Energy-Rich Pakistan Can End IMF Bailouts and Power Blackouts

Frequent IMF bailouts and power blackouts in energy-rich Pakistan are closely tied. One of the key reasons for recurring balance-of-payment crises is the country's rapidly rising oil import bill. The lack of sufficient fuel exacerbates load shedding, negatively impacts economy, reduces tax revenue growth and worsens current account and budget deficits. This requires repeated injections of IMF loans in US dollars to meet import requirements and deal with budget shortfalls.

Pakistan's Untapped Energy Riches:

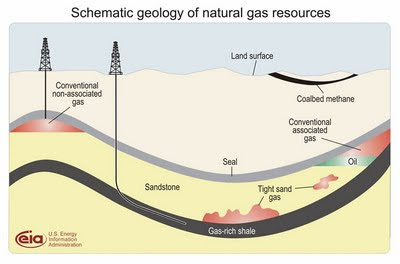

1. Shale Oil:

A recent US EIA report released in June 2013 estimates Pakistan's total shale oil reserves at 227 billion barrels of which 9.1 billion barrels are technically recoverable with today's technology. In fact, US EIA (Energy Information Administration) puts Pakistan among the top ten countries by recoverable shale oil reserves. These include Russia (75 billion barrels), United States (58 billion barrels), China (32 billion barrels), Argentina (27 billion barrels), Libya (26 billion barrels), Venezuela (13 billion barrels), Mexico (13 billion barrels), Pakistan (9.1 billion barrels), Canada (8.8 billion barrels) and Indonesia (7.9 billion barrels).

2. Shale Gas:

The latest US EIA report has raised estimates of Pakistan's recoverable shale gas reserves from 51 trillion cubic feet to 105 trillion cubic feet. It says Pakistan has 586 trillion cubic feet of shale gas of which 105 trillion cubic feet (up from 51 trillion cubic feet reported in 2011) is technically recoverable with current technology.

3. Tight Gas:

Rough estimates indicate the presence of at least 33 trillion cubic feet of unconventional gas reserves trapped in tight sands, according to an ENI Pakistan report. Another report by Shahab Alam, technical director of Pakistan Petroleum Concessions, puts the estimate at 40 trillion cubic feet of tight gas reserves in the country. These unconventional gas reserves are in addition to the remaining conventional proven gas reserves of over 30 trillion cubic feet.

4. Conventional Gas:

In addition to unconventional oil and gas resources, Pakistan also has about 30 trillion cubic feet of remaining conventional natural gas.

5. Thar Coal:

Pakistan's coal reserves in the Thar desert are estimated at 175 billion tons, according to Geological Survey of Pakistan. It's low BTU content coal. The carbon content of Thar lignite is around 60-80%; the rest is composed of water, air, hydrogen, and sulfur. It's hard to transport it but it can used to generate electricity in an integrated mining-generation facility.

6. Hydro:

Pakistan's hydroelectric potential is over 100,000 MW of electricity of which 59,000 MW can come from currently identified sites by the nation's Water and Power Development Authority (WAPDA).

7. Wind:

According to data published by Miriam Katz of Environmental Peace Review, Pakistan is fortunate to have something many other countries do not, which are high wind speeds near major centers. Near Islamabad, the wind speed is anywhere from 6.2 to 7.4 meters per second (between 13.8 and 16.5 miles per hour). Near Karachi, the range is between 6.2 and 6.9 (between 13.8 and 15.4 miles per hour). In only the Balochistan and Sindh provinces, sufficient wind exists to power every coastal village in the country. There also exists a corridor between Gharo and Keti Bandar that alone could produce between 40,000 and 50,000 megawatts of electricity, says Ms. Katz who has studied and written about alternative energy potential in South Asia.

8. Solar:

Pakistan is an exceptionally sunny country. If 0.25% of Balochistan was covered with solar panels with an efficiency of 20%, enough electricity would be generated to cover all of Pakistani demand. Solar energy makes much sense for Pakistan for several reasons: firstly, very large population lives in 50,000 villages that are very far away from the national grid, according to a report by the Solar Energy Research Center (SERC). Connecting these villages to the national grid would be very costly, thus giving each house a solar panel would be cost efficient and would empower people both economically and socially.

Summary:

Pakistan's frequent bailouts and blackouts are clearly related. The key to solving these interlinked crises is to put high priority on developing the country's vast but untapped domestic energy resources identified above. These include shale oil, shale gas, tight gas, Thar coal, hydro and renewables like solar and wind. Reducing Pakistan's dependence on energy imports is also the key to making the nation less vulnerable to recurring external shocks from energy prices which vary wildly with international political and economic events and crises.

Related Links:

Haq's Musings

US EIA Estimates Pakistan's Shale Oil Reserves at 9.1 Billion Barrels

Pakistan's Vast Shale Gas Reserves

Pakistan's Energy History

Cheap Coal Electricity

Potential Renewable Energy Resources in Pakistan

Hydroelectricity Potential in Pakistan

US EIA Shale Oil and Gas Report 2013

| Pakistan Energy Infrastructure (Source: PPEPCA) |

Pakistan's Untapped Energy Riches:

1. Shale Oil:

A recent US EIA report released in June 2013 estimates Pakistan's total shale oil reserves at 227 billion barrels of which 9.1 billion barrels are technically recoverable with today's technology. In fact, US EIA (Energy Information Administration) puts Pakistan among the top ten countries by recoverable shale oil reserves. These include Russia (75 billion barrels), United States (58 billion barrels), China (32 billion barrels), Argentina (27 billion barrels), Libya (26 billion barrels), Venezuela (13 billion barrels), Mexico (13 billion barrels), Pakistan (9.1 billion barrels), Canada (8.8 billion barrels) and Indonesia (7.9 billion barrels).

2. Shale Gas:

The latest US EIA report has raised estimates of Pakistan's recoverable shale gas reserves from 51 trillion cubic feet to 105 trillion cubic feet. It says Pakistan has 586 trillion cubic feet of shale gas of which 105 trillion cubic feet (up from 51 trillion cubic feet reported in 2011) is technically recoverable with current technology.

3. Tight Gas:

Rough estimates indicate the presence of at least 33 trillion cubic feet of unconventional gas reserves trapped in tight sands, according to an ENI Pakistan report. Another report by Shahab Alam, technical director of Pakistan Petroleum Concessions, puts the estimate at 40 trillion cubic feet of tight gas reserves in the country. These unconventional gas reserves are in addition to the remaining conventional proven gas reserves of over 30 trillion cubic feet.

4. Conventional Gas:

In addition to unconventional oil and gas resources, Pakistan also has about 30 trillion cubic feet of remaining conventional natural gas.

5. Thar Coal:

Pakistan's coal reserves in the Thar desert are estimated at 175 billion tons, according to Geological Survey of Pakistan. It's low BTU content coal. The carbon content of Thar lignite is around 60-80%; the rest is composed of water, air, hydrogen, and sulfur. It's hard to transport it but it can used to generate electricity in an integrated mining-generation facility.

6. Hydro:

Pakistan's hydroelectric potential is over 100,000 MW of electricity of which 59,000 MW can come from currently identified sites by the nation's Water and Power Development Authority (WAPDA).

7. Wind:

According to data published by Miriam Katz of Environmental Peace Review, Pakistan is fortunate to have something many other countries do not, which are high wind speeds near major centers. Near Islamabad, the wind speed is anywhere from 6.2 to 7.4 meters per second (between 13.8 and 16.5 miles per hour). Near Karachi, the range is between 6.2 and 6.9 (between 13.8 and 15.4 miles per hour). In only the Balochistan and Sindh provinces, sufficient wind exists to power every coastal village in the country. There also exists a corridor between Gharo and Keti Bandar that alone could produce between 40,000 and 50,000 megawatts of electricity, says Ms. Katz who has studied and written about alternative energy potential in South Asia.

8. Solar:

Pakistan is an exceptionally sunny country. If 0.25% of Balochistan was covered with solar panels with an efficiency of 20%, enough electricity would be generated to cover all of Pakistani demand. Solar energy makes much sense for Pakistan for several reasons: firstly, very large population lives in 50,000 villages that are very far away from the national grid, according to a report by the Solar Energy Research Center (SERC). Connecting these villages to the national grid would be very costly, thus giving each house a solar panel would be cost efficient and would empower people both economically and socially.

