India Fudging GDP to Show Faster Growth Than China's?

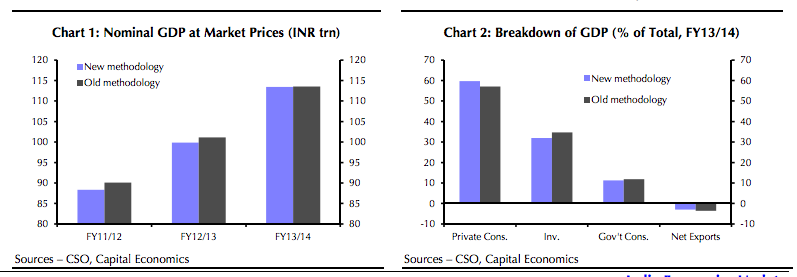

Indian government now claims that the country's GDP grew by 6.9% in 2013-14, well above the 4.7% growth the country had announced earlier.

Based on the latest methodology, it is claimed that the Indian economy expanded 7.5 percent year-on-year during the last quarter, higher than 7.3 percent growth recorded by China in the latest quarter, making it the fastest growing major economy in the world, according to Reuters. Is it wishful thinking to make Indian economy look better than China's?

The GDP revisions have surprised most of the nation's economists and raised serious questions about the credibility of government figures released after rebasing the GDP calculations to year 2011-12 from 2004-5. So what is wrong with these figures? Let's try and answer the following questions:

1. How is it possible that the accelerated GDP growth in 2013-14 occurred while the Indian central bankers were significantly jacking up interest rates by several percentage points and cutting money supply in the Indian economy?

2. Why are the revisions at odds with other important indicators such as lower industrial production and trade and tax collection figures? For the previous fiscal year, the government’s index of industrial production showed manufacturing activity slowing by 0.8%. Exports in December shrank 3.8% in dollar terms from a year earlier.

3. How can growth accelerate amid financial constraints depressing investment in India? Indian companies are burdened with debt and banks are reluctant to lend.

4. Why has the total GDP for 2013-14 shrunk by about Rs. 100 billion in spite of upward revision in economic growth rate? Why is India's GDP at $1.8 trillion, well short of the oft-repeated $2 trillion mark?

Questions about the veracity of India's official GDP figures are not new. These have been raised by many top economists. For example, French economist Thomas Piketty argues in his best seller "Capital in the Twenty-First Century that the GDP growth rates of India and China are exaggerated. Picketty writes as follows:

"Note, too, that the very high official growth figures for developing countries (especially India and China) over the past few decades are based almost exclusively on production statistics. If one tries to measure income growth by using household survey data, it is often quite difficult to identify the reported rates of macroeconomic growth: Indian and Chinese incomes are certainly increasing rapidly, but not as rapidly as one would infer from official growth statistics. This paradox-sometimes referred to as the "black hole" of growth-is obviously problematic. It may be due to the overestimation of the growth of output (there are many bureaucratic incentives for doing so), or perhaps the underestimation of income growth (household have their own flaws)), or most likely both. In particular, the missing income may be explained by the possibility that a disproportionate share of the growth in output has gone to the most highly remunerated individuals, whose incomes are not always captured in the tax data." "In the case of India, it is possible to estimate (using tax return data) that the increase in the upper centile's share of national income explains between one-quarter and one-third of the "black hole" of growth between 1990 and 2000. "

Related Links:

Haq's Musings

India-Pakistan Economic Comparison 2014

Challenging Haqqani's Op Ed: "Pakistan's Elusive Quest For Parity"

State Bank Says Pakistan's Official GDP Under-estimated

Pakistan's Growing Middle Class

Pakistan's GDP Grossly Under-estimated; Shares Highly Undervalued

Fast Moving Consumer Goods Sector in Pakistan

3G-4G Roll-out in Pakistan

Based on the latest methodology, it is claimed that the Indian economy expanded 7.5 percent year-on-year during the last quarter, higher than 7.3 percent growth recorded by China in the latest quarter, making it the fastest growing major economy in the world, according to Reuters. Is it wishful thinking to make Indian economy look better than China's?

|

| India GDP Revisions. Source: Financial Times |

The GDP revisions have surprised most of the nation's economists and raised serious questions about the credibility of government figures released after rebasing the GDP calculations to year 2011-12 from 2004-5. So what is wrong with these figures? Let's try and answer the following questions:

1. How is it possible that the accelerated GDP growth in 2013-14 occurred while the Indian central bankers were significantly jacking up interest rates by several percentage points and cutting money supply in the Indian economy?

2. Why are the revisions at odds with other important indicators such as lower industrial production and trade and tax collection figures? For the previous fiscal year, the government’s index of industrial production showed manufacturing activity slowing by 0.8%. Exports in December shrank 3.8% in dollar terms from a year earlier.

