Pakistan Middle Class Larger & Wealthier Than India's

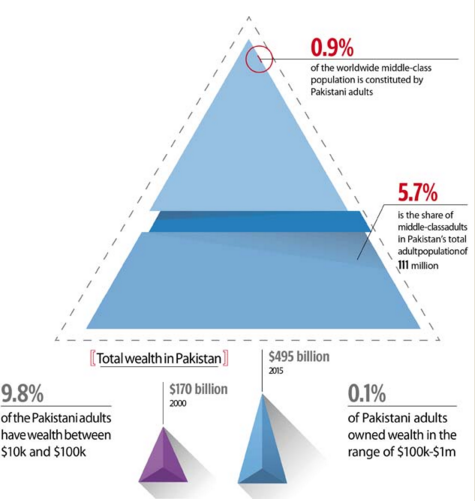

Pakistan’s middle class consists of over 6.27 million adults, according to wealth criteria used by Credit Suisse in its Global Wealth Report 2015. It represents 5.7% share of Pakistan’s total adult population of 111 million, almost twice as large as India’s middle class made up of 3% of its adult population based on the same criteria.

Average ($4,459) and median ($2,216) wealth figures for Pakistani middle class adults are higher than average ($4,352) and median ($868) wealth figures for their Indian middle class counterparts. It's a consequence of lower income wealth inequality in Pakistan compared to its neighbor. For comparison, only 1.1% of Bangladesh adult population qualify as middle class. Their average wealth is $2,201 and median wealth $1,102 per adult.

Credit Suisse's report estimates Pakistan's total private wealth in mid-2015 at $495 billion, Bangladesh's at $237 billion and India's at $3.45 trillion.

Credit Suisse said Pakistan's middle class is the 18th largest and India's 8th largest in the world. The report says 14% of world adults qualify as middle class in 2015 and they own 32% of the world's wealth. 6.7 million Pakistani adults make up 0.9% of the world's middle-class adult population. China tops the list with 108.7 million, followed by the United States 91.8 million and Japan 62 million.

A little more than 90% Pakistani adults had wealth less than $10,000 in 2015. The share of Pakistani adults with wealth between $10,000 and $100,000 in 2015 was 9.8% while only 0.1% adults owned wealth in the range of $100,000 and $1 million, the report revealed.

Other studies based on income criteria of $2 or more per day put Pakistan's middle class at 55% of the population. A 2010 ADB report titled "Asia's Emerging Middle Class: Past, Present and Future" report put Pakistan's middle class growth from 1990 to 2008 at 36.5%, much faster than India's 12.5% growth in the same period. Other reports have indicated Pakistan's median per capita income is higher than both India's and Bangladesh's.

Even though Pakistan's GDP growth has been relatively low compared to India and Bangladesh in recent years, the country's middle class has continued to grow rapidly. It's explained as follows: It's not the overall GDP growth and average per capita income and wealth increases but the median per capita income and wealth growth that tells you how the GDP gains are shared among the population.

Data shows that economic gains in Pakistan are shared better than India and Bangladesh because of lower inequality. Income poverty rate (those below $1.25 per capita per day) in India is 33% and Bangladesh 43% versus 13% in Pakistan, according to WB data on povcalNet. Gini Index for India is 33, Pakistan 29 and Bangladesh 32, indicating that Pakistan has lower inequality.

Related Links:

Haq's Musings

Pakistan's Middle Class Grows to 55%

Upwardly Mobile Pakistan

Median Per Capita Incomes of Bangladesh, India and Pakistan

India and Pakistan Compared in 2014

Bangladesh-Pakistan Comparison in 2012

Modi's Superpower Delusions

|

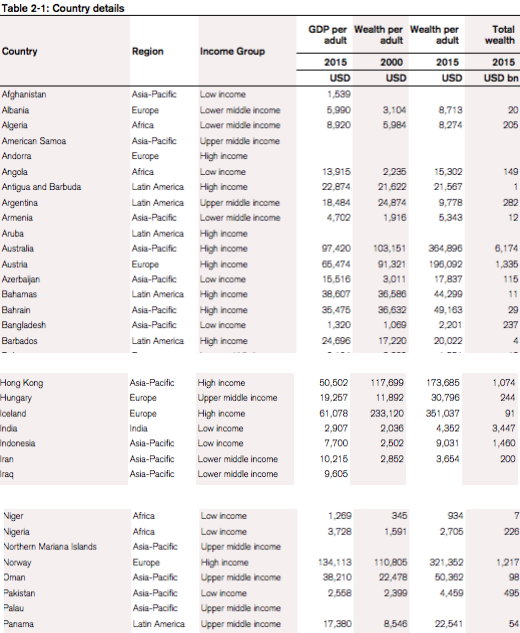

| Source: Credit Suisse Wealth Databook 2015 |

Average ($4,459) and median ($2,216) wealth figures for Pakistani middle class adults are higher than average ($4,352) and median ($868) wealth figures for their Indian middle class counterparts. It's a consequence of lower income wealth inequality in Pakistan compared to its neighbor. For comparison, only 1.1% of Bangladesh adult population qualify as middle class. Their average wealth is $2,201 and median wealth $1,102 per adult.

