Impact of Industrial Revolution on World's Economy and History

The Industrial Revolution marked the beginning of a major shift in economic, military and political power from East to West.

A research letter written by Michael Cembalest, chairman of market and investment strategy at JP Morgan, and published in the Atlantic Magazine shows how dramatic this economic power shift has been. The size of a nation's GDP depended on the size of its population and labor force in agrarian economies prior to the Industrial era. With the advent of the Industrial revolution, the use of machines relying on energy from fossil fuels dramatically enhanced labor productivity in the West and shifted the balance of power from Asia to America and Europe.

The shift in power was not just in economic terms. Enabled by machines such as steamboats and weapons like the repeating gun, the West engaged in long distance trade and warfare that led to the colonization and exploitation of Asia and Africa. The new colonies were used as a source of cheap raw materials for European factories and the colonized people served as captive customers for their manufactured products.

While development of Asian and African nations stagnated and their share of world GDP dropped precipitously, their colonial rulers in the West prospered. Social indicators like literacy and life expectancy showed little improvement in the colonies, according to data compiled by Professor Hans Rosling. For example, his Gapminder.org animations show that life expectancy in India and Pakistan was just 32 years in 1947. In Pakistan, it has

jumped to 67 years in 2011, and per Capita

inflation-adjusted PPP income has risen from $766 in 1948 to about $3000 in 2011. Similarly, literacy rate in undivided India was just 12% in 1947. It has increased to about 67% in India and 62% in Pakistan for people 15 years and above.

While development of Asian and African nations stagnated and their share of world GDP dropped precipitously, their colonial rulers in the West prospered. Social indicators like literacy and life expectancy showed little improvement in the colonies, according to data compiled by Professor Hans Rosling. For example, his Gapminder.org animations show that life expectancy in India and Pakistan was just 32 years in 1947. In Pakistan, it has

jumped to 67 years in 2011, and per Capita

inflation-adjusted PPP income has risen from $766 in 1948 to about $3000 in 2011. Similarly, literacy rate in undivided India was just 12% in 1947. It has increased to about 67% in India and 62% in Pakistan for people 15 years and above.

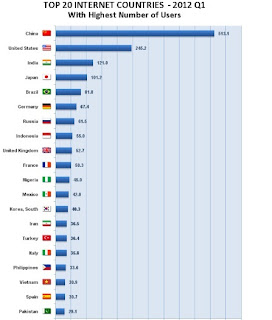

Indicators such as per capita energy consumption and Internet usage confirm the rise of Asia, particularly Asian giant China's. China's per capita energy consumption now stands at 68 million BTUs, about a fifth of US per capita energy consumption, but it's rising rapidly. Pakistan is at 15 million BTUs per capita, Bangladesh at 6 million BTUs and Sri Lanka at 10 million BTUs.In terms of Internet access, China now tops the world with over 500 million users, more than twice the number of Internet users in the United States. Among the world's top 20 are South Asian nations of India with 120 million Internet users and Pakistan with 30 million users, according to Internet World Stats.

While there has been progress on economic and social fronts in South Asia, the combined GDP of SAARC nation is still accounts for less than 4% of the world GDP. China has significantly increased its share and now accounts for more than 10% of the world GDP marking the biggest economic shift since the Industrial Revolution. China's growing economic clout will ultimately translate into political and military power in the international arena.

All indications are that the pendulum of power has just begun its swing eastward in the last decade. It could be a century or more before the effects of this swing are truly felt in terms of the exercise of economic, military and political power on the world stage. Meanwhile, the 21st century is shaping up to be another American century in which United States' extraordinary power will not go entirely unchallenged by multiple potential adversaries, including China.

Here's a video discussion on the subject:

http://vimeo.com/117657383

Vision 2047: Political Revolutions and South Asia from WBT TV on Vimeo.

Here's a video of a BBC documentary about Al Andalusia or Muslim Spain:

Related Links:

Haq's Musings

Pakistan Military Industrial Revolution

China's Checkbook Diplomacy

Education Attainment in South Asia

Pakistan Needs Comprehensive Energy Policy

Social Media Growth in Pakistan

Is America Young and Barbaric?

Godfather Metaphor for Uncle Sam

A research letter written by Michael Cembalest, chairman of market and investment strategy at JP Morgan, and published in the Atlantic Magazine shows how dramatic this economic power shift has been. The size of a nation's GDP depended on the size of its population and labor force in agrarian economies prior to the Industrial era. With the advent of the Industrial revolution, the use of machines relying on energy from fossil fuels dramatically enhanced labor productivity in the West and shifted the balance of power from Asia to America and Europe.

