Shale Gas Investment Can Help US-Pakistan Ties

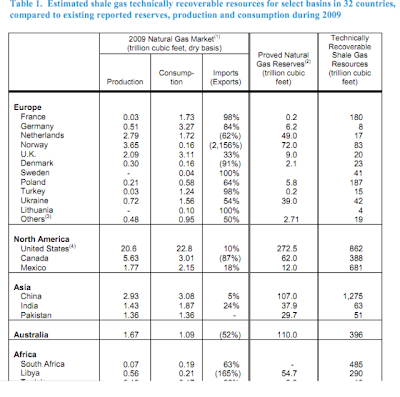

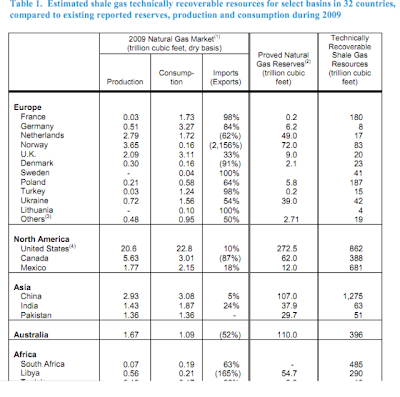

Pakistan has over 50 trillion cubic feet of shale gas reserves, according to the US Energy Information Administration (EIA) estimates. It's enough to energize Pakistani homes, businesses, power plants, CNG vehicles, fertilizer plants and factories for 25 years at a rate of 2 trillion cubic feet of consumption per year at half the currently agreed price of imported gas from Iran, an agreement the US strongly opposes. It will also save Pakistanis hundreds of billions of dollars in foreign exchange.

The relevant question here is whether America is willing to offer through its oil and gas companies the necessary investment and the advanced technology to quickly and profitably develop shale gas fields in Pakistan in exchange for abandoning the Iran-Pakistan gas pipeline?

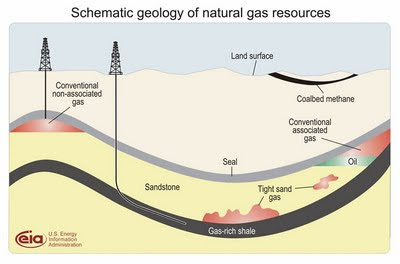

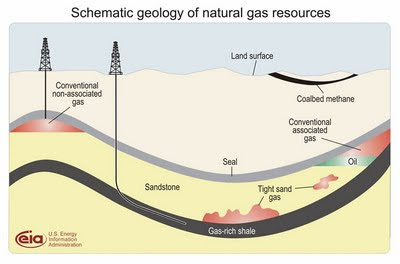

Shale gas revolution began a few years ago when an American named George P. Mitchell defied the skeptics and fought his opponents to extract natural gas from shale rock. The method he and his team used to release the trapped gas, called fracking, has paid off dramatically. In 2000, shale gas represented just 1 percent of American natural gas supplies. Today, it is over 30 percent and rising.

Up until 2009, the US was the largest importer of Qatari LNG. However, the discovery of development of shale gas has caused a glut in the US. The Qatari LNG imports are no longer needed and the gas prices have plummeted in the United States. Qatari oil minister was quoted by Bloomberg as saying that 60 percent of Qatari LNG exports “moved to the east” in 2009.

Increased production of gas from shale in the US has created a huge new supply, pushing down gas prices from $13/BTU (million British thermal units) four years ago to just $2/BTU today, even as the price of oil has more than doubled. By contrast, the Iran pipeline gas formula links the gas price to oil prices. It means that Pakistan will have to pay $12.30/BTU at oil price of $100/barrel, and a whopping $20/BTU for gas if oil returns to its 2008 peak of $150/barrel.

To encourage investment in developing domestic shale gas, Pakistan has approved a new exploration policy with improved incentives as compared with its 2009 policy, a petroleum ministry official said recently. Pakistan Petroleum is now inviting fresh bids to auction licenses to explore and develop several blocks in Dera Ismail Khan (KPK), Badin (Sind), Naushero Firoz (Sind) and Jungshahi (Sind), according to Oil Voice.