3. How can growth accelerate amid financial constraints depressing investment in India? Indian companies are burdened with debt and banks are reluctant to lend.

4. Why has the total GDP for 2013-14 shrunk by about Rs. 100 billion in spite of upward revision in economic growth rate? Why is India's GDP at $1.8 trillion, well short of the oft-repeated $2 trillion mark?

Questions about the veracity of India's official GDP figures are not new. These have been raised by many top economists. For example, French economist Thomas Piketty argues in his best seller "Capital in the Twenty-First Century that the GDP growth rates of India and China are exaggerated. Picketty writes as follows:

"Note, too, that the very high official growth figures for developing countries (especially India and China) over the past few decades are based almost exclusively on production statistics. If one tries to measure income growth by using household survey data, it is often quite difficult to identify the reported rates of macroeconomic growth: Indian and Chinese incomes are certainly increasing rapidly, but not as rapidly as one would infer from official growth statistics. This paradox-sometimes referred to as the "black hole" of growth-is obviously problematic. It may be due to the overestimation of the growth of output (there are many bureaucratic incentives for doing so), or perhaps the underestimation of income growth (household have their own flaws)), or most likely both. In particular, the missing income may be explained by the possibility that a disproportionate share of the growth in output has gone to the most highly remunerated individuals, whose incomes are not always captured in the tax data." "In the case of India, it is possible to estimate (using tax return data) that the increase in the upper centile's share of national income explains between one-quarter and one-third of the "black hole" of growth between 1990 and 2000. "

Related Links:

Haq's Musings

India-Pakistan Economic Comparison 2014

Challenging Haqqani's Op Ed: "Pakistan's Elusive Quest For Parity"

State Bank Says Pakistan's Official GDP Under-estimated

Pakistan's Growing Middle Class

Pakistan's GDP Grossly Under-estimated; Shares Highly Undervalued

Fast Moving Consumer Goods Sector in Pakistan

3G-4G Roll-out in Pakistan

Comments

Much of the information about the new GDP method had already been made public in a 144-page document released last month. But who has the time? Here are some highlights.

1. In India, all cars used to be equal. In earlier Indian GDP data, the key manufacturing indicator was the monthly index of industrial production, which is based on the total quantity of output in a sample of a few thousand factories.

“The problem is that Marutis and Audis are all put together as the same,” said Ashish Kumar, director-general of the Central Statistical Office. In other words, by gauging only the volume of production, the old series was overlooking changes in monetary value brought about by product improvement and differentiation.

In the old GDP series, a yearly survey of industrial firms supplemented the production index when it became available. But that survey, too, has a limitation: Because it measures activity at the factory level, it doesn’t account for the marketing, development, logistics and financial-planning activities that take place at manufacturing firms’ head offices.

“In the earlier series, we were not capturing this,” Mr. Kumar said. “Because we never had access to any such information.”

The new GDP series therefore incorporates a new database of company balance sheets from the Ministry of Corporate Affairs. For the year ended March 2012, the database includes information from more than 500,000 firms. A central-bank study that had been used previously to gauge corporate activity covered fewer than 2,500 companies.

The impact on final growth rates is huge—and still slightly hard to swallow. In the 12 months that ended March 2013, manufacturing expanded 6.2% in the new GDP series, compared with 1.1% in the old. And in the following year, for which the old series had shown a 0.7% contraction, the new series has manufacturing growing by 5.3%.

2. All workers used to be equal, too. Well, at least for gauging activity in the informal economy. Small, unregistered companies—a major chunk of the Indian economy—typically employ unpaid helpers in addition to owners and hired workers. But before, these firms’ output was being estimated by taking the total number of workers and multiplying by per-capita added value.

No longer. The new GDP series uses an “effective labor input” method, which assigns different weights to different kinds of workers based on their productivity. The chart is here:

3. Agriculture isn’t just about crops, and livestock isn’t just about meat. Two major changes in the agricultural component of the new GDP series have to do with livestock. The first is a new way of valuing “meat byproducts.” State governments had been failing to provide direct data on the values and quantities of animals’ heads, legs, fat and skin on a “systematic and regular basis.” So, thanks to a study by the National Research Center on Meat, in Hyderabad, these are now being recorded simply as a share of the total value of the animals’ flesh.

Yum. “EOG” stands for “edible offals and glands.”

The second major change to livestock measurement has to do with a different kind of byproduct. “For the first time, we have included the evacuation rate of goats and sheep in the production of organic manure,” said Sunil Jain, a deputy director-general at the statistics office.

Translation: Using a study on how much those animals defecate, statisticians have added that particular kind of biological output to their economic value.

