, orders of new vessels have fallen to a record low and companies can’t get rid of ships fast enough.

About 1,000 ships that have the combined capacity to haul 52 million metric tons of cargo will be dragged onto beaches, cut into pieces and sold for scrap metal this year. That is second only to the record amount of capacity of 61 million so-called dead weight tons that were scrapped and recycled in 2012.

The global economic slowdown is putting shipping through its most bruising period since the 2008 financial crisis. Companies including Maersk Line, a unit of Danish conglomerate A.P. Møller Maersk A/S, Germany’s Hapag-Lloyd AG and China Cosco Bulk Shipping Co. have 30% more capacity in the water than cargo. As the companies, mostly based in Europe and Asia, fight for bigger shares of the global market, freight rates have dropped so low they barely cover fuel costs.

In the five years through 2015, owners ordered an average of 1,450 ships annually. This year orders through July fell to 293 vessels, or 11.6 million tons, according to U.K. marine data provider Vessels Value.

“Given the tremendous overcapacity, it will take much more recycling and at least two to three years of no growth in capacity to see some balance between supply and demand,” said Basil Karatzas, chief executive of New York-based Karatzas Marine Advisors Co.

------

Two years ago, in India, Pakistan and Bangladesh were paying about $460 a ton of steel. Last year it was $300 and it is now roughly $250, shipowners say. Officials at the Alang scrapyard—one of the world’s biggest, on India’s West Coast—said prices were likely to stay low through the rest of the year, as China is flooding the market with recycled steel.

Braemar ACM expects about 550 dry-bulk ships to be recycled this year, 29% more than last year and 48% more than in 2014. About 170 container ships are likely to be scrapped this year, compared with 85 last year and 164 in 2014. The scrapping of other ship types, such tankers, car carriers, general cargo ships and fishing boats, bring the year’s total to about 1,000 vessels.

South Asian scrapyards recycle about three-quarters of all ships every year. The remainder goes to yards in China and Turkey.

http://www.wsj.com/articles/economic-slump-sends-big-ships-to-scrap-heap-1471192256

China exported a total of 112.4 million tons of steel in 2015, the first time it reached 100 million tons, but it came with an increasing number of trade frictions. Forty-six trade remedy investigations were targeted at China's steel industry last year, an increase of 19 from the year earlier and accounting for 46.9% of all the trade remedy probes in China in 2015. Worse still, China's steel industry has been accused by some of being responsible for the steel overcapacity that has gripped the world.

Chinese industry insiders, however, have cited rapidly rising exports and the surge of trade protectionism as the real cause of the simmering trade frictions.

In late May, the United States issued hefty anti-dumping and anti-subsidy duties on corrosion-resistant steel not only from China, but also from India, Italy and South Korea. Moreover, Japan is also the target of a number of anti-dumping cases, demonstrating worldwide surging frictions in the steel industry.

"The international steel market has become a buyer's market with the steel glut worldwide. International buyers choose to buy China's steel, thus contributing to the growth of China' steel exports," said Li Xinchuang, the head of the China Metallurgical Industry Planning Association, recently. The surge in China's steel export is a result of the increasing competitiveness of China's steel products, he added.

--------------

Experts have proposed several ways of tackling the steel overcapacity and trade frictions. Lu Feng, a professor with the National School of Development of Peking University, said that expanding China's steel exports can move forward with the cooperation with developing countries.

He took the example of China and Pakistan. China's steel exports to Pakistan increased from 370,000 tons in 2011 to 2.56 million tons last year, a nearly six-fold increase in 4 years.

"The steel trade between China and Pakistan in recent years is mainly carried out in new projects under the Belt and Road initiative, thus it will not jeopardize the existing interest of other countries, but will help Pakistan better develop its economy," he said.

As a matter of fact, China's steel exports in recent years have increased significantly in countries involved in the Belt and Road initiative and developing countries. Data shows that the value of China's steel exports to Belt and Road countries has jumped from US$10 billion in 2009 to more than US$30 billion last year.

Lu Feng also said that digging deeper into China's domestic market and encouraging mergers of steel companies will also help the country's steel industry.

http://www.china.org.cn/business/2016-08/16/content_39099647.htm

Chinese state-backed firms are frontrunners to buy a $1.5 billion controlling stake in Pakistani utility K-Electric, sources said, as they bet the benefits of a Beijing-led economic corridor will trump the risks of investing in Pakistan.

State-backed Shanghai Electric Power (600021.SS) and China Southern Power Grid are among Chinese firms leading the pack of about half a dozen bidders in K-Electric KELA.KA, one person familiar with the matter said.

Shanghai-headquartered Golden Concord Holdings is also among the bidders, as are some local Pakistani and other companies, according to people who know about the process.

Chinese companies' interest comes after China last year announced energy and infrastructure projects worth $46 billion in the South Asian nation, with a view to opening a trade corridor linking western China with the Arabian Sea.

"The China-Pakistan Economic Corridor (CPEC) is the main driver, with a lot of Chinese funding flowing into Pakistan," said one person aware of the K-Electric deal.

That demand underpins President Xi Jinping's ambitious "One Belt, One Road" initiative, under which Beijing is seeking to open new trade routes and markets as the domestic economy slows.

