Underground Economy Underpins Pak Consumption Boom

Car sales increased 14 percent in February from a year earlier. Cement sales are rising with growing housing demand for increasing population. Lucky Cement, Pakistan’s biggest publicly traded construction materials company, is expected to post record earnings this year. Rising farm prices of bumper crops are pumping hundreds of billions of rupees each year into Pakistan's rural economy.

Contrary to government statistics of a stagnant economy, packed shopping malls and waiting lines at restaurants tell a different story-- the story of growing discretionary incomes of Pakistani consumers today.

So where is the disconnect between these two opposite views of Pakistan's economy? Naween Mangi of Businessweek answers it in her piece "The Secret Strength of Pakistan's Economy". She attributes it to the fast growing informal sector of the nation's economy that evades government's radar, illustrating it with the story of a tire repair shop owner Muhammad Nasir. Nasir steals water and electricity from utility companies, receives cash from his customers in return for his services and issues no receipts, pays cash for his cable TV connection, and pays off corrupt police and utility officials and local politicians instead of paying utility bills and taxes.

Here's an excerpt from Mangi's Businessweek story:

"The rhythms of life in the underground economy remain largely undisturbed. After work, Nasir and his friends sometimes hire a rickshaw to head to the beach or to a religious festival. The driver, part of the flourishing local transport business, doesn’t turn on the meter because he doesn’t have one. On his way home, Nasir stops to buy cooking oil, wheat flour, and sugar at a small grocery store that isn’t officially there. Out of about 1 million shops, up to 400,000 are grocery stores, and most of them are not registered and don’t pay taxes, according to Rafiq Jadoon, president of the City Alliance of Markets Association. In the evening, Nasir unwinds in front of the television. He watches an Indian movie transmitted by a local cable operator to whom he pays a monthly fee—in cash."

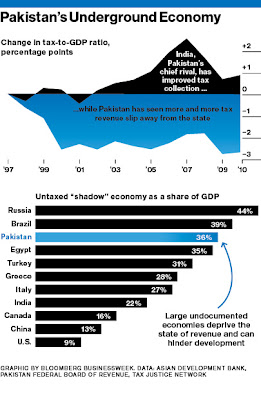

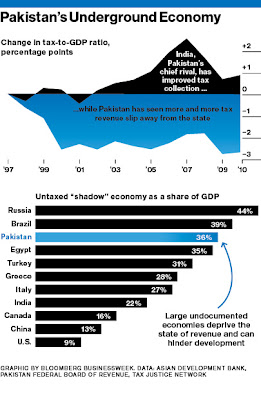

The estimates of the size of Pakistan's underground economy vary from 30% to 50% of the official GDP of just over Rs. 18 trillion (US$200 billion). Businessweek's Mangi claims that the government is losing as much as Rs. 800 billion (US$9 billion) in taxes from the informal sector...nearly enough to wipe out Pakistan's current fiscal deficit.

In my view, there are two major problems that arise from the underground economy described by Mangi. First, the massive tax evasion fosters Pakistan's dependence on foreign aid which comes with strings attached and infringes of national sovereignty. Second, the widespread theft of electricity is largely responsible for the huge circular debt and the ongoing power shortages that affect all aspects of life and scare away investors. The sooner the government and the people realize the severe downsides of the underground economy, the better it will be for Pakistan.

Related Links:

Haq's Musings

Rural Consumption Boom in Pakistan

Pakistan's Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

Pakistan's Circular Debt and Load-shedding

Contrary to government statistics of a stagnant economy, packed shopping malls and waiting lines at restaurants tell a different story-- the story of growing discretionary incomes of Pakistani consumers today.

So where is the disconnect between these two opposite views of Pakistan's economy? Naween Mangi of Businessweek answers it in her piece "The Secret Strength of Pakistan's Economy". She attributes it to the fast growing informal sector of the nation's economy that evades government's radar, illustrating it with the story of a tire repair shop owner Muhammad Nasir. Nasir steals water and electricity from utility companies, receives cash from his customers in return for his services and issues no receipts, pays cash for his cable TV connection, and pays off corrupt police and utility officials and local politicians instead of paying utility bills and taxes.

Here's an excerpt from Mangi's Businessweek story:

"The rhythms of life in the underground economy remain largely undisturbed. After work, Nasir and his friends sometimes hire a rickshaw to head to the beach or to a religious festival. The driver, part of the flourishing local transport business, doesn’t turn on the meter because he doesn’t have one. On his way home, Nasir stops to buy cooking oil, wheat flour, and sugar at a small grocery store that isn’t officially there. Out of about 1 million shops, up to 400,000 are grocery stores, and most of them are not registered and don’t pay taxes, according to Rafiq Jadoon, president of the City Alliance of Markets Association. In the evening, Nasir unwinds in front of the television. He watches an Indian movie transmitted by a local cable operator to whom he pays a monthly fee—in cash."

The estimates of the size of Pakistan's underground economy vary from 30% to 50% of the official GDP of just over Rs. 18 trillion (US$200 billion). Businessweek's Mangi claims that the government is losing as much as Rs. 800 billion (US$9 billion) in taxes from the informal sector...nearly enough to wipe out Pakistan's current fiscal deficit.

In my view, there are two major problems that arise from the underground economy described by Mangi. First, the massive tax evasion fosters Pakistan's dependence on foreign aid which comes with strings attached and infringes of national sovereignty. Second, the widespread theft of electricity is largely responsible for the huge circular debt and the ongoing power shortages that affect all aspects of life and scare away investors. The sooner the government and the people realize the severe downsides of the underground economy, the better it will be for Pakistan.

Related Links:

Haq's Musings

Rural Consumption Boom in Pakistan

Pakistan's Tax Evasion Fosters Aid Dependence

Poll Finds Pakistanis Happier Than Neighbors

Pakistan's Rural Economy Booming

Pakistan Car Sales Up 61%

Resilient Pakistan Defies Doomsayers

Land For Landless Women in Pakistan

Pakistan's Circular Debt and Load-shedding

Comments

The local bourse broke the 14,000 level on an intraday basis for the first time since 16th May 2008. The positive sentiment was on the back of expectations of the issuance of the much awaited SRO on capital gain tax rules. Additional impetus also came after the release of the robust cement dispatches data and easing of Consumer Price Index (CPI) to 10.8 per cent in March-12. As a result, the KSE 100 Index gained 113 points (up 0.8 per cent WoW) to close at 13,875 level. Volumes improved by 5 per cent WoW to 387mn shares indicating the upbeat investor sentiments. Foreigners, on the other hand, offloaded shares worth $1.6 million. Pakistan Bureau of Statistics (PBS) released CPI figure for the month of March-12 during the week. CPI clocked in at 10.8 per cent YoY in March-12, down from 11.0 per cent in February-12. The marginal improvement in the headline inflation came on the back of ease in food prices.

---------------

Release of robust cement dispatches numbers kept the cement stocks in the limelight once again. Consequently, LUCK and DGKC both outperformed the market by 11.6 per cent and 6.9 per cent respectively. Conversely, HUBC underperformed the market by 2.4 per cent on news that the company’s dividend payments may get delayed after FBR froze the company accounts.

Though the market increased by 0.8 per cent during the week but it managed to cross 14,000 points level on intraday basis during the week. Cement stocks remained in the limelight on the back of increase in export price to Afghanistan and expectations of healthy earnings. Restoration of gas supply to Engro Corp new plant also kept the stock in investors’ radar. While lower than expected inflation numbers for March did not have any impact on the market sentiments.

--------------

As per monthly data released by All Pakistan Cement Manufacturers Association (APCMA) total dispatches witnessed a modest rise of 4 per cent YoY to 23.63m tons in 9MFY12 as against the total dispatches of 22.81m tons in the corresponding period last year. During the 9MFY12 growth in overall industry dispatches was primarily on account of 8 per cent YoY rise in local dispatches to 17.39m tons in comparison of the local dispatches of 16.04m tons in the same period last year. Local dispatches were higher in north zone by 7 per cent YoY to 14.09m tons and in south zone by a sharp 13 per cent YoY to 3.30m tons. On MoM basis, local dispatches were seen substantially higher by 32 per cent MoM mainly because of the reconstruction activities in flood affected areas, normal construction and on going work on mega projects.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-online/business/09-Apr-2012/cement-sector-outperforms-others-at-kse

A rebound in rice supply from India and Pakistan this year will calm fears over food inflation faced by poor nations as cheaper grain from the South Asian neighbours corners a third of the global market.