Under the new policy, exploration companies will be offered 40-50% higher prices for the extracted gas compared with the $4.26/Btu price announced in Exploration and Production Policy 2009. Companies which succeed in recovering gas from tight fields within two years will get 50% hike over the 2009 price and if it takes more time they will get only a 40% hike on the 2009 price. As an added incentive, the leases for the fields will now be for 40 years instead of 30 in the 2009 policy, the official said.

Even with the higher prices for the tight gas offered to the exploration companies, it is estimated that Pakistan will have to pay a maximum of $6.50/Btu for the gas compared with $12.30/Btu for gas imports, according to a report by Platts.

Pakistan should ask the Obama administration to help fund and develop shale gas in exchange for abandoning the Iran-Pakistan gas pipeline. It will be a historic win-win for both nations, as historic as the US aid to Pakistan for Green Revolution in 1960s. Pakistanis will get relief from the severe energy crisis which affects almost everyone in the country. The US energy companies will create thousands of American jobs and make a huge profit in the process with the potential bonus of largely neutralizing the strong anti-American sentiments in the country.

Related Links:

Haq's Musings

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Water Scarcity in Pakistan

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Zardari Corruption Probe

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

BMI Energy Forecast Pakistan

The relevant question here is whether America is willing to offer through its oil and gas companies the necessary investment and the advanced technology to quickly and profitably develop shale gas fields in Pakistan in exchange for abandoning the Iran-Pakistan gas pipeline?

Shale gas revolution began a few years ago when an American named George P. Mitchell defied the skeptics and fought his opponents to extract natural gas from shale rock. The method he and his team used to release the trapped gas, called fracking, has paid off dramatically. In 2000, shale gas represented just 1 percent of American natural gas supplies. Today, it is over 30 percent and rising.

Up until 2009, the US was the largest importer of Qatari LNG. However, the discovery of development of shale gas has caused a glut in the US. The Qatari LNG imports are no longer needed and the gas prices have plummeted in the United States. Qatari oil minister was quoted by Bloomberg as saying that 60 percent of Qatari LNG exports “moved to the east” in 2009.

Increased production of gas from shale in the US has created a huge new supply, pushing down gas prices from $13/BTU (million British thermal units) four years ago to just $2/BTU today, even as the price of oil has more than doubled. By contrast, the Iran pipeline gas formula links the gas price to oil prices. It means that Pakistan will have to pay $12.30/BTU at oil price of $100/barrel, and a whopping $20/BTU for gas if oil returns to its 2008 peak of $150/barrel.

To encourage investment in developing domestic shale gas, Pakistan has approved a new exploration policy with improved incentives as compared with its 2009 policy, a petroleum ministry official said recently. Pakistan Petroleum is now inviting fresh bids to auction licenses to explore and develop several blocks in Dera Ismail Khan (KPK), Badin (Sind), Naushero Firoz (Sind) and Jungshahi (Sind), according to Oil Voice.

Under the new policy, exploration companies will be offered 40-50% higher prices for the extracted gas compared with the $4.26/Btu price announced in Exploration and Production Policy 2009. Companies which succeed in recovering gas from tight fields within two years will get 50% hike over the 2009 price and if it takes more time they will get only a 40% hike on the 2009 price. As an added incentive, the leases for the fields will now be for 40 years instead of 30 in the 2009 policy, the official said.

Even with the higher prices for the tight gas offered to the exploration companies, it is estimated that Pakistan will have to pay a maximum of $6.50/Btu for the gas compared with $12.30/Btu for gas imports, according to a report by Platts.

Pakistan should ask the Obama administration to help fund and develop shale gas in exchange for abandoning the Iran-Pakistan gas pipeline. It will be a historic win-win for both nations, as historic as the US aid to Pakistan for Green Revolution in 1960s. Pakistanis will get relief from the severe energy crisis which affects almost everyone in the country. The US energy companies will create thousands of American jobs and make a huge profit in the process with the potential bonus of largely neutralizing the strong anti-American sentiments in the country.