The shift in power was not just in economic terms. Enabled by machines such as steamboats and weapons like the repeating gun, the West engaged in long distance trade and warfare that led to the colonization and exploitation of Asia and Africa. The new colonies were used as a source of cheap raw materials for European factories and the colonized people served as captive customers for their manufactured products.

|

| History of Per Capita GDP of Selected Countries. Source: Angus Maddison |

While development of Asian and African nations stagnated and their share of world GDP dropped precipitously, their colonial rulers in the West prospered. Social indicators like literacy and life expectancy showed little improvement in the colonies, according to data compiled by Professor Hans Rosling. For example, his Gapminder.org animations show that life expectancy in India and Pakistan was just 32 years in 1947. In Pakistan, it has

jumped to 67 years in 2011, and per Capita

inflation-adjusted PPP income has risen from $766 in 1948 to about $3000 in 2011. Similarly, literacy rate in undivided India was just 12% in 1947. It has increased to about 67% in India and 62% in Pakistan for people 15 years and above.

While development of Asian and African nations stagnated and their share of world GDP dropped precipitously, their colonial rulers in the West prospered. Social indicators like literacy and life expectancy showed little improvement in the colonies, according to data compiled by Professor Hans Rosling. For example, his Gapminder.org animations show that life expectancy in India and Pakistan was just 32 years in 1947. In Pakistan, it has

jumped to 67 years in 2011, and per Capita

inflation-adjusted PPP income has risen from $766 in 1948 to about $3000 in 2011. Similarly, literacy rate in undivided India was just 12% in 1947. It has increased to about 67% in India and 62% in Pakistan for people 15 years and above.Indicators such as per capita energy consumption and Internet usage confirm the rise of Asia, particularly Asian giant China's. China's per capita energy consumption now stands at 68 million BTUs, about a fifth of US per capita energy consumption, but it's rising rapidly. Pakistan is at 15 million BTUs per capita, Bangladesh at 6 million BTUs and Sri Lanka at 10 million BTUs.In terms of Internet access, China now tops the world with over 500 million users, more than twice the number of Internet users in the United States. Among the world's top 20 are South Asian nations of India with 120 million Internet users and Pakistan with 30 million users, according to Internet World Stats.

While there has been progress on economic and social fronts in South Asia, the combined GDP of SAARC nation is still accounts for less than 4% of the world GDP. China has significantly increased its share and now accounts for more than 10% of the world GDP marking the biggest economic shift since the Industrial Revolution. China's growing economic clout will ultimately translate into political and military power in the international arena.

All indications are that the pendulum of power has just begun its swing eastward in the last decade. It could be a century or more before the effects of this swing are truly felt in terms of the exercise of economic, military and political power on the world stage. Meanwhile, the 21st century is shaping up to be another American century in which United States' extraordinary power will not go entirely unchallenged by multiple potential adversaries, including China.

Here's a video discussion on the subject:

http://vimeo.com/117657383

Vision 2047: Political Revolutions and South Asia from WBT TV on Vimeo.

Here's a video of a BBC documentary about Al Andalusia or Muslim Spain:

Related Links:

Haq's Musings

Pakistan Military Industrial Revolution

China's Checkbook Diplomacy

Education Attainment in South Asia

Pakistan Needs Comprehensive Energy Policy

Social Media Growth in Pakistan

Is America Young and Barbaric?

Godfather Metaphor for Uncle Sam

Comments

Just a few weeks ago, global credit rating agency Standard and Poor’s (S&P) released a study titled, “Will India be the first BRIC fallen angel?” The report suggests that India may become the first “BRIC” country (Brazil, Russia, India and China) to lose its investment grade rating. While it remains to be seen if India can escape this ignominy, the country has earned another dubious distinction: It ranks the lowest among the BRIC nations on the Global Innovation Index 2012.

This innovation index was released recently by the international business school INSEAD and the World Intellectual Property Organization (WIPO) along with the Confederation of Indian Industries (CII), Alcatel-Lucent and Booz & Co. The index ranks 141 countries on the basis of their innovation capabilities and results. Brazil, Russia and China were ranked 58th, 51st and 34th respectively. India stands at the 64th position, two notches below where the country landed last year.

According to the study, “The innovation front in India continues to be penalized by deficits in human capital and research; infrastructure and business sophistication, where it comes last among BRICs, and in knowledge and technology outputs, where it comes in ahead of Brazil only.” The report also notes that the BRIC countries need to invest further in their innovation capabilities to live up to their expected potential.

Vijay Govindarajan, a professor of international business at Dartmouth College and the first professor-in-residence and chief innovation consultant at General Electric, points out that innovation is critical to India’s future. He suggests that the government must provide seed capital to strengthen applications research and create incentives for universities, research labs and industry to collaborate. “Much is at stake if India does not move up on the Global Innovation Index,” Govindarajan says. “Without business model innovations, India cannot solve the problems for 90% of Indians. Such innovations can then be used to launch global strategies. This is the essence of reverse innovation [innovations adopted first in the developing world] — where India can lead.”

As part of the same report, India is ranked second (behind China) in the global innovation efficiency index. (The innovation efficiency index is the ratio of innovation input and innovation output.) Chandrajit Banerjee, director-general of CII notes that innovation efficiency is “a ratio and not a direct measure …. [This implies that] while India can produce innovation output best in the world when equal amounts of input are fed into its innovation ecosystem, it also needs to strengthen certain innovation drivers that will improve the situation.”