South Asia’s ample grain stocks will help it undercut key traditional suppliers, as a populist scheme in Thailand prices its grain out of competition and high export floor prices in Vietnam deter some buyers.

India is likely to emerge as the world’s second largest rice exporter in 2012, selling around 7 million tonnes, while Pakistan’s shipments are expected to bounce back to about 4 million tonnes amid the high prices of rival Thailand.

“Indian rice supplies will act as a price stabilisation factor against high global food inflation,” said Tajinder Narang, advisor at a New Delhi-based trading company Emmsons International.

Global food prices rose in March for a third straight month with more hikes to come, the UN’s Food and Agriculture Organisation (FAO) said last week, with higher prices of oilseeds and grains contributing to the rise.

The FAO index, which measures monthly price changes for a basket of cereals, oilseeds, dairy, meat and sugar, averaged 215.9 points in March, up from 215.4 points in February.

Although the index level is below its Feb. 2011 peak of 237.9, it still exceeds the level during the 2007-08 food price crises that triggered global alarm.

After benchmark Thai white rice prices climbed to a record above $1,050 a tonne in May 2008, several nations, including India, put a ban on exports.

That left buyers scrambling for supplies, unleashing concerns over food inflation and the threat of unrest in poor nations in Africa and Asia. But high stock levels in India and Pakistan could help avert a replay this year.

---------

India’s exports this year are expected to jump 50 per cent from last year’s shipments of 4.6 million tonnes, according to data from the US Department of Agriculture. India had exported 2.2 million tonnes in 2010.

Neighbouring Pakistan, which is expected to ship 3.8 million to 4.0 million tonnes in 2012, or an increase of at least 19 percent from 3.2 million last year, is cracking new markets with the sale of 200,000 tonnes to China and unconfirmed exports to the Philippines through unofficial channels.

“When we got a setback from Iran, our exporters looked elsewhere and that has led to diversification,” said Javed Agha, chairman of the Rice Exporters Association of Pakistan, referring to the impact of tightening Western sanctions over Iran’s nuclear programme.

In Thailand, prices have spiked due to a government intervention scheme due to run until the end of June, that is paying farmers 15,000 baht for a tonne of paddy, lifting Thai rice export prices to $500-$560 per tonne....

http://dawn.com/2012/04/11/india-pakistan-rice-supplies-to-ease-agflation-fears-wa/

Due to increasing trust deficit between the Federal Board of Revenue (FBR) and taxpayers, incidence of avoidance and evasion is on the rise. As collections remain weak, the government struggles to generate money to run the country. The irony is that the taxpayers do not want to pay taxes because of the trust deficit. Thus, the government argues well – no money no honey. It is a kind of egg-chicken like situation.

Sadly speaking, the current tax-to-GDP ratio has been languishing below 10% since long. India has improved and its ratio has reached 16.4%, China 14.9%, Sri Lanka 14.8% and Bangladesh having the lowest of all at 8.1%.

Taxes should be equitable in the sense that the heaviest burden should fall more on the rich and incidence of evasion and avoidance is at the minimum. This is only possible when the economy has a more built-in capacity which means contribution of direct taxes (progressive or proportional) should be greater than indirect taxes (regressive).

In contrast, the current contribution of direct tax is around 39%. Indirect taxes contribute over 60% to the revenue collection. The major stumbling blocks in the way of improving direct tax collection are the increasing size of black or cash economy, leakages in tax collection, narrow tax base and politically motivated tax exemptions.

Topping the list is governance problem which has become putrid. The dogmatic position of some political parties and that of business community over the reformed general sales tax (RGST) has augmented the situation further. Its fate hitherto remains obscure.

Indeed, indirect taxes not only punish the poor the most but also stoke inflation. According to a joint study of the World Bank, IFC and PricewaterhouseCoopers, Pakistan’s ranking has slipped from 145 in 2011 to 158 in 2012 in terms of ease of paying taxes, 149 to 155 in terms of tax payments, 168 to 170 in terms of time required to comply with three major taxes.

Pakistan scores better on total tax rate (TTR) which measures the amount of taxes and mandatory contributions borne by the business in the second year of operation, expressed as a share of commercial profit. Only China scores high on the tax payment indicator.

With a narrow base and high enforcement cost, the need for additional revenues is substantial in Pakistan, but improving revenue mobilisation has importance beyond that. The role of the FBR thus is the centre of attention. Instead of undertaking piecemeal tax policy approach, the FBR should try to overhaul and modernise the existing tax administration which is free from all political influence.

Plugging leakages in the bucket can help but the FBR would need better quality buckets too.

http://tribune.com.pk/story/365203/taxing-the-comatose-economy/

SLAMABAD: Country’s budget deficit is likely to hover around 6.7 percent of the Gross Domestic Product (GDP) during the fiscal year 2012, revealed International Monetary Fund (IMF) Fiscal Monitor of April 2012.

According to an IMF report Pakistan’s revenues could be 12.8 per cent of the GDP during 2012 and may increase to 13.9 per cent of the GDP by 2017. Government’s expenditures, which are expected to be 19.2 per cent of the GDP 2012, are likely to come down to 18.8 per cent of the GDP by 2017.

Gross debt of the country to reach at 61.1 per cent in 2012 and would come down to 53.2 per cent of the GDP by 2017.

Net debt of the country is seen around 58.5 per cent of the GDP and would come down to 50.4 per cent of the GDP by end of 2017.

During 2012 country’s debt maturity may reach 23.3 per cent of the GDP and its financing needs 30 per cent of the GDP.

During 2013, the debt maturity could inch up to 24.3 per cent of the GDP, its budget deficit 6 percent of the GDP and its financial needs to go up to 30.3 percent of the GDP.

http://www.geo.tv/GeoDetail.aspx?ID=44996

Federal Finance Minister Hafeez Shaikh, wrapping up a week long tour in Washington, said that Pakistan will be receiving as much as $5.27 billion from the US, UK and international monetary organisations over the next four years.

Having met managing director of the World Bank Sri Mulyani, the Asian Development Bank President Haruhijo Kuroda, US AID administrator Dr Rajiv Shah, Sheikh, and IMF Pakistan mission chief Adnan Mazarei among senior US officials, confirmed that both the Asian Development Bank and the US have reaffirmed investment in to the Diamer Bhasha dam project in Pakistan. “We have told the ADB to send their assessment team to Pakistan soon,” the Finance Minister said.

Addressing a press conference at the Pakistani Embassy in Washington, DC, Shaikh said that the US has also agreed to invest in the renovation of the Mangla Dam, and for the Kurram-Tangi dam project. He said the US government had notified Congress that it would be spending $223 million on the projects.

Shaikh, who is wrapping up a one-week trip to Washington DC where he and his finance team attended the IMF/World Bank Spring Meetings 2012, said the International Finance Corporation, part of the WB group, would also invest $1 billion in various sectors in Pakistan’s private sector, including energy and finance. Shaikh said that the IFC investment was the highest for the group in Pakistan. He also added that the World Bank had increased its spending on Pakistan from $1.6 to $1.8 billion. Dr Shaikh also said that Britain had announced that Pakistan would be its biggest recipient of aid. “Britain will spend over $2.25 billion over the next four years, primarily in the field of education.”

While highlighting the increasing number of remittances, a higher growth rate and growing exports as signs of progress in Pakistan’s economy, Dr Shaikh said that the rising oil prices may impact Pakistani exports in the future. He added that if the economic conditions of Europe worsened, that too could impact Pakistan.

Record breaking foreign remittances expected

Shaikh said that Pakistan is due to receive a record $13.5 billion in foreign remittances this year in a sign of confidence of overseas Pakistanis’ in the economic policies of the government. “Overseas Pakistanis posing confidence in Pakistan, will send $ 13.5 billion this year, reflecting a 21 per cent increase from last year’s $ 11.2 billion,” the finance minister proudly announced at the press briefing.

