Shale Gas Revolution or Iran-Pakistan Gas Pipeline?

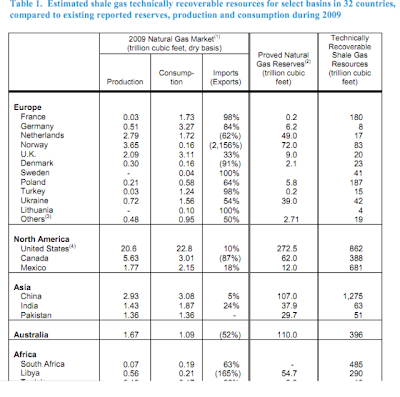

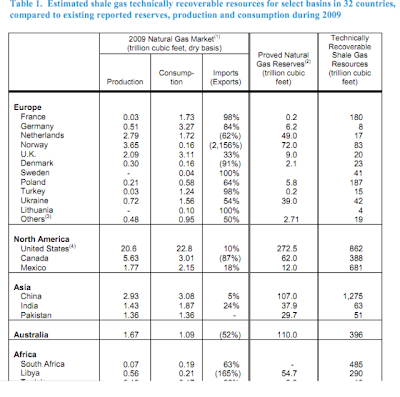

US natural gas prices have fallen below $2 per million BTU (approx 1000 cubic feet), about one-sixth of the price Pakistan has agreed to pay for Iranian gas. With over 50 trillion cubic feet of known shale gas reserves in Sindh alone, Pakistanis can also enjoy the benefits of cheap and abundant source of energy for decades via the shale gas revolution already sweeping America.

Increased production of gas from shale rock in the US has created a huge new supply, pushing down gas prices from $13/BTU (million British thermal units) four years ago to just $2/BTU today, even as the price of oil has more than doubled. By contrast, the Iran pipeline gas formula links the gas price to oil prices. It means that Pakistan will have to pay $12.30/BTU at oil price of $100/barrel, and a whopping $20/BTU for gas if oil returns to its 2008 peak of $150/barrel.

To encourage investment in developing domestic shale gas, Pakistan has approved a new exploration policy with improved incentives as compared with its 2009 policy, a petroleum ministry official said recently. Pakistan Petroleum is now inviting fresh bids to auction licenses to explore and develop several blocks in Dera Ismail Khan (KPK), Badin (Sind), Naushero Firoz (Sind) and Jungshahi (Sind), according to Oil Voice.

In addition to the fact that the Iran gas is extremely expensive, the entire Iran-Pakistan gas pipeline project raises other serious issues as well.

Iran-Pakistan Pipeline Issues:

1. Chinese investors and contractors have pulled out of the project for fear of being hit by US sanctions on their banks and other companies.

2. Russia's Gazrom is reportedly interested but only if it gets the deal at whatever price it decides to charge without any competitive bidding.

3. Pakistani companies and financial institutions are also under threat of US sanctions if they participate in the project.

4. If the pipeline does eventually get built, it will still be several years before gas starts to flow to Pakistan.

5. If Iran is still under US sanctions when the Iranian gas imports finally begin, Pakistan will have difficulty paying for the gas using international banking system. Iran has already been suspended by SWIFT, the Society for Worldwide Interbank Financial Telecommunication, which is the main mechanism used for international bank transactions.

6. The largest chunk of Pakistan's trade deficit is accounted for by energy imports. Iranian gas bill will only worsen this deficit, contributing to yet another balance of payments crisis sending Pakistan back to IMF.

Advantages of Domestic Shale Gas Development:

1. Cheap domestic gas can start flowing from Pakistani shale in a couple of years if Pakistan can make a deal with US (and American pioneers of shale gas like George Mitchel's Devon Energy) to invest and execute on an accelerated schedule in exchange for dropping Iran pipeline.

2. Pakistan will dramatically reduce its dependence on foreign sources and save a lot of foreign exchange spent on hydrocarbon imports.

3. Gas burns a lot cleaner than coal which is also a option given vast amounts of it in Thar desert. World Bank and other International financial institutions are more amenable to financing shale gas development than coal.

4. Abundant and cheap domestic gas supplies can help reduce electricity load-shedding which is caused mainly by under-utilization of installed generating capacity for lack of affordable fuel.