Gopichand Katragadda, managing director of General Electric’s John F. Welch Technology Center in Bangalore adds: “The results of the study point to the fact that, in India, the innovation ecosystem (input) is poor while the knowledge/creative output under the constraints is good. One interpretation of this is that we need better government measures on regulations, education and infrastructure to tap the demonstrated potential of talented people.”

According to Katragadda, if India does not get its act together on the innovation front, the country could lose the opportunity “to make this a century of Indian innovation, tapping into the brilliant technical minds of the region.”

http://knowledgetoday.wharton.upenn.edu/2012/07/india-ranks-lowest-amongst-brics-in-innovation/

The crisis of the euro zone is a geopolitical as well as an economic event. While Europe may yet find a path out of its economic quagmire, it will turn inward for some time as it reorganizes some of its core institutions. The world will not stand still while this happens.

To begin with, Europe's disorder is a grand opportunity for Russia. It is not all good news in the Kremlin—Russia will hurt economically, as the European Union is its most important trading partner and customer for oil and gas. But geopolitically, Russia will have a lot of new opportunities. Ukraine, Moldova and Belarus will feel less pull from the West and more from the East.

-----------

Elsewhere, the euro crisis has reinforced Turkey's decision to drop its long courtship of Europe and become an independent actor. Europe looks less and less to the Turks like a model to imitate and more and more like a fate to avoid. Turkey in any case would like to replace the EU as a major political and economic force in the Arab world, and it is likely to use this period of European introspection and preoccupation to advance its agenda.

Between Russia's new geopolitical opportunities and Turkey's detachment from Europe, the situation in the Balkans is going to become much more confused and perhaps even dangerous. If Greece ends up leaving the euro or is deeply embittered with Brussels and the EU over the long term, and if Cyprus is similarly affected (likely, given its close economic ties to Greece), we could see Greece and Cyprus tilt toward Russia.

------------

This is bad news for Americans. An assumption that Europe is in a period of continuing decline is to some degree baked into the cake of American foreign policy. The perception that Europe (and Japan) are no longer the powers they once were has driven the U.S. to look for new partners as it seeks to build a liberal world system in the 21st century.

But Americans expected a slow and gentle decline, with many years in which to make a gradual adjustment to the change. We hoped that the euro and the single market could mitigate or even reverse that decline. We have also taken for granted that the EU would at least be able to manage its own neighborhood, bringing peace, security and integration to the Balkans and drawing countries like Belarus, Ukraine and even Russia toward Western ways. We may now have to adjust to a world in which the EU is retreating faster and farther than anyone expected.

This euro crisis isn't just a banking or a currency issue. It is a serious political crisis that could dramatically alter the geopolitical balance in Europe and Asia.

http://online.wsj.com/article/SB10001424052702303640104577440362953611968.html

A massive power cut has caused disruption across northern India, including in the capital, Delhi.

It hit a swathe of the country affecting more than 300 million people in Punjab, Haryana, Uttar Pradesh, Himachal Pradesh and Rajasthan states.

Power Minister Sushil Kumar Shinde said most of the supply had been restored and the rest would be reinstated soon.

It is unclear why the supply collapsed but reports say some states may have been using more power than authorised.

Mr Shinde said he had appointed a committee to inquire into the causes of the blackout, one of the worst to hit the country in more than a decade. The committee will submit its report within 15 days, he said.

The power cut happened at 02:30 local time on Monday (2100 GMT Sunday) after India's Northern Grid network collapsed.

----------

Monday morning saw travel chaos engulf the region, with thousands of passengers stranded when train services were disrupted in Punjab, Haryana and Chandigarh.

The Rajdhani train from Jammu to Delhi was more than five hours late.

"The train stopped near Panipat station [in Haryana] at about 02:30. For a long time we had no idea what was holding us up," passenger DK Rajdan said.

"Rajdhani is air-conditioned so it was not uncomfortable. But for six or seven hours we couldn't get anything to eat or drink and people were beginning to get worried," he said.

Delhi Metro railway services were stalled for three hours, although the network later resumed when it received back-up power from Bhutan, one official said.

Traffic lights on the streets of the capital were not functioning as early morning commuters made their way into work, leading to gridlock.

Water treatment plants in the city also had to be shut for a few hours.

Officials said restoring services to hospitals and transport systems were a priority.

Power cuts are a common occurrence in Indian cities because of a fundamental shortage of power and an ageing grid. The chaos caused by such cuts has led to protests and unrest on the streets.

Earlier in July, crowds in the Delhi suburb of Gurgaon blocked traffic and clashed with police after blackouts there.

Correspondents say that India urgently needs a huge increase in power production, as hundreds of millions of its people are not even connected to the national grid.

Prime Minister Manmohan Singh has long said that India must look to nuclear energy to supply power to the people.