Under the program, Chinese companies invested nearly $15 billion in participating countries last year, up one fifth from 2014.

If successful, the K-Electric deal would be the biggest M&A agreement in Pakistan in a decade. Large tracts of Pakistan's economy remain nationalized or held by private businessmen with little interest in selling to new investors.

Chinese firms are eyeing new Pakistan power projects, roads and some engineering contracts but investing in a large private company that deals directly with consumers would be a first, a senior Karachi-based financial adviser said.

NO GUARANTEE

Dubai-based private equity firm Abraaj Group, whose 66-percent stake in K-Electric has a market value of about $1.5 billion, is seeking final bids for its stake by the end of August.

Sources cautioned that although talks between the parties are advanced, there is no certainty of a deal being clinched.

The Pakistani government owns about 24 percent, but a spokesman for the water and power ministry said it was not in talks to sell.

CPEC envisages the construction of roads, pipelines and power plants across Pakistan that run south to Gwadar port and should mean more business for distribution companies like K-Electric that sell the electricity to users.

China and Pakistan call each other "all-weather friends" and their ties have been underpinned by long-standing wariness of their common neighbor, India, and a desire to hedge against U.S. influence in the region.

Islamabad wants Chinese funding to reinvigorate an economy hurt by militant violence and weak productivity, to provide new jobs and to ease chronic power shortages.

For China, markets like Pakistan and Malaysia are opening up new frontiers, just as it faces hurdles in countries including Australia.

"CHINESE ARE COMING"

"We are getting a lot more enquiries from Chinese investors about Pakistan in the last couple of years," said Muhammad Sohail, CEO at Karachi-based brokerage Topline Securities.

"Before it was always U.S. and Europe. The Chinese are coming," Sohail added.

Still, foreign investment in Pakistan remains relatively muted as it struggles to shake off a reputation for violence, corruption and instability, and despite the $250 billion economy growing at its fastest pace in eight years.

Inbound M&A into Pakistan has risen more than six times in the past five years, totaling $516 million so far this year, according to Thomson Reuters data.

http://tribune.com.pk/story/1170448/pakistans-3g4g-user-base-rises-32-million/

In Pakistan, the number of users on mobile-phone internet networks – 3G/4G – has increased to almost 32 million.

According to the Pakistan Telecommunication Authority (PTA), in July, over 2.2 million new 3G/4G users were added by the telcos, taking the total number users in the country from 29,530,254 (2.9m) to 31,779,549 (almost 3.2m).

Pakistan’s 3G/4G users doubled to 29.53 million in FY16

The userbase increased by over seven per cent.

Leading the pack was Mobilink, which added over 1.2 million new 3G users to its network, whereas Zong attracted half a million new 3G users in addition to 109,000 4G users.

Mobilink is also leading in terms of total number of 3G/4G users with over 10.2 million 3G users – almost one-third of the total 3G/4G users in the country. It was followed by Ufone with around 8.6 million 3G users.

Beware Pakistani mobile internet users

According to the PTA, the total number of broadband subscribers have increased from over 32 million at the end of fiscal year 2016 to 34.5 million by the end of July.

Commenting on the growth of 3G/4G services in the country, Parvez Iftikhar, an expert on information and communication technology, said “The availability of low-cost smartphones and aggressive roll-out of apps has made this possible.”

The availability of social networking apps such as Whatsapp and Facebook, has played a significant role in attracting huge traffic on mobile internet, he added.

http://www.forbes.com/sites/panosmourdoukoutas/2016/09/14/why-pakistans-market-beats-chinas-and-indias/#1a3ab86b269f

Pakistan’s equity market has been outperforming China’s and India’s markets by a big margin in recent years. In the last twelve months, Global X MSCI MSCI +% Pakistan ETF was up 20%, beating India’s and China’s comparable ETF’s by almost two to one – see table.

That may come as a big surprise to some. Pakistan has been suffering all sorts of terrorist attacks, which makes it a very unstable country to put your money in. And it has been lagging behind both India and China in key macroeconomic metrics like GDP growth rates and unemployment—see table.

Index/Fund 12-month Performance 5-year Performance

Global X MSCI Pakistan (NYSE:PAK) 20% 400%*

IShares China (NYSE:FXI) 9.80% 16.00%

iShares S&P India 50 (NASDAQ:INDY) 12.77 % 33.0%

iShares MSCI Emerging Markets (NYSE:EEM) 5.38% 1.52%

*In local currency.

Source: Yahoo YHOO +0.98%. Finance and Karachi Exchange 9/5/2016

Pakistan’s, India’s and China’s Key Metrics

Country China India Pakistan

GDP $10866 billion 2074 billion $270 billion

GDP Growth yoy 6.7% 7.1% 4.24%

Unemployment 4.05% 4.9% 5.9%

Inflation Rate 1.3% 5.05% 3.56%

Capital flows -594 HML -$300 million -$1882 million

Government Debt to GDP 43.9% 67.2% 64.8%

What does the collective wisdom of markets see in Pakistan’s markets that others are missing?