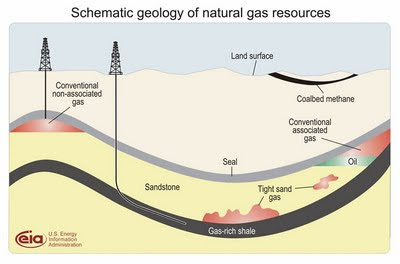

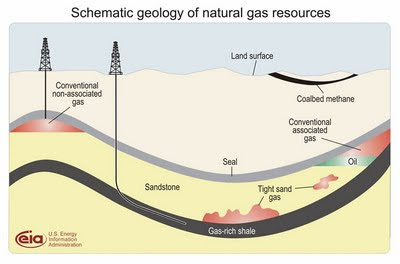

Shale gas revolution began a few years ago when an American named George P. Mitchell defied the skeptics and fought his opponents to extract natural gas from shale rock. The method he and his team used to release the trapped gas, called fracking, has paid off dramatically. In 2000, shale gas represented just 1 percent of American natural gas supplies. Today, it is over 30 percent and rising.

Among the potential downsides of shale gas development is the possibility of groundwater contamination reported in some places in the United States. Such risks can be minimized by following accepted practices to protect the aquifers which are found at levels well above the deep shale rock fractured for extracting natural gas.

Cheap and abundant energy is a pre-requisite for rapid economic growth in any country. Pakistan is no exception. The sooner Pakistanis recognize and resolve this crisis, the better it will be for the south Asian nation.

Related Links:

Haq's Musings

Pakistan's Vast Shale Gas Reserves

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Water Scarcity in Pakistan

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Zardari Corruption Probe

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

BMI Energy Forecast Pakistan

Increased production of gas from shale rock in the US has created a huge new supply, pushing down gas prices from $13/BTU (million British thermal units) four years ago to just $2/BTU today, even as the price of oil has more than doubled. By contrast, the Iran pipeline gas formula links the gas price to oil prices. It means that Pakistan will have to pay $12.30/BTU at oil price of $100/barrel, and a whopping $20/BTU for gas if oil returns to its 2008 peak of $150/barrel.

To encourage investment in developing domestic shale gas, Pakistan has approved a new exploration policy with improved incentives as compared with its 2009 policy, a petroleum ministry official said recently. Pakistan Petroleum is now inviting fresh bids to auction licenses to explore and develop several blocks in Dera Ismail Khan (KPK), Badin (Sind), Naushero Firoz (Sind) and Jungshahi (Sind), according to Oil Voice.

In addition to the fact that the Iran gas is extremely expensive, the entire Iran-Pakistan gas pipeline project raises other serious issues as well.

Iran-Pakistan Pipeline Issues:

1. Chinese investors and contractors have pulled out of the project for fear of being hit by US sanctions on their banks and other companies.

2. Russia's Gazrom is reportedly interested but only if it gets the deal at whatever price it decides to charge without any competitive bidding.

3. Pakistani companies and financial institutions are also under threat of US sanctions if they participate in the project.

4. If the pipeline does eventually get built, it will still be several years before gas starts to flow to Pakistan.

5. If Iran is still under US sanctions when the Iranian gas imports finally begin, Pakistan will have difficulty paying for the gas using international banking system. Iran has already been suspended by SWIFT, the Society for Worldwide Interbank Financial Telecommunication, which is the main mechanism used for international bank transactions.

6. The largest chunk of Pakistan's trade deficit is accounted for by energy imports. Iranian gas bill will only worsen this deficit, contributing to yet another balance of payments crisis sending Pakistan back to IMF.

Advantages of Domestic Shale Gas Development:

1. Cheap domestic gas can start flowing from Pakistani shale in a couple of years if Pakistan can make a deal with US (and American pioneers of shale gas like George Mitchel's Devon Energy) to invest and execute on an accelerated schedule in exchange for dropping Iran pipeline.

2. Pakistan will dramatically reduce its dependence on foreign sources and save a lot of foreign exchange spent on hydrocarbon imports.

3. Gas burns a lot cleaner than coal which is also a option given vast amounts of it in Thar desert. World Bank and other International financial institutions are more amenable to financing shale gas development than coal.

4. Abundant and cheap domestic gas supplies can help reduce electricity load-shedding which is caused mainly by under-utilization of installed generating capacity for lack of affordable fuel.

