Pakistan's Year-End 2015 Review

A Happy, Peaceful and Prosperous New Year to all my readers.

The year 2015 turned out to be a good year for Pakistan with the return of general optimism among businessmen, investors and consumers. Economic recovery continued as Pakistan Army's efforts, including its Operation Zarb e Arb and Karachi Operation by Rangers, started to bear fruit with significant decline in terrorism. There were new signs of a thaw in India-Pakistan ties with Indian Prime Minister Modi's surprise year-end visit to Lahore. Efforts to bring peace in Afghanistan took a new positive turn with the hopeful entry of the Taliban into a quadrilateral process involving Afghanistan, Pakistan, China and the United States. Threat of ISIS (Daish) presence rose in South Asia with reports of stepped up ISIS recruitment in Afghanistan and Pakistan.

Highlights:

1. Pakistan economy neared the historic one trillion dollar mark in PPP terms in 2015. The nation's PPP GDP increased from $884 billion to $930 billion, an increase of $46 billion. Pakistan per capita PPP GDP is $4,902 for 2015, up from $4,749 in 2014, according to the IMF. Nominal GDP based on current exchange rates is reported at $270 billion in 2015, up from $246 billion in 2014, an increase of $24 Billion. Pakistan's per capita nominal GDP for 2015 is $1,427.085, up from $1,325.790 in 2014.

2. Pakistan's actual GDP is higher than what the official figures show, according to the State Bank of Pakistan. The SBP annual report for 2014 released in 2015 said: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM."

3. Terrorism declined to the lowest level since 2006 as civilian deaths in terrorist incident nearly halved from 1781 in 2014 to 911 in 2015, according to South Asia Terrorism Portal.

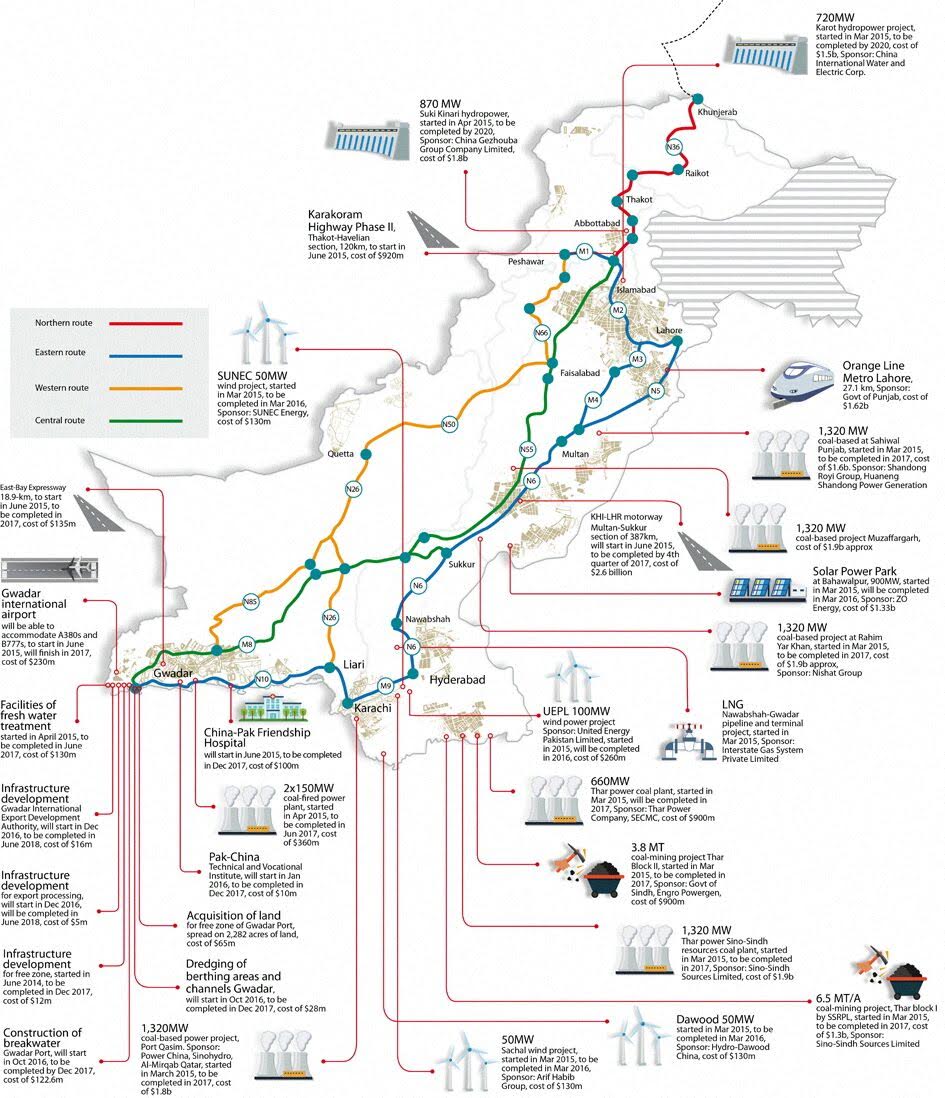

4. China announced plans of massive $46 billion investment in the country as part of the China-Pakistan Economic Corridor (CPEC). Once completed, the this corridor with a sound industrial base and competitive infrastructure combined with low labor costs is expected to draw growing FDI from manufacturers in many other countries looking for a low-cost location to build products for exports to rich OECD nations.

