World's Tallest Skyscraper Planned in Pakistan

Bahria Town and Abu Dhabi Group agreed to invest $45 billion in real estate in Pakistan. After signing the investment deal, Malik Riaz and Shaikh al-Nahyan announced that Karachi, not Dubai nor Shanghai, will soon boast having the world's tallest building.

Representing the largest foreign investment to date in Pakistan, there will be $35 billion invested in several large commercial and residential real estate projects in Karachi, and another $10 billion in Lahore and Islamabad. It's expected to create 2.5 million new jobs in the country.

His Highness Sheikh Nahyan bin Mubarak al Nahyan, Chairman of Abu Dhabi Group, was quoted by Express Tribune as saying, “I am genuinely happy that in this historic project of Pakistan we are working with the visionary Malik Riaz Hussain, this guarantees that not only the project will be delivered beyond our expectations but also before time. We will Inshallah be welcoming first residents in next 3-4 years.”

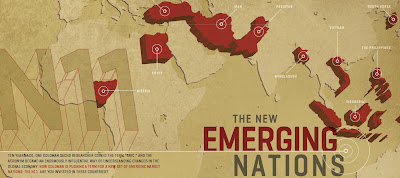

Why is Abu Dhabi Group interested in investing in Pakistan? Why not put all or most of these $45 billion in GCC or other Middle East nations? Answering a reporter's question about the growth prospects of GCC (oil-rich nations of Gulf Cooperation Council) at a recent investment conference in Dubai, Golman Sachs' Jim O'Neill said: "Some GCC countries are well placed to be hubs for the BRIC and N-11-influenced world. I often think of Dubai as a kind of N-11 center, even the capital of the N-11 world, given its business adjacency to Egypt, Pakistan, Iran, Turkey, and, of course, India and Russia."

Pakistan is already experiencing a renewed construction boom with cement sales rising by double digits. Domestic cement consumption surged 10.10% in Pakistan in January 2013, according to All Pakistan Cement Manufacturers Association. On top of 8% increase in Fiscal Year 2011-12, it jumped another 8% for the first seven months of Fiscal Year 2012-13.

There is a lot of privately funded real estate development activity visible in all major cities of the country. Big real estate developers like Bahria Town and Habib Construction are developing both commercial and housing projects in Islamabad, Karachi and Lahore. Other cities like Faisalabad, Hyderabad, Larkana, Multan, Mirpur, Peshawar and Quetta are also seeing new housing communities, golf courses, hotels, office complexes, restaurants, shopping malls, etc.

Cement consumption is an important barometer of national economic activity, according to a research report compiled by a Credit Suisse analyst. Last year, CS analyst Farhan Rizvi said in his report that "higher PSDP (Public Sector Development Program) spending has led to a resurgence in domestic cement demand in FY12 (+8%) and with increased PSDP allocation for FY13 (+19%) and General Elections due in 2013, domestic demand is likely to remain robust over the next six-nine months". This latest investment will add to it. It will give a big boost to the national economy.

The Abu Dhabi Group is a major investor in Al-Falah Bank and United Bank in Pakistan. It recently announced acquisition of all of SingTel’s shares in Warid Telecom, a mobile telephone service operator in Pakistan. With the agreement, the group has become the sole owner with equity holding of 100% in the Pakistani telecom company. Abu Dhabi Group said it plans to improve Warid Telecom’s operations in Pakistan by introducing new technologies, services and packages.

Back in 2008, there was a lot of excitement in Pakistan when Dubai developer Emaar announced a massive real estate project valued at $43b to develop two island resorts near Karachi. That investment never materialized. Let's hope this time will be different. Let's hope Abu Dhabi Group and Bahria Town will follow through on their commitments.

Here's a video of Malik Riaz speaking with Dunya News:

Related Links:

Haq's Musings

Renewed Construction Boom Pushes Cement Sales in Pakistan

DCK Green City in Karachi, Pakistan

Pakistan on Goldman Sachs' Growth Map

Investment Analysts Bullish on Pakistan

Precise Estimates of Pakistan's Informal Economy

Comparing Pakistan and Bangladesh in 2012

Pak Consumer Boom Fuels Underground Economy

Rural Consumption Boom in Pakistan

Pakistan's Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Representing the largest foreign investment to date in Pakistan, there will be $35 billion invested in several large commercial and residential real estate projects in Karachi, and another $10 billion in Lahore and Islamabad. It's expected to create 2.5 million new jobs in the country.