Estimates say that nuclear energy contributes only 3% to the country's current power supply. But the construction of some proposed nuclear power stations have been stalled by intense local opposition.

http://www.bbc.co.uk/news/world-asia-india-19043972

As India copes with a massive power breakdown for a second successive day, some interesting facts about the country's power situation to chew on:

India has an installed capacity of more than 170,000 megawatts, up from a mere 1,362 megawatts at the time of Independence in 1947

The majority (around 60%) is generated from coal and lignite, while just under a quarter (about 22%) is hydro-electric

Despite its soaring energy needs, India has one of the lowest per capita rates of consumption of power in the world - 734 units as compared to a world average of 2,429 units. This is nothing compared with say, Canada, (18,347 units) and the US (13,647 units). China's per capita consumption (2,456 units) is more than three times that of India.

The low per capita consumption is despite the fact that the power sector has been growing at more than 7% every year.

Homes and farms are consuming more power today than industries and businesses. Industrial consumption has actually dropped from 61.6% in 1970-71 to 38% in 2008-2009.

India has suffered consistent power shortages since Independence in 1947. Peak demand shortage is more than 10%, whereas the overall energy shortage is more than 7%.

Sixty-five years after Independence, only nine states - Andhra Pradesh, Gujarat, Karnataka, Goa, Delhi, Haryana, Kerala, Punjab and Tamil Nadu - of 28 have been officially declared totally electrified.

India remains perennially energy starved despite 15% or more of federal funds being allocated to the power sector. Bankrupt state-run electricity boards, an acute shortage of coal, skewed subsidises which end up benefiting rich farmers, power theft, and under-performing private distribution agencies are to blame, say experts. There is no shortage of money, and the problem, as the Planning Commission admits, is more "in the delivery process [than] in the system".

Transmission and distribution losses have leapt from 22% in 1995-96 to about 25.6% in 2009-2010. The states with the worst losses are Indian-administered Kashmir, Bihar, Chhattisgarh, Jharkhand and Madhya Pradesh. The best performers: Punjab, Himachal Pradesh, Andhra Pradesh and Tamil Nadu.

India's first power generation company was the private Calcutta Electric Supply Corporation (CESC) started in 1899. The first diesel power plant was set up in Delhi in 1905. The first hydro-electric power station was set up in Mysore in 1902. At the time of Independence, about 60% of India's power sector was privately owned. Today, about 80% of the installed capacity is in the hands of the government. Private companies own 12% of the capacity.

http://www.bbc.co.uk/news/world-asia-india-19063241

The United States on Friday announced a multi-year Pakistan Private Investment Initiative worth $80 million in financial support to promote economic activities in the country.

Drawing on public-private partnerships, this initiative will spur job growth and economic development by expanding access to capital for Pakistan’s small to medium sized companies, according to a statement by the US embassy.

“Pakistan has a wealth of talented entrepreneurs that desperately needs capital to fully realise their potential,” said US Charge d’affaires in Pakistan, Richard E Hoagland.

He said that through this initiative, the United Stated can move beyond the traditional foreign assistance by playing a constructive role to help entrepreneurs expand their businesses, provide new jobs to Pakistan’s fast-growing population, and by improving lives in the country.

He said that market-oriented, commercial solutions which support Pakistan’s economic development have been a priority for the United States.

The US Charge d’affaires said that the “Pakistan Private Investment Initiative” will generate investment funds catalysed by US assistance.

The initiative seeks private or other qualified sources of capital for matching investments and funding management services. The investment funds will make equity investments in promising Pakistani companies, under-served by existing sources of capital.

The Pakistan Private Partnership Initiative welcomes proposals from qualified Pakistani, regional, and international fund managers keen on investments in Pakistan by October 12, 2012, said a statement of from the United States embassy.

http://tribune.com.pk/story/436968/us-announces-80-million-for-pakistan-private-investment-initiative/

KARACHI - Pakistan’s gas requirements are growing hastily, while the domestic gas production is not growing at the same pace. Primary energy consumption in Pakistan has grown by almost 80pc over the past 15 years, from 34 million tons oil equivalent (TOEs) in 1994/95 to 60 million TOEs in 2010/11 and has supported an average GDP growth rate in the country of about 4.5pc per annum.

Consumer Rights Commission of Pakistan (CRCP) in collaboration with Citizens’ Voice Project hold policy dialogues on “Role of Government and Regulators in the Gas Sector of Pakistan” with parliamentarians, policy makers, regulators and civil society organisations here on Wednesday.

CRCP recommended Effective Governance & Regulation for development of Gas Policy in dialogue.

The present natural Gas crisis clearly indicates that overall governance of the gas sector needs improvement. The growing energy shortages have made life difficult for Pakistanis across the board. The quality of life of citizens has deteriorated.

Dialogue reported that economic growth rates have been stunted, and industry and agriculture have suffered. The Government of Pakistan has not yet recognising magnitude of crisis and its effect on the people and the economy. Government has to take emergency measures to address, manage and reduce the impact of crisis. The reasons for present crisis in gas sector have both technical and governance aspects.

The dialogues have given comprehensive insight into the current situation of transparency, public participation and accountability processes in gas sector of Pakistan. The intervention is likely to result in enhanced understanding of the sect oral issues for the stakeholders.