|

| Pakistan Wealth Source: Global Wealth Report 2015 Via Express Tribune |

Credit Suisse said Pakistan's middle class is the 18th largest and India's 8th largest in the world. The report says 14% of world adults qualify as middle class in 2015 and they own 32% of the world's wealth. 6.7 million Pakistani adults make up 0.9% of the world's middle-class adult population. China tops the list with 108.7 million, followed by the United States 91.8 million and Japan 62 million.

Other studies based on income criteria of $2 or more per day put Pakistan's middle class at 55% of the population. A 2010 ADB report titled "Asia's Emerging Middle Class: Past, Present and Future" report put Pakistan's middle class growth from 1990 to 2008 at 36.5%, much faster than India's 12.5% growth in the same period. Other reports have indicated Pakistan's median per capita income is higher than both India's and Bangladesh's.

Even though Pakistan's GDP growth has been relatively low compared to India and Bangladesh in recent years, the country's middle class has continued to grow rapidly. It's explained as follows: It's not the overall GDP growth and average per capita income and wealth increases but the median per capita income and wealth growth that tells you how the GDP gains are shared among the population.

Data shows that economic gains in Pakistan are shared better than India and Bangladesh because of lower inequality. Income poverty rate (those below $1.25 per capita per day) in India is 33% and Bangladesh 43% versus 13% in Pakistan, according to WB data on povcalNet. Gini Index for India is 33, Pakistan 29 and Bangladesh 32, indicating that Pakistan has lower inequality.

Related Links:

Haq's Musings

Pakistan's Middle Class Grows to 55%

Upwardly Mobile Pakistan

Median Per Capita Incomes of Bangladesh, India and Pakistan

India and Pakistan Compared in 2014

Bangladesh-Pakistan Comparison in 2012

Modi's Superpower Delusions

Comments

KARACHI: Local car sales (including light commercial vehicles, jeeps and vans) jumped to 54,812 units in the first three months (Jul-Sep) of fiscal year 2016, up 72% compared to 31,899 units in the same period of last year, according to data released by the Pakistan Automotive Manufacturers Association (PAMA).

It is important to note that in September 2015, despite fewer working days due to Eidul Azha, local car sales rose 45% year-on-year (YoY) to 18,424 units. They, however, declined by 10% month-on-month (MoM).

The overall healthy growth in the auto sector is indicative of an increase in per capita income, lower interest rates and overall recovery of the economy. Car financing is also picking up gradually (currently estimated at 30% versus 5% a few years ago).

To recall, car sales (excluding imported ones) in Pakistan grew at a five-year (FY11-15) compound annual growth rate (CAGR) of 5.3% to 179,953 units. While volumes surged by 31% in fiscal year 2015 (FY15) on the back of the new model of Toyota Corolla, Punjab taxi scheme and an increase in car financing due to 42-year low interest rates in the country also helped.

“We forecast local car sales to grow at 13% in FY16 to reach 203,653 units,” Topline Securities reported on Monday.

Amongst individual companies, Pak Suzuki sales increased by 98% YoY to 33,770 units in 1QFY16 primarily due to the taxi scheme. Volumes declined by 12% MoM.

Indus Motor sold 14,767 units in 1QFY16 compared to 9,862 units in the same quarter last year. In the month of September, Indus Motor’s sales stood at 4,984 units which rose by 6% year on year. On a MoM basis, however, following the trend in Pak Suzuki, Indus sales also decreased by 10%.

Honda Cars sold 6,184 units in 1QFY16 compared to 4,887 units in the same period last year. In September, Honda Cars sold 2,001 units, up by 14% YoY, while remained flat on a MoM basis.

http://tribune.com.pk/story/971872/local-car-sales-jump-72/

The richest 1% of Indians hold 58% of the country’s total wealth, according to Oxfam India.

The stark inequality in India is worse than the global data put out by the organization, which show that the richest 1% have more than 50% of the total world wealth, Oxfam said.

The anti-poverty advocacy group released a report, “An Economy for the 99%” this week to coincide with the meeting of some of the world’s wealthiest business leaders and most powerful policymakers in Davos, Switzerland.

It said recently improved data on the distribution of wealth, particularly in countries like India and China, indicate that the poorest half of the world has less wealth was previously thought. Oxfam singled out India repeatedly in the report.

It said that companies are increasingly driven to pay higher returns to their shareholders. In India, the amount of profits corporations share with shareholders is as high as 50% and growing rapidly, the report said.

The report said the annual share dividends paid by from Zara’s parent company to Amancio Ortega – the world’s second richest man – are equal to around 800,000 times the annual wage of a worker employed by a garment factory in India.