His Highness Sheikh Nahyan bin Mubarak al Nahyan, Chairman of Abu Dhabi Group, was quoted by Express Tribune as saying, “I am genuinely happy that in this historic project of Pakistan we are working with the visionary Malik Riaz Hussain, this guarantees that not only the project will be delivered beyond our expectations but also before time. We will Inshallah be welcoming first residents in next 3-4 years.”

Why is Abu Dhabi Group interested in investing in Pakistan? Why not put all or most of these $45 billion in GCC or other Middle East nations? Answering a reporter's question about the growth prospects of GCC (oil-rich nations of Gulf Cooperation Council) at a recent investment conference in Dubai, Golman Sachs' Jim O'Neill said: "Some GCC countries are well placed to be hubs for the BRIC and N-11-influenced world. I often think of Dubai as a kind of N-11 center, even the capital of the N-11 world, given its business adjacency to Egypt, Pakistan, Iran, Turkey, and, of course, India and Russia."

Pakistan is already experiencing a renewed construction boom with cement sales rising by double digits. Domestic cement consumption surged 10.10% in Pakistan in January 2013, according to All Pakistan Cement Manufacturers Association. On top of 8% increase in Fiscal Year 2011-12, it jumped another 8% for the first seven months of Fiscal Year 2012-13.

There is a lot of privately funded real estate development activity visible in all major cities of the country. Big real estate developers like Bahria Town and Habib Construction are developing both commercial and housing projects in Islamabad, Karachi and Lahore. Other cities like Faisalabad, Hyderabad, Larkana, Multan, Mirpur, Peshawar and Quetta are also seeing new housing communities, golf courses, hotels, office complexes, restaurants, shopping malls, etc.

Cement consumption is an important barometer of national economic activity, according to a research report compiled by a Credit Suisse analyst. Last year, CS analyst Farhan Rizvi said in his report that "higher PSDP (Public Sector Development Program) spending has led to a resurgence in domestic cement demand in FY12 (+8%) and with increased PSDP allocation for FY13 (+19%) and General Elections due in 2013, domestic demand is likely to remain robust over the next six-nine months". This latest investment will add to it. It will give a big boost to the national economy.

The Abu Dhabi Group is a major investor in Al-Falah Bank and United Bank in Pakistan. It recently announced acquisition of all of SingTel’s shares in Warid Telecom, a mobile telephone service operator in Pakistan. With the agreement, the group has become the sole owner with equity holding of 100% in the Pakistani telecom company. Abu Dhabi Group said it plans to improve Warid Telecom’s operations in Pakistan by introducing new technologies, services and packages.

Back in 2008, there was a lot of excitement in Pakistan when Dubai developer Emaar announced a massive real estate project valued at $43b to develop two island resorts near Karachi. That investment never materialized. Let's hope this time will be different. Let's hope Abu Dhabi Group and Bahria Town will follow through on their commitments.

Here's a video of Malik Riaz speaking with Dunya News:

Related Links:

Haq's Musings

Renewed Construction Boom Pushes Cement Sales in Pakistan

DCK Green City in Karachi, Pakistan

Pakistan on Goldman Sachs' Growth Map

Investment Analysts Bullish on Pakistan

Precise Estimates of Pakistan's Informal Economy

Comparing Pakistan and Bangladesh in 2012

Pak Consumer Boom Fuels Underground Economy

Rural Consumption Boom in Pakistan

Pakistan's Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Comments

KARACHI: VY Belokrenitsky says the country has come a long way since Partition

Many intellectuals believe that internal problems and geopolitical upheavals have taken Pakistan to the brink. But according to Russian scholar VY Belokrenitsky, who has spent decades studying its history, the country remains as strong as any other.