Shale gas revolution began a few years ago when an American named George P. Mitchell defied the skeptics and fought his opponents to extract natural gas from shale rock. The method he and his team used to release the trapped gas, called fracking, has paid off dramatically. In 2000, shale gas represented just 1 percent of American natural gas supplies. Today, it is over 30 percent and rising.

Among the potential downsides of shale gas development is the possibility of groundwater contamination reported in some places in the United States. Such risks can be minimized by following accepted practices to protect the aquifers which are found at levels well above the deep shale rock fractured for extracting natural gas.

Cheap and abundant energy is a pre-requisite for rapid economic growth in any country. Pakistan is no exception. The sooner Pakistanis recognize and resolve this crisis, the better it will be for the south Asian nation.

Related Links:

Haq's Musings

Pakistan's Vast Shale Gas Reserves

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Water Scarcity in Pakistan

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Zardari Corruption Probe

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

BMI Energy Forecast Pakistan

Comments

Yet it has one of the biggest, barely-touched, single coal reserves on the planet - the massive Thar coalfield in the northern Sindh province with 175 billion tonnes of extremely high water-content, low energy coal.

This kind of low-grade, watery coal is found in abundance in other countries, such as Indonesia, the world's biggest exporter, but it has not been economic to exploit in the past.

But high oil and gas prices, rising coal prices and new technology to dry out watery, gaseous coal or leave it in the ground but extract the gas from it instead, has prompted projects around the world.

The Pakistan government this year declared the Thar coal fields as a Special Economic Zone, with tax breaks and incentives to lure investors to develop coal gasification and mining as part of its strategy to fill the energy gulf.

"In five years, coal's contribution to the energy mix will reach 10 to 12 percent. It's minor at the moment," said Najib Balagamwala, Chief Executive Officer of Karachi-based trader Seatrade.

"The private sector is considering coal-fired plants very seriously, as there's margin there," he added.

Pakistan's energy mix has changed in recent years from mostly hydro to thermal, consisting of domestic gas and imported fuel oil, according to a report by the Asia Development Bank this month.

----------

"The private sector is considering coal-fired plants very seriously, as there's margin there," he added.

Pakistan's energy mix has changed in recent years from mostly hydro to thermal, consisting of domestic gas and imported fuel oil, according to a report by the Asia Development Bank this month.

The supply-demand power gap at peak hours reached over 5,000 MW in financial year 2011, the ADB report said.

"The need for coal to fuel the rising demand for energy in Pakistan is well understood," said Shahrukh Khan, Chief Executive Officer of Oracle Coalfields PLC, which is developing mines in Sindh.

Of the 10 coal blocks in Thar, four have been drilled and explored by Oracle, Cougar Energy, SECMC and another un-named gasification project company, according to the Sindh province website on Thar.

Two Chinese firms are also looking to build gasification and coal mining projects in Thar, industry sources said.

---------

The high water content of Pakistan's domestic coal makes it tricky to mine and transport long distances economically but mine-mouth power plants and coal gassification projects to capture and extract gas trapped in coal seams without mining it are much more viable, industry sources said.....

http://www.reuters.com/article/2012/04/13/pakistan-coal-idUSL6E8FC45O20120413

DOMESTIC CONSUMERS: The minimum charges for domestic consumers have also been increased by Rs17.34 per MMBTU (million British Thermal Unit) per month. The first slab of domestic consumers (using 100 cubic meters per month) will now be charged at Rs107.87 per unit, up by Rs12.87 per unit. For the second slab (using 100-300 cubic meters per month) it will go up to Rs215.74 per unit from Rs190 per unit, up by Rs25.74 per unit.

A substantial increase has been allowed for the third domestic slab (of over 300-500 cubic meters per month and the new rate will be Rs908.39 per unit over the existing rate of Rs800 per MMBTU. Domestic consumers using more than 500 cubic meters per month will be charged at Rs1,142.75 per MMBTU, up by Rs136 per unit from the existing rate of Rs1006.

COMMERCIAL RATES: Commercial consumers like cafes, bakeries, milk shops, tea stalls, canteens, ice factories, barber shops, laundries, entertainment places including cinemas and clubs, private offices and clinics would now be charged at Rs526.59 per MMBTU, up by about Rs63 per unit. Minimum charges in this category have been increased by Rs297 per month to Rs2,485.88.

