Rising Fuel Costs Hit Power Sector in India & Pakistan

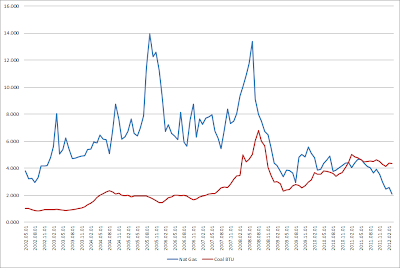

Lack of affordable fuel has forced many power producers in Pakistan to operate at a fraction of their installed capacity since 2008. It has led to widespread load-shedding in the country, seriously hurting its economy. Similar situation now appears to be developing in India as well, although it's not quite as serious as Pakistan's current crisis yet. Current costs of various fuel options vary from $4 per mmBTU for coal to $20 per mmBTU for oil. Recently, the US prices of natural gas have dropped dramatically from $12 per mmBTU a few years ago to less than $2 per mmBTU, about half the price of coal, with the shale gas revolution currently sweeping the United States.

India burns coal to produce 55 percent of its electricity needs. Domestic coal production has increased just 1 percent last year while 11 percent additional power generation capacity has been installed. Some power producers have been importing coal, but that option has become more untenable recently because India’s biggest supplier, Indonesia, has doubled coal prices, according to a report in New York Times. The gap between demand and supply in India has increased to 10.2 percent last month, from 7.7 percent a year earlier. In some states like Andhra Pradesh and Tamil Nadu, power cuts have become so common that many factories report getting more electricity from diesel generators than they do from the power grid, at much higher cost. Retail rates for electricity are lower than the cost of producing and delivering it and the difference is made up by Indian state government subsidies running into hundreds of billions of rupees annually.

Unlike India which uses coal, Pakistan relies heavily on natural gas for the bulk of electricity production and other energy needs. Demand for natural gas now exceeds 4.5 billion cubic feet per day or 1.6 trillion cubic feet per year, with a shortfall of nearly 300 million cubic feet per day. According to BMI, gas accounted for 47.5% of Pakistan's primary energy demand (PED) in 2007, followed by oil at 30.7%, hydro-electric energy at 12.9% and coal with a 7.9% share.

The main option Pakistan is pursuing now is Iran-Pakistan pipeline to import gas and reduce the growing gap between supply and demand. However, this option faces serious obstacles with tightening US and international sanctions aimed at isolating Iran because of concerns about Iran's nuclear ambitions. At the same time, Pakistan is also negotiating for LNG imports from Algeria. The wholesale prices of these options are 3 to 4 times more expensive than the the retail rate of $3 to $5 per mmBTU for domestic gas being produced in Pakistan.

In addition to gas imports, Pakistan has other options to meet its energy needs. Some of these are as follows:

1. Developing its shale gas reserves estimated 51 trillion cubic feet near Karachi in southern Sindh province. The US experience has shown that investment in shale gas can increase production quite rapidly and prices brought down from about $12 per mmBTU in 2008 to under $2 per mmBTU recently. Pursuing this option requires US technical expertise and significant foreign investment on an accelerated schedule.

2. Increasing production of gas from nearly 30 trillion cubic feet of remaining conventional gas reserves. This, too, requires significant investment on an accelerated schedule.

3. Converting some of the idle power generation capacity from oil and gas to imported coal to make electricity more available and affordable.

4. Utilizing Pakistan's vast coal reserves in Sindh's Thar desert. The problem here is that the World Bank, Asian Development Bank and other international financial institutions (IFIs) are not lending for coal development because of environmental concerns.And the Chinese who were showing interest in the project have since pulled out.

5. Hydroelectric and other renewables including wind and solar. Several of these projects are funded and underway but it'll take a while to bring them online to make a difference.

In my view, Pakistan should pursue all of the above options with options 1, 2 and 3 as a priority for now. Pakistan's best interest is not in defying Saudis and Americans to buy expensive Iranian gas and end up with crippling sanctions which could be much worse than its current energy crisis. Its best interests will be served by developing its own cheap domestic shale gas on an accelerated schedule with Saudi investment and US tech know-how. If the Americans and the Saudis refuse to help, then Pakistan will have a stronger case to go with the Iran gas option.