Claiming that the national economy was now on the path to stability and growth, Dr Shaikh said that Islamabad’s policies are yielding results despite soaring international oil prices and uncertain global economic situation and that this year Pakistan’s economy will grow at four per cent of the GDP, the highest growth seen over the past five years.

He recounted a host of positive indicators including six per cent expansion in exports, which follow a 30 per cent increase in exports last year, and a jump of 25 per cent in revenue collection in the past nine..

http://tribune.com.pk/story/369070/hafeez-shaikh-caps-off-successful-us-tour-securing-promises-of-aid-loans/

Pakistan’s economy will probably expand 3.2 percent in the fiscal year through June 2012, lower than a previous forecast of 4 percent, the nation’s statistics office said in a preliminary estimate.

Gross domestic product increased 3 percent in the 2010-2011 financial year, more than an earlier report of 2.4 percent, following a change in the base year for calculating the pace of expansion, the Pakistan Bureau of Statistics also said in a statement released yesterday.

Pakistan’s $200 billion economy has been hampered by blackouts from its worst energy crisis, an insurgency on the Afghan border, elevated inflation and diminished aid flows. The nation’s Supreme Court yesterday convicted Prime Minister Yousuf Raza Gilani of contempt of court, adding to political tensions ahead of general elections due by February.

“Growth will remain subdued this fiscal year,” said Khalid Iqbal Siddiqui, the head of research at Karachi-based United Bank Ltd. “Manufacturing industries are suffering from power and gas shortages, while there are signs that the urban economy dominated by the service sector is performing poorly as well.”

http://www.bloomberg.com/news/2012-04-27/pakistan-s-gdp-growth-forecast-cut-to-3-2-by-statistics-office.html

LAHORE: Pakistan’s economy is resilient and growing with some phenomenal growth in remittances and informal economy, but the people are reluctant to invest due to many reasons including energy crisis.

This was the crux of a panel discussion held under Finance Minister Abdul Hafeez Sheilkh at World Bank headquarter a few days ago. International experts on Pakistan’s financial and social issues were present at the event.

According to the panellists Pakistan being the second largest country of the South Asian region a great potential to explore.

The World Bank Vice President for South Asia Isabel Guerrero posed two questions to the panel: What inspires you about Pakistan and what is the one shift needed to change the country for the better?

“The grace of the people of Pakistan amidst adversity inspires me,” Shaikh responded to the first question, and many of the other answers also cited Pakistan’s resilience in the face of multiple crises. Shaikh noted, “Countries that invested in their people, exported their products, and found the right balance between the public and private sector get ahead.”

Nancy Birdsall, president of the Center for Global Development, said a “culture of philanthropy” has helped Pakistanis embrace displaced people and respond to these challenges. She said the country is similar in this regard to the United States, as well as in its tradition of religious moderation.

Mohsin Khan, a senior fellow at the Peterson Institute cited the growth of the middle class - now 70 million out of Pakistan’s population of about 175 million - the informal economy, remittances from Pakistanis overseas, and the rural economy as encouraging factors.

“The most interesting factors are $75 billion consumer spending - almost 40 percent of the country’s GDP; a booming informal economy; and a 70 million strong middle class population out of 175 million total population are amazing numbers when we think about Pakistan as a poor country,” he remarked.

Mohisn said around 1.5 million motorcycles and half a million cars are registered each year in Pakistan. Toyota Camry has a price tag of around 35,000 dollars in the US, while in Pakistan it costs 100,000 dollars, “and you will see too many these sort of cars running on the roads, exposing the resilience of the (Pakistani) economy.”

He said that opinion about Pakistan going down the drain was wrong in a scenario when country was getting $12 billion annual remittances, $4 billion private transfers and $25 billion exports despite the fact that the industrial sector was producing at 50 percent of its capacity due to energy crisis. He said people were reluctant to pump in this money into the economy due to various reasons. Mohsin appreciated that Pakistan’s migrants had improved their skill level so they were getting higher wages than past so that remittances were growing.

Robin Raphel, senior advisor for Pakistan at the US Department of State said: “The war next door in Afghanistan, the 2005 quake, floods in 2010, recession - Pakistan has coped with all these things.”

Other speakers focused on the growing strength of Pakistan’s democracy, while noting the need for stronger political and governmental institutions.

“There is a historic and strategic shift happening in Pakistan,” Rehman said. “A choice has been made ... that we wish to live not just as a democratic country but as responsible global citizens.”

Anatol Lieven, a professor at King’s College in London, said the most pressing change Pakistan needed to make was to collect more taxes, and Shaikh said revenue collection has increased 25% this fiscal year.

http://www.thenews.com.pk/Todays-News-3-105322-World-Bank-panel-sees-Pakistans-economy-resilient-growing

Pakistan car (including LCVs, Vans and Jeeps) sales during 9MFY12 rose by 15 percent to 128,576 units compared to 111,852 units in same period last year.

The volumetric growth primarily stems from i) June to July deferred sales on account of reduced tax structure announced in Federal Budget FY12 ii) Yellow cab scheme announced by the Punjab Government iii) 21 percent increase in workers’ remittance in 9MFY12 and iv) monetization due to rising government fiscal deficit.

According to Topline Securities analysis report, in 3QFY12 (Jan-Mar) the industry sales rose by 7 percent from 43,753 units to 46,632 units in same period last year, while are up by a significant 22 percent as compared to last quarter (Oct-Dec).

In March 2012 car sales stood at 16,678 units up 6 percent as against 15,710 units sold in March of last year and are up 11 percent versus 14,962 units sold last month.

With respect to individual companies, PSMC continued to depict strong growth of 32 percent in 9MFY12 to 81,360 units versus 61,693 units seen in same period last year as it stands out to be the prime beneficiary of announced yellow cab scheme.

In 3QFY12, the company sales stood at 30,642 units from 3QFY11, up 31 percent and 26 percent from 3QFY11 and 2QFY12, respectively. In March, PSMC sales stood at 11,198 units, up 16 percent from same month last year and 12 percent from last month.

Indus Motors 9MFY12 sales growth remained subdued. Company sold 38,858 units compared to 37,259 units in same period last year, up by 4 percent.

In 3QFY12 the company sold 14,792 units against 14,851 units in the same period last year, but depicted a significant jump of 26 percent as compared to last quarter.

The recent recovery in sector’s volumetric sales along with the improved margin is expected to bode well for the sector’s profitability going forward.

http://www.brecorder.com/pakistan/business-a-economy/52787-car-sales-up-by-15pc-during-9-months-of-current-financial-year-.html

Their biggest challenge at the moment is to explain how nearly seven million Pakistanis have come out of the vicious cycle of poverty.

According to the survey, the incidence of poverty has declined from 17.2 per cent in 2008 to slightly over 12 per cent in 2011. It was conducted by a committee constituted to calculate the incidence of poverty on the basis of Pakistan Social and Living Standards Measurement Survey 2010-11.

“The biggest challenge in front of us is how to explain this figure to the masses and economists when the economy grew at an average rate of 2.6 per cent and average inflation remained above 15 per cent during the last four years,” a member of the committee told The Express Tribune requesting anonymity due to political sensitivity attached to the figure.

He said poverty declined to slightly over 12 per cent with sharp declines in both rural and urban poverty. He said rural poverty declined more than urban poverty but, “the behaviour was the same and consistent with previous years’ results.”

In 2007-08 when the Pakistan Peoples Party-led coalition government took over, poverty had been assessed at 17.2 per cent. But the government decided not to release the figure saying poverty was at 35-40 per cent. It shared 40 per cent figure with Friends of Democratic Pakistan in its maiden meeting held in Tokyo.

It is facing the same dilemma exactly after four years, as its own people are now telling that poverty has declined to 12 per cent.

According to the United Nations Multi Dimensional Poverty Index, half of the country’s population lives below the poverty line.

----------

In 2007-08 the country’s estimated population was 164.7 million. By that account in 2008 as many as 28.3 million people lived below the poverty line. In 2010-11, the estimated population was 175.3 million and around 21.5 million people were in abject poverty.