Summary:

Pakistan's frequent bailouts and blackouts are clearly related. The key to solving these interlinked crises is to put high priority on developing the country's vast but untapped domestic energy resources identified above. These include shale oil, shale gas, tight gas, Thar coal, hydro and renewables like solar and wind. Reducing Pakistan's dependence on energy imports is also the key to making the nation less vulnerable to recurring external shocks from energy prices which vary wildly with international political and economic events and crises.

Related Links:

Haq's Musings

US EIA Estimates Pakistan's Shale Oil Reserves at 9.1 Billion Barrels

Pakistan's Vast Shale Gas Reserves

Pakistan's Energy History

Cheap Coal Electricity

Potential Renewable Energy Resources in Pakistan

Hydroelectricity Potential in Pakistan

US EIA Shale Oil and Gas Report 2013

Comments

Dawn:

Statistics showed the oil import bill reached $13.937 billion in July-May this year as against $10.467 billion over the last year, indicating an increase of 33.15 per cent.

http://beta.dawn.com/news/728216/import-bill-increases

Daily Times:

The country has suffered $20.432 billion trade deficit during last fiscal year 2012-13, according to the official figures released by Pakistan Bureau of Statistics on Friday.

July to June: The exports from Pakistan during last 12 months of the last fiscal year 2012-13 were recorded at $24.518 billion as compared with exports of $23.624 billion in the same period of previous fiscal year 2011-12, projecting an increase of 3.76 percent.

http://www.dailytimes.com.pk/default.asp?page=2013%5C07%5C13%5Cstory_13-7-2013_pg5_1

ISLAMABAD: Pakistan and United States on Tuesday agreed to enhance cooperation in energy sector with special focus on development of bio-gas and wind energy to help Pakistan overcome power crisis.

Pakistan needs investment, particularly in the most needed energy sector, said Finance Minister Ishaq Dar while addressing a joint press conference along with President Overseas Private Investment Corporation (OPIC), Elizabeth L. Littlefield, who was heading the US delegation in talks with Pakistan.

Earlier, US delegation held detailed discussions with Pakistan’s economic and energy managers led by the finance minister and discussed various issues related to investment in various sectors of economy, particularly in energy sector.

Dar told media representatives that talks with the Opic were the part of government's efforts to bring foreign investment into the country and help enhance economic growth.

He said that both the countries agreed in principle to continue dialogue on Civil Nuclear Technology cooperation. However, he added that no timeline could be given for any future agreement on the issue.

The finance minister said that Independent Power Producers (IPPs) have capability to generate more electricity and the government has paid circular debt to enhance generation capacity.

He said both the sides also agreed to continue dialogue on the pending issues of Bilateral Investment Treaty (BIT) to tap the investment potential.

Terming the terrorism as one of the challenges the country was facing, Ishaq Dar said the government was committed to come up with a comprehensive strategy by taking onboard all political parties to overcome this menace.

He said that ensuring transparency and good governance were among the top priorities of the government.

Earlier, the minister informed the US delegation about the successful passage of federal budget 2013-14.

He said the government, this year, has enhanced the allocations for Public Sector Development Programme to Rs1.155 trillion besides enhancing the allocations of Income Support Programme from Rs40 billion to Rs70 billion.

Dar urged the Opic to bring into investment of private companies in Pakistan's energy sector. He assured the US delegation that Pakistan was a safe as well as lucrative country for investment and provides a conducive atmosphere for foreign investors.

Addressing the press conference, Elizabeth Littlefield said the investment through Opic into Pakistan has increased from $80 million to $300 million, witnessing manifold increase during past couple of years.

She said that Pakistan was facing some challenges. She, however, expressed the optimism that the new government would overcome all these challenges and lead the country towards better future.

Littlefield said her country will enhance cooperation with Pakistan in power generation through wind and bio-gas, besides enhancing technical cooperation to increase power generation through alternative ways.

She said that the US companies have already been involved in development of energy sector of Pakistan as a 50 megawatt electricity project by an American firm was continuing in Sindh province.

Earlier, while briefing the finance minister and his delegation about the operations of the Opic, she said the corporation mobilises private capital to help solve critical development challenges.

The Opic works with the US private sector and helps businesses gain footholds in emerging markets, catalysing revenues, jobs and growth opportunities both at home and abroad.

The corporation achieves its mission by providing investors with financing, guarantees, political risk insurance, and support for private equity investment funds, she added.

http://dawn.com/news/1029436/pakistan-us-to-enhance-cooperation-in-energy-sector

Completion of the Chashma Nuclear Power Plants CHASNUPP-III and CHASNUPP-IV by 2016, 340 megawatts (MW) respectively, will help meet the target of the Pakistan Atomic Energy Commission (PAEC) for generating 8,800 MW by the year 2030 via nuclear power reactors. The plants reactors and other facilities are being built and operated by the PAEC with Chinese support. In November 2006, the International Atomic Energy Agency (IAEA) approved an agreement with the PAEC for new nuclear power plants to be built in the country with Chinese assistance. The 35-member board of governors of the IAEA unanimously approved the safeguards agreement for any future nuclear power plants that Pakistan would construct. According to official sources, the allocation of budget for the PAEC for the financial year 2013-14.is estimated at around Rs49,512.186 million "An amount of Rs34.6 billion has been set aside for Chashma nuclear power plants C3 and C4. The total cost of these two projects is Rs190 billion which will be partially funded by a Rs136 billion Chinese loan,” an official said. The government has so far spent 62.4 billion on the mega-project having a 660 MW generation capacity. With an additional spending of 34.6 billion, the government has already completed almost half of the work, the official said. The 300 MW Chashma nuclear power plant-I is a pressurized water reactor that began commercial operation in 2000.It is located at Kundian in Punjab while the 300 MW Chashma Nuclear PowerPlant-II is part of the Chashma Nuclear Power Complex in the north-western region of Thal Doab. On April 28, 2009 a general engineering and design contract for CHASNUPP-3 and CHASNUPP-4 was signed with Shanghai Nuclear Engineering Research and Design Institute (SNERDI)...

http://www.pakistantoday.com.pk/2013/07/17/news/profit/680mw-nuclear-plants-to-start-generating-power-by-2016/

Pakistan Petroleum Limited (PPL) and Italy’s Eni have calculated that the price of shale gas should be $14 per million British thermal units (mmbtu), which has been rejected by the government as too much for the country’s existing tariff regime to absorb, an official told The Express Tribune.

The price was determined on the basis of expenditure required to drill for hard-to-reach shale gas reservoirs following a rise in interest in tapping this potential on the back of reports that Pakistan has massive reserves.

“There has to be a steady transition from conventional gas to tight and then finally to shale gas,” said Moin Raza Khan, Deputy Managing Director of PPL and head of its exploration operation. “This has to be a slow process because of the economics involved in the operations.”

Almost all the 4,000 million cubic feet per day (mmcfd) of gas produced in Pakistan comes from conventional gas fields, which can be reached relatively easily. Tight gas is trapped in impermeable rocks whereas gas trapped in shale formation is called shale gas.

Average consumer gas price is around $4 per mmbtu, undermining the prospects for shale gas to be brought into the system at this stage, Khan said.

“One reason why the US produces shale gas in abundance is because of the economies of scale. We would have to do that to make it feasible and this can’t happen overnight,” he said.

So for the time being exploration firms including PPL are focusing on tight gas, for which the government has increased the price by 40% through a separate petroleum policy.

First tight gas flows entered the transmission and distribution system in June this year as production of 15 mmcfd started from Kirthar block, which is a joint venture between a Polish firm and PPL.

Sui dilemma

For more than 57 years, Sui gas field fuelled the economy, so much that natural gas became synonymous with Sui gas. And now it has depleted.

“If you ask me I think the gas pressure will sustain for another 10 to 12 years,” Khan said. “The pressure used to be 1,300 psi (pounds per square inch), which has come down to only 300 psi.”

To tackle that problem, the company regularly installs compressor plants on the wells to maintain the pressure. “We are considering installing equipment for 100 psi and even 50 psi.”

Offshore expedition

PPL along with its local and foreign partners plans to drill a well in offshore Block-G in the Indus, the world’s second largest delta after the Bay of Bengal.

“Having a discovery offshore is very important,” he said, referring to the successive past failures. “So far, 13 wells have been drilled in Indus. Gas was found only in one and that wasn’t commercially feasible to take out.”