A few things. First, terrorist attacks don’t usually affect financial markets, unless they are disruptive to trade, which hasn’t been the case in Pakistan. Second, Pakistan is a frontier rather than an emerging market, and therefore, favored by the numbers game. Third, its market reform efforts have been getting a couple of votes of confidence from overseas like $1 billion in support from the World Bank – and a couple of domestic acquisitions from foreign suitors like the acquisition of Karachi’s K-Karachi by Shanghai Electric Power Co. This has all been music to the ears of foreign investors.

Pakistan's government is aiming to double the country's oil product storage capacity by inviting foreign and local companies to build additional facilities, a Ministry of Petroleum official said Thursday.

The country's current storage capacity equates to around 20 days of consumption at 1.2 million-1.3 million mt, and oil marketing companies typically maintain stock levels below that to minimize inventory losses due to price volatility, the official said.

The government will both invite privately-owned domestic and foreign companies to build additional storage capacity and ask oil marketing companies to increase their storage volumes, he said.

"We will provide tax benefits and companies could acquire loans at lower interest rates to hasten the process of increasing the capacity," the official added.

Pakistan's motor gasoline consumption has increased sharply in the past two years as the economy gathers pace, he said.

Consumption averaged 557,000 mt/month over July-October, up from 365,000 mt in fiscal 2015-16 (July-June) and 311,000 mt in fiscal 2014-15.

Raising storage capacity was necessary given the sharp increase in the consumption of oil products in Pakistan, especially gasoline, said Zeeshan Afzal, director of research at Insight Securities.

It would also help meet any shortfall in supply or delay in seaborne cargo arrivals, he said.

Pakistan's gasoline consumption rose 17.5% year on year to 4.385 million mt in fiscal 2015-16, while high speed diesel consumption rose 2.6% to 6.223 million mt and furnace oil sales fell 250,000 mt to 8 million mt, Oil Companies Advisory Committee data showed.

Cement sales are likely to post nine percent year-on-year (YoY) jump in November due mainly to strong domestic demand, a brokerage reported on Thursday. Analyst Nabeel Khursheed at Topline Securities said cement industry is expected to record sales of 3.7 million tons in November.

Local sales are expected to be at 3.2 million tons in November, up 12 percent YoY and five percent month-on-month (MoM). “We remain upbeat on local sales outlook, owing to large scale infrastructure developments and higher demand from private sector,” Khursheed added. Exports are likely to remain at 0.5 million tons, up six percent YoY, but down four percent MoM. “This is mainly because of a likely 20 percent decline in dispatches to Afghanistan,” the equity analyst added. The neighbouring Afghanistan consumes 35 percent of Pakistan’s cement exports. The brokerage, citing the Pakistan Bureau of Statistics, said retail cement prices were in the range of Rs520 to 540/bag in north and Rs567-580/bag in south region in November. An average nationwide price was Rs545/bag.

Cement sales are likely to increase around nine percent to 16 million tons in the first five months of this fiscal year. Local sales would be up 11 percent to 13.6 million tons in the July-November period.

http://www.dawn.com/news/1303460

Trailblazer in the small cars industry and producer of successful 4x4 range sports utility vehicles (SUVs), Pak Suzuki on Wednesday launched one of the lightest SUV’s named Vitara in Pakistan.

The 4th generation crossover Vitara has been introduced in Pakistan in response to the steadily climbing demand of SUVs as trends change in the local vehicle market. To this end, the top of the line Vitara GLX is available for Rs. 3,799,000 and the Vitara GL+ is available for Rs. 3,490,000

Before its launch in Pakistan, Vitara had already received an overwhelmingly positive response in Europe and has won several prestigious awards for its performance.

As far as security is concerned, Vitara also earned high ratings by credible by global inspectors.

Vitara comes with a 1.6L naturally aspirated engine which delivers a decent 118bhp at 6,000 revs. This may not sound much however the USP of this product is its weight. Weighing in at only 1185 kilos the

Vitara is one of the lightest SUV’s on offer. This not only allows it to carry more but also improves its power to weight ratio which stands in at 104 bhp/ton. Other big brands offering turbocharged engines may offer more power however the power to weight ratios remain well under 100 which clearly indicates how well the Vitara is when it comes to performance.

In addition to push start functionality, the Vitara comes standard with multi-function steering that features cruise control and audio control. The 6 speed Automatic transmission is enabled with a manual mode which allows the driver to have the manual changing sensation with the paddle shifters equipped on the steering wheel. The multifunction display shows the economy, mileage and range of the vehicle along with other variables. The air conditioning system of Vitara can be automatically controlled with input from outside temperature sensors.

The hi-spec Vitara also comes equipped with a panoramic sunroof which makes the drive even more pleasurable. Keyless entry is also enabled for the hi-spec variant along with automatic headlamps and wipers for driver’s convenience.

http://www.brecorder.com/supplements/88/118454/

Pakistan is an emerging market for Automobile and Allied Industry. The Industry plays an important role within the large-scale manufacturing sectors in spurring economic growth having enormous investment opportunities with positive growth of 23.3% FY 2016. Pakistan is among the 40 automobile producing countries and 4 of the top 10 global car makers have plants in Pakistan.