5. Hopes for resolving Pakistan's energy crisis rose as liquified natural gas (LNG) prices hit historic new lows and hydrocarbon prices continued to plummet. An LNG terminal started operations at Port Qasim in Karachi and started receiving LNG cargoes.

6. Over 20 million users signed up for 3G and 4G mobile broadband services after initial rollout in late 2014. Double digit growth was recorded in cement consumption and automobile sales, all pointing to accelerating economic growth.

7. Enrollment in grades 13 through 16 exceeded 3 million mark in Pakistan's 1,086 degree colleges and 161 universities. The 3 million enrollment is 15% of the 20 million Pakistanis in the eligible age group of 18-24 years. In addition, there are over 255,000 Pakistanis enrolled in vocational training schools, according to Technical Education and Vocational Training Authority (TEVTA).

8. Prime Minister Nawaz Sharif launched a national health insurance plan in the closing days of 2015, further expanding a basic social safety net that started with Benazir Income Support program for the poor during the PPP years in power.

Lowlights:

1. Out-of-school children declined by just 1% as Pakistan continued to lag behind neighbors, particularly Bangladesh, India and Sri Lanka, on human development indices.

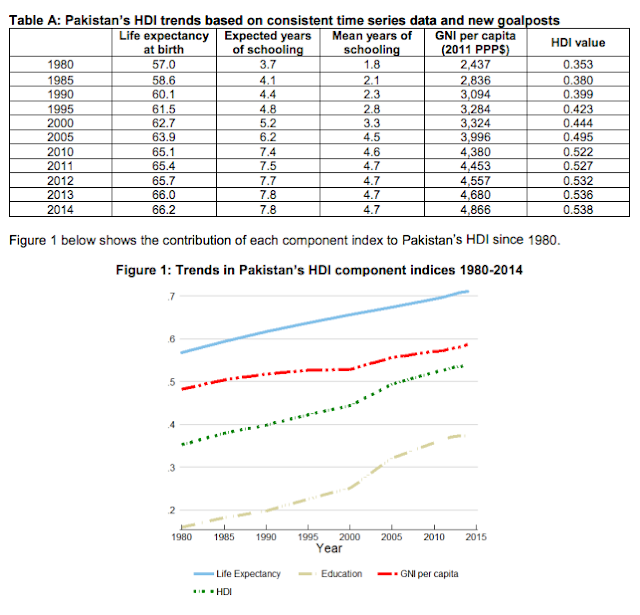

2. The latest human development report for 2015 from UNDP shows human development progress over several decades and confirms it's been the slowest in this decade. Pakistan's HDI grew 13% in 1980s, 11.2% in 1990s, 17.6% in 2000s, and just 3% since 2010. It grew the fastest when President Musharraf was in office from 2000 to 2008.

3. Several reports and arrests of ISIS sympathizes and fundraisers indicated rising threat in South Asia from the Iraq-Syria based terror group.

4. Many politicians, particularly in Sindh province, continued to hinder the Pakistan Army Rangers' efforts to bring peace to Karachi.

5. The implementation of National Action Plan to fight terror has received little more than lip service from the civilian leadership in the country, raising fears of the return of terrorism in the future.

Summary:

Decline of terrorism has enabled Pakistan's economy to begin to recover in 2015. It needs to be sustained for the long term. A basic requirement for sustainable development is investment in and focus on human resources of the country. Education and health care must receive top priority to build a peaceful and prosperous Pakistan.

Related Links:

Haq's Musings

Pakistan's Trillion Dollar Economy

China-Pakistan Industrial Corridor (CPEC)

How Can Pakistan Benefit From Low LNG Prices?

Who's Better For Human Development? Politicians or Musharraf?

Pakistan's Economic Recovery in 2015

SBP: Pakistan's GDP is Underestimated

The year 2015 turned out to be a good year for Pakistan with the return of general optimism among businessmen, investors and consumers. Economic recovery continued as Pakistan Army's efforts, including its Operation Zarb e Arb and Karachi Operation by Rangers, started to bear fruit with significant decline in terrorism. There were new signs of a thaw in India-Pakistan ties with Indian Prime Minister Modi's surprise year-end visit to Lahore. Efforts to bring peace in Afghanistan took a new positive turn with the hopeful entry of the Taliban into a quadrilateral process involving Afghanistan, Pakistan, China and the United States. Threat of ISIS (Daish) presence rose in South Asia with reports of stepped up ISIS recruitment in Afghanistan and Pakistan.