Pakistan has a coastline spread over 1,990 km and sub-divided into Indus and Makran deltas. Indus delta alone is spread over 1.1 million square kilometres. Pakistan’s area covers over 240,000 sq km of this....

http://tribune.com.pk/story/577736/too-hot-to-handle-govt-rejects-shale-gas-price-terming-it-too-much-to-absorb/

ISLAMABAD, July 14 (KUNA) -- An increase of USD 733.64 million in the remittance of overseas Pakistani was observed by the State Bank of Pakistan (SBP) in the last fiscal year (July 2012-June 2013).

Overseas Pakistanis remitted an amount of USD13,920.26 million during the last fiscal year showing a growth of 5.56 per cent or USD733.64 million compared with USD13,186.62 million received during the same period of the last fiscal year (July- June 2012), State Bank of Pakistan said.

The inflow of remittances during July-June 2013 from Saudi Arabia, UAE, USA, UK, GCC countries (including Bahrain, Kuwait, Qatar and Oman) and EU countries amounted to USD4,104.73 million, USD2,750.17 million, USD2,186.21 million, USD1,946.01 million, USD1,607.88 million and USD357.37 million respectively. These amounts could be compared to the inflow of USD3,687.00 million, USD2,848.86 million, USD2,334.47 million, USD1,521.10 million, USD1, 495.00 million and USD364.79 million respectively in July-June 2012.

According to State Bank, remittances received from Norway, Switzerland, Australia, Canada, Japan and other countries during the last fiscal year (July-June 2013) amounted to USD967.79 million as against USD935.36 million received in the last fiscal year (July- June 2012). The monthly average remittances for July-June 2013 period comes out to USD1,160.02 million compared to USD1,098.89 million during the corresponding period of the last fiscal year, said the SBP.

http://www.kuna.net.kw/ArticleDetails.aspx?id=2322337&language=en

Saudi billionaire Prince Alwaleed bin Talal warned that the Gulf Arab kingdom needed to reduce its reliance on crude oil and diversify its revenues, as rising U.S. shale energy supplies cut global demand for its oil.

In an open letter to Oil Minister Ali al-Naimi and other ministers, published on Sunday via his Twitter account, Prince Alwaleed said demand for oil from OPEC member states was "in continuous decline".

He said Saudi Arabia's heavy dependence on oil was "a truth that has really become a source of worry for many", and that the world's biggest crude oil exporter should implement "swift measures" to diversify its economy.

(Read more: Oil prices jump as US crude takes bigger role on world oil stage)

Prince Alwaleed, owner of international investment firm Kingdom Holding, is unusually outspoken for a top Saudi businessman.

But his warning reflects growing concern in private among many Saudis about the long-term impact of shale technology, which is allowing the United States and Canada to tap unconventional oil deposits which they could not reach just a few years ago. Some analysts think this may push demand for Saudi oil, as well as global oil prices, down sharply over the next decade.

Over the past couple of years the Saudi government has taken some initial steps to develop the economy beyond oil - for example, liberalising the aviation sector and providing finance to small, entrepreneurial firms in the services and technology sectors.

Nowhere Is Immune from Unrest: Saudi Prince

Saudi Prince Alwaleed Bin Talal, talks to CNBC about turmoil in the Middle-East and the price of oil.

Naimi said publicly in Vienna in May that he was not concerned about rising U.S. shale oil supplies. Prince Alwaleed told Naimi in his open letter, which was dated May 13 this year, that he disagreed with him.

"Our country is facing a threat with the continuation of its near-complete reliance on oil, especially as 92 percent of the budget for this year depends on oil," Prince Alwaleed said.

(Read more: Don't mess with West Texas: US oil to keep outpacing Brent)

"It is necessary to diversify sources of revenue, establish a clear vision for that and start implementing it immediately," he said, adding that the country should move ahead with plans for nuclear and solar energy production to cut local consumption of oil.

The shale oil threat means Saudi Arabia will not be able to raise its production capacity to 15 million barrels of oil per day, Prince Alwaleed argued. Current capacity is about 12.5 million bpd; a few years ago the country planned to increase capacity to 15 million bpd, but then put the plan on hold after the global financial crisis.

While most Saudi officials have in public insisted they are not worried by the shale threat, the Organization of the Petroleum Exporting Countries (OPEC) has recognised that it needs to address the issue.

(Read more: OPEC ministers: falling demand is our top concern)

In a report this month, OPEC forecast demand for its oil in 2014 would average 29.61 million bpd, down 250,000 bpd from 2013. It cited rising non-OPEC supply, especially from the United States.

At its last meeting in Vienna in May, OPEC oil ministers spent time discussing shale technology and set up a committee to study it.

http://www.cnbc.com/id/100920411

Analysts said that severe energy crisis in the country and lower capacity operations of refineries pushed the oil import bill upwards. They said that rise in imports of finished products was due to high demand for energy generation. They further said that oil import bill might further increase in December and January. According to the figures of Pakistan Bureau of Statistics (PBS), the country’s petroleum products import has shown an increase of 1.15 per cent in one year, as it imported oil worth of $7.697 billion in July-December of the ongoing financial year against $7.610 billion of July-December of the last year 2011-2012.

Analysts said that the country should ensure energy supply through own resources; otherwise the oil import bill would affect the country’s fiscal position. “As gas supply situation in the country is not expected to improve in the near future, the oil import bill will continue to mount pressure both on value and volumetric basis,” an analyst said.

The break-up of $7.697 billion oil import bill revealed that country spent $4.920 billion on petroleum products and $2.777 billion on import on petroleum crude during the first six months of ongoing financial year.

The PBS figures revealed that country imported food stuff worth of $2.157 billion during July-December of the year 2012-13. The break-up of $2.157 billion revealed that import bill of milk products was up by 3.20 per cent, dry fruits and nuts 1.02pc, import of tea increased by 6.46 per cent, import of spices decreased by 30.06 per cent, soyabean oil’s imports went up by 26.47 per cent, palm oil import decreased by 18.92 per cent, sugar import declined by 78 per cent, import of pulses went down by 12.76 per cent and import of all other food items decreased by 24.80 per cent during the period under review.

Meanwhile, according to PBS figures, the country imported machinery worth of $2.907 billion. Transport group imports stood at $951 million, textile group $1.115 billion, agricultural and other chemicals $3.136 billion, metal group $1.529 billion, miscellaneous group imports were recorded at $402 million and all other items imports remained $ 2.026 billion during July-December period of 2012-13 against July-December period of 2011-12.

It is worth mentioning here that Pakistan’s overall imports were recorded to $21.922 billion in July-December period of ongoing financial year as compared to $22.678 billion of the corresponding period last year.

http://nation.com.pk/business/23-Jan-2013/oil-import-bill-surges-to-7-697b-in-6-months

Hungarian energy company MOL said Friday it made a new discovery of oil and gas in Pakistan, bringing the total there so far to an even dozen.

Operating through a national subsidiary in Pakistan, the company said its discovery in the so-called TAL block in Pakistan is No. 8 so far in that basin and No. 12 in its history in the country. MOL has worked in Pakistan for the last 17 years.

"We are very proud of our 8th discovery in the MOL-operated TAL block," Berislav Gaso, MOL's chief officer for exploration and production, said in a statement. "This new discovery will help to improve the energy security of the country."

Pakistan consumes most of the natural gas it produces and the country has faced power issues because of aging infrastructure. According to the Asian Development Bank, addressing chronic energy issues is one of the ways in which Pakistan can ensure its economic growth remains on course.

Pakistan's economy is expected to expand from a 4.2 percent growth rate in 2015 to 4.8 percent by next year. A net importer of energy resources, the ADB said lower oil prices and soft inflationary pressures were pushing Pakistan's economy forward.

MOL said it was producing around 80,000 barrels of oil equivalent per day from the TAL block so far. Reserves flowed from the latest confirmed discovery at a test rate of around 2,000 barrels of oil per day and 900 barrels of oil equivalent in natural gas per day.

http://tribune.com.pk/story/1132448/pakistans-oil-gas-discoveries-touch-record/

Pakistan has made the highest number of oil and gas discoveries in the current month as exploration companies found fresh hydrocarbon deposits in six wells that will add 50.1 million cubic feet per day (mmcfd) of gas and 2,359 barrels per day (bpd) of oil to the existing production levels.