INDUSTRIAL RATES: The price for industrial consumers has been increased by Rs52 per MMBTU to Rs434.18 per unit.

The minimum charge for industrial consumers has gone up by Rs1,747 per month to Rs14,640 from Rs12,893.

FERTILISER: While rates for feedstock have remained unchanged, the price of gas used by fertiliser plants for fuel or electricity generation has been increased by Rs52 per MMBTU to Rs434.

POWER STATIONS: Gas rates for power stations of Wapda and KESC and captive power plants have been increased by Rs54 per MMBTU to Rs447 and while the minimum charge to Rs15,077 per month from Rs13,278 – up by Rs1800 per month.

Likewise, gas rates for independent power producers have been raised by Rs45 per unit to Rs377 per MMBTU.

http://dawn.com/2011/08/08/gas-prices-up-by-135pc/

With Qatar adamant on charging a high price of $18 per unit for liquefied natural gas (LNG), Pakistan has decided to explore the option of cheaper LNG import from energy-rich Algeria.

A senior official of the Ministry of Petroleum and Natural Resources told The Express Tribune that LNG import would come up for discussion in the second session of Pakistan-Algeria Joint Ministerial Commission (JMC) scheduled to be held from April 14 to 19 in Algeria.

The petroleum ministry will lead the Pakistani side while joint secretaries of Economic Affairs Division (EAD) and Foreign Office will also attend the meeting. Petroleum Minister Asim Hussain will join later on either April 16 or 17.

Quoting agenda of the meeting, the official said main focus would be on mutual cooperation in the oil and gas sector. “Pakistan is vigorously pursuing LNG import to overcome energy crisis and the Algerian side will be asked to export LNG and set up a terminal in Pakistan,” he said.

The petroleum ministry is exploring different options for LNG import to achieve a competitive price. Last month, a Pakistani team visited Qatar, but Doha refused to offer gas at less than $18 per million British thermal units (mmbtu).

“The ministry also tabled a summary on an integrated LNG import project in a meeting of the Economic Coordination Committee (ECC) on Thursday, but the matter was deferred to next meeting,” the official said, adding this was also one of the options to buy gas at a competitive price.

Earlier, the government had allocated pipeline capacity to private LNG importers for supply of 1.4 billion cubic feet per day of gas, but they also quoted the price of $18 per mmbtu.

----------

Earlier, the government had allocated pipeline capacity to private LNG importers for supply of 1.4 billion cubic feet per day of gas, but they also quoted the price of $18 per mmbtu.

Pakistan and Qatar have already signed a memorandum of understanding for the import of LNG on government-to-government basis. According to the agreement, Pakistan will import 500 million cubic feet per day (mmcfd) of gas, which will be utilised to generate 2,500 megawatts of electricity.

The government will also inject LNG into the pipeline network of Sui Northern Gas Pipelines and Sui Southern Gas Company and charge a weighted average price of gas. This may lead to a hefty increase in domestic gas prices to $9 per mmbtu compared to existing $4.5 per mmbtu, which will affect all categories of consumers.

“Many power producers are using furnace oil, which costs a price equal to $20 per mmbtu and LNG import at $18 per unit is still affordable for the companies using furnace oil,” the official insisted

http://tribune.com.pk/story/364425/lng-import-as-qatar-seeks-high-price-pakistan-turns-to-algeria/

The government has approved a draft of gas sale purchase agreement for the US-backed Turkmenistan-Afghanistan-Pakistan-India (TAPI) gas pipeline and also endorsed the gas price at 70% of crude price, which is cheaper than the gas to be purchased from Iran.

The approval was given here on Thursday in a meeting of the Economic Coordination Committee (ECC) of the cabinet, headed by Finance Minister Dr Abdul Hafeez Shaikh.

The move will pave the way for signing the GSPA agreement by next month. Earlier, the agreement was to be inked on April 19 but it was deferred due to upcoming talks between Afghanistan, Pakistan and India on transit fee.

US is pushing Pakistan to sign the $7.6 billion TAPI gas pipeline agreement, which will provide 3.2 billion cubic feet of gas per day, and has threatened to impose sanctions if it does not abandon the Iran project.