The estimated “evacuation rates” are 0.3 kilograms per day for goats and 0.8 kilograms per day for sheep. The study, titled “Positive Environmental Externalities of Livestock in Mixed Farming Systems of India,” was conducted jointly by the Central Institute for Research on Goats, in Makhdoom, Uttar Pradesh, and the National Center for Agricultural Economics and Policy Research in New Delhi.

http://blogs.wsj.com/indiarealtime/2015/04/17/indias-new-gdp-numbers-a-peek-under-the-hood/#?mod=wsj_valettop_email

“This year we will close at 7.5 percent GDP growth and next year hopefully higher,” Jaitley predicted. Jaitley is a no-nonsense lawyer by profession and is a successful politician. To be sure, as India’s finance minister, his words carry weight within the country and abroad.

They influence even the IMF, which has since acclaimed that India is poised to “overtake” China in growth. That’s a tongue-in-cheek remark, of course, because who doesn’t know that China’s economy has outstripped India’s by four decades or more already and comparing India with China is no more than a folk tale. But then, perceptions form the stuff of our day-to-day life and most of us Indians are not trained economists.

Unsurprisingly, the widespread perception in India today is that the country has finally caught up with China in growth and development. For a country smitten by a keen sense of envy bordering on rivalry vis-a-vis China, this easily transmutes as the stuff of national pride. And Prime Minister Narendra Modi suddenly looks ten feet tall.

Even President Barack Obama took note, which was only to be expected since the lure of the fastest growing market in the world is there on his mind always. The Indian market is important for boosting US exports and creating jobs in America and it could not have escaped Obama’s highly focused mind.

Obama probably thought it will be a clever move on his part to pen a panegyric on Modi. There couldn’t be a better way of flattering Modi, after all. And, believe it or not, amidst all that ugly, exasperating wrangle with the US Congress over the Iran deal, Obama was quietly writing a panegyric on Modi!

But nothing works well for Obama thse days and the Time magazine’s piece by the US president on Modi, which appeared yesterday, however, turned out to an overkill that might even embarrass Modi, who usually likes flattery.

Obama probably thought it pays to cater to Modi’s vanities, since he knows Modi can take arbitrary decisions and that can be useful for promoting American business interests. But he stepped way out of line by bracketing Modi with Martin Luther King and Mahatma Gandhi. The point is, like what the famous song supposedly about Sophia Loren says, Obama never looked inside Modi’s head.

Obama’s panegyric most certainly inspired Jaitley to exceed his own month-old prophecy. He now believes that India has the potential to make nine to 10 percent growth rate “a new normal.” He made this prophecy at a US-India business conclave organized by a Washington-based think tank.

If Obama gets to hear what Jaitley just announced, maybe, he will now do an oil painting of Modi. Anything is possible. Obama has a focused mind.

To be sure, Jaitley has proved to be a past master in the ancient Indian rope trick. He has done a masterly job in stringing the public opinion and duping Obama by creating the misperception that under Modi’s magical touch, Indian economy has turned the corner and is zipping ahead.

http://atimes.com/2015/04/how-india-bettered-chinas-growth-story/

India’s back-series GDP (gross domestic product) data, released by the NITI Aayog just four months before the 2019 general elections, turns the basic laws of macroeconomics on their head.

Here’s one that is most intriguing. The data shows lower GDP growth during the UPA years, which is when the gross investment to GDP ratio was peaking at 38%. And conversely, it shows higher GDP figures during the four years of Modi-led NDA-II government, which is when the gross investment to GDP ratio was at its lowest, at 30.3%.

Economic theory has always held that higher investments lead to higher GDP. So how can GDP grow faster when the investment-to-GDP ratio has fallen?

Technically, the only circumstance in which this can happen is when the economy’s productivity or the ‘Incremental Capital Output Ratio’ (ICOR) improves equally dramatically. Simply put, it means the economy generates a lot more output for the same amount of capital employed. There is no sign of that happening during the Modi government’s four years in which productivity was in fact negatively impacted by the twin shocks of demonetisation and messy GST implementation. Besides this, much of the NDA-II period has also seen the largest quantum ever of unproductive assets locked up in the form of non-performing assets (NPAs). Banks are not lending because of unresolved bad loans. How can productivity surge in such circumstances?

Says Mahesh Vyas, CEO of the Centre for Monitoring Indian Economy, a reputed private data research firm, “The new GDP back series numbers show India to be a magical economy where when the investment ratio drops sharply, the economy accelerates sharply. During the period (2007-08 to 2010-11) when the investment to GDP ratio was peaking at average 37.4% the average GDP growth was 6.7%. And in the recent four years (2014-15 to 2017-18) when the investment ratio was down to 30.3% the economy was sailing at 7.2%. Is this productivity magic?” There is really no answer to this fundamental questIon.