Of these, major discoveries have been made in Sindh that already has a big share in total gas output in the country.

Gas utilities: World Bank recommends single transmission firm

Petroleum and Natural Resources Minister Shahid Khaqan Abbasi, while speaking during a meeting of the National Assembly Standing Committee on Petroleum and Natural Resources chaired by Bilal Ahmed Virk on Tuesday, said four discoveries were made in Sindh and the remaining two in Khyber-Pakhtunkhwa.

Of these, Oil and Gas Development Company made two finds, MOL Pakistan two and Petroleum Exploration Limited and United Energy Pakistan one each. The discoveries have shown presence of 31.6 mmcfd of gas and 339 bpd of crude oil in Sindh and 18.5 mmcfd of gas and 2,020 bpd of oil in K-P.

Sui Northern Gas Pipelines Limited (SNGPL) Managing Director Amjad Latif warned that the country’s gas reserves were depleting and no gas was available for the domestic consumers in Punjab. He pointed out that the purchasing cost of gas for domestic consumers stood at Rs510 per million British thermal units (mmbtu) but the consumers coming under the first slab were receiving it at Rs110 per mmbtu.

Eighty-five per cent of domestic consumers were paying less than 50% of the cost of gas and the industrial and commercial consumers were cross-subsiding the domestic consumers, he said.

However, now industrial and commercial consumers were being provided imported liquefied natural gas (LNG), so the burden of cross-subsidy had been shifted to SNGPL that was feeling the strain on its finances.

Though the gas production was declining, Latif told the committee that the company would lay pipelines over 8,000 km in the current year. At present, 1.5 million applications for new gas connections are awaiting approval of the company.

The country was facing gas shortages as politicians were using it as a tool to win elections.

During the meeting, National Assembly member Mian Tariq Mehmood, who belonged to the ruling PML-N, alleged that SNGPL had provided 100 gas meters in his constituency to please his political rival Imtiaz Safdar Warraich, though his requests for new meters were turned down repeatedly.

He insisted that the provision of gas meters to his opponent had damaged his political image. NA Standing Committee Chairman Bilal Ahmed Virk accused Director General Petroleum Concession Saeedullah Shah of not responding to the committee for the last two years.

Sui lease extension: PPL to pay 10% bonus to Balochistan

Describing Shah’s attitude as non-sense, he said he was not cooperating with the committee and sought the record of past meetings to show response of the director general of petroleum concession.

The committee also took up for review the issuance of licences for liquefied petroleum gas (LPG) stations to the defaulters that were previously running CNG stations.

It recommended that rules of Oil and Gas Regulatory Authority (Ogra) should be amended to ensure the clearance of outstanding bills of SNGPL, Water and Power Development Authority and banks before issuing licences for setting up LPG stations.

Energy has long been Pakistan’s curse. This is a country whose large and rising population (the

country had 195 million people as of October 2016, according to government data, making it the

world’s sixth most populous country) has long presented its government with a complex challenge:

to tap new sources of hugely valuable energy where little, if any, had historically existed.

There is carbon here in spades. Pakistan boasts 754 billion cubic metres’ worth of gas, placing it

28th in the list of the world’s largest sovereign producers of natural gas. It has rather less oil, at

least in comparison to other countries in the region, placing it 52th on the global list.

Coal, though, is another matter. A recent find in the desert district of Tharparkar, hard by the border

with the Indian province of Rajasthan, may ultimately generate up to 185 billion tonnes of

anthracite and lignite coal. If that find yields anything near its earliest estimates, it would vault

Pakistan overnight from a ‘resourcepoor’ nation into the energyproducing major leagues.

Coal would help diversify the

country’s energy mix. Pakistan is

heavily reliant on natural gas and

oil to meet its primary energy

requirements. The country’s gas

deficit currently runs at between 2

billion and 4 billion cubic feet per

day, depending on the season and

the time of day. Total local crude oil

production, meanwhile, has long

lagged: Pakistan currently has to

import around 87% of its oil needs,

mostly from the United Arab

Emirates and Saudi Arabia

------

In September 2016, Shahid Khaqan Abbasi, Minister of Petroleum and Natural Resources, told

Pakistan’s National Assembly that the oil and gas sector had received investments totaling

$15.3bn since the start of 2013, adding that the country had made 82 oil and gas discoveries over

the same period.

Analysts are impressed by what they are seeing. “Lucrative policies on gas pricing, stability

resulting from improving law and order, and vast arrays of unexplored territory, have created

attractive propositions for exploration and production companies, who are well positioned to deploy

the excess cash on their books,” notes Farrukh Sabzwaria, director of regional equities sales at

Credit Suisse in Singapore. “Oil & gas exploration has made up 30%40% of foreign direct

investment over the past few years — and four multinationals are firmly entrenched, and should

continue to bring in FDI for exploration and development activities.” In other words, Pakistan, once

a minnow in the fields of energy production and exploration, is well on its way to becoming a major

player in the field, thanks to farsighted government policy

--------

In September 2016, Finance Minister Ishaq Dar said that three southnorth pipelines, stretching

from Gwadar to western China, were under construction, with the first set for completion by the

end of 2016. “The second,” the finance minister added, “would be a parallel northsouth pipeline

built [with] Russian investment, while the third pipeline is planned between the towns of Gwadar

and Nawabshah” in the easterly province of Sindh.

--------

Then there are the country’s untapped reserves of carbon. In November 2015, petroleum ministry

advisor Zahid Muzaffar said Pakistan’s total oil and gas reserves, including unexplored offshore

wells and fields, were greater than all Central Asian states combined. If true — and given that

Central Asia includes one major gas producer, in Turkmenistan, and one major oil produce, in

Kazakhstan — it would place Pakistan’s energy sector and the wider economy in a highly

promising position.

https://www.economist.com/news/business/21736185-just-1-vast-reserve-discovered-1992-could-supply-fifth-countrys-current

PAKISTAN’s enormous mineral wealth has long lain untapped. Since a 1992 geological survey spotted one of the world’s largest coal reserves in Thar, a scrubby desert in the southern province of Sindh, prospectors have hardly dug up a lump. Among those to flounder is a national hero. Samar Mubarakmand, feted for his role in Pakistan’s nuclear-weapons programme, has just shut the coal-gasification company he founded in 2010, when he vowed on live television to crack Thar.

---

To such qualms, the government offers three rejoinders. First, severe power shortages have long blighted the nation, and renewable sources cannot offer the daylong, year-round power it needs. Second, coal accounts for less than 1% of current generation, compared with 70% in neighbouring India and China. And third, domestic coal would allow the country to forgo expensive imports of the fuel for newly built power stations, a drain on fast-dwindling foreign-exchange reserves.

---

Eight years ago Engro bought the rights to one of Thar’s 13 blocks, containing 1% of the reserve (more than enough given the gargantuan size of the mine). To work on extraction, it formed the country’s biggest ever public-private partnership, the Sindh Engro Coal Mining Company (SECMC), in which Engro digs and the state provides infrastructure. Relying on the state can break strong firms. Engro itself almost went bankrupt in 2012 after the government refused to honour a sovereign guarantee to provide gas to one of its fertiliser plants. Yet without similar government support, no other Thar block-owners have secured financing, leaving Engro’s diggers, which began work last year, to move ahead.

The endeavour benefits from being in the group of infrastructure projects that make up the $62bn China Pakistan Economic Corridor, a hoped-for trade route. Western banks shook their heads when approached about a coal project, so Engro has relied on Chinese financing. Analysts note an irony in China’s promotion of coal abroad as it withdraws from the fuel at home. Handling the extraction at Thar is the China Machinery Engineering Corporation, a state-owned firm with expertise beyond Pakistan’s reach.

Around 126 metres below the sands of Thar, with just 20 more to go, Engro’s diggers can now almost touch their prize. When the coal is reached, as is expected in mid-2018, it will feed a pit-mouth power station constructed by Engro, and, in time, three others owned by partners in the SECMC. These stations will furnish around a fifth of the country’s electricity for the next 50 years. The financial rewards could be vast. “All my richest friends are jumping up and down [because they did not get there first]”, says the boss of one big multinational construction business.