The committee member said that poverty has been worked out on the basis of consumption method. According to this method, if a person takes 2,350 calories per day that costs him slightly over Rs1,700 per month that person is taken as above the poverty line.

The official said that the committee has not formally submitted the poverty report to the Planning Commission, but it is expected to submit the report over the next couple of weeks. However, the committee has already shared its findings with the commission.

A senior government official, who also wished to remain anonymous, said that the concerned authorities were considering the poverty figure and framing their mind whether to release it or not. It is not yet clear whether the government would publish the poverty estimates in the Economic Survey of Pakistan 2011-12.

The committee member, while giving justifications for the decline in poverty despite harsh ground realities, said that poverty declined because of higher support price of major crops, especially wheat, healthy trend in inflows of remittances and impact of assistance provided by both the government and private sectors in the flood affected areas of the country.

http://tribune.com.pk/story/374384/solace-among-confusion-5-decline-in-poverty-surprises-govt/

The cement sales in domestic market posted fifth straight month of increase as compared to last year but the industry is still passing through difficult times as its exports registered third consecutive month of decline.

A spokesman of All Pakistan Cement Manufacturers Association stated this while discussing performance of the cement industry during first 10 months of the current fiscal.

He said that the total cement despatches up till April 2012 were 26.643 million tonnes, which is 3.31 percent higher than despatches during the corresponding period of last fiscal. The domestic sales during this period increased by 8.51 percent but exports registered a decline of 8.91 percent. He said performance of north and south-based mills depicted different trends both in domestic sales and exports. He said local sales of the north-based mills increased by 7.77 percent to 15.928 million tonnes while the south-based mills registered higher domestic consumption by 11.81 percent to 3.701 million tonnes. In exports, however, the mills in the north suffered comparatively less decline than in the south. The cement producers based in north exported 5.087 million tonnes of cement posting a decline of 6.23 percent over exports made during the same period last year. The exports of south region mills declined by 15.29 percent to 1.928 million tonnes.

Among the export markets, the Afghanistan market remained relatively stable as exports declined nominally by 0.15 percent to 3.778 million tonnes. Exports to India increased by 15.19 percent to slightly over half million tonnes. This includes exports by sea, as well as, through Wagah border. Exports to other destinations through sea however decreased by 16.96 percent to 2.699 million tonnes. Cement industry people said that cement is one the major commodities that is abundantly available in Pakistan and can be exported to India through the land route. Despite tall claims to increase bilateral trade, the respective governments failed to remove non-tariff barriers imposed on Pakistani products. There is currently a labour strike on Indian side resulting in piling up of consignments, which is affecting the movement of trucks from Pakistan.

Besides, merely 10 wheeler trucks from Pakistan are allowed to cross the border and maximum weight may not be more than 40 tonnes per truck. Unfortunately, most of the available transportation for cement has a loading capacity of more than 40 tonnes.

Availability of 10 wheeler trucks with a loading capacity up to 40 tonnes for cement is limited; resulting in the cement industry being unable to export its surplus capacity

There is only one scanner installed at the new gate at Wagah border resulting in long queues creating hurdles and delay for Pakistani exports to India. The Pakistani exporters have demanded of the government to look into the matter and allow trucks with a loading capacity up to 80 tonnes instead of 40 tonnes. They further urged the government that exporters should also be provided all necessary facilities at the border points so that they could easily clear their consignments.

http://www.dailytimes.com.pk/default.asp?page=2012\05\08\story_8-5-2012_pg5_2

Pakistan cut taxes and raised government salaries in an election-year budget that risks missing a target to narrow the deficit from a three-year high.

The government pledged to narrow the budget gap to 4.7 percent of gross domestic product in the year ending June 30, 2013 from 7.4 percent of GDP in the previous 12 months, Finance Minister Abdul Hafeez Shaikh said in his budget speech in Islamabad today. Opposition lawmakers shouted anti-government slogans, held up placards and scuffled during the presentation.

Prime Minister Yousuf Raza Gilani’s government, facing a general election by February at the latest, is under pressure to counter growing public anger over power blackouts, the fastest inflation in Asia and an insurgency on the Afghan border. The government is relying on domestic borrowings after aid flows from the U.S. and the International Monetary Fund dwindled.

“Raising salaries, reducing duties and increasing expenditure means they are likely to miss the fiscal deficit target once again,” said Saad Khan, fund manager and economist at Askari Investment Management Ltd., in Karachi which oversees 25 billion rupees ($267 million) in stocks and bonds.

The budget was unveiled after the nation’s financial markets closed. The Karachi Stock Exchange 100 Index (KSE100) rose 0.7 percent today and has climbed 14.5 percent in the past year. The Pakistan rupee was at 93.67 against the dollar, having declined 7.7 percent over the past 12 months.

http://www.businessweek.com/news/2012-06-01/pakistan-cuts-taxes-raises-wages-risking-deficit-as-vote-looms

If one looks objectively at

Pakistan’s economy, it is clear

that the system is facing serious

challenges. The list is familiar:

fiscal pressures that require an

increasing volume of domestic

financing; an energy shortage

that entails economic and social

costs; low investment that is

undermining future growth;

issues with law and order; and

the neighboring war in

Afghanistan.

At the risk of making too fine a

point on the matter, Pakistan’s

economic data appears to

suggest two things: first, that

Pakistan has fallen behind its neighbors in South Asia; and two, even this belowpotential

growth is quite impressive when seen in the context of the challenges

mentioned above. In our view, the latter point is not widely appreciated.

There is a growing sense that Pakistan’s undocumented economy (the informal

sector) is vibrant, and that official data understates the level of economic activity

that can be seen. In effect, there seems to be a disconnect.

------------

It is a stylized fact that the informal sector in Pakistan is buoyant, and is

generating jobs; incomes; and demand for goods and services. This, in turn, is

spilling over into the real sector that is documented. Hence, as discussed in

Chapter 2, there are clear signs that construction is up, which is helping ancillary

sub-sectors like steel; cement; chemicals; wood; glass; paints; etc.

Many would argue that a vibrant informal sector is a blessing, as it is driving

formal economic activities, and keeping Pakistan from a full blown recession as

seen in Europe. Furthermore, the increasingly precarious social safety net that is

stoking public anger in Europe, may not be relevant in Pakistan where the

extended family and community steps in to take care of the elderly, the

unemployed, and the destitute. Although we would concede these points, it is

important to keep things in perspective.

While social institutions like the extended family; mosques; neighborhood

charities; ethnic/community organizations; etc., are robust and sustainable sources

of social and economic uplift, the role of the state (beyond official safety nets)

cannot be eliminated. More specifically, physical infrastructure and other public

goods (e.g. security; law enforcement; judicial services and contract enforcement;

recreational spaces; etc.) would be undersupplied by private organizations, which

are required to promote sustainable economic activities. If the mind-set of

absolute self-sufficiency becomes more entrenched, it may segment the economy.

http://www.sbp.org.pk/reports/quarterly/fy12/Third/Ch-1.pdf

As per the latest available data of auto sales, recently released by the Pakistan Automotive Manufacturers Association (PAMA), car and LCV sales witnessed a 15.1% YoY growth in 11MFY12. Segment-wise break-up reveals that the economy segment (less than 1,000cc) led the growth with sales increasing by 24.9% YoY during the period under review. This was followed by the 1,000-1,300cc segment, which witnessed sales growth of 19.2% YoY to 26,734 units. The high-end segment (1300cc+) meanwhile remained the sector’s laggard and sales grew by a meager 2.1% YoY to 58,458 units. This lackluster performance can mainly be attributed to the suspension of production at Honda Atlas Car’s (HCAR) plant from Dec-11 to Mar-12, and single-digit sales growth of Corolla. Sales of LCV’s and 4×4’s registered a healthy 27.4% YoY growth in 11MFY12, mainly due to a jump in Bolan (PSMC), Ravi (PSMC) and Hilux (INDU) sales.

Pakistan Suzuki Motor Company Limited (PSMC) witnessed a 31% YoY improvement in sales in 11MFY12 to 100,805 units. PSMC has benefitted from the Punjab Government’s Yellow Cab Scheme, which has resulted in sales of Mehran and Bolan to increase by 39% YoY and 54% YoY respectively. Sales of Swift, Cultus and Alto meanwhile, increased by 67% YoY, 23% YoY and 15% YoY respectively in 11MFY12. Total units sold by the company in May-12, increased by 20% MoM to 10,608 units. On a YoY basis, this figure is 34% higher than May-11’s sales of 7,920 units.