Related Links:

Haq's Musings

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Water Scarcity in Pakistan

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Zardari Corruption Probe

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

BMI Energy Forecast Pakistan

Comments

India will launch its first-ever bid round for exploration of shale gas by December 2013, Oil Minister S Jaipal Reddy said today.

"We are pursuing the development of shale gas in the country. We have undertaken the mapping of shale gas resources and are working to put in place a regulatory regime for licensing round in shale gas, by December 2013," he said.

Six basins, namely Cambay, Assam-Arakan, Gondawana, KG onshore, Cauvery onshore and Indo Gangetic basins, have been identified that may have shale gas potential.

The country has, so far, only explored and produced conventional oil and gas as well as unconventional sources such as coal bed methane (CBM).

Shale gas ---- gas trapped in sedimentary rocks below the earth's surface ---- is the new focus area in the US, Canada and China as an alternative to conventional oil and gas for meeting growing energy needs.

These unconventional deposits have raised estimates for US gas reserves from 30 years to 100 years at current usage rates. Shale gas deposits were not considered worth tapping before Houston billionaire George P Mitchell pioneered new extraction techniques in the 1990s.

India aims to put in place a policy framework for exploitation of shale gas in a year's time.

Several basins in India are known to hold shale gas resources. Primarily, the focus is on three basins -- Cambay (in Gujarat), Assam-Arakan (in the North-East) and Gondwana (in central India).

India has signed a cooperation agreement with the US Geological Survey for knowledge-sharing in the area of shale gas.

"We are also harnessing coal bed methane: so far, we have held four licence rounds, and commercial production has commenced at Raniganj in West Bengal," Reddy added.

http://articles.economictimes.indiatimes.com/2012-02-14/news/31059276_1_shale-gas-conventional-oil-and-gas-george-p-mitchell

Pakistan bought more than 450,000 tonnes of fuel oil in March, its highest level this year, led by higher imports of high-sulphur grade fuel, official data showed on Thursday.

Total fuel oil imports, used for power generation, climbed 70,328 tonnes to 460,688 tonnes, up around 18 percent, figures from the Oil Companies Advisory Committee showed.

High-sulphur fuel oil (HSFO) volumes rose by 132,492 tonnes at 392,499 tonnes, while low-sulphur fuel oil (LSFO) fell 62,164 tonnes to 68,189 tonnes.

The rise was in line with expectations, as Pakistan imported only about 390,000 tonnes last month, out of the term volume of 890,000 tonnes state-owned company Pakistan State Oil (PSO) purchased for delivery between February and March.

PSO has also sought similar second quarter volumes, but has refrained from buying expensive low-sulphur fuel oil.

The country is looking to increase its hydropower capacity through a recently approved $1 billion World Bank loan in an effort to reduce its reliance on fuel oil imports.

The bank said $840 million of the loan will be used to boost capacity at the Tarbela hydro power project, northwest of Islamabad, by 1,410 megawatts.

http://www.reuters.com/article/2012/04/05/pakistan-fueloil-imports-idUSL3E8F50U920120405

Amid severe sanctions on Iran by US and Western countries, Russia has come forward to bail out Pakistan to complete the much-touted Iran-Pakistan gas pipeline and has agreed to fully provide both technical and financial help.

Russia, which had earlier gifted to Pakistan the OGDCL and Pakistan Steel Mills, has now promised to help construct the IP gas line at a time when the consortium, headed by the Industrial and Commercial Bank of China (ICBC), has refused to provide financial advisory services for the gas pipeline project mainly because of US opposition to the project.

In the recent talks, held in Moscow, Russia has given a go ahead signal to Pakistan for completing the project under a government-to-government arrangement. The Russian company Gazprom will arrange finances and construct the pipeline, including the completion of engineering and design of the project.

However, the Russian company is seeking the setting aside of the Public Procurement Regulatory Authority (PPRA)ís rules to complete the mega project for which international bidding is a must as per the PPRA.

"The demands of Russia will be placed in the next ECC meeting, seeking the approval of the demands so that the projects construction could take place as soon as possible," said an official. However, the Ministry of Petroleum and Natural Resources will also seek the approval of the ECC in a cautious move for permission to allow arranging funds for the project from its own resources through infrastructure development.