Highlights:

1. Pakistan economy neared the historic one trillion dollar mark in PPP terms in 2015. The nation's PPP GDP increased from $884 billion to $930 billion, an increase of $46 billion. Pakistan per capita PPP GDP is $4,902 for 2015, up from $4,749 in 2014, according to the IMF. Nominal GDP based on current exchange rates is reported at $270 billion in 2015, up from $246 billion in 2014, an increase of $24 Billion. Pakistan's per capita nominal GDP for 2015 is $1,427.085, up from $1,325.790 in 2014.

2. Pakistan's actual GDP is higher than what the official figures show, according to the State Bank of Pakistan. The SBP annual report for 2014 released in 2015 said: "In terms of LSM growth, a number of sectors that are showing strong performance; (for example, fast moving consumer goods (FMCG) sector; plastic products; buses and trucks; and even textiles), are either under reported, or not even covered. The omission of such important sectors from official data coverage, probably explains the apparent disconnect between overall economic activity in the country and the hard numbers in LSM."

3. Terrorism declined to the lowest level since 2006 as civilian deaths in terrorist incident nearly halved from 1781 in 2014 to 911 in 2015, according to South Asia Terrorism Portal.

|

| Source: South Asia Terrorism Portal |

4. China announced plans of massive $46 billion investment in the country as part of the China-Pakistan Economic Corridor (CPEC). Once completed, the this corridor with a sound industrial base and competitive infrastructure combined with low labor costs is expected to draw growing FDI from manufacturers in many other countries looking for a low-cost location to build products for exports to rich OECD nations.

|

| CPEC Projects Map |

5. Hopes for resolving Pakistan's energy crisis rose as liquified natural gas (LNG) prices hit historic new lows and hydrocarbon prices continued to plummet. An LNG terminal started operations at Port Qasim in Karachi and started receiving LNG cargoes.

6. Over 20 million users signed up for 3G and 4G mobile broadband services after initial rollout in late 2014. Double digit growth was recorded in cement consumption and automobile sales, all pointing to accelerating economic growth.

7. Enrollment in grades 13 through 16 exceeded 3 million mark in Pakistan's 1,086 degree colleges and 161 universities. The 3 million enrollment is 15% of the 20 million Pakistanis in the eligible age group of 18-24 years. In addition, there are over 255,000 Pakistanis enrolled in vocational training schools, according to Technical Education and Vocational Training Authority (TEVTA).

8. Prime Minister Nawaz Sharif launched a national health insurance plan in the closing days of 2015, further expanding a basic social safety net that started with Benazir Income Support program for the poor during the PPP years in power.

Lowlights:

1. Out-of-school children declined by just 1% as Pakistan continued to lag behind neighbors, particularly Bangladesh, India and Sri Lanka, on human development indices.

|

| Source: UNDP |

2. The latest human development report for 2015 from UNDP shows human development progress over several decades and confirms it's been the slowest in this decade. Pakistan's HDI grew 13% in 1980s, 11.2% in 1990s, 17.6% in 2000s, and just 3% since 2010. It grew the fastest when President Musharraf was in office from 2000 to 2008.

3. Several reports and arrests of ISIS sympathizes and fundraisers indicated rising threat in South Asia from the Iraq-Syria based terror group.

4. Many politicians, particularly in Sindh province, continued to hinder the Pakistan Army Rangers' efforts to bring peace to Karachi.

5. The implementation of National Action Plan to fight terror has received little more than lip service from the civilian leadership in the country, raising fears of the return of terrorism in the future.

Summary:

Decline of terrorism has enabled Pakistan's economy to begin to recover in 2015. It needs to be sustained for the long term. A basic requirement for sustainable development is investment in and focus on human resources of the country. Education and health care must receive top priority to build a peaceful and prosperous Pakistan.

Related Links:

Haq's Musings

Pakistan's Trillion Dollar Economy

China-Pakistan Industrial Corridor (CPEC)

How Can Pakistan Benefit From Low LNG Prices?

Who's Better For Human Development? Politicians or Musharraf?

Pakistan's Economic Recovery in 2015

SBP: Pakistan's GDP is Underestimated

Comments

http://www.brecorder.com/market-data/stocks-a-bonds/0:/1259793:economic-corridor-27-sites-identified-for-sezs/ …

The federal government has identified as many as 27 sites in provinces, Islamabad Capital Territory (ICT) and Gilgit-Baltistan for setting up of Special Economic Zones (SEZs) under the China Pakistan Economic Corridor (CPEC), it is learnt. Sources in the Finance Division and the Planning Commission told Business Recorder that provincial governments have also been requested to allocate land for sites of SEZs.