Most important of all, it is expected to inform the policy makers and especially the public representatives about the governance situation of the sector and shall persuade them to take positive actions for sectoral improvement. In Pakistan, industrial and fertilizer sectors are getting gas on subsidised rates, while the CNG stations were being subjected to an exorbitantly high tariff regime, neglecting the general public’s interest. The gas consumers’ woes could not be resolved unless Pakistan had an autonomous regulator free of political interference. Besides, the problems could not be resolved without improving people’s access to information, putting in place a system of strict penalties on consumers involved in gas pilferage and non-payment of gas bills

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-online/business/31-Jan-2013/primary-energy-consumption-grows-by-almost-80pc-in-15-years

The trouble for Microsoft came with the rise of new devices whose importance it famously failed to grasp. “There’s no chance,” declared Mr. Ballmer in 2007, “that the iPhone is going to get any significant market share.”

How could Microsoft have been so blind? Here’s where Ibn Khaldun comes in. He was a 14th-century Islamic philosopher who basically invented what we would now call the social sciences. And one insight he had, based on the history of his native North Africa, was that there was a rhythm to the rise and fall of dynasties.

Desert tribesmen, he argued, always have more courage and social cohesion than settled, civilized folk, so every once in a while they will sweep in and conquer lands whose rulers have become corrupt and complacent. They create a new dynasty — and, over time, become corrupt and complacent themselves, ready to be overrun by a new set of barbarians.

I don’t think it’s much of a stretch to apply this story to Microsoft, a company that did so well with its operating-system monopoly that it lost focus, while Apple — still wandering in the wilderness after all those years — was alert to new opportunities. And so the barbarians swept in from the desert.

Sometimes, by the way, barbarians are invited in by a domestic faction seeking a shake-up. This may be what’s happening at Yahoo: Marissa Mayer doesn’t look much like a fierce Bedouin chieftain, but she’s arguably filling the same functional role.

Anyway, the funny thing is that Apple’s position in mobile devices now bears a strong resemblance to Microsoft’s former position in operating systems. True, Apple produces high-quality products. But they are, by most accounts, little if any better than those of rivals, while selling at premium prices.

So why do people buy them? Network externalities: lots of other people use iWhatevers, there are more apps for iOS than for other systems, so Apple becomes the safe and easy choice. Meet the new boss, same as the old boss.

Is there a policy moral here? Let me make at least a negative case: Even though Microsoft did not, in fact, end up taking over the world, those antitrust concerns weren’t misplaced. Microsoft was a monopolist, it did extract a lot of monopoly rents, and it did inhibit innovation. Creative destruction means that monopolies aren’t forever, but it doesn’t mean that they’re harmless while they last. This was true for Microsoft yesterday; it may be true for Apple, or Google, or someone not yet on our radar, tomorrow.

http://www.nytimes.com/2013/08/26/opinion/krugman-the-decline-of-e-empires.html

The productivity gap, an indicator of a country’s output capabilities, is the ratio between the productivity of a benchmark country (such as the United States) and that of a less developed economy. The latest Latin America Outlook from the OECD, a think-tank, compared the productivity gaps of selected countries in the region with those of economies in Asia. In general, productivity gaps in Asian countries have narrowed significantly over the past three decades. America’s productivity in 1980 was 125 times that of China; by 2011 the gulf had come down to 17 times. In Latin America and the Caribbean, however, not only was there a much smaller reduction, in many cases the gap had grown.

http://www.economist.com/news/economic-and-financial-indicators/21588391-productivity-gaps?fsrc=scn/tw/te/pe/productivitygap

https://pbs.twimg.com/media/DBRZfLkUIAAbv87.jpg

Human greenhouse gas (GHG) emissions have been the primary contributor to a global temperature rise of ~1 C since pre-industrial times. Industrial processes, energy production from burning fossil fuels and deforestation have been the major contributors to this observed trend in global warming. Even though the overall trend is of global nature, the sources of GHG emissions across the globe have varied drastically between regions and individual countries. A new study by Concordia University’s H Damon Matthews et al. published in Environmental Research Letters last week represents a sound estimate of what countries have historically been the largest GHG emitters and contributors to global warming. The calculations performed in the include an from five different emissions:

Fossil Fuel CO2

Land-use CO2

Methane

Nitrous Oxide, and

Aerosols, which have a cooling effect on the climate.

The results of the study show that the United States is the clear leader is both GHG emissions and contributions to global warming. Of the 0.7 C increase in global temperature since pre-industrial times, the United States alone has contributed 0.15 C (~20%). The top seven contributors alone account for ~63% of warming contributions, and the top 20 countries account for ~82%. China, which is presently the largest global emitter of GHGs, ranks 2nd on historical contributions to global warming, followed by Russia and Brazil and India. Brazil and India are interesting cases given that most of its CO2 emissions have originated from land-use emissions, meaning that deforestation has contributed to Brazil’s high ranking. This is different from the other top GHG emitting countries, whose main CO2 emissions can be tied back to the burning of fossil fuels. The study also includes the cooling effects that aerosol emissions have on the global climate. Generally, countries that emit larger quantities of CO2 also produce larger amounts of aerosols, which help counteract the warming effects of the CO2 emissions.

https://www.nytimes.com/reuters/2017/07/10/business/10reuters-pakistan-lng-exclusive.html

Pakistan says it could become one of the world's top-five buyers of liquefied natural gas (LNG), with Petroleum Minister Shahid Abbasi predicting imports could jump more than fivefold as private companies build new LNG terminals.