In case the projectís commissioning gets later than the deadline of December 31, 2004, Pakistan will have to pay $1 million every day to Iran as penalty. "Once the engineering, procurement and construction (EPC) contract is given to the Russian company by putting aside the rules of PPRA, the Russian company will start completing the pipeline of 800km inside Pakistan," the official said.

http://paktribune.com/news/Russia-to-help-Pakistan-build-IP-gas-pipeline-248932.html

Here the reported cost of the pipeline is $700m for 900km of the 56-inch-diameter pipeline. Perhaps this figure is wrong but we need to get the full details from our Iranian friends and work out what we can do including the possibility that we acquire the required pipe from the Iranian Ahwaz Rolling Mill, which presumably provided the pipe for the Iranian IGAT 7.

Of the other pipelines the one I have studied most closely is the Dolphin Project’s construction of the 48-inch-diameter pipeline connecting over 244km from the gas-receiving plant in Taweelah to the Fujairah power and desalination plant.

This successfully completed project was awarded to Stroytransgaz — a Russian company — in 2008 at $418m or roughly $ 1.73m per kilometre. At that time, steel prices were at an all-time high and Dolphin or Stroytransgaz contracted to buy 120,000 tons of pipe from Mannesman in Germany for more than $200m. Since then, steel prices have halved.

According to the Steelonthenet.com website billet prices that were above $1,000 a ton in 2008 now stand at just about $500.

One assumes therefore that the cost of material would be about half of what had to be paid in 2008. Were we building a 48-inch-diameter pipeline we would have needed to use by Dolphin standard some 400,000 tons of pipe but since ours is a 42-inch-diameter pipeline the requirement would be reduced to about 320,000 tons and would cost, even if we went to the expensive Mannesman source, about $300m. (I have seen a news item that our interstate pipeline company has invited expressions of interest for the supply of 335,000 tons of pipe which is roughly in line with my calculation).

Compressor stations will be needed and I have not been able to determine how many will be needed and what they will cost but a perusal of the literature would suggest that for the amount of gas involved we may need three or four compressor stations with a total 100,000 horsepower. These should not in my view cost more than $50-75m.

As regard other costs an American study suggests that in America in 2007 pipeline costs were roughly divided between labour (35 per cent), material (35 per cent) and the balance as miscellaneous of which right-of-way costs were about eight to nine per cent.

They projected that material costs would decline but labour and right-of-way and other miscellaneous costs would rise.

Material costs have, as stated, declined. This, however, is the only factor, which is common to Pakistan and the US. The other costs are much lower in Pakistan. The Balochistan government has granted right of way for free, and the cost of the skilled welder in Pakistan is about 10-15 per cent of the cost of welders in the US.

Our design and other miscellaneous expenses have to be much more modest since the current designed path of the pipeline, running parallel to the coastal highway will create few environmental concerns and require culverts or other major tasks other than the crossing of the Indus.

Perhaps this is wrong and experts should indicate what their evaluation is but to my mind in Pakistan the cost of material will be about 50 per cent of the total cost of our pipeline. That means our 780km pipeline should cost about $700m to $800m and no more. It is an amount that the government can easily cough up from its own resources if it diverts the gas surcharge towards this end, and the problems of finding foreign financing need not arise.

Turning now to the question of paying for the pipe that I presume we would import from Iran if Ahwaz Rolling mills has the capacity, I believe we have to see greater use of imagination and innovation. To start with, we must work out a mechanism whereby our payment is made in rupees used by the Iranians to pay for what they import from Pakistan. What can this be?...

http://dawn.com/2012/04/11/the-path-of-gas/

Following a lacklustre period of several years, when things remained quite on the oil and gas exploration sector, in the face of heightened security situation and circular debt issues, the oil and gas fields have started to buzz with activity.

In the current financial year-to-date (July 1, 2012 to March 11, 2013) the country’s oil and gas sector has spudded as many as 56 wells. It represents a big leap over the 31 wells drilled in the same period last year. The sector has drilled 20 new exploratory wells as against 12 wells same time last year, depicting a significant increase of 67 per cent.

