Pakistan Facing Another Lost Decade Like 1990s?

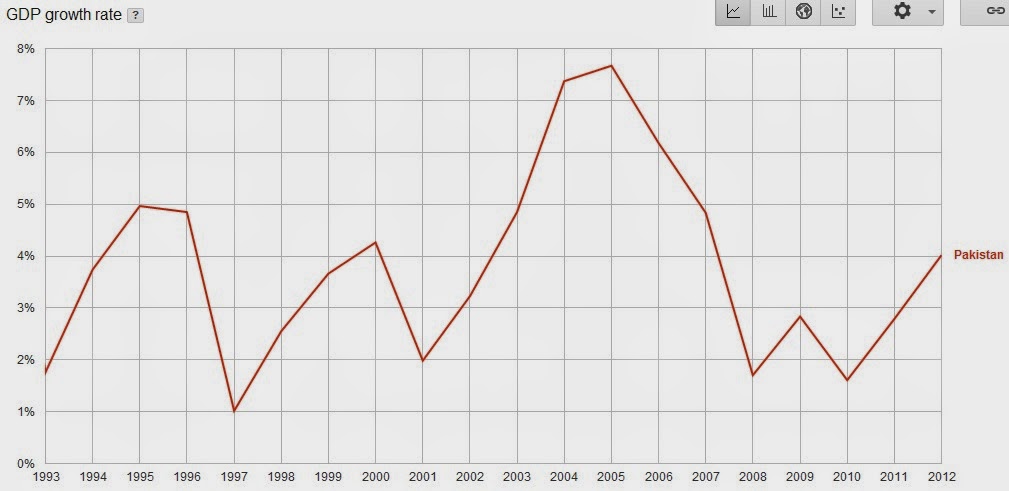

Meager 4.1% GDP growth reported by Pakistan for 2013-14 caps sixth consecutive year of disappointing economic performance under "democratic" governments in the country. This slow growth brings back bitter memories of the last lost decade of 1990s when economic growth plummeted to between 3% and 4%, poverty rose to 33%, inflation was in double digits and the foreign debt mounted to nearly the entire GDP of Pakistan as the governments of Benazir Bhutto (PPP) and Nawaz Sharif (PMLN) played musical chairs.

Economy in 1990s:

Before the current Prime Minister Nawaz Sharif was ousted by General Pervez Musharraf in 1999, Pakistan's two main political parties had presided over a decade of corruption and mismanagement. In 1999 Pakistan’s economy was the slowest in South Asia while its total public debt as percentage of GDP was the highest in the region– 99.3 percent of its GDP and 629 percent of its revenue receipts, compared to Sri Lanka (91.1% and 528.3% respectively in 1998) and India (47.2% and 384.9% respectively in 1998). Internal Debt of Pakistan in 1999 was 45.6 per cent of GDP and 289.1 per cent of its revenue receipts, as compared to Sri Lanka (45.7% and 264.8% respectively in 1998) and India (44.0% and 358.4% respectively in 1998).

Musharraf Era:

Under President Musharraf's leadership, Pakistan became one of the four fastest growing economies in the Asian region during 2000-07 with its growth averaging over 6 per cent per year for most of this period. As a result of strong economic growth, Pakistan succeeded in reducing poverty by one-half, creating almost 13 million jobs, halving the country's debt burden, raising foreign exchange reserves to a comfortable position and propping the country's exchange rate, restoring investors' confidence and most importantly, taking Pakistan out of the IMF Program.

The above facts were acknowledged by the PPP government in a Memorandum of Economic and Financial Policies (MEFP) for 2008/09-2009/10, while signing agreement with the IMF on November 20, 2008. The document clearly (but grudgingly) acknowledged that "Pakistan's economy witnessed a major economic transformation in the last decade. The country's real GDP increased from $60 billion to $170 billion, with per capita income rising from under $500 to over $1000 during 2000-07" elevating Pakistan from low-income to middle-income country.