Hurdles remain, not least complaints from nearby villagers about the disposal of the vast quantities of wastewater from the mine on their ancestral grazing lands in the form of a reservoir. In reply, Engro stresses its social work in the surrounding district of Tharparkar, the poorest in Sindh, which includes the construction of several free schools. More self-interestedly, it is training locals to drive so they can man the dump trucks that trundle day and night around the mine. According to Shamsuddin Shaikh, chief executive of Engro Powergen, the conglomerate’s energy division, Engro also has its sights on Reko Diq, a gargantuan and long-stalled copper mine in Balochistan, the least developed of Pakistan’s provinces. To tap one of the country’s two largest and most niggardly mines is hard enough. Imagine cracking them both.

NEPRA says maximum utilisation of local coal needs to be encouraged

https://tribune.com.pk/story/2384887/66-of-forex-spent-on-fuel-imports

LAHORE:

Pakistan’s reliance on costly imported fuels continues to grow in parallel to the increasing energy needs causing stagnation in the sector.

Pakistan is currently spending approximately $21.43 billion annually on fuel imports, which is about 66% of its total foreign exchange reserves. Hence, the switch to or focus on indigenous resources is becoming a ‘must’ in order to meet the growing energy demands of the country.

The fuel cost per unit of energy generated from imported coal increased from Rs20.17/kWh to Rs29.12/kWh while per unit cost of energy generated from local Thar coal remained around Rs4-4.5/kWh. This was revealed in the State of Industry Report 2022 recently issued by Nepra.

It is worth noting that coal-fired powerplants in Pakistan import coal mainly from South Africa and Indonesia, and this imported coal has incurred a major price surge of late. The delivered price of South African coal increased from $177 per tonne to $407 per tonne during the last one year only. Keeping this in view, a proposal to convert imported coal-based powerplants already set up in the country to Thar coal is under consideration, the report added.

“The Private Power and Infrastructure Board (PPIB) is leading the process. It apprised that as per the initial findings, imported coal powerplants can use Thar coal for some percentage without making any modification to their powerplants,” stated the report. Nepra believes that maximum utilisation of local coal needs to be encouraged and utilised to reduce reliance on imported fuel.

It is pertinent to mention that 3.8 million tonnes of coal per annum was being mined from Thar coal field by the Sindh Engro Coal Mining Company (SECMC) and the recent commercial operations date (COD) of phase-II of the mine has now pushed coal production to 7.6 million tonnes per annum.

This expansion will further reduce coal prices from its current $65 per tonne to around $46 per tonne which in turn, will power an additional capacity of 660MWs for the Thar coal based independent power producers (IPP).

In the phase-III expansion, approved last year, production of around 12.2 million tonnes of coal from Thar Block-II is expected to be achieved by early 2024. This is important because of the impact it will have on price – which will stand under $30 per tonne.

In addition, given the unprecedently high prices of imported fuel, Thar coal expansion III could also provide a huge relief to Pakistan’s forex reserves, with savings of approximately $2.5 billion, it read.

The report added that enhancing the share of electricity based on indigenous energy supplies is crucial to ensure energy security, self-reliance, affordability, sustainability, and reduction in dependency on imported fuel-based

https://nepra.org.pk/publications/State%20of%20Industry%20Reports/State%20of%20Industry%20Report%202022.pdf

The State of Industry Report 2022 (SIR-2022) captures and presents the status and performance of

various segments of the electric power sector i.e. generation, transmission, distribution and supply,

during the FY 2021-22. The SIR-2022 provides a snapshot of developments, and delivery of sectoral

players, identifies weaknesses of the sector, and suggests improvements in each segment of the electric

power services. The SIR-2022 has highlighted various challenges that were faced during the FY 2021-22.

Some of the issues were the same as highlighted in SIR-2021, continued to have an impact on the power

sector, while a few more new challenges surfaced during the FY 2021-22, which added to the woes of

the power sector. As discussed in the succeeding chapters, all these issues contributed towards increase

in the cost of electricity adversely affecting the affordability of the end-consumers.

Supplying affordable and reliable electricity to the end-consumers is to be treated as a priority for

sustainable development, economic uplift, and poverty alleviation. This, in return, creates an

environment of growth in electricity demand per capita; which is linked with the GDP growth of the

country. According to the data submitted by DISCOs and KE, Pakistan’s per capita annual electricity

consumption of 644 kWh, is among the lowest in the world, which is only 18% of the world average,

7% of the developed countries’ average, and 12% of that of China. Per capita electricity consumption

is considered as one of the key parameters, reflecting the living standards of the people in a country.

This indicates that there is a lot of room for improving the living standards of the people and running

the wheel of the economy to ensure sustainable growth.

Climate Change is a reality all across the globe and Pakistan is termed as one of the most vulnerable

countries to its impacts. The impacts of climate change include weather shifts, an increase in temperature,

heat waves, alteration in precipitation patterns, precipitation intensity, occurrence, and seasonal

variations, and the resultant impact on the hydrology, affecting the power sector twofold i.e. increase in

the electricity demand particularly for cooling, and reduction in electricity generation from hydropower.

Due to this, the reliance on expensive fossil fuel-based power generation was increased during FY

2021-22. There is a dire need to take climate change mitigation into account for future power system

integrated planning and management.

-------

The installed electric power generation capacity of Pakistan as of 30-06-2022 remained 43,775 MW

which includes 40,813 MW in CPPA-G System and 2,962 MW in KE System. Similarly, the dependable

capacity of Pakistan as of 30-06-2022 remained 40,532 MW which included 37,858 MW in CPPA-G

System and 2,674 MW in KE System.

During the FY 2021-22, 4,498 MW generation capacity has been added to the CPPA-G system which

includes 1,263 MW Trimmu RLNG Power Project which is under testing, 1,145 MW KANUPP-III Nuclear

Power Project, 720 MW Karot Hydropower Project, 660 MW Coal-Based Power Project of Lucky

Electric, Twelve (12) Wind Power Projects with an accumulated capacity of 600 MW and a 100 MW

Solar Power Project of Zhenfa Power. During the year, Licenses of 150 MW GENCO-IV, 97 MW Reshma

Power, 84 MW Gulf Powergen, 117 MW Southern Electric, 120 MW Japan Power, 31 MW Altern Energy

and 137 MW KANUPP have expired.

During FY 2021-22, total electricity generation in the country, including KE System remained 153,874.20

GWh. This generation translates into 43% utilization factor of dependable capacity meaning thereby

57% of the ‘Take or Pay’ based power generation capacity remained unutilized. The total electric

Coal fuels nearly three-quarters of the power output of India, which presented its decarbonisation strategy at the United Nation's COP27 climate summit this week - the last of the world's five largest economies to do so.

For all latest news, follow The Daily Star's Google News channel.

Use of coal globally, including in power generation, has grown since Russia's invasion of Ukraine in late February sent prices of other fossil fuels surging, derailing efforts to transition to cleaner fuels.

But the increase in India's coal-fired power output has outstripped its regional peers, data from the government and analysts showed.

---

India's coal-fired power output increased more than 10 per cent year-on-year from March to October to 757.82 terawatt hours, an analysis of government data shows, as electricity demand increased off the back of a heatwave and pickup in economic activity.

The government expects this output to grow at the fastest pace in at least a decade in the current fiscal year ending March 2023.

An analysis of data from independent think tank Ember shows India's surge in coal-fired output for the March-to-August period was 14 times faster than the average in Asia Pacific.

The heat wave and economic revival following the pandemic meant overall electricity demand grew twice as fast as rest of the region, Ember's data shows.

The European Union was the only region where coal-fired power output grew at a rate faster than India, the Ember data says, as nations in the region scrambled to reduce their reliance on Russian supplies.

India is also the only major country in Asia, besides Japan, where the contribution of coal-fired power in overall electricity production increased in the six months since March, the data shows.

India wants countries to agree to phase down all fossil fuels at the COP27 summit, rather than a narrower deal to phase down coal as was agreed last year.

State-run Coal India, the country's dominant coal miner, ramped up production to meet the utility demand. It reported a 13.5 per cent year-on-year increase in its coal output in March-October to a record high of 432 million tonnes.

Imports of thermal coal, predominantly used in power generation, rose by more than a quarter in the same period, double the pace seen in the pre-Covid years between 2017 to 2019, data from consultancy Coalmint showed.

"Like in China, Indian coal-fired generation will be correlated with Indian power demand – if total demand increases, then more coal-fired generation will be needed," said Jake Horslen, an analyst at Energy Aspects.