On the discovery side, the picture was a lot brighter than the earlier years as a total of 10 discoveries have been made by the sector in FY13 so far.

The sector’s drilling of a total of 56 exploratory and development (E&D) wells during the period also represents achieving 61 per cent of the full year target set at 91 wells. Even in that sphere, the sector fared better than the comparable period last year when only 41 per cent of the target 76 wells could be drilled.

“O&G sector’s focus continues to remain on the development wells”, says Nauman Khan, analyst at Topline Securities. Of the total wells drilled, 36 were development wells (representing 64 per cent of total activity). It reflected improvement over 19 wells or 61pc of total wells drilled in the comparable period last year.

Apart from the development wells, the activity on the exploration side also represented encouraging growth. Although, contribution of the exploratory wells had slightly declined to 36pc as against 39pc in the same period last year, the overall trend was heartwarming.

The sector spudded 20 exploratory wells, which was significantly more than 12 wells drilled in the comparable period last year while it represented 45pc of full year target of 44 wells.

Analyst said that amongst the listed companies, Pakistan’s largest oil and gas explorer, the Oil and Gas Development Company (OGDC) had drilled 13 wells which were 63 per cent higher than eight wells drilled last year. Included in those 13 wells, were two exploratory wells and 11 development wells.

Pakistan Petroleum Limited drilled five wells (one exploratory and four development), up from two development wells in the comparable period last year. However, with full year target of 16 wells (six exploratory and 10 development), sector watchers expect the drilling activity of the company to significantly intensify in the remaining of the year.

The third major oil and gas E&P company, the Pakistan Oilfields Limited drilled only one exploratory. In the comparable period last year, POL had drilled two exploratory wells.

Though much of the success eluded the E&P companies on the listed sector, the revival and discovery would benefit the country. The darkest hour for the sector came possibly in late 2010 and early 2011, when exploration and development work had started to limp.

According to the data compiled by Pakistan Petroleum Information Services (PPIS), 28 E&P companies in the country, that hold operator licences, together had drilled only 19 wells in first half of the year 2011, compared to 80 wells targeted for all of the FY11.Besides the poor security situation, the two major reasons for the underperformance of E&P companies were the nagging circular debt, which had affected the drillers’ liquidity thereby restricting their drilling portfolio and secondly, the continuation of the carry over wells of the earlier year that stalled companies from launching into new wells, keeping them focused on already drilled ground.

http://dawn.com/2013/03/24/oil-gas-sector-makes-10-discoveries/

..When Iranian President Mahmoud Ahmadinejad and Pakistani President Asif Zardari met at the Iranian port of Chabahar in early March, that was a long way after IP was first considered in 1994 – then as Iran-Pakistan-India (IPI), also known as the 'peace pipeline.' Subsequent pressure by both Bush administrations was so overwhelming that India abandoned the idea in 2009.

IP is what the Chinese call a win-win deal. The Iranian stretch is already finished. Aware of Islamabad’s immense cash flow problems, Tehran is loaning it $500 million, and Islamabad will come up with $1 billion to finish the Pakistani section. It’s enlightening to note that Tehran only agreed to the loan after Islamabad certified it won’t back out (unlike India) under Washington pressure.

IP, as a key umbilical (steel) cord, makes a mockery of the artificial – US-encouraged – Sunni-Shia divide. Tehran needs the windfall, and the enhanced influence in South Asia. Ahmadinejad even cracked that “with natural gas, you cannot make atomic bombs.”

Zardari, for his part, boosted his profile ahead of Pakistan’s elections on May 11. With IP pumping 750 million cubic feet of natural gas into the Pakistani economy everyday, power cuts will fade, and factories won’t close. Pakistan has no oil. It may have huge potential for solar and wind energy, but no investment capital and knowhow to develop them.

Politically, snubbing Washington is a certified hit all across Pakistan, especially after the territorial invasion linked to the 2011 targeted assassination of Bin Laden, plus Obama and the CIA’s non-stop drone wars in the tribal areas.