“If you look at all that has happened in the past, Pakistan’s is a success story,” he said during the launch of the book ‘A Political History of Pakistan: 1947 to 2007’ on day two of the fourth Karachi Literature Festival on February 16. He has co-authored the book with compatriot VN Moskalenko.

Belokrenitsky said that at the time of Partition, Pakistan was made up of areas which were less developed and faced problems. “Since then, many parts have urbanised and the population has grown manifold. It has become a vibrant society.”

The book has been divided into seven parts which trace the country’s history from the pre-partition era to the tumultuous end of General (retd) Pervez Musharraf’s government.

Belokrenitsky said the book has been written from the Russian perspective, with a particular emphasis on the relationship between the two countries. However, it also deals with prominent political developments.

“We have discussed matters related to the upper level of politics. There is something going on underneath all that as well and not many people know about that. It needs to be studied more.”

He said that years 2013 and 2014 can be a turning point for Pakistan as foreign troops are expected to exit Afghanistan. Columnist Humayun Gauhar also spoke at the event.

http://tribune.com.pk/story/508270/russian-scholar-labels-pakistan-a-success-story/

Pakistani construction tycoon Malik Riaz has signed a multi-billion dollar deal with Abu Dhabi group to build the world's tallest building in the country overtaking Dubai's Burj Khalifa.

The project is likely to come up on an island some 3 to 4 kilometres off the coast of Karachi and into the Arabian sea.

Riaz is confident that the project will generate around 2.5 million jobs and promote investment opportunities for different industries.

Riaz signed the USD 45 billion deal yesterday with the Abu Dhabi group which also successfully runs the Al-Falah bank chain in Pakistan.

According to the agreement, USD 45 billion would be invested on different construction projects in Pakistan.

Out of the total amount, about USD 35 billion worth of investments will be made in Sindh while USD 10 billion will be invested in Islamabad and Lahore, media reports said.

"We have selected the site for our mega project which will be spread over 16,000 acres of land and also house 125,000 houses," Riaz said today.

"Besides the world's tallest building the project will include a media city, a sports city, an international complex, a medical and educational complex, restaurants, shopping centres, multiplex halls," Riaz said.

Though Riaz did not name the site where the project would be constructed but sources aware of the developments told PTI that the site for the project would most likely be an island some 3 to 4 kilometres off the coast of Karachi and into the Arabian sea.

"It is most likely going to be the 'Kutta Island' which gets its name because stray dogs which are killed are dumped on it," a source said.

The source said the island was also given to another big construction magnate Emmar properties of the UAE but the project was scrapped.

Riaz said the Emmar project was scrapped and they lost millions of dollars because of the global recession and because there was no direct and strong local presence in the project.

Riaz rose to prominence with his 'Bahria' town residential projects throughout Pakistan and also after the Supreme Court took up the hearing of the case in which the son of Chief Justice Iftikhar Chaudhry was accused of taking money and favours from him allegedly in return of settling cases.

Riaz said the tallest building in Karachi would beat the Burj Khalifa of Dubai.

"This construction project will bring in staggering investment into Pakistan and it will benefit industries and people. My dream is to create a new Pakistan and new Karachi," he said.

http://www.hindustantimes.com/world-news/Pakistan/Pakistan-tycoon-to-build-world-s-tallest-tower/Article1-1012730.aspx

Pakistan has offered major financial and tax-free business incentives and infrastructure facilities to foreign investors as a big Saudi steel mills goes on stream.

These incentives were offered at the highest level by Prime Minister Raja Pervez Ashraf. The prime minister’s came on the occasion of the inauguration of production at the just-built state-of-the-art Tuwairqi Steel Mills Limited (TSML), built by Al Tuwairqi Group of Industries of Saudi Arabia, and South Korea’s Pohang Iron and Steel Company (Posco). Al Tuwairqi Group has invested $350 million and Posco $16 million in the project. This first phase of TSML has been completed at a cost of $366 million. It will produce 1.28 millions tonnes of steel annually. It is the first steel mill in Pakistan built by the private sector.

The inauguration ceremony was highlighted by the prime minister’s unveiling of the pro-FDI incentives plan. Prime Minister Ashraf invited foreign and local investors to come up with industrial projects to be located at Pakistan’s Export Processing Zones (EPZs).