Sales of Indus Motor Company Limited (INDU) decreased by 7% MoM in May-12 to 4,846 units. The primary reason behind this decline is the discontinuation of Coure, with only 63 units being sold during the month. During 11MFY12, the company sold a total of 48,907 units, which is 6% higher on a YoY basis. Hilux has remained at the forefront (with respect to sales growth), and its sales are higher by 56% YoY to 3,625 units in 11MFY12. Sales of Corolla during 11MFY12 increased by 9% YoY to 41,720 units.

Honda Atlas Cars Pakistan Limited (HCAR) reported a 53% MoM increase in total units sold to 1,150 units. The company’s endeavors to clear the backlog of orders of its City model resulted in sales of the model to jump by 533% MoM to 1,050 units. In 11MFY12 however, the company was only able to sell 9,901 units (33% lower YoY) owing suspension of production due to floods affecting its primary parts supplier in Thailand last year.

Al-Ghazi Tractors Limited (AGTL) registered a healthy 20% MoM sales growth to 2,743 units in May-12, helping the segment attain an overall performance improvement of 10% MoM to 6,913 units. On a YoY basis however, the sector recorded 33% lower sales owing to the imposition of GST last year, which resulted in demand for the product drying and production being suspended as a consequence. Millat Tractors Limited meanwhile, reported a 4% MoM improvement in sales to 4,170 units. On a YoY basis, sales of AGTL and MTL declined by 42% and 28% respectively during 11MFY12. This was mainly on account of the suspension of production mentioned above..

http://investorguide360.com/11mfy12-auto-sales-register-15-yoy-growth-lies-ahead-budget-ahl-research/

Isn’t it great that we in Pakistan finally have a mall which houses international brands such as Next, Nine West, Splash, Monsoon, Accessorize among other names? The retail boom is in full swing no matter what the economists say. Proof: Mango’s launch which brought out top models, stylists as well as your everyday shoppers.

Though its doors have been open to the public since June, its media launch (managed by Catalyst P.R. aka Frieha Altaf) was just held recently. Okay, so coming back to the basics, I love LOVE loveeeee shopping BUT I am an even bigger lover of a good bargain. IMAGINE my disappointment when a pair of heels (hideous ones by the way) at Nine West were for Rs.13,000! I had convinced myself that Mango will fair no better. I was pleasantly surprised…to an extent.

The thing is that these brands are RETAIL brands, NOT designer brands, as some may think. The price points cannot be “unaffordable” as they have to appeal to the general public. Right? Where Mango had their summer clothes (which I loved!!!) there was winter wear as well! Hmm, isn’t it still summer and isn’t winter like MONTHS away? Winter in Karachi won’t be until end of November (if we are lucky), so what is the point of having SWEATERS smack in the start of one of the hottest summers we have had? What is that? Yes, that’s a puzzle even I couldn’t figure out! There were cute tops and accessories, bags and shoes, scarves, fun summer maxis and jeans – all the good stuff. What Nine West or Monsoon lack in affordability, Mango makes up for it. Comparatively, Mango is much more affordable than the rest of the retail counterparts which have come to town. Next, though was one of the first retail brands to open its doors in Karachi and Lahore, has the inventory which can easily be classified as, say it with me “ANCIENTT!!!” They should just pack up or change their management. Note to Management of Next, WAKE UP!!

Coming back to Mango, jeans were ranged between Rs.4,000 and under Rs.6,000 – Gold Star for Mango! The summer maxis however, were above 13,000! Five thumbs down! Over all, the accessories were relatively affordable as well as current. Noted fashion designer Sadaf Maletarre said and I quote “It’s great to have Mango in Pakistan.”

Top model Fayezah Asad Ansari said, “It is brilliant that Mango has opened up in Karachi, though for a retail brand I wish the clothes were more affordable.” This concern was also shared by stylist Beenish Pervez. “The clothes are fantastic, that being said they are not as affordable for everyone.”

I have to agree and disagree with my fellow fashionistas. It’s excellent for these brands to open their door here which is perfect for people who cannot travel abroad and shop. They finally have an avenue to have what people who travel abroad have had for years… however, people who travel do know what is in the stores in London, New York, Toronto, Dubai etc. and can quickly asses what is new and what was in stock last season. For them, it is pointless to shop here anyways.

http://dawn.com/2012/07/09/retail-boom-in-full-swing/

The actual Gross Domestic Product (GDP) of Pakistan is nearer to $300 billion and not $210 billion, as is shown officially. And, if the ailing economy of the troubled Pakistan is assumed to grow by 3 per cent per year by 2015 the size of the actual GDP would likely to set between $ 350 and $ 375 billion. This was stated by Managing Director KSE Nadeem Naqvi while briefing the visiting V. Shankar, Member of the Board, Standard Chartered Bank PLC and CEO Europe, Middle East, Africa and Americas here at Karachi Stock Exchange (KSE) on Wednesday.

“Using conservative estimates, 50 per cent of the economy is in the undocumented sector,” Naqvi said adding that further estimation showed that the per capita income of top 10 per cent of households in Pakistan was near $5,000 versus national per capita income of $1,190.

“This represents a significant potential market for investment and financial services,” the MD added. Also, Naqvi highlighted the areas where KSE and SCBPL could cooperate that, he said, include investor awareness generation, attracting Non-Resident Pakistanis (NRPs) to the capital market and helping private companies list on the Exchange. Earlier, Shankar, accompanied by Mohsin Nathani, Chief Executive of Standard Chartered Bank (Pakistan) Limited (SCBPL) and senior members of his management team, rang the “Opening Bell” of the KSE in the presence of Chairman KSE Muneer Kamal, MD Nadeem Naqvi, DMD KSE Haroon Askari and directors of the KSE Board.

On the occasion Shankar said there was tremendous opportunity for growth in intra-regional trade for the South Asian economies, particularly India and Pakistan. Illustrating India-China bilateral trade, he said when Sino-Indian trade opened up they had to overcome some apprehensions, however, today they were one of the largest trading partners with benefit to both countries. Welcoming the guests, chairman KSE Muneer Kamal said Pakistan’s economy was at an inflection point. Despite challenges posed by low tax-to-GDP ratio, power sector difficulties and current account pressure due to demand slowdown in key export markets, Pakistan at present was in a position to repay IMF loans.

The foreign exchange reserves, supported by strong remittances by overseas Pakistanis, were in a much healthier position than at the height of global financial crisis in late 2008. While debt servicing burden had risen, it should be viewed in the global context and Pakistan’s total debt-to-GDP ratio of 64 per cent was far lower than many Euro zone and G-8 economies.

A concerted effort to mobilise tax revenue and focus on emerging domestic energy resources such as coal would go a long way in fixing structural deficiencies causing large budget deficits. Kamal highlighted that economic growth can be further accelerated with growing intra-regional trade in the sub-continent. He pointed out that while intra-regional trade in East Asia was 23 per cent of GDP, it was only 1 per cent of the GDP in South Asia.

http://www.pakistantoday.com.pk/2012/03/01/news/profit/kse-contradicts-official-figures-for-pakistan%E2%80%99s-gdp-says-actual-amounts-to-300bn/

LAHORE, Pakistan — A perfectly coiffed model, draped in diamonds, shoots a sultry gaze from the cover of a glossy in-room magazine at a luxury hotel chain in downtown Lahore. The cover line on the ad-packed issue screams: “Wow! World of Women.”

And with good reason. Economists say that, in recent years, Pakistani women have fueled a retail boom in name-brand shopping as they move from a traditional homebound life into the working world.

“You can go into any shopping mall or any cafe, and you will see young girls sitting, having lunch, chatting away,” said Rashid Amjad, vice chancellor at the Pakistan Institute of Development Economics in Islamabad. “Despite all this conservatism that has been growing at the same time, you have a change.”

In many urban centers, the days when girls were forced to abandon education and eschew employment in favor of remaining within the walls of their homes seem to be mostly a memory.