The federal government has identified seven sites in Balochistan for the establishment of SEZs. The sites identified in Balochistan for industrial estates are as follows: (i) Gwadar with 3,000 acres for mines, minerals, food processing, agriculture and livestock, (ii) industrial estate at Lasbela (1,290 acres, iron steel, hardware, paper industry, pharmaceuticals), (iii) industrial and trading estate at Turbat (1,000 acres, manufacturing), (iv) Dera Murad Jamali with 50 acres, (v) Winder Industrial and Trading Estate, (vi) mini industrial estate Khuzdar (50 acres) and (vii) Bolan Industrial Estate (1,000 acres). The government has identified three sites in Sindh to set up Special Economic Zones, which include Chinese industrial zone near Karachi (2,000 acres, Exclusive Chinese Industrial Estate), Textile City at Port Qasim, Karachi with (1,250 acres) and Marble City at Karachi with (300 acres).

As per official documents, eight sites in Khyber Pakhtunkhawa province have also been identified for special economic zones. They include, marble and granite based industrial estate at Mansehra (80 acres, mining), industrial estate Nowshera (1000 acres, manufacturing), expansion of Industrial Estate Hatter (424 acres, manufacturing), industrial estate at Chitral (80 acres, food processing) as well as Industrial Estate Ghazi (90 acres, manufacturing) and industrial estate Dera Ismail Khan (188 acres, manufacturing).

Industrial estate at border of Kohat and Karak and industrial and economic zone at Bannu (400 acre) in KP have also been identified as sites for SEZ under CPEC. The government has identified seven sites for special industrial zones in Punjab. These included Multan Industrial Estate phase-II (80 acres), Rahim Yar Khan Industrial Estate (450 acres), Bhalwal Industrial Estate (400 acres), DG Khan Industrial Estate (3815 acres), Mianwali Industrial Estate (600 acres), Rawalpindi Industrial Estate (200 acres) and Pind Dadan Khan Industrial City (10000 acres) for agri, textile, food processing, livestock, manufacturing & energy).

Additionally, the existing under-development sites would also be included in SEZs for the CPEC. One site for special economic zones in Gilgit-Baltistan Moqpondass (2,000 kanal, mining & food processing) and one for Islamabad Capital Territory has also been identified under the CPEC.

A closely watched index signaled a contraction in Indian manufacturing for the first time in more than two years, showing weakness in the economy even as headline growth numbers are among the fastest in the world.

The Nikkei and Markit Economics Index fell to 49.1 in December, the lowest since August 2013, data showed Monday. A reading above 50 signals expansion while anything below that indicates a contraction. A similar gauge for crucial services growth is due on Wednesday.

The data underscores Prime Minister Narendra Modi’s struggle to boost private investment in the face of legislative logjams, choked credit lines and weakened global prospects due to China’s slowdown. Government spending has underpinned India’s growth, which the Finance Ministry forecasts at 7 percent to 7.5 percent in the year through March.

“This clearly shows that people are not expecting a quick recovery," said Tirthankar Patnaik, a Mumbai-based economist at Mizuho Bank Ltd.

But international fund houses frequently find joint ventures difficult to navigate. “You have to realise you will be junior partner to a local firm,” says Mr Celeghin, adding that this is something global asset managers are uncomfortable with.

Foreign asset managers face several other challenges, including being unable to sell international products, such as mutual funds regulated in Europe. Instead, they need to set up local funds. These are typically focused on Indian stocks and shares, partly because of restrictions on what can be sold to retail investors. “If you want to do business in India, you need to have an investment team in the country to create and run a fund, and that is costly,” says Mr Celeghin.

Distribution can also be an obstacle. Banks tend to favour the products of their own asset management arms, according to Cerulli. Meanwhile, the regulatory landscape for financial advisers, which control around 30 per cent of the mutual fund market, has been in flux.

In 2009, the Indian regulator introduced rules for mandatory disclosure of rebates — money paid from asset managers to financial advisers to entice them to sell their products. This was later overturned. The Securities and Exchange Board of India has also mooted phasing out commissions entirely, but this looks unlikely at the moment.

“The business environment is one where the rules are changing frequently. It is hard to get clear guidance on what twist or turn can be expected in the future,” says Mr Celeghin.

Ajit Dayal, chairman of Quantum Asset Management Company, which sells funds directly to investors, says: “While [the regulator] is trying to force the industry to adopt a more transparent practice, the distribution industry is dominated by large banks and brokerages and it is not in their interest to necessarily have a more competitive market.”

As a result, foreign asset managers have struggled to mop up assets. Goldman Sachs’s Indian fund business had just $1.1bn in assets under management when it announced plans to sell its mutual fund business.

But Franklin’s Mr Bindal says fund houses that depart are missing a big opportunity. Despite the challenges in the country, India’s fund industry is growing rapidly. Since March 2012, the market for Indian mutual funds has almost doubled in size, according to data from the Association of Mutual Funds in India, the local trade association.