TAPI gas price has been worked out at 70% of Brent crude price, which is 8% cheaper than Iranian gas, according to petroleum ministry documents. Pakistan and Turkmenistan will share risks to the gas pipeline passing through Afghanistan, said the petroleum ministry. The turmoil in Afghanistan is a major risk to the project.

http://tribune.com.pk/story/363610/govt-approves-draft-of-tapi-gas-pipeline-agreement/

Pakistan and World Bank on Thursday signed five pacts for loans of $1.13 billion for improving power supply and agricultural productivity and revitalising community services in strife-torn areas of the country.

Out of $1.13 billion, $35 million will be provided as a grant under the Multi-Donor Trust Fund, administered by WB and established for restoring livelihood and rebuilding infrastructure in the troubled areas.

Economic Affairs Division (EAD) Secretary Dr Waqar Masood and WB Country Director Rachid Benmessaoud signed the agreements.

The bank has given $840 million for extension of Tarbela IV hydropower project that will produce an additional 1,400 megawatts of electricity.

According to EAD, the project will contribute about 4,000 gigawatts of low-cost non-carbon renewable energy annually. Average cost of electricity generated through the project will be 2.49 cents per unit and the project will lay the foundation for a 5th extension of Tarbela.

WB will also provide $250 million for the Punjab Irrigated Agriculture Improvement project. A high-efficiency irrigation system using drips, bubblers and sprinklers will be put in place over an area of about 120,000 acres under the project.

Italy’s soft loan for citizens programme

Pakistan and Italy also signed an agreement for a soft loan of 57.8 million euros for the Citizens Damage Compensation Programme.

The agreement was signed by EAD Secretary Waqar Masood and Italian Ambassador Vincenzo Prati. WB Country Director Rachid Benmessaoud was also present.

The soft loan has been extended at zero interest rate with a repayment period of 40 years including grace period of 31 years. Masood said the assistance would go a long way in alleviating the miseries of flood victims.

http://tribune.com.pk/story/363929/wb-offers-1-1b-for-power-supply-agriculture/

Q: Do you think the decisions taken at recent energy summit would resolve the power and gas crisis? Is it the most burning issue impacting Pakistan’s productivity?

Mansha: Short-term decisions are no solution to a problem that requires long term planning. The government could save a trillion rupees if the power plants using furnace oil were run on coal.

In fact about a year back I proposed to the government to allow me to convert Nishat group furnace oil power plants to coal. The investment plan and revenue sharing formula to cover the cost was also outlined. I regret that things have not moved painfully slow on this proposal of vital national importance. Converting these plants to coal would wipe out entire circular debt in a year and generate resources for alternate energy and hydroelectric projects.

Q: How do you propose to reform the power sector?

Mansha: The deteriorating fuel mix is increasing the base cost. We are producing over 50 percent of power using the most expensive furnace oil as fuel. The losses and theft in electricity distribution are alarmingly high at 35 percent. The public sector power projects are operating a very low efficiency. Sensible solution to the crisis is to privatise and deregulate this sector.

The power distribution companies should emulate KESC that ensures most productive use of electricity by exempting industries from load shedding.

Q: You are pioneer in alternative energy projects, are they feasible?

Mansha: We have been seeking cheaper energy solution. Our cement plant first shifted to coal from furnace oil and then to biomass and municipal solid waste that were even cheaper alternatives.

Pakistan is blessed with large quantity of biomass that has a potential to produce 6000 MW of electricity. Our companies are using corncob, rice husk, wheat straw, cotton plant sticks and other agriculture residue, solid municipal waste, slippers, sandals, and used tyres to generate energy.

http://www.thenews.com.pk/Todays-News-3-102987-India-offers-bigger-trade-opportunities-than-China-Mansha

India — India has long struggled to provide enough electricity to light its homes and power its industry around the clock. In recent years, the government and private sector sought to change that by building scores of new power plants.

But that campaign is now running into difficulties because the country cannot get enough fuel — principally coal — to run the plants. Clumsy policies, poor management and environmental concerns have hampered the country’s efforts to dig up fuel fast enough to keep up with its growing need for power.

A complex system of subsidies and price controls has limited investment, particularly in resources like coal and natural gas. It has also created anomalies, like retail electricity prices that are lower than the cost of producing power, which lead to big losses at state-owned utilities. An unsettled debate about how much of its forests India should turn over to mining has also limited coal production.