In China, the government's strict "Covid-zero" policy and resulting restrictions, plus increased use of renewable and hydro sources of power generation, led to a decline in coal use.

Consultancy Wood Mackenzie expects India's coal-fired power output to grow 10 per cent in 2022 compared to the previous year. China's generation from the polluting fuel is expected to decline marginally.

India's government has said it was committed to achieve net zero emissions by 2070, and official data reviewed by Reuters shows that renewable energy generation grew 21 per cent in March to October, even as coal use for power increased.

India is expected to add up to 360 gigawatts of power generation capacity from clean energy sources to its overall output over the next decade, said Hetal Gandhi, director of research at CRISIL Market Intelligence. "This would help lower coal's contribution in generation by 40-45 per cent by fiscal 2032," he said.

https://www.dawn.com/news/1726787

The International Energy Agency (IEA) said on Friday that coal consumption in Pakistan dropped 7pc in 2021 to 23m tonnes as its prices in the global markets surged to unusually high levels. The use of coal in Pakistan during 2022 is estimated to have fallen further by 3.8m tonnes, said the global intergovernmental organisation in a study released on Friday.

The reason for the drop in consumption of dirty fuel is the unaffordability of large seaborne imports, which forces the country to rely on supplies from domestic coal mines and land-based imports from Afghanistan.

“Additionally, the heavier-than-usual monsoon season brought severe flooding in June, covering more than one-third of the country’s land area and exacerbating the economic crisis,” it added.

The power sector, cement makers and the general industry are major consumers of coal in Pakistan. More than half of coal imports, which are lower than total consumption given the expanding production from the Thar coalfield, are still consumed by the power sector alone.

That’s the reason the National Electric Power Regulatory Authority (Nepra) is considering a proposal to convert imported coal-based power plants to Thar coal. In a recent report, the power sector regulator said imported coal power plants could use Thar coal for some percentage without any plant modifications.

Two power plants, Engro Powergen Thar and Thar Energy, run on local coal. Four coal-based electricity makers — Sahiwal Power Plant, Port Qasim Power Plant, China Power Hub Generation and Lucky Electric Power — burn the fuel imported mainly from South Africa and Indonesia.

Lucky Electric Power has been designed to operate on Thar lignite coal. However, it’s going to run on imported lignite coal until the completion of the third and final phase of mining within Block 2 under Sindh Engro Coal Mining Company (SECMC).

Being the only company that’s mining coal from the Thar coalfield, SECMC extracted 3.8m tonnes of coal every year and sold its entire output to Engro Powergen Thar until recently. It doubled its mining capacity to 7.6m tonnes per year in October, which coincided with the commissioning of the 330-megawatt Thar Energy plant. Another power producer of 330MW, ThalNova Power Ltd, will soon start producing electricity, ensuring 100pc consumption of the enhanced output of SECMC’s mine in Block 2.

With the mining block’s third-phase expansion by June 2023, its output will increase to 12.2m tonnes per year. The increased mining will supply fuel to the 660MW power plant that Lucky Electric Power Company has just commissioned at Port Qasim.

The share of coal-based electricity in the country’s power generation mix in October was 15.5pc.

https://arynews.tv/thar-solution-pakistans-energy-crisis-murad-ali-shah/

“Chinese cooperation has proved a landmark in power generation from coal deposits in Thar,” chief minister said. “Chinese companies are increasing power generation from coal in Thar,” he further said.

Pakistan facing a formidable energy crisis that has badly affected economy of the country. The government sees energy generation from massive coal deposits in Sindh’s desert district of Thar could address the country’s energy problems.

Sindh’s Energy Minister Imtiaz Ahmed Shaikh recently announced an additional 1320 Megawatt of electricity from the Thar coal power plant included in the national grid.

He said the trial run to generate 1320 megawatts of electricity from the Shanghai Electric power plant was started today. Meanwhile, 660 MW of electricity has been added from Engro and Hubco power plants.

Sindh energy minister, while talking about the full potential of the coal power project said that a total of 2640 MW of electricity will be supplied to the National Grid from Thar coal soon.

https://tribune.com.pk/story/2393593/330mw-from-thar-coal-added-to-national-grid

HYDERABAD:

Hub Power Company Limited (HUBCO)’s 330-megawatt (MW) power plant, fired by Tharparkar’s coal, formally started supplying electricity to the national grid on Friday in Islamkot. Inaugurated by the Minister of State, Mahesh Malani, this fresh addition of 330MW will take Thar’s coal contribution to power generation up to 3,000MW.

by Waqar Rizvi

https://www.freiheit.org/south-asia/war-ukraine-impact-pakistans-energy-security

Pakistan has long dealt with energy-insecurity, a state of affairs exacerbated by the disastrous economic effects of the pandemic, floods and war in Ukraine. While some experts warned Pakistan that its energy dependence was untenable, there were others who believed such concerns were overblown thanks to the abundance and low cost of Liquefied Natural Gas. The war in Ukraine has proven the latter group wrong, the subsequent sanctions disrupting energy supplies from Russia and driving up global prices. Europe's entry into the market and ability to meet any cost in securing limited worldwide supplies place Pakistan in an even more difficult position.

Pakistani officials already warn of mass gas shortages, and load-shedding in households is rampant with areas of the country experiencing daily power cuts that are 16 hours long. The country’s vital textile industry also stands to suffer from an interrupted and limited supply. This situation exists despite Pakistan's possession of exploitable natural resources, owing to policy-makers' dogmatic view that the development of these resources for self-reliance was unachievable. In addition, insecurity and political instability in areas such as resource-rich Balochistan have thwarted any remedial measures.

Pakistan’s alliances and loyalties with traditional allies are being tested at this difficult time. To encourage vital foreign investment in Pakistan's energy sector, the government can take advantage of the desire of the Chinese, Russians, Americans and Europeans to gain influence in the country. Restricted by geopolitical considerations from taking sides in the war on Ukraine, Pakistan must secure its national interests, especially energy security.

Pakistan should eschew inactivity despite the risk of being outbid in the competitive global LNG market. Responsible energy policymaking must be embraced, including the implementation and incentivisation of energy conservation measures, whilst shielding the lower classes from additional energy costs. Needed is a multifaceted energy policy that considers all available resources such as gas, oil, coal, solar, hydro and wind power. Experts must be involved in the formulation of sound strategies to exploit these sources, and Pakistan must learn from its mistakes, such its signing of bad-faith contracts with LNG middlemen, which allowed them to abandon Pakistan's agreements for profits.

However, political turmoil remains the largest contributor to Pakistan's energy insecurity. The government and opposition parties will need to put aside their partisan bickering to prioritize the country’s interests. Sound policies grounded in reality, as opposed to theoretical ones, are called for, and leaders must step up during crises.

Pakistan is in dire need of an infrastructural upgrade and must play all its cards to achieve it. Diplomatically, Pakistan holds significant influence in international forums and has valuable voting power at the United Nations. Economically, Pakistan can promise significant benefits to nations that invest in its natural resources.

https://www.dawn.com/news/1738824

Only 1,800MW of the 2,400MW Thar power plants can be evacuated at any given time owing to transmission constraints. Delays in the construction of the second transmission line between Thar and Matiari Converter Station have resulted in the coal-based power plants sitting idle despite ranking highly on the merit order of efficient electricity producers.

Central Power Purchasing Agency-Guarantee Ltd (CPPA-G), which is the government-owned single buyer of electricity from independent power producers, recently wrote a letter to National Transmission and Despatch Company Ltd (NTDC) demanding that CPPA-G be updated about the “progress and tentative commissioning date” of the transmission line.

“It is clear that in the present scheme, all four Thar coal power projects cannot be evacuated completely at once, which raises a serious concern on the power evacuation and the capacity of the transmission line,” said the letter seen by Dawn.

Demand for electricity will increase in the coming summer season, but the “full cheap-power evacuation from indigenous coal is not possible” under the current circumstances, it added.

Power generation began in Thar with two coal-based plants of 330MW each by Engro Powergen in Block-2. Later on, Hub Power along with other shareholders built two more power plants of 330MW each in the same Block-2.

Meanwhile, Shanghai Electric built two power plants of 660MW each in Block-1 of Thar coalfields. Around 2,400MW of the installed capacity of 2,640MW is dispatchable. But only one transmission line, which can carry up to 1,800MW, is currently available for the four Thar projects.