Outlining Pakistan's ambitious plans - which, if fully implemented, could shake up the global LNG market - Abbasi told Reuters that imports could top 30 million tonnes by 2022, up from just 4.5 million tonnes currently.

Cheaper than fuel oil and cleaner burning than coal, LNG suits emerging economies seeking to bridge electricity shortfalls and support growth on tight budgets.

(For a graphic on LNG market share by region click http://reut.rs/2uGUu9X)

"Within five years, I don't see any reason why we should not be beyond 30 million tonnes (in annual LNG imports). We will be one of the top five markets in the world," Abbasi said.

That kind of jump would represent one of the fastest growth stories in the energy industry, comparable to what China has done in many commodities - but there are doubts whether Pakistan can achieve its ambitions, given the complexity and cost of expansion projects.

"It's always possible, but seems very difficult as they will need much more (regasification) capacity and downstream pipeline capacity," said Trevor Sikorski at Energy Aspects, a London-based industry market researcher. "There are infrastructural issues and financial issues."

"Still, it is one of the key LNG growth markets, and its demand will help tighten up the market that has threatened to lurch into over supply."

Abbasi said no one took Pakistan seriously after a decade of botched attempts to bring LNG to the country, but this has changed with the construction of new LNG terminals and gas plants. He said foreign suppliers are now arriving in Pakistan - where energy shortages have prompted Prime Minister Nawaz Sharif to promise he'll end the country's frequent blackouts.

"Before, we used to go out to talk to LNG suppliers. Now they're coming to us," Abbasi said.

"(LNG) is really what has saved the whole energy system. It has been a huge success in Pakistan and it will continue," he said after Sharif on Friday inaugurated a new Chinese-built LNG power plant that uses General Electric turbines.

GETTING CONNECTED

Pakistan built its first LNG terminal in 2015 and, after some delays, a second terminal is due to come online in October, doubling annual import capacity to about 9 million tonnes.

A consortium of Exxon Mobil, Total, Mitsubishi, Qatar Petroleum and Norway's Hoegh is expected to decide by September whether to build a third LNG terminal for about $700 million, Abbasi said.

Pakistan has dropped plans to finance up to two more terminals, as private companies have said they would finance these themselves and use Pakistan's existing gas network to sell directly to consumers.

"That's been the real success and that's where the growth will come from," Abbasi said, adding that about 10 million homes are linked to gas connections in Pakistan - a nation of around 200 million.

"In the last four years, we would have added two million additional connections. We are really ramping that up."

If Pakistan achieves its ambitious development goals, it could significantly erode market oversupply, which has helped pull down Asian LNG spot prices by more than 70 percent since 2014 to around $5 per million British thermal units (mmBtu).

https://www.weforum.org/agenda/2018/02/height-lifespan-gdp-humanity-has-stagnated-for-most-of-its-history

Over the past millennium, income per capita in the selected countries has increased 32-fold, from 717 US dollars per person per year around the year 1000 to 23,086 dollars in 2010. This contrasts sharply with the previous millennia, when there was almost no advance in income per capita. The figure shows that it started rising and accelerating around the year 1820 and it has sustained a steady rate of increase over the last two centuries. One of the main challenges for growth theory is to understand this transition from stagnation to growth and in particular to identify the main factor(s) that triggered the take-off.

Is the finding that there was stagnation in the standard of living until 1820 truly robust? This claim is particularly important given that mankind experienced significant technological improvements that would have been expected to increase productivity and income per person, from the Neolithic revolution to the invention of the printing press.

Two facts corroborate the idea that there was indeed stagnation over the most part of human history: first, estimates of longevity computed on specific groups across time and space do not display any trend before 1700 CE. For example, De la Croix and Licandro (2015) show using a long-running database of 300,000 famous people that there was no trend in mortality during most of human history, confirming the existence of a Malthusian stagnation epoch.

Second, body height computed from skeletal remains does not display any trend either, while height is known to depend very much on nutrition when young (Koepke and Baten, 2005). This indicates that there was no systematic improvement in nutrition over time. One has to wait until the 19th century to observe a trend in height, as witnessed by the data of the Swedish army.

The three measures of standard of living proposed here – GDP per capita, height and lifespan – are therefore in the same direction: that of stagnation for most of human history. The economic growth that we now enjoy, with its positive effects on the standard of living but also its negative effects on the environment, is therefore an unprecedented and recent phenomenon on a historical scale.