The power sector’s problems have substantially contributed to a second year of slowing economic growth in India, to an estimated 7 percent this year, from nearly 10 percent in 2010. Businesses report that more frequent blackouts have forced them to lower production and spend significantly more on diesel fuel to run backup generators.

The slowdown is palpable at Sowmya Industries, a small company that makes metal shutters that hold wet concrete in place while it solidifies into columns and beams, a crucial tool for the construction industry.

The company, located outside this city on the southeast coast of India, is struggling with several issues, including a 20 percent increase in the price of raw materials and falling orders.

But Sowmya’s manager, R. Narasimha Murthy, said the lack of reliable power was an even bigger problem. His company loses three hours of power every evening. And all day on Wednesdays and Saturdays — euphemistically called “power holidays” — it receives only enough electricity to turn on the lights but not enough to use its large metal-cutting machines.

-------------

A major problem is the anemic production of coal, which provides 55 percent of India’s electricity. Coal production increased just 1 percent last year while power plant capacity jumped 11 percent. Some electricity producers have been importing coal, but that option has become more untenable recently because India’s biggest supplier, Indonesia, has doubled coal prices.

------------

For many businesses, the power shortage has become debilitating.

In the southern state of Tamil Nadu, Srihari Balakrishnan, a textile factory owner, said he goes through 6,300 gallons of diesel fuel on an average day to keep his operation running, spending $3,000 more than he would if power were available around the clock.

“We are not able to use 20 to 30 percent of our capacity,” he said. “We can’t use grid power for two full days of the week. When we have power, we have a six-hour cut,” he added, using an Indian term for blackouts.

----------

Other companies are also stuck. Reliance Power, controlled by the investor Anil Ambani, says it has stopped construction on a large electricity plant nearby because it can no longer afford to buy coal from Indonesia as planned.

http://www.nytimes.com/2012/04/20/business/global/india-struggles-to-deliver-enough-electricity-for-growth.h

Advisor to Prime Minister on Petroleumand Natural Resources Dr. Asim said that Pakistan offers great potential in the oil and gas sector and the government is doing its part by introducing new policies to meet the rising energy demand .

He was presiding over a seminar organized by the Petroleum Institute of Pakistan (PIP), a representative body of the oil and gas industry, on the topic "Shale Gas Potential in Pakistan" on Saturday.

The purpose of holding this seminar was to create awareness aboutpotential and challenges of shale gas in Pakistan and establish PIP'sprofessional standing in view of assisting the government on dealing with the energy crises in the country.

The forum consisted of 150 distinguished guests from the oil and gas fraternity including government officials, media personnel and students from Karachi's top universities/colleges.

Dr. Asim Hussain said he has been advocating the need to balancecountry's energy mix, which currently is heavily dependent on natural gas.

He stated that the US Energy Information Administration have estimated 51 TCF Shale Gas Reserves in Pakistan, while as estimated reserves for Low BTU Gas are 2 TCF and that of tight gas are 40 TCF.

He added that Shale Gas exploration is high technical and costly, therefore, in order to encourage its exploration, pilot projects are planned.

The Ministry of Petroleum and Natural Resources will facilitate E&P Companies wishing to explore shale gas, by granting special concessions through transparent process and based on merit.

Chairman PIP Asim Murtaza Khan stressed on PIP's role as an effective energy sector advisory body, supporting government and industry in Pakistan todevelop a progressive and sustainable roadmap to meet present and futurechallenges.

He said that PIP is planning to hold series of seminars in nearfuture. The big ticket items that will be discussed and which need theimmediate attention will be the "LPG Outlook in Pakistan", "Fast-trackingimports of LNG", "Refining Vision 2020", "Energy conservation" and"Restructuring of the Pakistan's gas sector".

http://www.brecorder.com/pakistan/business-a-economy/107602-pakistan-offers-great-potential-in-oil-gas-sectors-dr-asim-.html

The cheapest and most profitable oil North America has ever seen is now “flooding” into the market, as producers once again use old technology to create a wave of new profits.

Producers are using “waterfloods”— pushing water into underground formations to flush a large amount of oil out to nearby producing wells — to increase production and profits. It’s the next big money-making phase of the Shale Revolution.

Waterflooding has been around for 70 years or more, but the Big Question over the last five years has been — can you do it effectively with tight oil?

The answer is a Big Yes, and waterflood potential has become so important that institutional investors now see them as major share price catalysts for junior producers—and track them closely.