The history of Pakistan's Automotive Industry is one of the oldest in the Asian countries. The Industry started semi knockdown production of trucks (Bedford) in 1949 by (General Motors, which marked the start of the Industry's history after the independence from British India. From this year onwards the Industry has not shown steady growth and thus lags behind and is overtaken by other countries in Asia such as China. Thailand and India which entered in the market in 1980s, consequently its positioning in the global market is also questioned.

The automobile industry in Pakistan includes companies involved in the production/assembling of passenger cars, light commercial vehicles, trucks, buses, tractors and motorcycles. The auto spare parts industry is an allied of the auto industry. The auto & allied industry form a major manufacturing sector in Pakistan.

Car sales hit to 180,079 units in 2015-2016 as compared to 151,134 units in 2014-2015, followed by a jump in truck sales to 5,550 units from 4,111 and bus sales to 1,017 from 569 units. The impressive figures of 2015-16 were backed by 50,000 units of Suzuki Bolan and Ravi sold under Punjab Taxi Scheme.

It is believed that car sales will grow at 5-year (2016-20) compound annual growth rate (CAGR) of 12 Pc due to improving law and order situation in the country, rising auto financing owing to 42-year low interest rates and increasing disposable income.

However, in the real substance, automobiles and the auto sector mean much more than this. It represents mobility, transportation and communication. It represents an industry that has a strong impact on a dozen other sectors may it be steel, vending, petrol or even employment. Hence auto sales reflect not only the basic human desire for mobility but these are also an important economic indicator. For the development of Automobile Sector Pakistan has many positive factors such as low cost of labor and access to entire Central Asia Market, but at the same time it has to address many shortcomings. Our Academia still has to look into the fact that here is not any public institute which offers majors in Automobile engineering. Moreover transfer of technology and local manufacturing of vehicle components are minimal. Although, the Automotive Parts industry has shown an active growth in the last many years and a variety of automotive parts have been developed locally but still the full implantation of deletion program has not yet been achieved due to vested interests of Vehicle Assemblers resulting the shortage of technology transfer in the vendor industry.

Pakistan has the 6th largest population while 50% of the total population is below 30 years in age. There are 90 million young potential consumers demand for cars and other passenger vehicles is being increased day by day but existing auto manufacturers and assemblers are unable to match the demand. In Automobile Sector such as buses, LCVs, trucks and jeeps & cars registered growth of 81.95%, 68.53%, 41.68% and 29.73%, respectively FY 2016. The only decline witnessed in the production of tractors which declined by 38.63%. After the oil & petroleum sector, auto industry sector in Pakistan is the second largest taxpayer in the country.

http://tribune.com.pk/story/1295031/energy-rich-k-p-16-trillion-cubic-feet-gas-deposits/

Pakistan is producing only 96,000 barrels of oil per day (bpd), far lower than its demand for 400,000 bpd, which can mostly be met by energy-rich Khyber-Pakhtunkhwa (K-P) that has huge hydrocarbon reserves, says a high official of the province’s energy company.

“Khyber-Pakhtunkhwa has reserves of 16 trillion cubic feet of natural gas and 1.1 billion barrels of oil,” disclosed Nouman Akbar, Director General Human Resources, Corporate Affairs and Marketing of the Khyber-Pakhtunkhwa Oil and Gas Company Limited (KPOGCL).

Speaking to members of the Faisalabad Chamber of Commerce and Industry (FCCI), he said K-P was catering to 57% of Pakistan’s crude oil production and contributing 15% to the demand for natural gas. In addition to these, it accounts for 25% of the liquefied petroleum gas (LPG) production in the country.

Akbar said KPOGCL had been set up to step up work and explore the untapped oil and gas resources in order to make Pakistan self-reliant in energy production.

The government has allocated five blocks to the company, of which exploration work on the Lucky block is in full swing. “The Potohar region is rich in hydrocarbon resources and in many cases gas is oozing out of the soil,” he said.

Similarly, shallow digging also leads to the discovery of oil reserves. At least, 26 spots had been identified where oil and gas reserves were present in abundance and Akbar emphasised that efforts should be expedited in collaboration with the private sector to tap the resources.

He was of the view that at least $110 million were required from the private sector for development of the five exploration blocks. The amount could be made available in the form of shares, which could also be purchased by small investors, he said.

The K-P government has finished geological mapping of the province and is setting up a technical testing laboratory in Peshawar in a bid to conduct analysis of the soil data collected from various sites.

Earlier, soil samples were sent to laboratories of other countries that charged a fee in dollars, but now these tests could be conducted in the country with a nominal fee.

“Plans are also on the cards to establish a most modern refinery for the processing of crude oil. This refinery, expected to be operational within four years, will be able to cater to the needs of the country,” Akbar said.

: For that indicator, The U.S. Energy Information Administration provides data for Pakistan from 1980 to 2013. The average value for Pakistan during that period was 285.37 thousand barrels per day with a minumum of 104 thousand barrels per day in 1980 and a maximum of 434 thousand barrels per day in 2013.

http://www.theglobaleconomy.com/Pakistan/oil_consumption/

Despite claims by the government of bringing improvement in the energy crisis, power generating machinery's demand soared as Pakistan spent Rs 172.9 billion on the import of power generating machinery during July-December of the current fiscal, showing 110 percent growth over same period of last fiscal.