Traditionally, men here bear the burden of sustaining the household, so for many middle-class women, their paychecks are entirely their own to spend — a boon for the newly booming retail industry.

“I can afford to spend whatever I like,” said Rabiya Bajwa, 37, a lawyer. “My income is roughly 20 percent more than what it was five years ago.” Bajwa does contribute to the household budget, but her two-income family enjoys a comfortable “cushion,” and she splurges on expensive designer clothes.

But this good fortune is not evenly distributed, said Hafiz Pasha, a noted economist at Beaconhouse National University in Lahore. Pakistan, he said, is still far behind other countries in terms of women’s economic contribution.

“This growth is witnessed in urban centers where middle-class working women are found,” Pasha said. “In rural areas, although the participation of women in the economy is more than the urban centers, they are not well-paid, and their share in the economy is much less.”

Although women have long been underpaid and subject to discrimination in the Pakistani workforce, they are coming into their own at a surprising rate. Since about 2002, Amjad said, participation by women, traditionally low, has been rising.

Many men left agriculture jobs, so work was being generated and women readily moved in, Amjad noted. Now, somewhere between 28 percent and 36 percent of women work in Pakistan, he said, but many work in home-based businesses, so their numbers are not easily ascertained.

In schools and colleges, young women study side by side with their male counterparts. “They seem to be very easy together, they talk very easily, and they discuss issues quite comfortably,”Amjad said, “so in a way higher education has increased female confidence to work with men, and that has helped.”

Three retail store owners surveyed in Lahore said most of their customers are working women, and they credited them with increasing their business.

“We started from a small store, but now we have five outlets in various parts of the city,” said Hasan Ali, manager of Bareeze, a leading brand of women’s clothing. “We have been in the market for the last 10 years, and roughly the business has expanded 40 percent in that period. . . . There are those out there who don’t even ask the price, and pay.”

Rukhsana Anjum, 47, a senior instructor at the Government College of Technology in Lahore, said she earns about 100,000 rupees, or $1,054, a month. “Gradually in the last five years I have become brand-conscious,” she said. “Today, definitely I spend more on my clothes and jewelry.”

http://www.washingtonpost.com/world/asia_pacific/pakistani-women-drive-retail-boom/2012/09/30/b6e38eea-0a3f-11e2-afff-d6c7f20a83bf_story.html

ISLAMABAD: Pakistan’s informal economy has expanded, reaching 91.4 percent of Gross Domestic Product (GDP). At a PIDE conference on Thursday, economist, M Ali Kemal said, “according to data for 2007-08, our formal GDP is half our actual GDP. However, it is still an under-estimated figure since investment data is not adjusted. The informal economy is 91.4 percent of the formal economy.”

He further said that the formal economy contributed Rs10,242 billion of the estimated Rs19,608 billion that the economy generates. Moreover, the informal economy stands at approximately Rs9,365 billion.

“Estimating the size of the underground economy is crucial for policy makers,” said Kemal. According to Economic Survey findings, total consumption for the entire population of the country is Rs17,261.6 billion and private consumption is Rs7,835.31 billion.

The sum of Rs9,426.29 billion is not reported in the formal economy.

During the session on poverty and household consumption, Dr Ashfaque H Khan, Dean NUST Business School (NBS) and Umer Khalid cited findings from a research paper on the consumption pattern of male and female-headed households in Pakistan.

According to their findings, marginal expenditure shares were highest for housing, durables, food and drink for households headed by men while they were highest for durables, followed by housing and food, and drinks for households headed by women. Higher marginal expenditures by households headed by females on education and durables were found in comparison with their male counterparts as these results were consistent in urban and rural areas of Pakistan.

Further, households headed by women were found to have higher budget shares for education, housing, fuels and lighting, clothing and footwear and lower average expenditure on food, drink, transport and communication compared to those headed by men.

The study also examined the consumption behavior of both types of households to determine consumption patterns and how they vary with change in economic status.

This analysis revealed that in the first three expenditure quintiles, the consumption expenditures of households headed by men were higher than those by women.

Moreover, in the last two quintiles, the consumption expenditures for households headed by women were slightly higher than those headed by women.

http://www.thenews.com.pk/Todays-News-3-143058-Size-of-informal-economy-at-914-percent-of-GDP-study

http://www.pide.org.pk/psde/25/pdf/AGM28/M%20Ali%20Kemal%20and%20Ahmed%20Waqar%20Qasim.pdf

I have a serious problem with the cynic brigade that writes and comments on social, developmental and political issues along familiar lines. What is their familiar line? The Taliban are coming, extremism is on the rise, corruption is pervasive and life is miserable. This is a partial truth, not the whole truth. That nothing can change is a viewpoint that conflicts with history and the evolution of societies.

Cynicism in hard times like ours and in a climate of fear, insecurity and violence, sells and viewers and readers readily embrace the dark side of things rather than looking at what is bright and shining. The other issue is the habit of most of my colleagues and columnists to write from the comfort of their offices or homes. They tend to look at the big picture that gives a disturbing spectre rather than examining achievements at local levels, and by dedicated individuals and communities. If there is any meaningful and real change in Pakistan, it is taking place at these levels in every aspect of the social and economic life of this country. By missing details of development and positive change at the smaller scale, we may draw a big picture of a society and country that may not be in agreement with reality. This is what is unfortunately happening.

One of my social beliefs is that only by changing at the local level will Pakistan change for the better at the national level. The national in spatial terms is nothing but local. By often travelling through the villages, mostly in Punjab, I have seen thousands of positive contributions and developments that are neither documented nor narrated. Never has our regular cynic brigade opened its eyes and minds to what this change is and how it is becoming a catalyst for more and larger changes.

Let me share one man’s gigantic contribution at a government agricultural research farm in Bahawalpur. I had heard about Mushtaq Alvi for his collection of berries and date palm trees for some years. Last weekend, I had the opportunity to visit this fabulous farm, which may not be noticed from outside the walls. Mr Alvi, as a young man with his first job, started the plantation in 1985. He went to every place in Pakistan to collect the best local species of date palms, berries, mangoes, guavas and pomegranates. Today, he has 35 species of date palms, 20 of berries, 20 of mangoes and five of pomegranates, and almost every of guavas. Never has his search for new findings ended.

While the collection continues to expand, the farm has supported thousands of farmers and households that would like to have various species of these trees. Every season, thousands of berry plants and hundreds of date palms are distributed. Then there are private collectors of these trees that have developed their own farms and would like to sell plants to new farmers. Each new tree becomes a source for saplings leading to further proliferation.

Scientists like Mr Alvi and many of his colleagues may move on to other research stations or retire but what they have done is something remarkable. This is just one example of ordinary Pakistanis making a difference to society. Unfortunately, our media, commentators and pseudo intellectuals cannot lift their eyes from what is wrong in society and shift their attention, even for a moment, to what is right and working.

Recognition and celebration of achievements by individuals and communities encourages positive change, positive attitudes and stimulates energies for innovation and more contribution. While grieving about the many things that are troubling us, let us not ignore the pleasing side of changing Pakistan. Go out and see it.

http://tribune.com.pk/story/509088/changing-pakistan/

...More detailed metrics of economic activity also show great ‘tranquillity’ in the west (Balochistan & KP). Detailed figures on consumption of electricity by industrial and commercial categories of consumer, for instance, show very little change over the years.

------

But take a closer look and you’ll find something odd. The State Bank has a data series on its website that shows something enormous, of truly gigantic proportions, stirring beneath the tranquillity suggested by the formal macroeconomic data.

Here is what the data reveals: the amount of money passing through the clearing houses of Quetta and Peshawar is so large that it rivals the amounts in clearing houses of cities like Faisalabad, Multan and Rawalpindi.

First some background. Every time you write a cheque and the other party deposits that cheque in their account, it goes through a process called “clearing”. Because banks don’t hold your money themselves — much of it is held by the State Bank — the task of actually taking the money out of the books of one bank and transferring it to the books of another every time a cheque is cleared, is performed by the State Bank at its clearing house.

The State Bank operates 16 clearing houses in cities all over the country. Every month it releases data on how many cheques were presented for clearing in each of these, and what the total amount cleared by cheques was.