IMF MOU of 2008 further acknowledged that Pakistan's "volume of international trade increased from $20 billion to nearly $60 billion. The improved macroeconomic performance enabled Pakistan to re-enter the international capital markets in the mid-2000s. Large capital inflows financed the current account deficit and contributed to an increase in gross official reserves to $14.3 billion at end-June 2007. Buoyant output growth, low inflation, and the government's social policies contributed to a reduction in poverty and improvement in many social indicators". (see MEFP, November 20, 2008, Para 1)

Pakistan experienced rapid economic and human capital growth in years 2000 to 2008 on President Pervez Musharraf's watch. Savings, investments and exports hit new records and the rate of increase in human development reached new highs not seen before or since this period.

"Pakistan's economy witnessed a major economic transformation in the last decade. The country's real GDP increased from $60 billion to $170 billion, with per capita income rising from under $500 to over $1000 during 2000-07" to elevate Pakistan from low-income to middle-income group. It further acknowledged that "the volume of international trade increased from $20 billion to nearly $60 billion. The improved macroeconomic performance enabled Pakistan to re-enter the international capital markets in the mid-2000s. Large capital inflows financed the current account deficit and contributed to an increase in gross official reserves to $14.3 billion at end-June 2007. Buoyant output growth, low inflation, and the government's social policies contributed to a reduction in poverty and improvement in many social indicators". (see MEFP, November 20, 2008, Para 1)

Human Capital Development:

In addition to the economic revival, Musharraf focused on social sector as well. Pakistan's HDI grew an average rate of 2.7% per year under President Musharraf from 2000 to 2007, and then its pace slowed to 0.7% per year in 2008 to 2012 under elected politicians, according to the 2013 Human Development Report titled “The Rise of the South: Human Progress in a Diverse World”.

Overall, Pakistan's human development score rose by 18.9% during Musharraf years and increased just 3.4% under elected leadership since 2008. The news on the human development front got even worse in the last three years, with HDI growth slowing down as low as 0.59% — a paltry average annual increase of under 0.20 per cent. Going further back to the decade of 1990s when the civilian leadership of the country alternated between PML (N) and PPP, the increase in Pakistan's HDI was 9.3% from 1990 to 2000, less than half of the HDI gain of 18.9% on Musharraf's watch from 2000 to 2007.

Acceleration of HDI growth during Musharraf years was not an accident. Not only did Musharraf's policies attracted significant new domestic and foreign investments to accelerate economic growth, they also helped create 13 million new jobs, cut poverty in half and halved the country's total debt burden in the period from 2000 to 2007, his government also ensured significant investment and focus on education and health care. The annual budget for higher education increased from only Rs 500 million in 2000 to Rs 28 billion in 2008, to lay the foundations of the development of a strong knowledge economy, according to former education minister Dr. Ata ur Rehman.

Student enrollment in universities increased from 270,000 to 900,000 and the number of universities and degree awarding institutions increased from 57 in 2000 to 137 by 2008. Government R&D spending jumped from 0.1% of GDP in 1999 to 0.7% of GDP in 2007. In 2011, a Pakistani government commission on education found that public funding for education has been cut from 2.5% of GDP in 2007 to just 1.5% - less than the annual subsidy given to the various PSUs including Pakistan Steel and PIA, both of which continue to sustain huge losses due to patronage-based hiring.

To see a discussion of the above subject and the current situation, please watch the following video:

http://vimeo.com/84504051

Civil-military Stand-Off on Musharraf Trial; Musharraf Govt's Performance Record from WBT TV on Vimeo.

Related Links:

Haq's Musings

Musharraf Earned Legitimacy By Good Governance

Musharraf Wants to Face Trial; Military Opposed to it

Saving Pakistan's Education

Political Patronage Trumps Public Policy in Pakistan

Dr. Ata-ur-Rehman Defends Pakistan's Higher Education Reforms

Twelve Years Since Musharraf's Coup

Musharraf's Legacy

Pakistan's Economic Performance 2008-2010

Role of Politics in Pakistan Economy

India and Pakistan Compared in 2011

Musharraf's Coup Revived Pakistan's Economy

What If Musharraf Had Said No?