This exorbitant rise clearly indicates that the demand for power generating machinery is continuously putting pressure on the import bill of Pakistan, as precious foreign currency is utilized for the import of generators. It is to be noted that Pakistan's monthly average bill for power generating machinery stood at $52 million by 2012, however the lingering power outages pushed this bill gigantically up to $225 million in December 2016.

The government was continuously claiming addition of significant electricity on the national grid last year, but the statistics indicate that the country is still struggling to prevail over the shortage of energy. New fiscal year is still witnessing a gloomy situation in terms of persisting power shortages, which has led to 12 to 15 hours power load shedding per day in the country.

The State Bank of Pakistan (SBP)'s first quarterly report for the fiscal year 2016-17 (FY17) said that the country's import bill grew in current fiscal year led by an increase in machinery imports, the rise in non-oil imports more than offset the decline in Petroleum Oil Lubricants (POL) imports in the period. Machinery imports surged by 60.0 percent year on year (YoY) in the first quarter of FY17 and reached $ 2.7 billion, surpassing POL imports during the period.

In fact, 94.3 percent of the increase in overall imports in the period was due to the rise in machinery imports, the SBP added. A surge in investment in power generation and distribution infrastructure boosted demand for power generation and electrical machinery. Construction activities related to China-Pakistan Economic Corridor (CPEC) projects also put an upward pressure on imports of products like cranes, weighing machinery and compressors, and vacuum pumps, the report added.

http://dailytimes.com.pk/business/22-Jan-17/pakistan-imports-generators-worth-rs-283-billion-in-2016

http://tribune.com.pk/story/1310741/optimistic-loads-limited-ceo-just-bullish-pakistans-auto-sector/

Munir Bana advised many of his employees to buy the company’s shares as date of the book-building portion of the IPO neared. Many of them hesitated, but some of them opted to buy a personal stake in the auto part maker’s expansion plan.

Weeks later, many regretted their decision and those who bought the shares wished they had invested more.

After all, the share price of Loads Limited – the last listing on the Pakistan Stock Exchange in 2016 – jumped over 100% within a few weeks of trading. It is currently priced at Rs56.76 after starting on Rs34 and has also handed out 10% bonus shares and Rs1 as dividend to its shareholders.

“Our employees were hesitant to enter the stock market, but when I insisted many of them bought the company’s shares,” said Bana, the CEO of Loads Limited, one of the leading auto part makers in the country.

“Those who did not buy or purchase just a few shares now regret (their decision).”

Before offering 50 million shares through the IPO, the company first offered 2.5 million shares to its employees to engage them in the company’s future aggressive investment plans. The company eventually managed to raise Rs1.7 billion, an amount the company is now using for expansion of its production capacity.

Loads makes radiators, exhaust systems, mufflers, sheet metal components among other parts, and its clients include more than a dozen national and multinational companies engaged in the production of motorcycles, cars and heavy vehicles manufacturers.

Bullish on future growth

Bana, a Chartered Accountant, believes two developments have been positive triggers for the local auto industry — the China-Pakistan Economic Corridor (CPEC), a $55-billion investment and loan package that envisages changing the way China conducts trade, and the Automotive Development Policy (ADP) 2016-21 announced in March 2016.

Industry experts believe the auto sector would be a major beneficiary of CPEC, given the corridor’s vision of upgrading Pakistan’s road and highways network.

Officials say the country would need heavy vehicles not only during the construction phase, but also after the infrastructure projects are completed.

“New entrants and new models, as well as the increase in heavy vehicles, all speak for themselves,” he said.

https://www.worldcement.com/indian-subcontinent/06022017/british-company-to-build-cement-plant-in-pakistan/

UK company, Asian Precious Minerals (APML), is to build a new cement plant in Pakistan, according to local news reports, with an investment of US$400 million.

The plant is to be built in the province of Khyber Pakhtunkwha in the northwestern region of Pakistan. The investment was announced at a meeting between APML officials, the Chief Minister of Khyber Pakhtunkwha, Pervez Khattak, and officials from the British High Commission.

“We are delighted to be investing in a new cement plant in Khyber Pakhtunkwha,” said Nadim Khan, CEO of APML. “We look forward to constructing a model, state-of-the-art and environmentally friendly cement plant.

Khan also praised the provincial government for improving the security situation in Khyber Pakhtunkwha, which borders Pakistan’s tribal region and Afghanistan, as well as its “pro-business stance and good governance policy”.

“This British investment will help create local jobs and stimulate the local economy,” said Chief Minister Khattak. “I am glad to see that the UK recognises the dramatic improvements in the province and I look forward to welcoming more British companies in future.”

Pakistan’s cement sector is currently booming with utilisation rates at cement plants reaching over 90%, according to the All Pakistan Cement Manufacturers Association. In the six months to the end of 2016, cement shipments in the country grew to 19.896 million t on the back of local demand growth of 11.07%.

“Pakistan growth is being driven by the Economic Corridor with China (CPEC),” according to cement industry analysts, IA Cement.

“The CPEC allocates US$11 billion to infrastructure projects and US$35 billion towards new power projects and has already led to a strong double-digit growth in cement demand in 2016.In 2017, many projects will either reach completion or be in the full construction phase [and] we therefore expect another year of strong growth with cement demand rising 8 – 10%.”