He believes investment companies just need to work harder. “India is truly an attractive market for asset managers,” he says.

While one international asset manager after another has fallen away in India, Franklin Templeton Investments appears to have found the recipe for success.

It was one of the first international fund companies to enter the country, setting up after the government announced plans to allow non-banks to manufacture mutual funds in the early 1990s.

Harshendu Bindal, president of Franklin Templeton in India, says its early foray played an important role in helping it become the country’s seventh-largest asset manager.

“We are one of the oldest fund houses in the country, with a 20-year record, which gave us a long head start [on other foreign asset managers],” he says.

The fund house, which manages $10bn in assets in India, set up a range of local funds, introduced trail-based commissions to incentivise distributors to sell its products and launched various savings products, such as its Family Solutions range, in order to win business.

Patience is vital to success in India, says Mr Bindal. “A fund house may need anywhere between five and seven years, or at times even a decade, before it turns profitable.”

The country (Pakistan) is brimming with untapped potential and a population filled with unfilled dreams. The people are very similar to Indians, and I can say with some certainty that they wish to be an integral part of the capitalist system. They should be given that opportunity, and under the premiership of Nawaz Sharif, I believe they will.

The Pakistan capital markets, and in particular the Karachi Stock Market and its benchmark index KSE100, have over the past few years performed well, returning over 150% cumulatively in local currency since January 7, 2012. China has recently shown great interest in Pakistan and has pledged to assist them in building an economic corridor with a $46 billion network of transportation links as part of China’s “one belt, one road” initiative.

When completed, no doubt, this will add substantially to Pakistan’s GDP growth of 4.2%. Recently, Mr. Sharif spoke at a forum in Sri Lanka where he said, “Democracy creates far better opportunities for both economic growth and cultural progress than the authoritarian regimes. My government has placed strong emphasis on bold economic reforms to achieve significant improvement in all sectors of the economy." But he did not elaborate on what the reforms would be.

As far as investment opportunities, it is of interest to me that Global X recently launched a Pakistan focused ETF (

PAK

), which since its launch in May 2015 has a return of negative 15%. I expected that, in the light of what most Asian stocks have returned in 2015. However again, I am not going to invest in the ETF, but would rather gain exposure by investing in some GDRs being traded on the London Stock Exchange. With all the infrastructure projects being talked about and the tangential business derived from that, for a retail investor, I believe the financial sector would be a great entry point, and in particular banks.

The largest Pakistani bank, Habib Bank Ltd. (HBL), is only traded on the Karachi Stock Exchange, but retail investors can purchase shares online. However, the banks I would like to target are Pakistan’s fourth largest bank, MCB Bank (MCBS) which is trading at $3.50 a share, and is at a 52-week low but has tremendous upside; and United Bank (UBLS) which is trading around $6.70 a share, close to its 52-week high. In the coming years, these two banks should outperform. Both banks are part of the PAK ETF which also includes some sectors that I do not think will perform well in the near term. They are of course, oil and gas.

So, in my opinion, Pakistan should be characterized in the near future to emerging market status from frontier market. They deserve it. But more importantly, Pakistan’s youth deserve a bright and rewarding future. Oh, and one last item. Have you ever watched the Coca-Cola Ramzan commercial? You should. You knew I had to bring Coke into this article!

http://www.hydroworld.com/articles/2016/01/ctgc-will-construct-the-us-2-4-billion-1-100-mw-kohala-hydroelectric-project-in-pakistan.html …

China Three Gorges Corporation (CTGC) announced today, it will develop the planned 1,100-MW Kohala hydropower project, a run-of-river scheme that will be built on the Jhelum River in Azad-Jammu-Kashmir (AJK).

The project is scheduled for commission in 2023.

AJK is a self-governing administrative division of Pakistan west of the Indian-administered state of Jammu and Kashmir.

In 2014, Pakistan’s National Transmission and Dispatch Co. and China International Water and Electric Corp. (CWE) -- a subsidiary of Three Gorges Dam -- finalized a 30-year tariff at 7.9 cents per unit and estimate the project will cost about US$2.4 billion.

The Kohala hydroelectric scheme will have a gravity, roller-concrete compacted dam on the upper branch of the Jhelum, 40 km from Muzaffarabad. The powerhouse, on the lower branch of the Jhelum near Barasala, will house four 275-MW Pelton turbines.

CWE is required to construct the project on a build, own, operate and transfer basis. In 2014, local published reports said the average tariff for the first 12 years was set at 8.9 cents per unit and during the following 18 years would be 5.1 cents per unit. The average tariff for the 30-year life of the project is 7.9 cents per unit.

The tariff ensures 17 per cent return on equity on internal rate of return basis. The project is expected to earn carbon credit from the United Nations Framework Convention on Climate Change for clean energy development under the Kyoto protocol.