Human Development in Musharraf Years

|

| Pakistan GDP Growth Rates Since 1993. Source: World Bank |

Economy in 1990s:

Before the current Prime Minister Nawaz Sharif was ousted by General Pervez Musharraf in 1999, Pakistan's two main political parties had presided over a decade of corruption and mismanagement. In 1999 Pakistan’s economy was the slowest in South Asia while its total public debt as percentage of GDP was the highest in the region– 99.3 percent of its GDP and 629 percent of its revenue receipts, compared to Sri Lanka (91.1% and 528.3% respectively in 1998) and India (47.2% and 384.9% respectively in 1998). Internal Debt of Pakistan in 1999 was 45.6 per cent of GDP and 289.1 per cent of its revenue receipts, as compared to Sri Lanka (45.7% and 264.8% respectively in 1998) and India (44.0% and 358.4% respectively in 1998).

Musharraf Era:

Under President Musharraf's leadership, Pakistan became one of the four fastest growing economies in the Asian region during 2000-07 with its growth averaging over 6 per cent per year for most of this period. As a result of strong economic growth, Pakistan succeeded in reducing poverty by one-half, creating almost 13 million jobs, halving the country's debt burden, raising foreign exchange reserves to a comfortable position and propping the country's exchange rate, restoring investors' confidence and most importantly, taking Pakistan out of the IMF Program.

The above facts were acknowledged by the PPP government in a Memorandum of Economic and Financial Policies (MEFP) for 2008/09-2009/10, while signing agreement with the IMF on November 20, 2008. The document clearly (but grudgingly) acknowledged that "Pakistan's economy witnessed a major economic transformation in the last decade. The country's real GDP increased from $60 billion to $170 billion, with per capita income rising from under $500 to over $1000 during 2000-07" elevating Pakistan from low-income to middle-income country.

IMF MOU of 2008 further acknowledged that Pakistan's "volume of international trade increased from $20 billion to nearly $60 billion. The improved macroeconomic performance enabled Pakistan to re-enter the international capital markets in the mid-2000s. Large capital inflows financed the current account deficit and contributed to an increase in gross official reserves to $14.3 billion at end-June 2007. Buoyant output growth, low inflation, and the government's social policies contributed to a reduction in poverty and improvement in many social indicators". (see MEFP, November 20, 2008, Para 1)

Pakistan experienced rapid economic and human capital growth in years 2000 to 2008 on President Pervez Musharraf's watch. Savings, investments and exports hit new records and the rate of increase in human development reached new highs not seen before or since this period.

|

| Exports as Percentage of GDP in South Asia. Source: World Bank |

Savings and Investments:

Domestic savings rate reached 18% of the GDP and foreign direct investment (FDI) hit a record level of $5.4 billion in 2007-8. This combination of domestic and foreign investments nearly tripled the size of the economy from $60 billion in 1999 to $170 billion in 2007, according to IMF. Exports nearly tripled from about $7 billion in 1999-2000 to $22 billion in 2007-2008, adding millions of more jobs. Pakistan was lifted from a poor, low-income country with per capita income of just $500 in 1999 to a middle-income country with per capita income exceeding $1000 in 2007.

|

| Pakistan Per Capita Income 1960-2012. Source: World Bank |

The PPP government summed up General Musharraf's accomplishments well when it signed a 2008 Memorandum of Understanding with the International Monetary Fund which said:

"Pakistan's economy witnessed a major economic transformation in the last decade. The country's real GDP increased from $60 billion to $170 billion, with per capita income rising from under $500 to over $1000 during 2000-07" to elevate Pakistan from low-income to middle-income group. It further acknowledged that "the volume of international trade increased from $20 billion to nearly $60 billion. The improved macroeconomic performance enabled Pakistan to re-enter the international capital markets in the mid-2000s. Large capital inflows financed the current account deficit and contributed to an increase in gross official reserves to $14.3 billion at end-June 2007. Buoyant output growth, low inflation, and the government's social policies contributed to a reduction in poverty and improvement in many social indicators". (see MEFP, November 20, 2008, Para 1)

Human Capital Development:

In addition to the economic revival, Musharraf focused on social sector as well. Pakistan's HDI grew an average rate of 2.7% per year under President Musharraf from 2000 to 2007, and then its pace slowed to 0.7% per year in 2008 to 2012 under elected politicians, according to the 2013 Human Development Report titled “The Rise of the South: Human Progress in a Diverse World”.