It is ironical then that we may right now similarly be losing out on another revolution. This contemporary ‘Manchester moment’ is about digital technologies and digital economy. As industrial revolution automated mechanical power, digital revolution is about automation of intelligence. Both represent fundamental shifts in human affairs. The digital revolution will as thoroughly transform our economic, social and political organisation as did industrial revolution.

This tragedy is unfolding right in front of our eyes, in a nation supposed to be in good political and economic control of itself. It also has sufficient basic competencies in digital technologies and conducting modern business. As it was in 18th-19th centuries, India’s failure is primarily political.

Missing the digital revolution

A decade or so ago, China trailed India in terms of IT or software technologies. How has China then suddenly become a digital super-power, posing a challenge even to the US? Digital technologies build over and subsume traditional IT and software, but are centrally about next-generation data-based systems.

It is simple. Just examine where in China (or US) all the cutting edge development of digital technologies – like artificial intelligence (AI), Interent-of-Things and blockchain – takes place. It is within super-large domestically-owned digital ecosystems like Baidu, Alibaba, Tencent and Didi. (In the US, these are Google, Amazon, Facebook, Apple etc). Unlike industrial technologies, digital ones are socially-iterative technologies that develop in real-world social and business settings, and not so much in laboratories. Innovating start-ups too get routinely bought and integrated into these ecosystems.

Over the last decade, China created ideal conditions for development of such large domestically-owned digital ecosystems, which catapulted China to global digital leadership. Both Chinese and US governments devote considerable public funds to partner with their private digital ecosystems for digital R&D.

And India? It first allowed Amazon to dump billions of dollars to close in on the domestic e-commerce market leader Flipkart. Not only were many other Indian e-commerce platforms suffocated in the process, domestic leaders like Flipkart had to off-load considerable equity abroad to obtain capital for matching Amazon’s cash burn. And now, most unthinkably, India is ready to sell its top e-commerce platform Flipkart to Walmart. Very soon, India’s two largest digital ecosystems will be foreign-controlled.

It is difficult to understand why India is inviting foreign corporations to own its digital ecosystems that are epicentres both of digital economy and development and control of digital technologies. It is difficult to think of a quicker path to total digital dependency.

Despite what most people think, digital platforms aren’t just ‘more efficient’ marketplaces. They are monopolistic intelligent agents that reorganise and control whole sectors, as they form backward and forward linkages – from manufacturing, inventory management and logistics, to payment and delivery.

https://thewire.in/economy/does-flipkarts-sale-represent-a-manchester-moment-for-indias-digital-economy

#China too suffered from opium wars imposed by colonial #Britain. #India suffered more because its entire productive industries like #textiles were destroyed and raw #cotton shipped off to #Manchester for #manufacturing. You should read William Dalrymple’s Anarchy: East India co

Textiles were the dominant industry of the Industrial Revolution in terms of employment, value of output and capital invested. The textile industry was also the first to use modern production methods. The Industrial Revolution began in Great Britain, and many of the technological innovations were of British origin.

https://www.theguardian.com/world/2021/jun/29/british-empire-india-amartya-sen

It is true that before British rule, India was starting to fall behind other parts of the world – but many of the arguments defending the Raj are based on serious misconceptions about India’s past, imperialism and history itself

-----------

https://www.theguardian.com/world/2021/jun/29/british-empire-india-amartya-sen

To illustrate the relevance of such an “alternative history”, we may consider another case – one with a potential imperial conquest that did not in fact occur. Let’s think about Commodore Matthew Perry of the US navy, who steamed into the bay of Edo in Japan in 1853 with four warships. Now consider the possibility that Perry was not merely making a show of American strength (as was in fact the case), but was instead the advance guard of an American conquest of Japan, establishing a new American empire in the land of the rising sun, rather as Robert Clive did in India. If we were to assess the achievements of the supposed American rule of Japan through the simple device of comparing Japan before that imperial conquest in 1853 with Japan after the American domination ended, whenever that might be, and attribute all the differences to the effects of the American empire, we would miss all the contributions of the Meiji restoration from 1868 onwards, and of other globalising changes that were going on. Japan did not stand still; nor would India have done so.

---------

I was persuaded that Marx was basically right in his diagnosis of the need for some radical change in India, as its old order was crumbling as a result of not having been a part of the intellectual and economic globalisation that the Renaissance and the Industrial Revolution had initiated across the world (along with, alas, colonialism).

There was arguably, however, a serious flaw in Marx’s thesis, in particular in his implicit presumption that the British conquest was the only window on the modern world that could have opened for India. What India needed at the time was more constructive globalisation, but that is not the same thing as imperialism. The distinction is important. Throughout India’s long history, it persistently enjoyed exchanges of ideas as well as of commodities with the outside world. Traders, settlers and scholars moved between India and further east – China, Indonesia, Malaysia, Cambodia, Vietnam, Thailand and elsewhere – for a great many centuries, beginning more than 2,000 years ago. The far-reaching influence of this movement – especially on language, literature and architecture – can be seen plentifully even today. There were also huge global influences by means of India’s open-frontier attitude in welcoming fugitives from its early days.