Oxfam said that the combined wealth of India’s 57 billionaires is equivalent to that of the country’s poorest 70%.

“India is hitting the global headlines for many reasons, but one of them is for being one of the most unequal countries in the world with a very high and sharply rising concentration of income and wealth,” Nisha Agarwal, chief executive of Oxfam said in a statement.

Oxfam said India should introduce an inheritance tax and raise its wealth levies as well as increasing public spending on health and education. It said it should end the era of tax havens and crack down on rich people and corporations avoiding tax.

India Average Wealth Per Capita $5,976 Gini 83% Household Wealth Up 9.9% since 2016

India Median Wealth Per Capita $1295

Pakistan Average Wealth Per Capita $5,174 Gini 52.6% Household Wealth Up 6.3% since 2016

Pakistan Median Wealth Per Capita $3,338

http://publications.credit-suisse.com/tasks/render/file/index

Indian inequality higher than Pakistan, China, Bangladesh; 92% adults' net worth less than $10,000; of 0.5% plus $100,000

http://www.counterview.net/2017/11/indian-inequality-higher-than-pak-china.html

Giving a scary picture of inequalities in India, the recently-released “Global Wealth Report 2017”, published by Credit-Suisse, a Swiss multinational financial services holding company, headquartered in Zurich, has said that India’s 92% of adults “have net worth less than USD 10,000”, while “a small fraction of the population (just 0.5% of adults) has a net worth over USD 100,000.”

While the 0.5% adult population of India “translates into 4.2 million people” because of its huge population, the report says, “By our estimates, 1,820 adults have wealth over USD 50 million, and 760 have more than USD 100 million.”

A further breakup of wealth among the top echelons reveals that 10% of the adult population has 73.3% of wealth, 5% has 64.1% of wealth, and 1% has 45.1% of wealth.

In absolute numbers, the report says, as of mid-2017, 770,089,000 adult individuals have a wealth range of under USD 10,000, 60,116,000 have a wealth range between USD 10,000 and 100,000, 4,158,000 have wealth range between USD 100,000-1 million, and 245,000 individuals have wealth more than USD 1 million.

Pointing out that “while wealth has been rising in India, not everyone has shared in this growth”, the report’s data show that India’s Gini index – an internationally recognized, most commonly used measure of inequality, with 100% representing maximal inequality – is found to be 83%. By comparison, Pakistan’s Gini index is 52.6%, Bangladesh’s 57.9%, Sri Lanka’s 66.5%, Nepal’s 67.3%, and China’s 78.9%

https://www.economist.com/news/leaders/21734454-should-worry-both-government-and-companies-india-has-hole-where-its-middle-class-should-be

Centre parting

Worse, the chances of India developing a middle class to match the Middle Kingdom’s are being throttled by growing inequality. The top 1% of earners pocketed nearly a third of all the extra income generated by economic growth between 1980 and 2014, according to new research from economists including Thomas Piketty. The well-off are ten times richer now than in 1980; those at the median have not even doubled their income. India has done a good job at getting those earning below $2 a day (at purchasing-power parity) to $3, but it has not matched other countries’ records in getting those on $3 a day to earning $5, those at $5 a day to $10, and so on. Middle earners in countries at India’s stage of development usually take more of the gains from growth. Eight in ten Indians cite inequality as a big problem, on a par with corruption.

The reasons for this failure are not mysterious. Decades of statist intervention meant that when a measure of liberalisation came in the early 1990s, only a few were able to benefit. The workforce is woefully unproductive—no surprise given the abysmal state of India’s education system, which churns out millions of adults equipped only for menial work. Its graduates go on to toil in small or micro-enterprises, operating informally; these “employ” 93% of all Indians. The great swell of middle-class jobs that China created as it became the workshop to the world is not to be found in India, because turning small businesses into productive large ones is made nigh-on impossible by bureaucracy. The fact that barely a quarter of women work—a share that has seen a precipitous decline in the past decade—only makes matters worse.

Good policy can do an enormous amount to improve prospects. However, hope should be tempered by realism. India is blessed with a deeply entrenched democratic system, but that is no shield against poor decisions. The sudden and brutal “demonetisation” of the economy in 2016 was meant to target fat cats, but ended up hurting everybody. And the path to prosperity walked by China, where manufacturing produced the jobs that pushed up incomes, is narrowing as automation limits opportunities for factory work.

All of which means that companies need to deal with the India that exists today rather than the one they wish to emerge. A strategy of waiting for Indians to develop a taste for products that the global middle class indulges in—cars as income per head crosses one threshold, foreign holidays when it crosses the next—may lead to decades of frustration. Only 3% of Indians have ever been on an aeroplane; only one in 45 owns a car or lorry. If nearly 300m Indians count as “middle class”, as HSBC has proclaimed, some of them make around $3 a day.