Waterfloods start 1-2 years after drilling the well, in a time window producers call “secondary recovery.” (Drilling is primary recovery.) Waterfloods are cheap to try and cheap to run (with most operations costing just $5-10 per barrel!), and now the industry is seeing that they are sometimes doubling reserves from a well.

“Secondary recovery is where you really make all your money in this industry,” says Dan Toews, VP Finance and CFO of Pinecrest Energy (PRY-TSX.V).

Pinecrest is very vocal about their waterflood potential. They say they can double the amount of oil they recover (called the Recovery Factor, or RF) from a well — at less than $15/barrel — half the price of primary recovery costs, which are over $30/barrel.

“Everyone is trying to find a new resource play,” says Toews. “First you find a resource, and then you drill it like crazy. But the second stage is to go in for your secondary recovery, through waterflooding of some kind if possible.”

To date, Pinecrest isn’t yet flowing even one barrel of waterflooded oil—so their powerpoint slide is just projections. Toews and his team expect to be waterflooding all of their operations by the end of this quarter. But analysts are already seeing the waterfloods as a share price catalyst.

“Just about every investor and institution we talk to wants to know the status with our waterfloods,” says Toews. “The buy side (fund managers = buy side, brokerage firms = sell side—ed.) is very savvy on waterfloods. Once we apply the method, this is what has the potential to shoot up our share prices.”

Realistically, the effects can be seen within 2-3 months, but it’s best to give them a year—or more—of operations before judging their impact. Waterfloods can last up to 20 years or more.

Another Canadian oil junior, Raging River Exploration (RRX-TSX), also explains the waterflood potential in their powerpoint. They expect to be swimming in 1 million EXTRA recoverable barrels of oil per square mile, courtesy of waterfloods—at an even cheaper cost of $5-10 barrel, vs $30 barrel for the first 600,000 barrels.

Raging River is developing the Viking formation in SW Saskatchewan—a large, tight oil play that since the 1950s has had an improved outlook from 2 billion barrels of oil to an estimated 6 billion barrels of oil in place, all thanks to horizontal drilling.

Raging River expects waterflooding to increase its RF from 8% from primary recovery methods (drilling vertical and horizontal wells) using 16 wells/section, to 16-20%. The simple math says that will increase the number of barrels recovered from 480 million at 8% to 1.25 billion at 20% RF.

If Raging River—or any producer—can show a steady RF for over a year, I would suggest to investors those barrels will be worth $10-$15 each—creating huge value to shareholders on a buyout.

Some Viking waterfloods have even seen results as high as 30% RF....

http://oilprice.com/Energy/Crude-Oil/US-Shale-Industry-Set-for-a-Second-Boom-with-Waterflood-Technology.html

Pakistani Prime Minister Nawaz Sharif said he would proceed with a plan to build a gas pipeline from Iran, despite objections from the U.S., and said that he plans to use his speech at the United Nations on Friday to hit out against American drone strikes in his country.

In an interview in New York with The Wall Street Journal, Mr. Sharif also spelled out, for the first time, the conditions that Pakistani Taliban would have to accept if his government proceeds with a peace deal with the militant group, demanding that they lay down arms and recognize Pakistan's constitution. At the same time, he voiced fears that continued U.S. drone attacks would wreck his policy to negotiate with the Pakistani Taliban, a group closely linked to al Qaeda.

----

In the interview Wednesday, Mr. Sharif acknowledged frictions with the U.S. but said he believed that the issues could be overcome. "President Obama was very kind to call me up immediately after my election and express his desire to work with Pakistan. I also want to work with the United States of America," he said.

The White House said Thursday that President Barack Obama and Mr. Sharif will meet Oct. 23 at the White House, part of what officials said was a broader effort to deepen ties.

A White House statement said terrorism and the economy will be among the topics discussed, but didn't mention the controversial pipeline. "The visit will highlight the importance and resilience of the U.S.-Pakistan relationship and provide an opportunity for us to strengthen cooperation on issues of mutual concern, such as energy, trade and economic development, regional stability, and countering violent extremism," the White House said in a statement.

---

An inadequate supply of gas, used to produce electricity, is one of the main reasons for the crippling shortage of power in Pakistan. Mr. Sharif said Pakistan had a contractual obligation to go ahead with the agreement, or face penalties from Iran of $3 million a day if it is not completed by the end of next year. He said that in Islamabad's legal opinion, the pipeline wouldn't trigger the sanctions.