Moreover, Islamabad will need close cooperation with Tehran to assert a measure of control of Afghanistan after 2014. Otherwise an India-Iran alliance will be in the driver’s seat.

Washington’s suggestion of a Plan B amounted to vague promises to help building hydroelectric dams; and yet another push for that ultimate 'Pipelineistan' desert mirage – the which has existed only on paper since the Bill Clinton era.

---

The big winner is… China

IP is already a star protagonist of the New Silk Road(s) – the real thing, not a figment of Hillary Clinton’s imagination. And then there’s the ultra-juicy, strategic Gwadar question.

Islamabad decided not only to hand over operational control of the Arabian Sea port of Gwadar, in ultra-sensitive southwest Balochistan, to China; crucially, Islamabad and Beijing also signed a deal to build a $4 billion, 400,000 barrels-a-day oil refinery, the largest in Pakistan.

Gwadar, a deepwater port, was built by China, but until recently, the port's administration was Singaporean.

The long-term Chinese master plan is a beauty. The next step after the oil refinery would be to lay out an oil pipeline from Gwadar to Xinjiang, parallel to the Karakoram highway, thus configuring Gwadar as a key Pipelineistan node distributing Persian Gulf oil and gas to Western China – and finally escaping Beijing’s Hormuz dilemma.

Gwadar, strategically located at the confluence of Southwest and South Asia, with Central Asia not that far, is bound to finally emerge as an oil and gas hub and petrochemical center – with Pakistan as a crucial energy corridor linking Iran with China. All that, of course, assuming that the CIA does not set Balochistan on fire.

The inevitable short-term result anyway is that Washington’s sanctions obsession is about to be put to rest at the bottom of the Arabian Sea, not far from Osama bin Laden’s corpse. And with IP probably becoming IPC – with the addition of China – India may even wake up, smell the gas, and try to revive the initial IPI idea....

http://rt.com/op-edge/iran-pakistan-syria-pipeline-843/

ISLAMABAD: In a major development the US has agreed to extend the technical help for the exploration of shale gas reserves in Pakistan and to this effect a US company is all set to initiate a study for an exact assessment of oil and gas reserves – particularly the shale gas – available in Pakistan, an official told The News.

The study is to take nine months to be completed, reveals one of the senior officials – who were part of the high level delegation that recently visited the US and held dialogues on energy in Washington and Houston between November 12 and 16.

The delegation – headed by the Minister for Petroleum and Natural Resources Shahid Khaqan Abbasi – comprised of secretaries and heads of public sector entities.

Later, the petroleum ministry signed an agreement with the US consultant Advanced Engineering Associates International, Inc (AEAI) that would embark on the strategic study to assess the actual reserves of shale gas in Pakistan and then with the help of the US experts four methods would be formulated to exploit the shale gas reserves.

The Director General Petroleum Concession Saeed Ullah Shah said the study will be completed in nine months. To a question, he said that the USAID would finance the study.

The EIA (Energy Information Administration) — US federal authority on energy statistics and analysis – in June last said that Pakistan was estimated to have fresh recoverable shale gas reserves of 105 trillion cubic feet (TCF) and more than nine billion barrels of oil.

The official said Pakistan has conventional gas reserves of just 23 TCF and conventional oil reserves of 286 million barrel per day. “We have set the date to AEAI for the exact identification and authentication of shale gas reserves,” he said.

“Shale gas had seen tremendous developments in the United States and a couple of other countries were trying to use the latest energy source. Pakistan was also encouraging exploration and production companies to venture into the field,” said the official. Secretary petroleum and natural resources Abid Saeed said that US officials showed willingness to help Pakistan in coping with energy crisis and extend the technical expertise and training to Pakistan’s officials in shale gas exploitation. USAID has already helped Pakistan in formulating the shale gas policy.

http://www.thenews.com.pk/Todays-News-3-215321-US-to-provide-technical-assistance-to-Pakistan-for-shale-gas-reserves

Hungarian energy company MOL said Friday it made a new discovery of oil and gas in Pakistan, bringing the total there so far to an even dozen.