CTGC said the Kohala project is its largest investment in the Pakistani hydropower market.

The project is part of the China-Pakistan Economic Corridor, a 3,000-km-long network of roads, railways and energy infrastructure to assist development in Pakistan and boost growth for the Chinese-border economy.

Pakistan's Water and Power Development Authority issued a supporting letter for the project the week of Dec. 19.

Pakistan stands to benefit from three tailwinds over the near- to medium-term, with average growth projected at 5.5 per cent over the forecast period, said the World Bank’s Global Economic Prospects report for 2016.

The report identified the ‘tailwinds’ as rising investments from China under the China-Pakistan Economic Corridor (CPEC); the anticipated return of Iran to the international economic community; and persistently low international oil prices.

The report also pointed out that macroeconomic adjustment in Pakistan under an International Monetary Fund programme is progressing, while efforts to crackdown on violent crime in Karachi, the country’s industrial and commercial hub, are supporting investor confidence.

The CPEC agreement, signed in 2015, “has further bolstered investor optimism, and, if implemented, has the potential to lift long-term growth,” the report predicted.

But the World Bank also pointed out that national elections in Pakistan are due in 2018, and warned that “hard won fiscal consolidation gains may be lost if spending ramps up in the pre-election period.”

“In addition, sovereign guarantees associated with the CPEC could pose substantial fiscal risks over the medium term,” the report added.

The report noted that the government of Pakistan usually refers to growth in real GDP “at factor cost” for policy purposes. Real GDP growth at factor cost is projected at 4.5pc in fiscal 2015-16.

The report, which described South Asia as a “bright spot” in next year’s global economic prospects, noted that both India and Pakistan have been on a path of fiscal consolidation over the past three years, and fiscal restraint is curbing demand-side pressures. Lower inflation has enabled central banks in India and Pakistan to cut policy rates to support activity.

The Pakistani currency, which had appreciated in real effective terms since 2013, has stabilised in recent months. The current account deficit has continued to narrow, reflecting lower oil import cost and strong remittance inflows.

The report showed that Pakistan has also made progress in reining in its budget deficit from 8.4pc of GDP in FY13 to 5.3pc in FY15. However, debt levels remain high at 65pc of GDP, the result of years of fiscal slippages, and interest payment costs are about 4.4pc of GDP.

Industrial activity has slowed in Pakistan, while external trade remains weak.

The central bank, with IMF assistance, is gradually strengthening monitoring of financial stability risks, and is in the process of instituting a modern deposit insurance scheme in line with international best practices.

Estimated at around $45bn of investment until 2030, the CPEC initiative will finance a series of transport infrastructure projects. These include $11bn, mostly public investment, in the transport sector, and $33bn in energy projects, also mostly private.

The projects foreseen in the CPEC to receive funding from China also include $4bn Silk Road Fund and partial financing for the $1.65bn Karot hydropower project.

But the report explained that stronger growth and investment in Pakistan “is predicated on reforms to strengthen the business climate, an improvement in the security situation, implementation of the CPEC and an associated easing in energy constraints.”

But the World Bank warns that these “developments might not materialise as expected … risks are mostly of domestic origin and mainly on the downside.”

http://www.dawn.com/news/1231705

Cement sector remained buoyant locally during the last six months but exports remained under pressure, affecting the pace of growth in cement dispatches.

Dispatches increased by 6.4 per cent to 18.21 million tonnes during July-December 2015 as compared to 17.12m tonnes during the same period of 2014 due to increased domestic consumption which was up by 16.34pc to 15.2m tonnes as compared to 13.06m tonnes during July-December 2014.

The All-Pakistan Cement Manufacturers Association (APCMA) said that exports declined by 26pc to 3m tonnes as compared to 4.06m tonnes during July-December 2014.

Factories located in north witnessed 15.32pc rise in domestic consumption as 12.63m tonnes of cement was sold in the domestic market in the last six months as against 10.96m tonnes during the same period of 2014.

South-based factories supplied 2.56m tonnes of cement to the local market as against 2.10m tonnes in the same period 2014, up by 22pc.

In exports, north-based mills registered a decline of 25pc as exports remained restricted to 1.9m tonnes as compared to 2.54m tonnes.

Factories in South also suffered a decline of 26.67pc in exports as quantity dropped to 1.11m tonnes in July-December 2015 as compared to 1.52m tonnes during the same period of 2014.

A spokesman for the association said that the industry had time and again drawn the attention of the government towards illegal imports from Iran or its under-invoicing. A proper vigilance and accountability system needs to be put in place to stop cement smuggling,” he said.

The government, the spokesman said, should impose 20pc regulatory duty on import of cement in addition to Customs Duty to protect the local industry.

The spokesman said the government should also give due attention to reduce energy cost, including removal of Gas Infrastructure Development Cess (GIDC) on gas, reduction of Customs Duty on coal to zero per cent and additional incentive of 5pc on export of cement by sea to reduce overall cost of operations to make Pakistani cement industry competitive globally.