If you take this data, which stretches back to 1999, and plot it for each city in Pakistan, you notice something very interesting. Remove the cities of Karachi and Lahore from the sample for the time being, because these are global cities in a sense with long-distance connections. Compare only the regional cities and here is what you’ll find.

Following 9/11, half the cities in the total sample will show a sharply rising trend in the amount of money going through their clearing houses. For the other half, the line is flat.

The cities that show a rising trend are led by Peshawar, with Faisalabad, Multan, Rawalpindi and Quetta in close succession. For Peshawar, the amount of money being cleared via cheque in the year 2011 crosses Rs1.3 trillion! For Quetta, in the same year, the amount is just under Rs900 billion, meaning between them these two regional cities are seeing almost Rs2tr going through their clearing houses in one year alone.

This figure compares with Faisalabad at Rs1.3tr, Rawalpindi at Rs1.4tr, and Multan at Rs826bn. Cities that show a flat trend over the entire reporting period include Sukkur, Hyderabad, Sialkot and D.I. Khan.

What the data shows is a steep intensification of transactions being cleared by cheque in some cities, and no change in others, meaning the pace of economic activity accelerated unevenly over the decade, sweeping some along its path and leaving others behind.

But what are Peshawar and Quetta doing on this list? With Faisalabad and Multan, it’s easy to understand. These are regional hubs, productive centres, large seats of agrarian operations.

----

In fact, after Karachi and Lahore, it is Multan, Faisalabad and Rawalpindi that account for the bulk of transactions in branchless banking, which shows the intensification of activity in the clearing houses of these cities is accompanied by an overall deepening of the financial sector.

-----------.

http://dawn.com/2013/02/28/the-hidden-economy/comment-page-1/

It fails to include important industries that have sprung up since the last census of the manufacturing base was conducted nine years ago.

The State Bank of Pakistan (SBP) highlighted this anomaly in its annual report on The State of the Economy 2013-14, mentioning economic contributors not incorporated in the Large Scale Manufacturing (LSM) and agricultural data.

Manufacturing has a 11% share in economic output, but experts have been going on for years, saying that tens of thousands of establishments from Karachi to Faisalabad are the real drivers of the economy but remain unreported.

The last Census of Manufacturing Industries (CMI) was carried out by the Pakistan Bureau of Statistics (PBS) in fiscal 2005-06 on the basis of response received from 6,417 factories — a number much smaller than the actual size of the industrial base.

Some very large businesses are not covered by the PBS at all.

Engro Polymer and Chemicals, which meets over one-third of the domestic demand for caustic soda, is a glaring example.

Caustic soda holds the largest chunk in the 11 categories of chemicals reported by PBS. Excluding Engro distorts actual output of the industry, the SBP said.

While the production of caustic soda posted a 8.4% year-on-year decline in 2013, Engro Chemicals reported a 5.6% increase in production this year. “The inclusion of this company could have offset the reported decline in caustic soda,” SBP said.

When it comes to automobiles, PBS relies on data provided by the members of Pakistan Automotive Manufacturers Association (Pama). This leaves out leading bus and truck manufacturers like Afzal Motors and Al-Haj Faw Motors that entered the market later.

Textile and food

Similarly, the weightage of cotton yarn and cotton cloth is one of the highest in CMI, together holding 17%. Yet PBS leaves out 90% of the manufacturers as it covers only mill-related activity, which is based on units registered with the Ministry of Textiles.

As a matter of fact, data of wearing apparels and dressing, publishing, printing products and recorded media, fabricated metal products, computers, medical precision and optical instruments, and other industries, is not included as part of LSM, stated the SBP.

“In the food sector as well, demand and production of a number of processed food items like packaged milk, yogurt, dairy items, pastas cereals, has grown in past few years. But the production of these items is not included in LSM data,” it noted.

This basically leaves out manufacturers like Unilever, Kolson, Nestle, Engro Foods and National Foods, it noted.

The story is the same with cosmetics and personal care goods produced by FMCGs like Unilever and P&G that are also not part of the LSM.

Plastic sector

Another sector, which has emerged as an important contributor to the economy, and ignored in CMI, is plastics. The Pakistan Plastic Manufacturing Association (PPMA) has around 6,000 upstream and downstream units, employing 0.6 million people.

----------

Plastic sector has a weight of 0.75% in CMI while data is collected from only 142 units. As per PBS’ own numbers, in 2013-14, Pakistan exported 253, 896 tons of plastics products valued at $350.7 million, which was a 7% decrease compared with plastics exports in the previous year.

SBP also pointed out that while exports are down, imports of raw materials witnessed 26.4% growth in this year, which indicates robust growth in manufacturing in this segment.

The last CMI recorded 3,590 factories in Punjab, 1,825 in Sindh, 673 in Khyber-Pakhtunkhwa (K-P) and 212 in Balochistan.

At basic prices, textile sector had the highest contribution to GDP of 27.41%, food products and beverages 15.82%, chemicals and chemical products 14.83%, and non-metallic mineral products 7.52%.

http://tribune.com.pk/story/823774/misrepresented-and-misunderstood/

Meanwhile, manufacturing activity in a number of sectors has been enhanced and many new manufacturing units have started operating in country in recent past. Hence, an expanded data coverage exercise of manufacturing units and new categories is required, to present a more realistic picture of LSM in the country, it added.

In annual report for FY14, the SBP said LSM data was not being compiled in Pakistan according to International Standard Industrial Classification (ISIC) of United Nations Statistics Division’s defined 22 broad categories of manufacturing.

As in Pakistan, the coverage of LSM pertains to only 15 sectors identified by the ISIC while data pertaining to manufactures of wearing apparels and dressing, publishing, printing products and recorded media, fabricated metal products (except machinery and equipment), office and accounting machinery and computers, medical precision and optical instruments and recycling of metal and non-metal waste scrap, is not included as part of Pakistan’s LSM.

Pointing out main concerns, the SBP said LSM data for cotton cloth and cotton yarn was collected by Ministry of Textile, which only covered mill sector activity. The non-mill sector, which entails over 90 percent of overall production of cotton cloth in country, is not included in the data set. While the growth in manufacturing textiles posted a slowdown in FY14, the export quantum of almost all textile categories (with the exception of cotton yarn) posted an increase in the year. In fact, the provision of generalised system of preferences plus status from the European Union (EU) suggests strong growth prospects of this sector.

Similarly in automobiles, the PBS reported production of units registered with Pakistan Auto Manufacturers Association only while some leading bus and truck manufacturers namely Afzal Motors and Al-Haj FAW Motors were not included by the PBS. The PBS reports data for 11 categories of chemicals, with caustic soda claiming the largest share. For caustic soda, production of Engro Chemicals, which caters to one-third of the entire domestic demand of caustic soda, is not included in LSM data. The demand and production of a number of processed food items has grown in the past few years (eg packaged milk and products, dairy items, yogurt, pastas, cereals, frozen and ready to cook items etc). The production of these items, however, is not included in LSM data which leaves out large and vibrant manufacturers like Unilever, Kolson, Nestle, Efoods and National Foods.

Similarly, non-food Fast Moving Consumers Goods (FMCGs) products like cosmetics, personal care products and toiletries, which are produced by prominent brands like Unilever, Medicam and Procter and Gamble are also not captured by LSM. The production of plastics is completely absent from LSM data set.

According to Pakistan Plastic Manufacturing Association there are around 6,000 upstream and downstream units operating in the country, employing 0.6 million people. This sector is producing a broad range of products ranging from household items, industrial containers, medical and surgical items, auto parts, stationery items, PVC pipes etc. Yet they are not covered in LSM.

http://www.dailytimes.com.pk/business/14-Dec-2014/sbp-shows-dissatisfaction-with-pbs-s-lsm-coverage

https://www.dawn.com/news/1725956

According to research by Oraan, around 41pc Pakistanis saved via committees (or Rosca), whereas Karandaaz puts that figure at 34pc. Assuming the informal economy accounts for roughly 30pc, as suggested by research from the Pakistan Institute of Developing Economics, it translates into annual committees of Rs4 trillion at base prices, using conservative inputs.