Operating through a national subsidiary in Pakistan, the company said its discovery in the so-called TAL block in Pakistan is No. 8 so far in that basin and No. 12 in its history in the country. MOL has worked in Pakistan for the last 17 years.

"We are very proud of our 8th discovery in the MOL-operated TAL block," Berislav Gaso, MOL's chief officer for exploration and production, said in a statement. "This new discovery will help to improve the energy security of the country."

Pakistan consumes most of the natural gas it produces and the country has faced power issues because of aging infrastructure. According to the Asian Development Bank, addressing chronic energy issues is one of the ways in which Pakistan can ensure its economic growth remains on course.

Pakistan's economy is expected to expand from a 4.2 percent growth rate in 2015 to 4.8 percent by next year. A net importer of energy resources, the ADB said lower oil prices and soft inflationary pressures were pushing Pakistan's economy forward.

MOL said it was producing around 80,000 barrels of oil equivalent per day from the TAL block so far. Reserves flowed from the latest confirmed discovery at a test rate of around 2,000 barrels of oil per day and 900 barrels of oil equivalent in natural gas per day.

Author links open overlay panel Ghulam Mohyuddin Sohail a, Ahmed E. Radwan b, Mohamed Mahmoud c

https://www.sciencedirect.com/science/article/pii/S235248472200840X

Recent advancements in technologies to produce natural gas from shales at economic rates has revealed new horizons for hydrocarbon exploration and development worldwide. The importance of shale oil and gas has aroused worldwide interest after the great success of production in North America. In this study, different marine source rocks of Pakistan are evaluated for their shale gas potential using analogs selected from various North American shales for which data have been published. Pakistani formations reviewed are the Datta (shaly sandstone), Hangu (sandy shale), Patala (sandy shale), Ranikot (shaly sandstone), Sembar (sandy shale) and Lower Goru (shaly sandstone) formations, all of which are known source rocks in the Indus Basin. Available geological data of twenty-six wells (e.g., geological age, depositional environment, lithology and thickness), geochemical data (e.g., total organic carbon (TOC), vitrinite reflectance (Ro), rock pyrolysis analysis and maturity), petrophysical data (e.g., porosity and permeability) and dynamic elastic parameters estimated from logs (Young’s modulus and Poisson’s ratio) have been investigated. According to this study, the Pakistani shales are explicitly correlated with the most active shale gas plays of North America. The burial depths or geological position of the Pakistani shales are generally comparable to or slightly higher than the North American shales based on the available data. The thicknesses of the Pakistani (except for the Sembar shale) and North American shales fall in similar ranges. In terms of mineralogical composition, all of the Pakistani shales except the Ranikot and Hangu shales have quartz contents in the 40% to 50% range (approximately), which is similar to most of the North American shales. The high maximum TOC of the Hangu and Sembar shales (10%) is comparable to the New Albany, Antrim and Duvernay shales. The maximum TOC values for the Ranikot (3%), Lower Goru (1.5%) and Datta (2%) shales are lower than all North American shales. The TOC of Patal Shale (

5%–10%) is comparable to Fayetteville and Eagle Ford shales. The geological and geochemical parameters of all the Pakistani shales reviewed in this work are promising regarding their shale gas prospects. However, geomechanical data are required before conclusions on these shales’ economic production can be made with confidence.

-------------------

The exploitation of shale gas reservoirs may enhance gas production and reduce the severity of the ongoing energy crisis. The main challenge in Pakistan is to evaluate the shales using limited data and samples. That is why only a few companies are working on shale gas reservoirs in Pakistan now. The researchers need to assess and rank prospective Pakistani shales to entice companies to consider shale gas development. The geological characterization of Pakistani shales has been investigated by several authors (e.g., Warwick et al., 1995, Kazmi and Abbasi, 2008, Ahmad et al., 2012, Hakro and Baig, 2013, Jalees, 2014), but detailed work is required on geochemical, petrophysical and geomechanical characterization for assessing the actual potential of shales in Pakistan (Abbasi et al., 2014).