Related Links:

Haq's Musings

Pakistan Needs Shale Gas Revolution

US Census Bureau's International Stats

Pakistan's Vast Shale Gas Reserves

US AID Overview of Pakistan's Power Sector

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Water Scarcity in Pakistan

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Zardari Corruption Probe

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

BMI Energy Forecast Pakistan

India burns coal to produce 55 percent of its electricity needs. Domestic coal production has increased just 1 percent last year while 11 percent additional power generation capacity has been installed. Some power producers have been importing coal, but that option has become more untenable recently because India’s biggest supplier, Indonesia, has doubled coal prices, according to a report in New York Times. The gap between demand and supply in India has increased to 10.2 percent last month, from 7.7 percent a year earlier. In some states like Andhra Pradesh and Tamil Nadu, power cuts have become so common that many factories report getting more electricity from diesel generators than they do from the power grid, at much higher cost. Retail rates for electricity are lower than the cost of producing and delivering it and the difference is made up by Indian state government subsidies running into hundreds of billions of rupees annually.

Unlike India which uses coal, Pakistan relies heavily on natural gas for the bulk of electricity production and other energy needs. Demand for natural gas now exceeds 4.5 billion cubic feet per day or 1.6 trillion cubic feet per year, with a shortfall of nearly 300 million cubic feet per day. According to BMI, gas accounted for 47.5% of Pakistan's primary energy demand (PED) in 2007, followed by oil at 30.7%, hydro-electric energy at 12.9% and coal with a 7.9% share.

The main option Pakistan is pursuing now is Iran-Pakistan pipeline to import gas and reduce the growing gap between supply and demand. However, this option faces serious obstacles with tightening US and international sanctions aimed at isolating Iran because of concerns about Iran's nuclear ambitions. At the same time, Pakistan is also negotiating for LNG imports from Algeria. The wholesale prices of these options are 3 to 4 times more expensive than the the retail rate of $3 to $5 per mmBTU for domestic gas being produced in Pakistan.

In addition to gas imports, Pakistan has other options to meet its energy needs. Some of these are as follows:

1. Developing its shale gas reserves estimated 51 trillion cubic feet near Karachi in southern Sindh province. The US experience has shown that investment in shale gas can increase production quite rapidly and prices brought down from about $12 per mmBTU in 2008 to under $2 per mmBTU recently. Pursuing this option requires US technical expertise and significant foreign investment on an accelerated schedule.

2. Increasing production of gas from nearly 30 trillion cubic feet of remaining conventional gas reserves. This, too, requires significant investment on an accelerated schedule.

3. Converting some of the idle power generation capacity from oil and gas to imported coal to make electricity more available and affordable.

4. Utilizing Pakistan's vast coal reserves in Sindh's Thar desert. The problem here is that the World Bank, Asian Development Bank and other international financial institutions (IFIs) are not lending for coal development because of environmental concerns.And the Chinese who were showing interest in the project have since pulled out.

5. Hydroelectric and other renewables including wind and solar. Several of these projects are funded and underway but it'll take a while to bring them online to make a difference.

In my view, Pakistan should pursue all of the above options with options 1, 2 and 3 as a priority for now. Pakistan's best interest is not in defying Saudis and Americans to buy expensive Iranian gas and end up with crippling sanctions which could be much worse than its current energy crisis. Its best interests will be served by developing its own cheap domestic shale gas on an accelerated schedule with Saudi investment and US tech know-how. If the Americans and the Saudis refuse to help, then Pakistan will have a stronger case to go with the Iran gas option.