While this back-of-the-envelope calculation is far from scientific, it helps contextualise how big the informal savings market really is. Everyone from a widow looking to save up for her children’s education to young adults trying to save up for their marriage, committees are what they turn to.

This phenomenon is not exclusive to Pakistan. According to a note by Middle East Venture Partners (one of the investors in Bykea), “the global market is largely untapped and ripe for disruption with 2.4 billion people using money circles through traditional channels.”

They recently participated in the Egyptian digital committees’ startup MoneyFellows’ $31m Series B.

Apart from the traditional financial institutions’ general apathy towards the customer, committees appeal to an average Pakistani for several reasons: they are a community-based instrument with some level of flexibility and there is no interest involved.

Most importantly, it helps them manage cash flow better due to habitual change. For women, the product enjoys particular popularity since the former financial services are largely inaccessible.

However, since committees are primarily cash-based with virtually no money trail involved, it poses massive risks, as we saw recently when a girl, Sidra Humaid, who ran a network of committees through social media, defaulted on Rs420m of payments.

----

Even beyond this, committees have flaws by design, only amplified by Pakistan’s macros. For instance, the person receiving the first lump sum amount will always be at an advantage since their instalments in the subsequent months would be worth less due to both inflation and rupee depreciation. The recipient of the last payment would see the amount’s purchasing power eroded substantially by the time they get it.

Moreover, due to the community-based nature of the product, the risk of network defaulting is higher as people of usually similar risk profiles would be pooling in their money.

For example, if employees from an organisation have running office committees, delayed salaries or layoffs within the organisation would lead to a bad equilibrium, creating losses for the rest of the group, often resulting in default.

However, there are ways to address some of those challenges. First of all, to (partially) protect your lump sum from depreciation or devaluation, you can enter a committee with a duration of up to 10 months. Given Pakistan’s macros of late, you’d still lose money in real terms but to be fair, that’d most likely be the case in any other instrument as well, including the risk-free government papers.

In fact, contrary to popular perception, there are certain ways to further alleviate the inflation problem. Digital committees have an option of gamifying the experience by rewarding good payment behaviour through loyalty programs and/or brand partnerships to provide discounts on utilities-based services and products.

Secondly, digital committees help create a trail of money which, coupled with a centralised authority (the platform itself), brings in accountability and recourse in the event of a default. The receipt and/or ledger helps with basic accounting in committees creating transparency for people within the group.

The third benefit of digital committees is the security factor. The participant has to go through a know-your-customer and credit check process to make sure there is no fraudulent behaviour that could negatively impact the group, along with the participant’s ability and willingness to pay to create an overall environment for responsible finance.

https://profit.pakistantoday.com.pk/2022/02/27/plotistan-the-mystery-of-low-savings-rate/

Economic agents are not rational, and neither are government policies often driving the interplay of savings and investments

There is a lot of noise regarding the savings rate, and how a transition towards the formal economy would enhance the savings rate. This is indeed a novel idea, and recent digitization measures would certainly boost savings rate as an increasing number of transactions flow through the system, while the size of the informal economy contracts. Over the last ten years, Pakistan has had a savings rate of 14.5 percent, stooping to a low of 12.5 percent only a few years back. Savings rate in Pakistan has gradually dropped in this century, after hitting a peak of 23 percent in 2004.

A traditional national income identity, where cumulative GDP for a country is a function of consumption, investment, government expenditure, and net exports (negative if imports are higher), suggests that as savings in an economy increases, overall investment also increases. The underlying assumption is that rational agents in an economy would save for a certain rate of return, which they would get by investing in the economy. As the overall stock of savings increases, the overall investment also increases. The overall increase in investment enhances the overall national income, with a spillover effect on increasing consumption (higher employment, and higher disposable income), as well as higher exports – if investments are routed towards export-oriented activities.

However, the real world is slightly different. Economic agents are not rational, and neither are government policies often driving the interplay of savings and investments. National accounts often consider what can be measured, or what is formal, and disregard the informal, or the shadow economy. Savings that either result in an increase in bank deposits, stock of national savings, or flow into the capital markets, among other avenues can be counted as savings in national accounts, eventually being routed as investments – with banks lending into the real economy (or back to the government), while various businesses raise capital in the primary and secondary markets, and so on. However, if the same capital is simply redeployed in a multitude of real estate schemes, which are not developed and simply operate secondary market of ‘plot files’, then that truly is savings – but isn’t really an investment that would be recognized in national accounts.

The last ten years have resulted in emergence of plotistan. An economy which encourages investment in plots (whether legal, or illegal) for accumulation of wealth, rather than allocating that capital towards more productive areas of the economy. The capital markets have barely seen a sliver of fresh retail capital flowing into it, depressing valuations, and discouraging businesses from fresh listings given unattractive valuations. Meanwhile, the value of plots in cities across the country have grown multifold.

A marginal, and negligible taxation regime, massive distortion in reported value and transaction value of real estate, and amnesty schemes to further accelerate scarce capital to move towards real estate rather than actual productive enterprise has ensured that plots remain a safe haven for preservation of grey capital. A largely cash based market also ensures that fire sales are far and few in between, as investors (or plot-ists) as they like to call themselves are fine with staying underwater as that still remains a more tax efficient structure than investing in the formal economy. A drop in savings rate during the last ten years has been accompanied by an increase in cash in circulation as a % of GDP, signifying how an increasing number of economic activity is being conducted in cash, rather than through formal financial institutions.

https://www.imf.org/en/News/Articles/2021/07/28/na-072821-five-things-to-know-about-the-informal-economy

The informal economy is a global and pervasive phenomenon. Some 60 percent of the world’s population participates in the informal sector. Although mostly prevalent in emerging and developing economies, it is also an important part of advanced economies.

The informal economy consists of activities that have market value but are not formally registered.

The informal economy embraces professions as diverse as minibus drivers in Africa, the market stands in Latin America, and the hawkers found at traffic lights all over the world. In advanced economies, examples can range from gig and construction workers, through domestic workers, to registered firms that engage in informal activities.

The International Labor Organization estimates that about 2 billion workers, or over 60 percent of the world’s adult labor force, operate in the informal sector--at least part time.

The informal economy is a global phenomenon, but there is great variation within and across countries. On average, it represents 35 percent of GDP in low- and middle- income countries versus 15 percent in advanced economies.

Latin America and sub-Saharan Africa have the highest levels of informality, and Europe and East Asia are the regions with the lowest levels of informality.

The informal economy is difficult to measure.

This is because activities within it cannot be directly observed, and for the most part, participants in the informal economy do not want to be accounted for.

But it is important to try and measure the size of the informal economy because of its significance, and also because it employs some of the world’s most vulnerable people.

Informality can be measured in two different ways. The direct approach is based on surveys, voluntary replies, and other compliance methods to directly measure the number of informal workers and firms.

Indirect methods focus on certain characteristics, or proxies, that can be observed and are related to informal economic activity. Examples of proxies include electricity consumption, night-light satellite data, and cash in circulation. Using these methods, the share of the informal economy in total output can be measured.

The COVID-19 pandemic hit informal workers particularly hard, especially women.

This uneven impact of the pandemic is because the majority of informal workers are employed in contact-intensive sectors (such as domestic workers, market vendors, and taxi drivers) and in insecure jobs that do not offer paid leave or the ability to work from home.

Close to 95 million more people—many of them informal workers--are estimated to have fallen below the threshold of extreme poverty in 2020 compared with pre-pandemic projections.

Gender inequality is also increasing as millions of women who are informal workers, have been forced to stop working since the start of the pandemic. For example, women make up 80 percent of domestic workers globally, and 72 percent of them have lost their jobs as a result of the pandemic.

In sub-Saharan Africa, 41 percent of women-owned businesses closed, compared with 34 percent of those owned by men.

The informal economy is central to the economic development process.

Understanding the drivers and consequences of informality is central to sustainable and inclusive development, as informality is critically related to how fast countries grow, and to poverty and inequality, including gender inequality. Whereas some individuals and firms operate informally by choice, 85 percent of all informal workers are in precarious employment, not through choice but due to a lack of opportunities in the formal sector. This has important economic consequences.

https://journals.sagepub.com/doi/full/10.1177/2277978719898975