Overall, Pakistan's human development score rose by 18.9% during Musharraf years and increased just 3.4% under elected leadership since 2008. The news on the human development front got even worse in the last three years, with HDI growth slowing down as low as 0.59% — a paltry average annual increase of under 0.20 per cent. Going further back to the decade of 1990s when the civilian leadership of the country alternated between PML (N) and PPP, the increase in Pakistan's HDI was 9.3% from 1990 to 2000, less than half of the HDI gain of 18.9% on Musharraf's watch from 2000 to 2007.

|

| R&D Spending Jumped 7-fold as % of GDP 1999-2007 Source: World Bank |

Acceleration of HDI growth during Musharraf years was not an accident. Not only did Musharraf's policies attracted significant new domestic and foreign investments to accelerate economic growth, they also helped create 13 million new jobs, cut poverty in half and halved the country's total debt burden in the period from 2000 to 2007, his government also ensured significant investment and focus on education and health care. The annual budget for higher education increased from only Rs 500 million in 2000 to Rs 28 billion in 2008, to lay the foundations of the development of a strong knowledge economy, according to former education minister Dr. Ata ur Rehman.

Student enrollment in universities increased from 270,000 to 900,000 and the number of universities and degree awarding institutions increased from 57 in 2000 to 137 by 2008. Government R&D spending jumped from 0.1% of GDP in 1999 to 0.7% of GDP in 2007. In 2011, a Pakistani government commission on education found that public funding for education has been cut from 2.5% of GDP in 2007 to just 1.5% - less than the annual subsidy given to the various PSUs including Pakistan Steel and PIA, both of which continue to sustain huge losses due to patronage-based hiring.

To see a discussion of the above subject and the current situation, please watch the following video:

http://vimeo.com/84504051

Civil-military Stand-Off on Musharraf Trial; Musharraf Govt's Performance Record from WBT TV on Vimeo.

Related Links:

Haq's Musings

Musharraf Earned Legitimacy By Good Governance

Musharraf Wants to Face Trial; Military Opposed to it

Saving Pakistan's Education

Political Patronage Trumps Public Policy in Pakistan

Dr. Ata-ur-Rehman Defends Pakistan's Higher Education Reforms

Twelve Years Since Musharraf's Coup

Musharraf's Legacy

Pakistan's Economic Performance 2008-2010

Role of Politics in Pakistan Economy

India and Pakistan Compared in 2011

Musharraf's Coup Revived Pakistan's Economy

What If Musharraf Had Said No?

Human Development in Musharraf Years

Comments

The corporate world’s fascination with Africa shows through clearly in the rates of change of sentiment, too. The data compare an average of corporate sentiment for year-to-date 2014 with an average of the results over the full-year 2013.

Four of the five countries with the highest positive change in sentiment are in sub-Saharan Africa, as well as seven of the top 10.

Pakistan, though, is ahead of the pack in terms of the number of companies newly taking an interest in it. Sentiment toward the South Asian nation of 183 million people improved by 5.6 percentage points, putting it ahead of Africa’s rising stars Nigeria and Kenya, which each saw sentiment improve by just over four percentage points.

In absolute terms, though, Nigeria is still the clear leader among the three with twice the number of companies in the index considering investing there. Nearly three in 10 companies have Nigeria on their watch list.

By contrast, Pakistan’s South Asian neighbors Bangladesh and Sri Lanka appear to be losing their appeal, with each seeing the number of companies focused on them slashed by more than half.

Myanmar, which has only recently emerged as a potential destination for investment, saw a similar decline in corporate interest, with a meager 4% of companies including it in their watch list. Companies’ waning interest in Myanmar most likely reflects the realization among executives that the country is far from ready to receive significant foreign investment in most sectors.

Not surprisingly, the country that saw the greatest decline in attention from multinationals was Ukraine, whose 12.5-point decline was almost double that of the next-worst performer, Oman. While financial investors have seen healthy returns from their high-risk bets on the tumultuous central European economy, businesses are looking elsewhere for long-term opportunities.