Pakistani EPZs have all modern infrastructure. “I urge foreign investors from across the globe to invest in Pakistan. I assure you full government support, facilities, a business-friendly environment and policies. At our EPZs we provide you with a huge number of incentives and exemptions,” he said.

The key features of Pakistan’s investment policy include, equal treatment to Pakistani and foreign investors, 100 per cent share holding in projects and businesses, an unlimited repatriation of the dividends, annual and accumulated profits. Highlighting these incentives, and still many more, the prime minister asked foreign investors, particularly those from Islamic countries, “to benefit from Pakistan’s EPZs.”

--------

“We at Al Tuwairqi, feel honoured in introducing the world’s most advanced DRI technology, based on the Midres process, owned by Kobe Steel of Japan, in Pakistan,” he said.

TSML is also embarking upon several new projects, subsequent to commercial operation of DRI project. It plans to work on the upstream and downstream production processes, involving billet/thin slabs production, and iron ore exploration in Pakistan, its beneficiation and pelletisation.

“As our social corporate responsibility, we are also focused on the clean power generation in Pakistan,” Dr Hussain said. “We see Pakistan as a land of immense opportunities. We are very clear in our perception that Pakistan, as a country has to grow, and we are determined to play an instrumental role towards its development. In the survival of Pakistan is the survival of the entire Muslim Ummah,” he said.

Posco chairman and CEO Joon-Yang Chung, said: “The TSML will significantly contribute towards Pakistan’s economy.”

“Today, Pakistan’s economic development and structural adjustment calls for a higher quality steel products to be manufactured in this country. At TSML, we will develop high-performance products, featuring high strength, corrosion resistance, sustainability and light- weight, and improve the technological competence related to such products. To add to its success, Posco is determined in building a successful partnership with Al Tuwairqi to benefit from its presence in Pakistan and is fully focused to make TSML a world class steel making unit through possible expansion of initially set DRI plant using forward and backward integration,” added Chung.

With all stakeholders so determined, and so upbeat, output of high-grade products, and larger investment inflows look all set to benefit Pakistan.

http://www.khaleejtimes.com/kt-article-display-1.asp?xfile=data/internationbusiness/2013/February/internationbusiness_February102.xml§ion=internationbusiness

KARACHI: Even as most of the city remained shut on Monday owing to a strike call, the Karachi Stock Exchange’s (KSE) benchmark 100-share index gained 0.38% or 68.39 points to end at 17,865.61 points.

The rally was helped by positive news flows from multiple sources, prominent among which were expectations that the cement sector would record a surge in earnings due to stronger domestic sales, higher prices and lower input costs. Also featured was news that the Oil and Gas Development Company (OGDC) had signed direct agreements with fertiliser manufacturers for the supply of gas, and increased expectation that telecom companies will record higher revenues following Pakistan Telecommunication Company’s stellar profits on the back of higher international call termination rates.

Trade volumes remained flat at 292 million shares compared with Friday’s tally of 293 million shares. The value of shares traded during the day was Rs7.18 billion.

“Led by Engro and DG Khan Cement (DGKC), the Karachi bourse achieved a new high,” observed Samar Iqbal, equity dealer at Topline Securities. Both Engro and DGKC’s stocks closed at their upper price limits by the end of the day.

“The said agreement [between Engro and OGDC] will allow Engro to receive gas directly from gas fields, reviving financial prospects for its fertiliser business,” reported Sibtain Mustafa from Elixir Securities. “DGKC continued its positive momentum from last closing as news reports of a $45 billion deal between the Abu Dhabi Group and real estate tycoon Malik Riaz brought in fresh interest.”

Shares of 360 companies were traded on Monday. At the end of the day, 147 stocks closed higher, 161 declined while 52 remained unchanged. Pakistan Telecommunication Company was the volume leader with 29.23 million shares, gaining Rs0.82 to finish at Rs22.77. It was followed by Pace (Pakistan) with 26.60 million shares, gaining Rs0.39 to close at Rs4.32 and NIB Bank with 19.83 million shares, gaining Rs0.15 to close at Rs2.88.