India’s monthly oil demand fell the most since May 2003 as the government’s crackdown on high-value currency notes continued to reverberate through the country’s $2 trillion economy.

Fuel consumption fell 4.5 percent to 15.5 million tons in January from 16.2 million tons a year ago, the Oil Ministry’s Petroleum Planning and Analysis Cell said Friday. Diesel use, which accounts for about 40 percent of total fuel demand in India, dropped 7.8 percent to 5.8 million tons, the biggest decline since September. Gasoline consumption fell the most since June.

Expansion in the world’s fastest-growing major economy is under pressure after Prime Minister Narendra Modi in November withdrew high-value currency notes in a country where almost all consumer payments are in cash. Growth in gross domestic product may slow to 6.5 percent in the year through March from 7.9 percent the previous year, according to an Economic Survey presented by the finance minister’s advisers.

“This decline in demand is due to demonetization,” according to Tushar Tarun Bansal, director at Ivy Global Energy. “I would expect this decline to be a one off and dissipate from February. This should result in a slower demand growth for diesel in the first quarter in 2017.”

India imports more than 80 percent of its crude requirement and the International Energy Agency expects it to be the fastest-growing consumer through 2040. In most areas people are spending the same amount on fuel that they did before the money crackdown, although some rural areas and small businesses are still affected, according to Bansal.

Petcoke consumption fell for the first time in more than a year, declining about 9.9 percent to 1.95 million tons. Gasoline consumption fell 0.6 percent to 1.8 million tons. Liquefied petroleum gas use expanded 16.4 percent to 2 million tons, while jet fuel demand increased 17.8 percent to 627,000 tons.

Pakistan has imported 11.76 million tons of refined and crude oil during July-December 2016 as compared with 7.82 million tons in the same period in 2015, according to the PBS.

Imported oil meets around 75% of the country’s demand, while the remaining is met through local production.

A local brokerage house reported the other day that oil marketing companies sold a total of 15.17 million tons in the first seven months (July 2016 to January 2017) of the current fiscal year 2017 – a year-on-year growth of 17%.

Moreover, in 2010, the then government exorbitantly relaxed the criteria for establishing a new oil marketing company. Accordingly, a new company in the making now may kick start its journey with minimum Rs100 million equity in hands and Rs500 million investment size.

Ghaznavi said Ogra has issued marketing licences to four companies since July 2016. “They have met the basic criteria of establishing storage facilities. Now, they would start opening petrol pumps in the areas and provinces where they have constructed the storage infrastructure,” he said.

https://tribune.com.pk/story/1321081/july-december-two-dozen-firms-jump-oil-marketing-bandwagon/

http://oilprice.com/Latest-Energy-News/World-News/Indias-2016-Oil-Demand-Jumps-11-To-Record-Highs.html

India’s economic growth and rising income pushed up vehicle sales and fuel demand last year, with oil consumption soaring 11 percent to the highest on record, according to oil ministry data.

India’s oil products consumption increased to 196.5 million tons last year from 177.5 million tons in 2015, with transport fuels gasoline and diesel making up more than half of the country’s oil products consumption. The increase was driven by rising income, which is encouraging people to buy more passenger cars, scooters and three-wheelers. In addition, the road transportation sector is also growing fast.

Gasoline demand jumped 12 percent last year while consumption of diesel increased by 5.6 percent.

FGE expects oil prices this year at between $50 and $60 per barrel, which is expected to drive “robust growth in transport and consumer fuels in India,” the analyst noted.

In September of 2016, India’s Petroleum Minister Dharmendra Pradhan said that he expected the demand for crude oil in the country to rise in excess of 11 percent for 2016, thanks to “better monsoon rains” and growth in economic activity. In 2015, India recorded an increase of 11 percent in the consumption of oil, versus projections for a rate of 7-8 percent. Year 2016 should see a higher increase, Pradhan said in September of 2016.

According to an India Energy Outlook by the International Energy Agency (IEA), demand for oil in India is expected to grow at the fastest pace through 2040, compared to any other region or country. Demand for oil is seen rising by 6 million bpd to reach 9.8 million bpd in 2040.

Total cement sales in Pakistan in February 2017 were 3.435Mt, down by 0.41 per cent from 3.449Mt during the corresponding month of last year, according to the All Pakistan Cement Manufacturers Association (APCMA).

Domestic cement sales reached 3.181Mt, up 6.7 per cent YoY. While domestic sales rebounded in February, exports saw a 45 per cent drop. Exports reached 0.254Mt, representing a 45.7 per cent fall when compared with February 2016.

On cumulative basis, during the first eight months of the fiscal year the country dispatched 26.339Mt cement, showing an overall growth of 6.4 per cent over the corresponding period of last fiscal. During this period the domestic consumption increased by 9.12 per cent, but exports declined by 8.54 percent.