Nabeel Khursheed of Top-Line Securities believes that start of construction projects under China-Pakistan Economic Corridor (CPEC) would be key to growth of cement industry.

On the cost side, international coal prices, which make up significant portion of the cost of cement manufacturing, have tumbled to near 10-year low of $52 per tonne. Crumbling coal prices, along with lower electricity charges, are likely to support margins of cement players going forward.

In the fiscal year 2016, he said, Pakistan’s cement sales may grow by 3.5pc year-on-year in the fiscal year 2016 to 36.7m tonnes (82pc capacity utilisation).

Local sales are likely to reach 31.5m tonnes, up 11.4pc year-on-year while exports are expected to decline by 28pc to 5.2m tonnes, he added.

http://sputniknews.com/middleeast/20160126/1033698159/daesh-unites-afghanistan.html … via @SputnikInt

The threat posed by Daesh could act to unite factions in Afghanistan and beyond, said Anatol Lieven, Georgetown University professor and Middle East expert, in an interview with Radio Sputnik.

Lieven claims that the emergence of Daesh in the country may potentially lead to the enhancement of peace talks between the government in Kabul and Taliban insurgents.

The two sides, along with groups in neighboring states, could find a commonality in their mutual rejection of the growing influence of the violent extremist group.

“The most important thing about ISIS (another abbreviation for Daesh) is that this is off style both to the government and the Taliban,” Lieven explained. “Indeed it is also off style to all the regional states. In that way, it could be the only force which unites the whole region,” the expert claimed.

Commenting on the recent setbacks of Afghan security forces, which have lost ground in the country to the Islamists, Lieven said he believes the most serious vulnerability is that of weak government forces.

“The problem is, that the Afghan army can hold territory, but they have been very poor, so far, at recapturing territory out in the countryside,” he said.

Afghan law enforcement additionally relies heavily on foreign assistance, especially that of the United States.

“They are wholly dependent – for money, for weapons, for pay – on continued US aid,” Lieven stated.

Kabul must offer something viable to the Taliban if they intend to pacify the country, he said, adding that, “Dividing and conquering also requires genuine and convincing peace offers to the mainstream Taliban.”

http://www.voanews.com/a/pakistan-indefinitely-closes-border-afghanistan/3756763.html

Pakistan is defying calls for permanently opening the border with landlocked Afghanistan, asserting that terrorist attacks emanating from the neighboring country continue to hurt Pakistani citizens and security forces.

A string of deadly suicide bombings across Pakistan last month prompted authorities to close all regular crossings for movements of people and trade convoys across the largely porous frontier spanning roughly 2,600 kilometers.

The move also halted transit of containerized cargo, an economic lifeline of Afghanistan, which is dependent on Pakistani ports.

Pakistan's Foreign Ministry spokesman, Nafees Zakaria, reiterated Thursday that fugitives linked to the anti-state Pakistani Taliban and affiliates of Islamic State are plotting the violence from across the border, pointing to statements the militants have made taking credit for it.

"The decision of the closure of the border was actually the security context ... to protect our own citizens from the dastardly attacks which were continuing from the other side of the border by those terrorist groups who are enjoying sanctuaries in Afghanistan," Zakaria told a news conference in Islamabad.

The Pakistan military earlier this week alleged that militants staged cross-border raids on its outposts, killing five soldiers.

The Afghan government says it has nothing to do with the violence and has criticized Pakistan for shutting the border. Kabul has called for the border's immediate opening to legitimate migration and trade.

Independent critics and some Pakistani commentators have emphasized the need for resolving political differences through diplomatic channels, rather than resorting to punitive measures such as closing the border.

Zakaria said that Pakistan has taken steps to strengthen security and tighten monitoring on its side under a comprehensive border management plan, and is urging the Afghan government to do the same for effectively deterring movement of terrorists in both directions.

“This border management is the most important aspect as far as we are concerned to control the cross-border terrorism and movement of terrorists who are actually hurting both sides. This is in the interest of both the countries to cooperate and this is what we had been talking about with Afghanistan,” the spokesman maintained.

http://asia.nikkei.com/Politics-Economy/Economy/Financing-partnerships-paving-way-forward-for-Pakistan-Ishaq-Dar

Finance minister sees 6% GDP rise as cash flows where it's needed most

GO YAMADA, Nikkei senior staff writer

TOKYO -- Pakistan is determined to funnel more money toward infrastructure, small businesses and the poor, and the government has found an array of international partners to make it happen. Finance Minister Ishaq Dar recently spoke with The Nikkei about the development drive and the federal budget for the coming fiscal year through June 2018, which he said will focus on generating 6% gross domestic product growth.