The inadequacy of infrastructure has resulted in “abnormal voltage” and “frequency fluctuations” for Thar power plants on the sole dedicated transmission line, the CCPA-G said.

A source in the power sector told Dawn that the two plants in Block-1 are being despatched continuously because of their low per-unit cost of coal.

As for Block-2, the source said only two of the four plants are despatched at any given time — one each from Engro and Hub Power.

According to an energy sector expert, producing 600MW on imported coal instead of Thar coal is costing around $30 million every month. Producing that much electricity through imported gas should cost $35m in imports, he said.

Speaking to Dawn, a senior official of NTDC said work on the under-construction transmission line should be complete in “two to two and a half months”. The 220-kilometre long transmission line costing about Rs12 billion was supposed to be complete by August 2022. The deadline was extended to January this year, but that was also missed.

“Prices of everything from steel and cement went up three times. Then the floods hit and halted all construction work. Building a transmission line involves right-of-way issues, which make the process complicated and time-consuming,” he said, adding that the process should be over by the end of April.

https://www.power-technology.com/marketdata/thar-matiari-line-new-500-kv-pakistan/

Thar – Matiari Line – New – 500 kV is a 500kV overhead line with a length of 247km from Thar, Tharparkar, Sindh, Pakistan, to Matiari, Sindh, Pakistan.

Construction works on the Thar – Matiari Line – New – 500 kV project was commissioned in 2018.

The Thar – Matiari Line – New – 500 kV, which is an overhead line, is being operated by National Transmission & Despatch. The Thar – Matiari Line – New – 500 kV is a new line. The line carries alternating current (AC) through double circuit cable.

Approximately $107.67m was financed by the authorities to undertake the construction works of the project.

Thar – Matiari Line – New – 500 kV project development status

The project works were completed in 2018.

About National Transmission & Despatch

National Transmission & Despatch Co Ltd (NTDC) operates as an electric utility that generates, transmits, dispatch and distributes electricity. The company operates and maintains a network of grid stations and transmission lines. Its services offerings include planning and design, operations and maintenance, monitoring and testing, pre-commissioning test, technical analysis, technical auditing, thermovision survey and technical training services. NTDC also provides online bill payment, rebates and incentives, electrical safety, energy conservation, outage reporting, load management, energy assistance and meter reading services.

Methodology

All publicly-announced T&D Line & Substation projects included in this analysis are drawn from GlobalData’s Power IC. The information regarding the projects is sourced through secondary information sources such as country specific utility players, company news and reports, statistical organisations, regulatory body, government planning reports and their publications and is further validated through primary from various stakeholders such as power utility companies, consultants, energy associations of respective countries, government bodies and professionals from leading players in the power sector.

@AmjadHafeez19

Two 500KV double circuit transmission lines were planned from Thar to Matiari and 2016. One completed in 2019 to evacuate Engro Tahr 660MW. 2nd line couldn't be completed 2018-22 period for further 1980MW Thar Coal Evacuation.

https://twitter.com/AmjadHafeez19/status/1629372792159326209?s=20

https://dailytimes.com.pk/1059922/10-years-of-bri-lawmakers-visit-port-qasim-power-project/

The Pakistan-China Institute (PCI) hosted a two-day delegation visit to CPEC projects such as the Port Qasim Power Project and the Thar Coal Mines at Sindh Electric Coal Mining Company, according to Gwadar Pro.

The delegation, led by Senator Mushahid Hussain Syed, included renowned parliamentarians from various political parties. Guo Guangling, CEO of Port Qasim Electric Power Company, hosted and welcomed the delegation on the first day and briefed them on the project’s unique operation.

The delegation was briefed on the most recent developments in CPEC’s energy sector, CPEC’ contribution to the Pakistani economy and the opportunities for interaction between Chinese investors and delegates.

The Port Qasim Power Project uses Super Critical Technology, which emits white smoke that is environmentally friendly. It is currently operational and connected to the national grid.

Senator Mushahid Hussain Syed thanked Power China and the people of China for trusting and investing in Pakistan, especially when Pakistan was facing the most deadly wave of terrorism. “By constructing an economic corridor that promotes connection, construction, exploration of investments, and people-to-people contacts for connectivity, CPEC is aiming to better the lives of the people of Pakistan and China,” he added.

According to the data provided by PCI, 12 energy projects have been completed under CPEC in the last 10 years. In total, there are 36 active projects with an estimated cost of $27.5 billion. It is expected that many of these projects will be completed by 2023.

As per the data, the completed energy projects include the 1320MW Sahiwal Coal-fired power plant, 1320 MW Coal-fired power plant at Port Qasim, Karachi, 1320 MW China Hub Coal Power Project, Hub Balochistan, 660 MW Engro Thar Coal Power Project, 720 MW Karot Hydropower Project, AJK/Punjab, 100MW UEP wind farm Jhimpir, Thatta, 50 MW Sachal wind farm, Jhimpir, Thatta, 100 MW Three Gorges second and third Wind power project, 1000 MW Quaid-e-Azam solar park Bahawalpur, 50 MW Hydro China Dawood Wind Farm Gharo, Thatta, Matiari to Lahore 660 KV HVDC transmission line project, 4000 MW evacuation capacity, and 330 MW HUBCO Thar coal power project.

For several years, Pakistan’s cities and villages have suffered from power outages lasting several hours a day. In January, a nationwide blackout plunged the country of 230 million people into darkness. But the problem isn’t energy supply.

https://www.cnbc.com/video/2023/03/06/whats-behind-pakistans-energy-blackouts-and-power-outages.html

This January, much of Pakistan’s population of nearly 230 million people plunged into darkness, bringing widespread disruption to people and industries for almost 24 hours.

“If you go to our government hospitals – which didn’t have back-up facilities – or field hospitals, or small nursing homes, they had to stop all their services,” said Dr. Shayan Ansari, a surgeon at a private hospital in Pakistan’s capital, Islamabad.

A similar incident struck last October. Meanwhile, smaller blackouts regularly hit cities and villages for several hours daily.

But the problem is not energy supply.

“We don’t have a problem as far as the supply of energy is concerned in Pakistan,” said Ishrat Husain, who served as an advisor to ex-Prime Minister Imran Khan. “Both outages were caused because there were fluctuations on the transmission lines, which have not been updated for quite some time.”

In 2020, nearly 20 percent of Pakistan’s energy was simply lost during transmission, distribution and delivery.

Pakistan’s energy problems are having a cascading effect on the country’s economy, which is on the verge of collapse. Watch the video above to find out more.

If India stopped burning coal tomorrow, over five million people would lose their jobs. But for a price tag of around $900 billion over the next 30 years, the country can make sure nobody is left behind in the huge move to clean energy to curb human-caused climate change, according to figures released by New Delhi-based think tank Thursday.

The International Forum for Environment, Sustainability and Technology, known by the acronym iFOREST, released two reports detailing how much it will cost for India to move away from coal and other dirty fuels without jeopardizing the livelihoods of millions who still are employed in coal mines and thermal power plants.

Ensuring that everyone can come along in the clean energy shift that's needed to stop the worst harms of climate change and guaranteeing new work opportunities for those in fossil fuel industries, known as a just transition, has been a major consideration for climate and energy analysts.

“Just transition should be viewed as an opportunity for India to support green growth in the country’s fossil fuel dependent states and districts,” said Chandra Bhushan, the head of iFOREST.

To get the $900 billion figure, the group researched four coal districts in India and identified eight different cost factors, like setting up infrastructure and getting workers ready for the transition.

The biggest single investment to enable a just transition will be the cost of setting up clean energy infrastructure, which the report estimates could be up to $472 billion by 2050. Providing workers with clean energy jobs will cost less than 10% of the total amount required for a just transition, or about $9 billion.

The think tank said $600 billion would come as investments in new industries and infrastructure, with an additional $300 billion as grants and subsidies to support coal industry workers and affected communities.

“The scale of transition is massive. If formal and informal sector workers are included, we are talking about an industry that is the lifeline for 15-20 million people,” said Sandeep Pai, a senior associate at the Center for Strategic and International Studies, a Washington D.C. based think tank. “Reports like this are extremely important since the just transition conversation is beginning only now in India ... we need much more of the same.”