“The majority of volumes were focused on third-tier stocks [...] as retail participation continues to rise. Furthermore, news of Ministry of Petroleum agreeing to increase POL margins by Rs0.25 per litre for motor spirit and Rs0.10 per litre for high-sulphur diesel brought interest in listed oil marketing companies near market end,” Mustafa added.

Foreign institutional investors were net buyers of Rs88.51 million worth of shares, according to data maintained by the National Clearing Company of Pakistan Limited.

http://tribune.com.pk/story/509210/market-watch-bourse-continues-climb-despite-strike/

Representatives of about twenty (20) Korean investment companies are scheduled to visit Pakistan from Feb 27 to March 2 to explore investment.

During the visit, the representatives of these companies are scheduled to hold meetings with the concerned quarters of the projects, sources of BOI said. According to details, the companies include Samsung Constructions and Trading Corporation that will hold meetings for investment in LNG offshore receiving terminal project, CNG bus project through PPP mode and power projects.

The company has also been requested to invest Karachi-Hyderabad expressway and Karachi-Port Qasim elevated expressway, the sources added.

Lotte Group would explore projects in petrochemical sector while Wisdom will be seeking investment opportunities in agriculture sector by utilizing the strengths of both the countries as Pakistan has rich agriculture and dairy resources while Korea has advanced food processing technology.

Similarly, Six-Group Company would be looking projects in LNG and steel market and is also expected to take part in the tender floated by Sui Southern Gas Company.

Korean Railroad would seek investment potential in supplying unused locomotives to Pakistan in addition to providing simulators and training for locomotives’ drivers through KOICA grant.

ECO-One would look investment opportunities in auto rickshaw market, while Korea Water Resource Corporation (K-Water) is interested in hydro power sector and consortium with Daewoo E&C in hydropower project and Lower Palos Valley project.

Dooson Corporation can be a potential investor for Special Economic Zones in Pakistan while GS E&C is interested in desalination, hydro power sector and highway projects. CK Solar will look for opportunities in solar energy sector as the company has been doing a pilot project of about 65kw in PM house and has signed 300 MW solar plant agreement in Balochistan.

Dongin Medical Centre is planning to establish a hospital and resort in any major city of Pakistan while Deokjae Construction (Pvt) Ltd is interested in road and high ways projects as it has participated in Hyderabad Mirpurkhas Dual Carriage Road Project.

Sambo Engineering Company and Korea Engineering Consultants Corporation is also interested in road and hydro power projects.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-online/business/20-Feb-2013/koreans-to-visit-pakistan-in-last-week-of-feb

KESC would invest about $500 million for setting up of coal-based power plants, improvement in transmission and distribution systems in Karachi during the next five years, said Tabish Gohar, chairman, KESC board of directors here on Thursday.

A five-member KESC delegation briefed the Minister for Water and Power, Chaudhry Ahmad Mukhtar, on plans to improve power supply situation in Karachi.

Mr Gohar said that the Bin Qasim power plant would be converted on imported and local coal to generate 400MW cheaper electricity with an investment of $300 million.

The conversion plan would take almost 20 months to complete.

The KESC would spend $80 million on conversion of gas-based plants on combined cycle, while $80 million would be spent on smart grid station that would help improvement and transmission system.

The KESC chairman said that due to investment plan, the power system in Karachi would improve, and power thefts and line losses would be checked.

He also briefed the minister on outsourcing of some of its feeders and future plans to meet the electricity requirements.

http://dawn.com/2013/02/22/kesc-to-invest-500m-in-coal-plants/

It has been erroneously reported by certain media outlets in Pakistan and elsewhere that an investment of $45 Billion is being considered by the Abu Dhabi Group in a major real estate development project in Karachi. The level of Investment referenced has not been discussed or agreed.

"It is possible that the amount referenced may be based upon Bahria Town's own estimates and projections, as the Sponsor and Developer of the project. It is perhaps indicative of the overall market value of the entire development once it is completed in the fifteen to twenty year forecasted timeframe. However, this cannot be verified.