Overall, sentiment toward frontier markets among the 200 or so multinationals included in the survey declined. All but 14 of the 70 countries covered in the survey have seen the level of corporate interest in them subside since last year.

Mr. Lasov believes the slide is less about the fundamental appeal of newly emerging markets and more about the revived interest in the developed world. “In the past few years, there has been a rebound in developed markets, which has attracted companies’ attention,” he says. “At the same time, companies have looked at the frontier markets and realized that many of them have tiny populations, so to build a business or manage a business in these smaller markets may not be worth the time.”

http://blogs.wsj.com/frontiers/2014/06/06/nigeria-argentina-and-vietnam-prove-top-picks-for-multinationals/

Investors who ventured into frontier markets—the smaller, lesser-known cousins of emerging markets—have been rewarded with impressive equity returns over the past 18 months.

While the MSCI Emerging Markets Index has been essentially flat since the start of 2013, the MSCI Frontier Markets Index has shot up by more than 50%. Developed markets grew strongly too, but the 32% surge in the MSCI World Index was still dwarfed by frontier markets’ growth.

Individual countries have posted some significant returns, too. Since the start of 2013, Bulgaria’s market has soared 91%, Pakistan’s has jumped 88%, and Nigeria’s has risen 47%. The strong performance is helping frontier markets—usually defined as countries that have a stock exchange but don’t meet the size and liquidity requirements to be in the emerging-markets index—to gain more acceptance in the investment community

Data from EPFR Global show that funds focused on frontier markets saw inflows of more than $1.5 billion in the first four months of this year. Since the start of 2013, the funds have attracted $5.6 billion.

There may be more good news: New research shows that frontier markets, often tagged as risky and unstable because of political and economic factors, may be less volatile than commonly assumed.

A previously unpublished study by the New York-based fund manager LR Global, released by the firm in late May to selected clients, looked at the weekly returns, in U.S. dollars, of 80 stock-exchange indexes across developed, emerging and frontier markets in the 10 years to the end of 2013.

The research showed that frontier markets’ stock indexes were significantly less volatile than emerging markets and slightly less bumpy than even developed markets.

LR Global, which has $200 million under management invested in frontier markets, defined volatility as the annualized standard deviation of stock-market returns. Standard deviation, which LR Global measured on a weekly basis, is a measure of how much the market swings up or down. The higher the standard deviation, the more volatile the market.

Brent Clayton, a portfolio manager at LR Global and one of the report’s co-authors, acknowledged that he was surprised by the results. “We had an inkling from looking at the indices that frontier markets would be less volatile than emerging markets, but we were shocked to find that not only was that clearly the case, but also they were less volatile than developed markets over most periods.”

Mr. Clayton attributes frontier markets’ low volatility partly to their limited exposure to the global financial system. In a panic-driven flight to safety, investors tend to bail out of emerging markets. Frontier markets, because they have seen lower inflows of foreign capital, have generally been less affected by such moves.

“These are markets that are primarily driven by local investors and avoid the whims of shorter-term-driven foreign capital flows,” Mr. Clayton said.

Not surprisingly, Ukraine is one of four frontier countries among the 10 most volatile markets in the world. The other three are Romania, Argentina and Kazakhstan. Five of the top 10 were emerging markets and the most volatile country of all was Iceland, a developed market that suffered especially badly during and after the financial crisis.

The least volatile of the 80 markets in the study was Trinidad and Tobago, one of nine frontier markets in the top-10 least volatile. The U.S. came in at No. 11 in the least-volatile ranking.

http://blogs.wsj.com/frontiers/2014/06/01/frontier/

Pakistan’s military began a full-scale operation in the Taliban stronghold of North Waziristan, prompting insurgents to warn foreign investors, airlines and multinational companies to leave the country.

“We’re in a state of war,” Shahidullah Shahid, a spokesman for the Tehrik-e-Taliban Pakistan, or TTP, said in a statement today. “Foreign investors, airlines, and multinational companies should cut off business with Pakistan immediately and leave the country or else they will be responsible for their damage themselves.”