He said that Pakistan would proceed "unless you give us the gas, or the $3 million a day."

However, Pakistan still needs to find $1.5 billion to build the pipeline, which is already completed on the Iranian side, according to Tehran. Islamabad is also hoping that a change in Washington's stance on Iran after the election of Mr. Rouhani could help Pakistan avoid the sanctions.

----

"The more the drones, the more the terrorists get multiplied. You kill one man, his sons, his father, his brothers, they become terrorists. So this is something that is not helping at all," said Mr. Sharif.

Washington believes the drones have been highly effective in killing senior al Qaeda commanders, Pakistani Taliban leaders and Afghan insurgents who use Pakistan's tribal areas, which border Afghanistan, as a sanctuary.

---

In words not used in the offer of talks, Mr. Sharif, in the Journal interview, laid out the terms that would be available to the militants.

"They will have to renounce terrorism," said Mr. Sharif. "They [Pakistani Taliban] will have to abide by the constitution of Pakistan."

"It's been often said by them that they don't recognize the constitution of the country," he said. "But the constitution has to be recognized. If we agree on addressing this terrorism, they will have to be disarmed, lay down their arms."

http://online.wsj.com/article/SB10001424052702303342104579099142009080988.html

Author links open overlay panel Ghulam Mohyuddin Sohail a, Ahmed E. Radwan b, Mohamed Mahmoud c

https://www.sciencedirect.com/science/article/pii/S235248472200840X

Recent advancements in technologies to produce natural gas from shales at economic rates has revealed new horizons for hydrocarbon exploration and development worldwide. The importance of shale oil and gas has aroused worldwide interest after the great success of production in North America. In this study, different marine source rocks of Pakistan are evaluated for their shale gas potential using analogs selected from various North American shales for which data have been published. Pakistani formations reviewed are the Datta (shaly sandstone), Hangu (sandy shale), Patala (sandy shale), Ranikot (shaly sandstone), Sembar (sandy shale) and Lower Goru (shaly sandstone) formations, all of which are known source rocks in the Indus Basin. Available geological data of twenty-six wells (e.g., geological age, depositional environment, lithology and thickness), geochemical data (e.g., total organic carbon (TOC), vitrinite reflectance (Ro), rock pyrolysis analysis and maturity), petrophysical data (e.g., porosity and permeability) and dynamic elastic parameters estimated from logs (Young’s modulus and Poisson’s ratio) have been investigated. According to this study, the Pakistani shales are explicitly correlated with the most active shale gas plays of North America. The burial depths or geological position of the Pakistani shales are generally comparable to or slightly higher than the North American shales based on the available data. The thicknesses of the Pakistani (except for the Sembar shale) and North American shales fall in similar ranges. In terms of mineralogical composition, all of the Pakistani shales except the Ranikot and Hangu shales have quartz contents in the 40% to 50% range (approximately), which is similar to most of the North American shales. The high maximum TOC of the Hangu and Sembar shales (10%) is comparable to the New Albany, Antrim and Duvernay shales. The maximum TOC values for the Ranikot (3%), Lower Goru (1.5%) and Datta (2%) shales are lower than all North American shales. The TOC of Patal Shale (

5%–10%) is comparable to Fayetteville and Eagle Ford shales. The geological and geochemical parameters of all the Pakistani shales reviewed in this work are promising regarding their shale gas prospects. However, geomechanical data are required before conclusions on these shales’ economic production can be made with confidence.

-------------------

The exploitation of shale gas reservoirs may enhance gas production and reduce the severity of the ongoing energy crisis. The main challenge in Pakistan is to evaluate the shales using limited data and samples. That is why only a few companies are working on shale gas reservoirs in Pakistan now. The researchers need to assess and rank prospective Pakistani shales to entice companies to consider shale gas development. The geological characterization of Pakistani shales has been investigated by several authors (e.g., Warwick et al., 1995, Kazmi and Abbasi, 2008, Ahmad et al., 2012, Hakro and Baig, 2013, Jalees, 2014), but detailed work is required on geochemical, petrophysical and geomechanical characterization for assessing the actual potential of shales in Pakistan (Abbasi et al., 2014).