----------

In the powerful indictment of British rule in India that Tagore presented in 1941, he argued that India had gained a great deal from its association with Britain, for example, from “discussions centred upon Shakespeare’s drama and Byron’s poetry and above all … the large-hearted liberalism of 19th-century English politics”. The tragedy, he said, came from the fact that what “was truly best in their own civilisation, the upholding of dignity of human relationships, has no place in the British administration of this country”. Indeed, the British could not have allowed Indian subjects to avail themselves of these freedoms without threatening the empire itself.

http://afe.easia.columbia.edu/special/japan_1750_perry.htm

Perry's small squadron itself was not enough to force the massive changes that then took place in Japan, but the Japanese knew that his ships were just the beginning of Western interest in their islands. Russia, Britain, France, and Holland all followed Perry's example and used their fleets to force Japan to sign treaties that promised regular relations and trade. They did not just threaten Japan — they combination their navies on several occasions to defeat and disarm the Japanese feudal domains that defied them.

Tokugawa Japan into which Perry Sailed

Japan at this time was ruled by the shôgun ("great general") from the Tokugawa family. The Tokugawa shogunate was founded about 250 years earlier, in 1603, when Tokugawa leyasu (his surname is Tokugawa) and his allies defeated an opposing coalition of feudal lords to establish dominance over the many contending warlords. But while Tokugawa became dominant, receiving the title of shôgun from the politically powerless emperor, he did not establish a completely centralized state. Instead, he replaced opposing feudal lords with relatives and allies, who were free to rule within their domains under few restrictions. The Tokugawa shôguns prevented alliances against them by forbidding marriages among the other feudal lords' family members and by forcing them to spend every other year under the shôgun's eye in Edo (now Tôkyô), the shogunal capital — in a kind of organized hostage system.

It was the third shôgun, Tokugawa Iemitsu, who enforced isolation from much of the rest of the world in the seventeenth century, believing that influences from abroad (meaning trade, Christianity, and guns) could shift the balance that existed between the shôgun and the feudal lords. He was proven right two centuries later, when change came in the form of Perry's ships.

Japan's Response

Upon seeing Perry's fleet sailing into their harbor, the Japanese called them the "black ships of evil mien (appearance)." Many leaders wanted the foreigners expelled from the country, but in 1854 a treaty was signed between the United States and Japan which allowed trade at two ports. In 1858 another treaty was signed which opened more ports and designated cities in which foreigners could reside. The trade brought much foreign currency into Japan disrupting the Japanese monetary system. Because the ruling shôgun seemed unable to do anything about the problems brought by the foreign trade, some samurai leaders began to demand a change in leadership. The weakness of the Tokugawa shogunate before the Western demand for trade, and the disruption this trade brought, eventually led to the downfall of the Shogunate and the creation of a new centralized government with the emperor as its symbolic head.

https://time.com/6297539/how-india-economy-will-surpass-us/

As for population size, India likely surpassed China this year to become the world’s most populous country, and the gap will only widen in the near future. That confers additional benefits through economies of scale in the provision of public goods. Take, for example, India’s digital payments infrastructure built on the biometric identity system known as Aadhaar and the United Payments Interface (UPI) platform, which serves as host to hundreds of banks. Using Aadhaar to verify identity, UPI clears transactions between bank-account holders in real-time. The larger the number of users, the lower the per-capita cost of building the infrastructure for it.

This same argument also applies to other sectors. Once an expressway has been built, for example, the larger the population in the communities residing around it, the lower the per-capita cost of connecting them to it. The same goes for railway and air connectivity, electricity, and piped water. Once these amenities have been brought to one village, the extra cost of extending them to other nearby villages is small.

Size also brings benefits when it comes to creating supply chains. A larger population means greater scope for agglomeration and cost efficiencies. Today, with the risks of investing and operating in China multiplying, multinationals are switching to the so-called "China+1" strategy, looking for an additional, less risky but cost-effective location for their investments. India has a distinct advantage in becoming that "+1" country because it constitutes the largest single market among potential competitors. Components produced in different locations can move freely without having to face a customs border. A large internal labor market also makes for better prospects for a closer match between the skills needed and those available.

But first, India needs to reduce its trade protectionism, which remains relatively high. No country has sustained growth rates of at least 8%, as India needs to do to overtake the U.S. economy, without embracing globalization. The country should roll back tariffs, strike more free trade deals with major economies and trade blocs, and cut back on the use of anti-dumping.

There are additional areas where India cannot afford to be complacent. The country must swiftly privatize a number of public sector enterprises, particularly banks, that have a long history of low or negative returns. Tax reform should also be high on the government's agenda; a constant complaint of businesses, especially small- and medium-sized ones, has been overzealous tax authorities and a convoluted and opaque system.

In essence, India needs to remember the spirit of its economic reforms in 1991—which centered around liberalization, privatization, and globalization—that have gone some distance toward accelerating growth. If the country wants to return to being one of the world's top two economies in the next 50 years, it must deepen and widen the reforms it began three decades ago.