Related:

Pakistan Army Starts Offensive Against Taliban in Tribal Area

Pakistan Military Says 80 Terrorists Killed in N. Waziristan

The army said yesterday it would target local and foreign terrorists in North Waziristan, a tribal region near the Afghan border the U.S. has called the “epicenter” of terrorism. The operation, long sought by the U.S., comes a week after militants attacked the country’s biggest international airport.

As Islamic militants capture cities in Iraq and the U.S. draws up plans to withdraw from Afghanistan, public opinion in Pakistan is shifting in favor of stronger action against fighters who were previously seen locally as more of a threat to America’s interests. The Taliban wants to impose its version of Islamic Shariah law in Pakistan, which includes a ban on music and stricter rules for women.

Pakistan’s Future

“At stake is the future of Pakistan,” Mahmud Ali Durrani, a former national security chief and ex-ambassador to the U.S., said by phone. “Do we want a Talibanized Pakistan or do we want to live according to the constitution, democracy? If we want to live according to our constitution and democracy then we have to fight for it, because they are the kind of people who don’t believe in these things.”

Prime Minister Nawaz Sharif’s party won an election last year after pledging peace talks with the TTP, the group at the forefront of an insurgency that has killed 50,000 people since 2001. Negotiations that began in March collapsed over the TTP’s demands for prisoner releases even before progressing on issues such as Shariah law.

http://mobile.bloomberg.com/news/2014-06-15/pakistan-army-strikes-at-terror-epicenter-after-airport-attack.html

The Chinese model gained favour as Africa wearied of the free-market capitalism and deregulation that characterised Western-style neoliberalism.

The failure of neoliberal economic policies in fostering social and economic development across the continent has caused political reorientations in Africa

Tim Zajontz

Tim Zajontz, a research fellow at South Africa’s Stellenbosch University, said China positioned its model as an alternative to Western-style democracy, which became a source of inspiration for other African countries such as Zimbabwe, Zambia and Tanzania.

“The failure of neoliberal economic policies in fostering social and economic development across the continent has caused political reorientations in Africa, with China’s economic trajectory frequently being invoked as a viable alternative development model,” Zajontz said.

Orville Schell, Arthur Ross director of the New York-based Asia Society’s Centre on US-China relations, agreed. “China has provided a successful authoritarian developmental model that has worked at home, and is thus seductive to other developing countries that have had difficulty organising their body politics, catalysing their economies with growth and keeping social order. The ‘China model’ has produced economic progress … if people are willing to live in an authoritarian, even totalitarian political environment. There is a trade-off,” Schell said.

China’s Ethiopian ambitions suffer setback with telecoms decision

29 May 2021

However, as Beijing pulls out all the stops to mark the centenary of the ruling party’s establishment on July 1, there is still no consensus on what the China model actually is.

Just over a decade ago after the global financial crisis in 2008, the Chinese government even refused to acknowledge the existence of such a model, or weigh in on the discussions about whether the China model was reality or just something possible.

Instead, a number of retired officials, including former vice-president of the party’s Central Party School Li Junru, cautioned against using the term, citing its possible negative impacts on China’s relations with the world and its domestic development.

In a commentary on Study Times, the school’s flagship newspaper, in December 2009, Li said the notion of China model was factually incorrect and dangerous because it led to “self-satisfaction and blind optimism” and tended to stereotype the country’s ongoing reform experiment.

The ‘China model’ has produced economic progress … if people are willing to live in an authoritarian, even totalitarian political environment

Orville Schell

In the decade since, a group of Chinese academics and intellectuals have also questioned the validity of the Chinese model. Renowned economists Zhang Weiying and Wu Jinglian warned against promoting it, saying it would undermine reform at home and fuel divide and confrontation with the West. Tsinghua University historian Qin Hui argued in 2010 that unlike the rise of China, the rise of the China model, featuring a low level of human rights and welfare, was by no means good news for the country and the world.

It was not until after President Xi Jinping took office in late 2012 that the “China model” finally won official blessing.

“With the rise of China’s national strength and global standing, discussions and studies on the ‘Beijing consensus’, ‘Chinese model, and ‘Chinese road’ have gathered pace in the world,” Xi told senior party cadres at an internal meeting in January 2013.