"In order to clarify matters, it should be stated for the record that a non-binding Memorandum of Understanding was entered into by Dhabi Contracting Establishment, a business unit based in Abu Dhabi, which is wholly owned by Sheikh Nahayan Mabarak Al Nahayan, and not by the Abu Dhabi Group. The Memorandum of Understanding was simply an indication of interest by Dhabi Contracting to cooperate with Bahria Town Pakistan (Pvt) Ltd to provide technical support and assistance to the project - as, when and if appropriate commercial terms and conditions were agreed.

"It must be stated clearly and unequivocally that neither Sheikh Nahayan, the Abu Dhabi Group, Dhabi Contracting nor any other related party have undertaken or assumed any financial obligation or commitment to invest in this project and that there is no agreement to do so. However, it should be noted that Sheikh Nahayan continues to value his long-standing relationship with Pakistan and remains committed to his existing investments and to future business opportunities that may arise. It is unfortunate that a discussion on possible technical matters between two construction companies has been misconstrued. "It is also unfortunate that discussions between the parties could not reach any conclusion and the Memorandum of Understanding has been cancelled. "This clarification should adequately correct the record for all interested parties," the clarification concludes.-PR

http://www.brecorder.com/market-data/stocks-a-bonds/0/1156592/

Bahria Town and a US investment group signed an memorandum of understanding (MoU) for $15 to 20 billion investment on Monday.

Former Chairman of Bahria Town Malik Riaz and US investment group Thomas Kramer inked the MoU on behalf of their respective companies for the Bodha Island City project.

Under the project Bahria Town in collaboration with the foreign companies associated with prominent US investor Thomas Kramer would construct the world’s tallest building and a number of other projects some 3.5-kilometres off the Karachi shore.

Malik Riaz speaking on the occasion said that if he is given a chance he would make Pakistan into Dubai and Europe, He said that the project would help provide employment to the unemployed and this in turn would help eliminate terrorism. He said that we would continue to invest in Pakistan despite all odds and we are in talks with foreign investors.

Malik Riaz said that he promises the nation that in next few years he would bring foreign investment worth more than Rs 50 billion and no one can stop that. He said that until children are given quality education Pakistan cannot excel.

A spokesman for the Bahria Town said the project called Bodha Island City would be developed within a period of five to 10 years. He said the project would comprise, Net City, Education City, Health City, Port City and other infrastructure projects.

He said the worlds’ most modern shopping mall would also be built on the Island City, which would deal with international brands.

According to reports, the Island City would be linked with Karachi through a six-lane bridge.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-online/national/11-Mar-2013/safe-city-project-malik-riaz-vows-to-bring-more-investment-in-country

..American real-estate tycoon Thomas Kramer and Bahria Town CEO Ahmed Ali Riaz Malik signed a $20 billion agreement for Pakistan’s first-ever Island City, Bundal & Buddo Islands, Karachi.

A joint consortium of international investors will join hands to develop this project and the deal with Kramer is the first level of this agreement. Announcement of other global investors from the Middle East and around the globe will be made soon.

Covering 12,000 acres of land, this project will be developed in a span of 5-10 years but the residential communities will start being handed over to people in 2016. The global attractions of the project comprise world’s tallest building, world’s largest shopping mall, sports city, educational & medical city, international city and a media city – all having the most modern facilities and amenities and the most advanced infrastructure.

Island City will be connected to the DHA Karachi via a six-lane modern bridge. The entire city will be a ‘high security zone’, having its own drinking water (converting seawater into drinking water) and power generation plants to enable it to be self-sufficient in electricity.

The project will have mosques, cinemas, spas, golf clubs, school, hospital and other global standard amenities to furnish a modern lifestyle.

Speaking on the occasion, Thomas Kramer said, “I have full confidence in the people and economy of Pakistan. In 1970 when I started my project in Germany it was the worst era of their history. Likewise when Miami Beach project was started, the area was in full control of Cuban criminals, different mafias and gangsters. Dead bodies used to be scattered on the beaches. I completed my projects successfully. Today they are the world’s most secure and advanced regions.