Dar is arguably the most influential member of Prime Minister Nawaz Sharif's cabinet. When Sharif was in exile during the rule of Pervez Musharraf, who led the country from 1999 to 2007, Dar was a key caretaker for Sharif's Pakistan Muslim League (Nawaz) party.

Talking about the forthcoming federal budget, to be announced on May 26, Dar said, "After [achieving] macroeconomic stability, we have fully focused on higher GDP growth that brings a better life to people, better per capita income, job opportunities and fills the gap in infrastructure demand."

Next fiscal year, he said, "our efforts will give [growth] another boost. Some fiscal measures and policies will be introduced."

Dar pointed to a recent agreement with the U.S.-based International Finance Corporation to partner on creating a Pakistan Infrastructure Bank.

The PIB will provide financing for infrastructure projects by the private sector, he explained, describing the new lender as an "equal partnership by the Pakistan government and IFC for 20% each." Other stakeholders from around the world will account for the rest, he said.

The bank is expected to have paid-up capital of $1 billion.

And the PIB is just one piece of the puzzle. "With partnerships with the U.K.'s Department for International Development and the German government-owned development bank KfW, we have created the Pakistan Microfinance Investment Company," Dar said. This entity's three-year business plan calls for boosting the number of "beneficiaries of microfinance from the current 4 million to 10 million," he added.

Meanwhile, the government, the DFID and KfW are teaming up on a Pakistan Poverty Alleviation Fund, with their respective shares to come to 49%, 34% and 17%.

“Though Jamat-ud-Dawa (JuD) is not listed as a political organization but it is a political entity, we want to register JuD as a political party. We played a positive role in the politics and we want to continue it,” said Hafiz Masood in Islamabad on March 27 this year.

Masood, brother of JuD chief Hafiz Muhammad Saeed, was speaking in a closed-door session on “Rehabilitation and Reintegration of Different Brands of Militants.” The discussion, organized by the think tank Pakistan Institute of Peace Studies (PIPS), centered on the reintegration of banned outfits like Jamat-ud-Dawa (JuD), Jaish-e-Muhammad (JeM), and Ahle-Sunnat Wal Jamaat (ASWJ).

Later, during a press briefing on April 26, the spokesman of the Pakistan Army, Major General Asif Ghafour, released a confessional video statement from Ehsanullah Ehsan, the former spokesman of the banned Jamat-ul-Ahrar (JuA), a splinter group of Tehreek-e-Taliban Pakistan (TTP).

In April last year, he handed over two deradicalization plans to Nawaz Sharif, prime minister of Pakistan. The first proposal was to be implemented through the Ministry of Interior (MoI) and the other was under the National Counter Terrorism Authority (NACTA). There was a role assigned to at least six different government departments in the proposed plan.

The proposal was to segregate different kinds of extremist on the basis of their history and nature of involvement in militancy. Some individuals are associated with the welfare work of banned outfits and some are part of the propaganda arm, while others actually take up arms against the state. Therefore, each individual would be reviewed according to his level of involvement in militant activities.

Pakistan is not the only country trying to develop a mechanism to rehabilitate militants. Deradicalization plans for repentant militants already exist in the Muslim world. Saudi Arabia, the United Arab Emirates, Bangladesh, Malaysia, Indonesia, Yemen, Morocco, and Jordan adopted such plans much earlier. Pakistan has another significant example: neighboring Afghanistan, where Hezb-i-Islami has announced it will shun violence and join mainstream politics in the country. The United Nations lifted its ban on the Hezb-i-Islami chief, Gulbuddin Hekmatyar, in February this year. The historic move was a result of a deal that was brokered between the Afghan government and Hekmatyar.

Pakistan is also running at least two deredicalization centers – Sabaon and Mashal – in the Sawat area of Khyber Pakhtunkhwa province.

Explaining the rationale of new proposed deredicalization program, retired Lt. Gen. Amjad Shoaib said that in January 2004, under orders from General (retd.) and then-President Pervez Musharraf, camps of banned outfits were dismantled and the militants were flushed out. It was a big blunder; for two years these men had been motivated and trained to wage jihad and then suddenly they were asked to vacate the area. “Those elements perceived that Pakistan betrayed the cause of Kashmir and [that’s when] Punjabi Taliban was formed. At that time nobody thought of starting a deradicalization program,” Shoaib explained.

Shuja Nawaz, a fellow at the Washington, DC-based South Asia Center of the Atlantic Council does not see rapid movement toward these goals given the lack of careful consideration of the deradicalization and de-weaponizing of Pakistani society. He believes that ties between these shadowy jihadi groups and the political system prevent firm actions. Nawaz, who author of the book Crossed Swords: Pakistan, Its Army, and the Wars Within, says, “Mainstreaming can only occur when wider actions alter the school systems and curricula and to remove the vestiges of Ziaist [referring to General Zia-ul-Haq] policies and systems in both the civil and military are effected. That needs political gumption, a rare commodity in Pakistan today.”