Former head of the Central Statistics Office (CSO) and chairman of the National Statistical Commission, Pronab Sen, is known to have a great feel for data and has been one of India’s foremost economists and chief statisticians. Sen has been critical of the manner in which the back-series data was essentially released by NITI Aayog and not by the CSO alone, as has been the practice in the past. This is tantamount to politicising institutions which deal with national statistics.

That apart, Sen also agrees that the back-series data does not pass the basic smell test linked to ground realities. While better productivity can theoretically produce higher output with the same quantum of capital or labour, he argues that the period of 2005-2012 also saw a big communication revolution in India due to mobile penetration. Consequently, it would be difficult to argue lower productivity in the UPA era. The service sector overall – whether communications, banking, real estate or hotels – clearly boomed during the UPA period.

Significantly, average GDP growth has been lowered to 6.7% during the UPA period in the new series, from over 8% in the earlier series, largely based on adjusting the service sector output (which was the biggest contributor to GDP) to lower levels.

There are other basic common sense tests which the new series fails. For instance, UPA-era growth is supposed to be lower even though the country’s exports were booming at 20%-plus, bank credit to industry grew at over 20% and the corporate earnings of the top 1,100 companies grew at at over 20%.

Aakar Patel

@Aakar__Patel

chief economic advisors a thread

first one (2014-2018) concluded gdp growth was off by 2%. that meant that before pandemic, after slowing for 9 consecutive quarters (2 years and 3 months starting jan 2018) india gdp was growing at only 2%

govt shrugged

https://twitter.com/Aakar__Patel/status/1531851911854714880?s=20&t=_LxmnwCnVe4SAMiaKZ0log

India's GDP growth overestimated by 2.5%, says former chief economic advisor

A new study by former chief economic advisor Arvind Subramaniam says the expansion was overestimated between 2011 and 2017

Rather than growing at about 7% a year in that period, growth was about 4.5%, according to the research paper

Read more at:

http://timesofindia.indiatimes.com/articleshow/69738363.cms?utm_source=contentofinterest&utm_medium=text&utm_campaign=cppst

----------------

Aakar Patel

@Aakar__Patel

his successor (2018-21) asked govt to release its own survey which showed indians were consuming less (incl on food) in 2018 than they were in 2012.

govt has not released survey

https://twitter.com/Aakar__Patel/status/1531852392399900672?s=20&t=_LxmnwCnVe4SAMiaKZ0log

Economic adviser prod to release consumer expenditure survey report

After the demand was made by Subramanian, the government is at present considering its release

https://www.telegraphindia.com/india/economic-adviser-prod-to-release-consumer-expenditure-survey-report/cid/1806405

A year after the NDA government withheld the release of a consumer expenditure survey for suspected discomfort over unfavourable findings, its chief economic adviser Krishnamurthy Subramanian has demanded its release, a minister has informed Parliament.

In response to a question in the Rajya Sabha by Congress members L. Hanumanthaiah and G.C. Chandrasekhar who wanted to know if the chief economic advisor had demanded to make the survey report public, minister of state for statistics and programme implementation Rao Inderjit Singh said in a written reply: “Yes Sir”.

The National Statistics Office (NSO) under the ministry of statistics and programme implementation had conducted an all-India survey on household consumer expenditure from the period July 2017 to June 2018. But the ministry decided not to release the report citing a higher divergence with the administrative data. According to a report in Business Standard, the survey found a fall in consumer spending for the first time in more than four decades.

After the demand was made by Subramanian, the government is at present considering to release the report.

“The ministry has followed a rigorous procedure for vetting of data and reports which are produced through surveys. The results of this survey were examined and it was observed that there was a significant variation in the levels in the consumption pattern as well as in the direction of the change while comparing with other administrative data sources. The matter is being looked into and finalisation of the results of the Consumer Expenditure Survey 2017-18 is under consideration,” the minister said.

It deals with the definitions used by the Modi government......such as the definitions of village electrification and open defecation.

Modi government claims the entire village is electrified with "only public buildings and 10% of households" electrified.

Modi gov't also calls villages "open defecation free" even when millions of people are still defecating in the open.

All of this false "multi-dimensional" data manufactured by Modi gov't is used by the UNDP report. That's reflected in a dramatic reduction in India's "multidimensional poverty" on Modi's watch.

https://www.economist.com/asia/2023/01/05/postponing-indias-census-is-terrible-for-the-country

"Narendra Modi often overstates his achievements. For example, the Hindu-nationalist prime minister’s claim that all Indian villages have been electrified on his watch glosses over the definition: only public buildings and 10% of households need a connection for the village to count as such"

"And three years after Mr Modi declared India “open-defecation free”, millions of villagers are still purging al fresco. An absence of up-to-date census information makes it harder to check such inflated claims. It is also a disaster for the vast array of policymaking reliant on solid population and development data"