“Current situation in Pakistan is much better than those areas. I am confident that this project along with boosting the economy will also eradicate terrorism from Pakistan. This is a once in a lifetime chance to bring Pakistan back on the map to the leading nations in the world.”

------------

Thomas Kramer is a visionary businessman commonly known as TK. He surveyed an island hideout of Cuban pirates in 1991-92 and later on developed it into the present day Miami Beach, which is one of the biggest international tourist destinations today. He is specialist in building skyscrapers in coastal areas. His company has successfully constructed several projects around the globe.

http://tribune.com.pk/story/519505/pakistans-1st-island-city-bahria-town-signs-20b-deal-with-us-tycoon/

The search for superior, uncorrelated risk-adjusted returns continues, and savvy investors such as endowments and family foundations are turning their attention to the frontier markets. Such markets exclude the BRICs, many of which posted sizable equity returns of over 30% last year, including Nigeria, Estonia, Pakistan, and Kenya. The MSCI Africa sub index posted one-year returns of over 60%. By comparison, the BRICs (Brazil, Russia, India and China) grew slower and sluggish—for example, around 4% on the Shanghai index and -2% on Brazil’s Bovespa.

A set of well-known factors bind these seemingly random countries. Solid debt and deficit dynamics; attractive labor trends, favorable demographics and upward mobility; and important productivity gains all make for a compelling economic growth story. However, there are two areas where perceptions of frontier economies are really changing: risk and liquidity.

In regards to risk, investors are beginning to better understand the significant benefits of delineating between risk, measurable and possible to calculate, and uncertainty, which is not. Like anywhere else, investors who can tap into on-the-ground networks and relationships have an advantage with risk management. But thankfully meaningful, the task of risk assessment has gotten easier with increases in transparency around economic and political information, data flows and widely available regulations over jurisdictions. The transition to western-styled democracy and fully transparent and liquid capital markets will be bumpy, but the uncertainty arising from these growing pains should be viewed in the context of an upwardly sloping trend line of progress which will almost certainly occur over a relatively short time line.

Correlations between frontier and developed stock market returns are around 0.75, compared to roughly 0.90 between developed and emerging economies such as the BRICs. Country risk premiums are close to those of the broader emerging markets. With proper risk management tools, this implies that investors can garner significant diversification benefits. The lower correlation between frontier and developed markets points to risk factors that are orthogonal to the global risk-on, risk-off theme that has captivated markets over the past five years. Frontier markets provide opportunities to step away from the global macroeconomic themes and focus on the micro stories on the ground, thus providing a better environment to identify unique investment opportunities. Smart investors are looking for great opportunities that are driven by company-specific issues from which they can analyze and profit.

In terms of liquidity, both equity and debt markets – international and local – have grown considerably over the last five years. Today, with a market cap of more than $1 trillion, the universe of stock markets boasts more than 8,000 listings across broad sectors with notable risk/reward profiles in financials such as banking and insurance, consumer goods, and telecommunications companies. A number of commentators erroneously believe investing in frontier markets is simply expressing a commodity trade. To assume this would be miss out on some of the more significant opportunities in these burgeoning markets such as in the logistics and telecommunication sectors. Moreover, to put a finer point on this, today Africa has almost 20 stock exchanges, with just over a thousand listed equities; more than 85% of these stocks are non-commodity related businesses....

http://qz.com/61403/forget-the-brics-frontier-markets-like-estonia-and-pakistan-are-the-place-for-alpha-investors/

Known as Waterfront Developments, the project has been devised to make huge fortunes for a select few, enormously powerful individuals, while giving short shrift to citizens’ rights and further decimating one of Karachi’s most valuable natural assets, its mangrove forests.

According to a petition filed against it in the Sindh High Court by advocate Mahfooz Yar Khan, the waterfront project involves a deal according to which some of the area will be acquired by DHA on payment while part of the remainder is to be developed by DHA and returned to the owner/s and the rest retained by DHA.

The parcelling out among political and military heavyweights of what should be protected land, and the manner in which the story has unfolded shows an astounding contempt for the law by all concerned.