APCMA once again urged the government to take effective steps to stop the penetration of Iranian cement in Pakistani markets on the strength of significant under-invoicing and misdeclaration. A proper vigilance and accountability system needs to be put in place to stop cement smuggling into the country. Government should also increase import duty for import of clinker and cement to protect the local industry, said APCMA.

http://www.business-standard.com/article/markets/india-s-fuel-consumption-grows-at-slower-rate-of-5-in-fy17-117041000750_1.html

India's fuel consumption grew at a slower rate of five per cent in the previous financial year ended on March 31 as diesel demand slowed.

The world's third largest oil consumer saw demand for fuel and petroleum products rise to 194.2 million tonne in 2016-17, up from 184.6 mt in the previous financial year, according to the data from Petroleum Planning and Analysis Cell (PPAC) of the oil ministry.

The demand growth was slower than 11.5 per cent recorded in 2015-16 when consumption had jumped to 184.67 mt from 165.5 mt in the previous year.

Demand for diesel, the most consumed fuel in the country, grew by 1.8 per cent to 74.6 mt in 2016-17. Diesel consumption has soared 7.5 per cent in 2015-16.

Last financial year saw LPG sales move up by 9.8 per cent to 19.6 mt as government released two crore new connections for the poor.

Petrol consumption was up 8.8 per cent to 21.84 mt on the back of rise in two-wheeler and car sales. Jet fuel sales were up 12 per cent at 6.2 mt.

Kerosene demand however declined by a steep 21 per cent to 6.8 mt as government restricted supply of subsidised cooking fuel only to the identified needy. Also, LPG replaced it as a cooking fuel in many households.

During March, fuel demand fell 0.6 per cent to 17.35 mt.

Petrol sales were up 2.9 per cent at 2.1 mt but diesel consumption showed a marginal 0.3 per cent rise at 6.8 mt. LPG demand was too was up only 1.9 per cent while kerosene sales fell by a massive 26 per cent to 414,000 tonne.

While naphtha demand surged 1.8 per cent to 1.14 mt, sales of bitumen, used for making roads, was 12.2 per cent lower. Fuel oil use edged lower 23.4 per cent to 567,000 tonne in Mar

Agha Steel Industries Ltd. is planning Pakistan’s biggest-ever private sector initial share sale this year to help boost output as China funds more than $55 billion in infrastructure projects across the nation and a buoyant stock market spurs investor demand.

The Karachi-based company plans to raise as much as 10 billion rupees ($95 million) selling a 25 percent stake, Executive Director Hussain Agha said in an interview. The sale will be the largest since the 12-billion rupees government stake sale of Habib Bank Ltd. in 2007, the country’s largest IPO yet.

Steel and cement makers in Pakistan are expanding to meet demand as the “One Belt, One Road” trade route financed by China spurs construction. The nation’s economy has grown at about 5 percent annually since 2013, encouraging Agha’s peers including International Steels Ltd. and Aisha Steel Mills Ltd. to lift production.

“You need roads, sky rises and housing,” said Agha. “Pakistan’s steel industry is in an infancy stage and growing at a massive pace -- the whole environment will change.”

Read more: Chinese Largesse Lures Countries to Its Belt and Road Initiative

The company will use the funds for $50 million expansion that will triple output to 500,000 metric tons within two years. Production will then double to a million tons by 2023, he said. Habib Bank has been appointed financial adviser while Arif Habib Ltd. and BMA Capital Ltd. were picked as book runners for transaction.

Pakistan’s steel output grew 23 percent to 3.6 million tons in 2016, the biggest gain among 40 nations, according to the World Steel Association. Agha Steel expects construction-grade steel, such as rebars and wire rods, to grow as much as 12 percent annually for the next three years.

The construction sector expanded 13 percent in year ended June 2016, more than twice the pace in the previous 12 months, according to State Bank of Pakistan’s annual report. Rapid urbanization and rising income levels has left the nation with an annual shortfall of 500,000 homes, according to real-estate developer Arif Habib.

“Real-estate is the main engine for this growth, it has really picked up,” said Ayub Khuhro, chief investment officer of Karachi-based Faysal Asset Management Ltd., which has about 8 billion rupees in stocks and bonds. “The government is also willing to protect companies with anti-dumping measures.”

by Faseeh Mangi , Kamran Haider , and Khalid Qayum

June 1, 2017, 2:30 PM PDT

https://www.bloomberg.com/news/articles/2017-06-01/cement-makers-see-china-led-bonanza-as-pakistan-spends-billions

Nation’s cement output to rise by half as most firms expand

China is financing more than $50 billion of Pakistan projects

In his air-conditioned office protected from the scorching heat and dust outside, S.M. Imran points at a white lined map pinned on his wall showing Power Cement Ltd.’s planned expansion at its plant in Pakistan’s arid southern Sindh province.

Power Cement is aiming to triple capacity, riding a wave of Chinese-financed infrastructure projects across Pakistan valued at more than $50 billion. It’s part of Chinese President Xi Jinping’s biggest gambit in his “One Belt, One Road” project to rebuild the ancient Silk Road, a trading route of ports, railways and highways snaking across mountains, deserts and disputed territory through Asia to Europe and Africa.

The anticipated demand has been a boon for Pakistan’s cement industry, which is expected to increase capacity by 56 percent to 70 million tons in five years, according to Karachi-based brokerage Alfalah Securities Ltd.

“We used to carry stocks, but not anymore,” said Imran, a project director and cement industry veteran who has been in the business for four decades. “This capacity will be required.”