India is one of the largest emitters of planet-warming gases, behind only China, the U.S. and the EU. The country depends on coal for 75% of its electricity needs and for 55% of its overall energy needs.

The country is still a far way off quitting coal. Earlier this month, the Indian government issued emergency orders stipulating that coal plants are run at full capacity through this summer to avoid any power outages. The country’s coal use is expected to peak between 2035 and 2040, according to government figures.

Prime minister Narendra Modi announced in 2021 that the country will achieve net zero emissions — where it only puts out greenhouse gases that it can somehow offset — by 2070. On Monday, United Nations Secretary-General António Guterres urged nations to speed up their net zero goals, calling for developing countries to set a target of 2050. He was met with a muted response.

The reports recommends that the Indian government focuses on retiring old and unprofitable mines and power plants first. Over 200 of India's more than 459 mines can be retired in this way.

https://www.globaltimes.cn/page/202303/1287903.shtml

Pakistani Prime Minister Shahbaz Sharif here on Wednesday formally inaugurated the Thar Coal Block-I Coal Electricity Integration project, an energy cooperation project under the framework of the China-Pakistan Economic Corridor (CPEC).

The plant, which was officially put into commercial operation in early February, has two 660-megawatt high-parameter coal-fired generating units, supported by an annual output of 7.8 million tons of lignite open-pit coal mine. It is capable of meeting the electricity demand of 4 million households in Pakistan.

Addressing the inauguration ceremony, Sharif said that it is a moment of great delight for the whole of Pakistan.

This was a desert region with the sand dunes only, the prime minister said, adding, "Now it has been transformed and industrialized."

It is producing electricity which is being transmitted all across Pakistan, bringing prosperity into the entire country, he said.

"This great project would provide a lot of boost to Pakistan's economy in the years to come," Sharif added.

On the occasion, Pang Chunxue, charge d'affaires of the Chinese embassy in Pakistan, said that Thar Coal Block-I would help Pakistan in reducing fuel imports, saving foreign exchange reserves, optimizing power supply structure and enhancing energy security.

"It has provided more than 18,000 direct employment opportunities for the locals, with a cumulative tax payment of 120 million U.S. dollars and corporate social responsibility expenditure of over 1.3 million dollars," said Pang.

https://www.livemint.com/news/india/indias-power-output-grows-at-fastest-pace-in-33-years-fuelled-by-coal-11680738025627.html

Fossil fuel-fired power output rises fastest in nearly 3 decades

Emissions from power gen rose nearly a sixth to 1.15 bln tonnes

Coal-fired power output up 12.4%, gas-fired output down 29%

Share of coal in overall power output rose to 73.1%

Renewables output rose 21.7%, share up to 11.8%

The rise in power demand due to intense summer heatwaves, a colder-than-usual winter in northern India, and an economic recovery compelled India to increase its power output from coal plants and solar farms, preventing power cuts.

An analysis of daily load data from regulator Grid-India showed that power generation in India increased by 11.5% to 1,591.11 billion kilowatt-hours (kWh) in the fiscal year ending in March 2023. This rise in power generation was the highest since the year ending March 1990.

The analysis revealed that fossil-fuel-based plants witnessed an 11.2% growth, the highest in over 30 years, with coal-fired plants recording a 12.4% surge in electricity production, compensating for a 28.7% decrease in cleaner gas-fired plant output due to high global liquefied natural gas (LNG) prices.

In the new fiscal year that began April 1, Indian power plants are expected to burn about 8% more coal.

The rapid acceleration in India's coal-fired output to address a spike in power demand underscores challenges faced by the world's third largest greenhouse gas-emitter in weaning its economy off carbon, as it attempts to ensure energy security to around 1.4 billion Indians.

Total power supplied during the last fiscal year was 1509.15 billion kWh, 8.4% higher than a year earlier but still 6.69 billion units short of demand, the widest deficit in six years.

Electricity generated from coal rose to 1,162.91 billion kWh, the data showed, with its share in overall output rising to 73.1% - the highest level since the year ending March 2019.

India's Central Electricity authority estimates that 1 million kWh of power produced from coal generates 975 tonnes of carbon dioxide, while the same amount of power generated from gas produces 475 tonnes. A plant fired by lignite, known as brown coal, emits 1,280 tonnes to produce equivalent power.

RENEWABLES PUSH

Increased fossil fuel burning for power in the world's fifth largest economy drove up CO2 emissions during the year by nearly a sixth, to 1.15 billion tonnes, Reuters calculations based on government data and emissions estimates show.

That is 3.4% of the International Energy Agency's estimate of annual global emissions of 33.8 billion tonnes in 2022.

Many major countries boosted coal use in the twelve months due to Russia's invasion of Ukraine, but the rise was steepest in India, data from energy think-tank Ember shows.

The government has defended India's high coal use citing lower per capita emissions compared with richer nations and rising renewable energy output.

After missing a target to install 175 GW in renewable energy capacity by 2022, India is trying to boost non-fossil capacity - solar and wind energy, nuclear and hydro power, and bio-power - to 500 GW by 2030.

During the fiscal year that recently ended, India's solar capacity additions increased by 20%, leading to a record increase of 33.3 billion units or 21.7% in renewable energy output to 187.1 billion units, as per data analysis.

The significant rise in green energy output prevented 32.5 million tonnes of CO2 emissions that would have otherwise resulted from coal-fired power generation.

The data also revealed that the share of renewables in power generation, excluding large hydro and nuclear power, increased from 10.8% to 11.8% in 2022/23, primarily due to a 35% rise in solar output.

Author links open overlay panel Ghulam Mohyuddin Sohail a, Ahmed E. Radwan b, Mohamed Mahmoud c

https://www.sciencedirect.com/science/article/pii/S235248472200840X

Recent advancements in technologies to produce natural gas from shales at economic rates has revealed new horizons for hydrocarbon exploration and development worldwide. The importance of shale oil and gas has aroused worldwide interest after the great success of production in North America. In this study, different marine source rocks of Pakistan are evaluated for their shale gas potential using analogs selected from various North American shales for which data have been published. Pakistani formations reviewed are the Datta (shaly sandstone), Hangu (sandy shale), Patala (sandy shale), Ranikot (shaly sandstone), Sembar (sandy shale) and Lower Goru (shaly sandstone) formations, all of which are known source rocks in the Indus Basin. Available geological data of twenty-six wells (e.g., geological age, depositional environment, lithology and thickness), geochemical data (e.g., total organic carbon (TOC), vitrinite reflectance (Ro), rock pyrolysis analysis and maturity), petrophysical data (e.g., porosity and permeability) and dynamic elastic parameters estimated from logs (Young’s modulus and Poisson’s ratio) have been investigated. According to this study, the Pakistani shales are explicitly correlated with the most active shale gas plays of North America. The burial depths or geological position of the Pakistani shales are generally comparable to or slightly higher than the North American shales based on the available data. The thicknesses of the Pakistani (except for the Sembar shale) and North American shales fall in similar ranges. In terms of mineralogical composition, all of the Pakistani shales except the Ranikot and Hangu shales have quartz contents in the 40% to 50% range (approximately), which is similar to most of the North American shales. The high maximum TOC of the Hangu and Sembar shales (10%) is comparable to the New Albany, Antrim and Duvernay shales. The maximum TOC values for the Ranikot (3%), Lower Goru (1.5%) and Datta (2%) shales are lower than all North American shales. The TOC of Patal Shale (

5%–10%) is comparable to Fayetteville and Eagle Ford shales. The geological and geochemical parameters of all the Pakistani shales reviewed in this work are promising regarding their shale gas prospects. However, geomechanical data are required before conclusions on these shales’ economic production can be made with confidence.

-------------------

The exploitation of shale gas reservoirs may enhance gas production and reduce the severity of the ongoing energy crisis. The main challenge in Pakistan is to evaluate the shales using limited data and samples. That is why only a few companies are working on shale gas reservoirs in Pakistan now. The researchers need to assess and rank prospective Pakistani shales to entice companies to consider shale gas development. The geological characterization of Pakistani shales has been investigated by several authors (e.g., Warwick et al., 1995, Kazmi and Abbasi, 2008, Ahmad et al., 2012, Hakro and Baig, 2013, Jalees, 2014), but detailed work is required on geochemical, petrophysical and geomechanical characterization for assessing the actual potential of shales in Pakistan (Abbasi et al., 2014).