-------

The story behind this mangrove forest goes back to 1994, when PPP’s Agha Tariq, then minister for mining, issued a 30-year mining lease for 342 acres (within the 490 acres now earmarked for the waterfront project) in the name of his wife, Gulnar Begum. In July 1996, through BoR Sindh, he had that lease illegally converted into a 99-year lease for commercial/residential/industrial purposes. Then, in September, through his wife, he sold the 342 acres to Marina City Developments, a partnership of businessmen Asif Baig Mohammed and Khalid Masood, and one Seema Treesa Gill.

“We wanted to develop the land into something better than the Dubai Marina, much before Dubai Marina even came up,” said Mr Masood.

According to court documents, the third partner, Ms Gill, was actually Gulnar Begum’s maidservant, an arrangement that gave the former de facto ownership in the 342 acres. In September 2007, Mr Tariq passed away.

There has been decades-long litigation over the 342 acres in various courts with regard to the allotment rate and, after a falling out between Mr Mohammed and Mr Masood, the issue of ownership as well. Court proceedings are still ongoing.

In the last few years another party has staked its claim to part of the 342 acres based on an agreement with one of the two businessmen. That case is also in the superior courts.

http://www.dawn.com/news/1140437/karachi-a-goldmine-for-land-developers

A 22 storey glass structure, 2 towers internally connected with 5 bridges? Wow. That's #UBLHeadOffice, a new #IconicLandmark in Karachi

According to UBL, this landmark represents the progressive and innovative past and the future of the bank. It is indeed a one of a kind high rise built by a banking company in Pakistan. The city’s skyline looks more lively with UBL’s new building towering over other commercial buildings in the area. https://propakistani.pk/2016/12/19/ubl-moved-headoffice-stunning-twin-skyline-karachi/

Egyptian billionaire ventures into Pakistan's real estate with $2b project

By Bilal MemonPublished: December 22, 2017

https://tribune.com.pk/story/1590668/2-egyptian-billionaire-ventures-pakistans-real-estate-2b-project/

Pakistan is set to see a new real estate venture – this time in the federal capital – as demand for housing keeps motivating projects across different parts of the country.

The $2-billion project, named Eighteen Islamabad based on its location, was formally launched in Islamabad on Friday and is a partnership between Egypt-based Ora Developers and Saif Group, the Pakistani conglomerate with business interests largely in textile, energy and real estate sectors. Additionally, Kohistan Builders and Developers is also partaking in the project.

Spread across 2.77 million square yards that will also feature a 18-hole golf course, the project will look to sell over 2,000 residential units – 1,068 villas of different sizes and over 900 apartments – along with commercial properties, meant to serve the upper-middle income groups.

The project also brings Egyptian billionaire Naguib Sawiris back to Pakistan after Orascom Telecom Media and Technology Holding, in which he has a majority stake and is also the chairman, had acquired Mobilink before the company sold its stake to VimpelCom.

Sawiris, however, is now on a different mission to Pakistan.

“I was here around 20 years ago when we started Mobilink,” said Sawiris, the chairman of Ora Developers, as he addressed a gathering of journalists at Serena Hotel.

“We wanted to continue our business in Pakistan and as we ventured out of telecom we thought of real estate development because I was horrified at the prices people were paying for villas and apartments in Islamabad,” he continued, referring to the phenomenally high prices of real estate in Pakistan that have continued to shoot in the last few years.

According to a World Bank estimate, there is a shortage of 10 million housing units in Pakistan, a deficit that continues to grow in urban areas. With population growth at 2%, the shortage will keep piling.

Sawiris said his aim would be to expand to other cities including Karachi and Lahore, but the challenge would be to find land in the provincial capitals.

“Land availability is the biggest issue facing the real estate sector in the country. Until the issue is resolved, challenges will remain.”

The $2-billion project features a 30% component of equity, to be injected by the investors, along with a 30% stake to be financed with major banks in Pakistan. Talks of these modalities are ongoing, said Eighteen Islamabad Chief Executive Officer Tarek Hamdy.

He also said no-objection certificates have been obtained from the Capital Development Authority in Islamabad and transfer deeds will be given to buyers since Eighteen Islamabad owns the land already.