Mega Projects

Cement-makers are betting Prime Minister Nawaz Sharif will ensure timely completion of much needed infrastructure projects ahead of next year’s election, which the premier is widely expected to contest for a second consecutive term.

With that in mind, the government has committed to a $9.6 billion expansion of the national roads network, such as the Karakoram highway -- the main trade route between China and Pakistan -- along with about $35 billion on energy projects and power plants to end daily blackouts.

Encouraged by the China-Pakistan Economic Corridor, or CPEC, Gharibwal Cement Ltd. is doubling capacity to more than 13,000 tons a day by August, according to company spokesman Rana Muhammad Ijaz, who said its existing plant is producing at its peak. Power Cement Ltd. is boosting its ability to churn out 10,700 tons a day, while Cherat Cement Co. announced plans to build a third unit days after completing a second, with a capacity of 7,100 tons a day.

Cement stocks have also outpaced the nation’s benchmark stock measure, with a group of 21 companies rising an average 47 percent in the past year, compared to the KSE100 Index’s 34 percent gain.

“The demand isn’t going down because of a boom in the construction sector,” Ijaz said. “Mega projects are being built and the CPEC is a key factor for this boom.”

https://www.thenews.com.pk/print/214600-Cement-sales-up-54pc-to-409MT

Cement industry witnessed a 5.4 percent surge to 40.9 million tonnes in its sales during the last fiscal year of 2016/17 as local construction sector boomed to have broken its annual growth record of the past five years.

Analyst Nabeel Khursheed at Topline Research attributed the double digit growth in local sales for the second year in a row to ongoing residential construction projects and infrastructure development under China-Pakistan Economic Corridor (CPEC).

Khursheed said the government released Rs715 billion under public sector development programme for FY17, 90 percent of the total allocation, “which bodes well for the construction sector.”

Industry’s annual capacity utilisation reached 89 percent, a rate that was last achieved in the fiscal year of 2005/06. The capacity utilisation stood at 85 percent in 2015/16.

Construction sector reported 9.1 percent growth in FY17, while annual growth for the last five years (FY12-16) growth averaged at 6.3 percent. Credit offtake in construction sector was up 40 percent to Rs129 billion in the last fiscal year over the previous year.

Stock analyst said exports fell short of expectation due to manufacturers’ increased focus to local market, tapering export to Afghanistan, which consumes 40 percent of Pakistan’s cement outflows, and competition from the Iranian substitute.

Sales from cement factories located in north region increased 10 percent in FY17 to 29.817 million tonnes, while cement makers based in south recorded 11 percent growth in sales to 6.594 million tonnes.

Exports of north as well south cement mills decreased 16 percent to 2.889 million tonnes and 33 percent to 1.643 million tonnes, respectively.

In June, cement sales remained flat at 3.354 million tonnes as compared to the same month a year earlier, while export fell 10 percent over May.

“The decline in monthly sales figures is due to slowdown in construction activities during Ramazan coupled with the prolonged Eid holidays,” said Fatima Mohsin Ali, an analyst at Taurus Securities Ltd.

Generally, growing local demand gave a leeway to cement markers to increase prices and avert the pressure built due to high coal prices previously.

“Players were able to pass on the impact of federal excise duty (FED) by increasing prices by additional Rs15-20/bag thanks to robust demand outlook,” Khursheed said. “We believe if demand remains strong, pricing arrangement will continue.”

Government raised FED on cement to Rs1.25/kg from Re1/kg in the budget announcement for the current fiscal year of 2017/18.

International coal prices averaged $76/tonne as compared to its peak of $91/ton in November 2016.

Market researchers said cement mills based in north region factored in FED impact by pushing up prices by Rs15 to 20/bag to Rs545 to 575/bag. Prices in southern region are still hovering between Rs560 and 585/bag.

Ali expected an upward revision in cement prices by southern players too in the next one week, “settling in the range of Rs575 to 600/bag.”

https://www.porttechnology.org/news/pakistan_ports_face_traffic_crisis

Pakistan’s oil importing facilities at Karachi Port and Port Qasim currently face congestion because of port constraints as well as traffic on roads and at sea, according to Dawn.

The situation was created by inefficiencies in port handling and trouble with onward transit to the north, according to an unnamed government official.

Constraints included handling traffic increases, limited storage at ports, inability to use an oil pier, and long oil testing and sampling times.

Pakistan's Government is discussing building a new terminal at Port Qasim, on receiving a report advising on the congestion issue.

The report uncovered a need for added tank storage at Keamari.

A ban on new tank build at Keamari as well as land availability for this magnitude of storage development is a major limitation for the port, it found.

Oil handling facilities at the Port Qasim are expected to reach capacity at 2019-20 and government should plan to build a new terminal.

Over six months, ships collectively had faced added waiting time amounting to 274 days at the outer anchorage and 63 days on berth.

Already Ministers from Malaysia and Pakistan have agreed to form a joint working group on maritime cooperation that could develop Pakistani port terminals for transhipment.

Port Quasim is expanding, however. Recently port Qasim in Pakistan inaugurated its first state-of-the-art coal, clinker and cement bulk terminal.