Related Links:

Haq's Musings

Pakistan Needs Shale Gas Revolution

US Census Bureau's International Stats

Pakistan's Vast Shale Gas Reserves

US AID Overview of Pakistan's Power Sector

US Can Help Pakistan Overcome Energy Crisis

Abundant and Cheap Coal Electricity

US Dept of Energy Report on Shale Gas

Pakistan's Twin Energy Crises

Pakistan's Electricity Crisis

Pakistan's Gas Pipeline and Distribution Network

Pakistan's Energy Statistics

US Department of Energy Data

Electrification Rates By Country

CO2 Emissions, Birth, Death Rates By Country

China Signs Power Plant Deals in Pakistan

Pakistan Pursues Hydroelectric Projects

Pakistan Energy Industry Overview

Water Scarcity in Pakistan

Energy from Thorium

Comparing US and Pakistani Tax Evasion

Zardari Corruption Probe

Pakistan's Oil and Gas Report 2010

Circular Electricity Debt Problem

International CNG Vehicles Association

Rare Earths at Reko Diq?

Lessons From IPP Experience in Pakistan

Correlation Between Human Development and Energy Consumption

BMI Energy Forecast Pakistan

Comments

WASHINGTON: The World Bank (WB) has allocated an unprecedented amount of $1.8 billion for Pakistan’s development projects, mainly in energy sector, in the current year, Finance Minister Dr Abdul Hafeez Shaikh said after holding a meeting with World Bank Vice President Isabel Guerrero on Friday.

Pakistan’s ambassador to the United States Sherry Rehman also attended the meeting during the IMF-WB annual spring gathering of economic leaders from across the world.

The WB has also agreed to assist with financing for a multi-year Dassu Dam, to be built in Kohistan area on River Indus with a 1500MW power generation capacity. The WB Board has already approved power generation enhancement project.

“This is a big sign of confidence in Pakistan’s ability to accomplish development for its people that the World Bank is allocating an unprecedented amount in one year,” Shaikh said.

The amount follows last year’s $1.2 billion assistance, and will be spent on completion of development projects in energy and water sectors as well as infrastructure, social and reform programmes.

The WB vice president was appreciative of Pakistan’s economic performance in these difficult times of global economic and regional challenges, the finance minister said.

Shaikh acknowledged the bank’s sustained cooperation with Pakistan, calling the financial institution a reliable development partner of the country.

The World Bank leader expressed satisfaction with the measures Islamabad has taken to enhance its revenue generation (which has increased by 25 percent over the last nine months), the continuing strong performance of the external sector, both exports and remittances and a healthy 4 percent GDP growth expected this year....

http://www.dailytimes.com.pk/default.asp?page=2012\04\21\story_21-4-2012_pg7_2

The World Bank on Saturday pledged $1.8 billion to development projects in Pakistan this year, with the majority of the funds allocated to the country's ailing energy sector (Dawn, ET). Pakistan, India, and Afghanistan on Friday agreed to a transit fee for gas obtained from Turkmenistan through the proposed TAPI pipeline, a key step toward actualizing the much-needed pipeline (DT, ET, The News). Pakistani Minister for Petroleum and Natural Gas Dr. Asim Hussain said Friday that the TAPI pipeline "would be cheap as compared to the Iran-Pakistan (IP) [pipeline]," over which the United States has threatened Pakistan with sanctions.

Pakistan may also look to import electricity from historical rival India, if a proposal supported by the Ministry of Water and Power is approved by the federal cabinet (ET). Setting aside political issues such as the conflict over Kashmir, India and Pakistan hope to normalize ties by promoting bilateral trade, exemplified by the recent opening of a trade post at the border town of Wagah, and the reduction in the number of products from India that Pakistan had barred (AP).

http://afpak.foreignpolicy.com/posts/2012/04/23/commercial_airliner_crash_in_pakistan_kills_127

KARACHI: The government is working on an alternative plan to finance the $1.5 billion Iran-Pakistan (IP) gas pipeline as hopes for funding from Russia fade in the face of mounting pressure from the US to stop the project, says a senior government official.

Earlier, a Chinese bank backed out of financing the vital gas supply project which may ease most of the energy shortage in the country.

“In the alternative plan, the government is studying a joint investment formula, according to which the engineering, procurement and construction (EPC) contractors will be invited to provide some funds for the pipeline,” the official said.

In talks held between Pakistani and Russian officials in the first week of April in Moscow, Pakistan asked Russia to either extend a loan or provide finished products and other material relating to the pipeline. Russia agreed to respond to the proposal in two weeks, but no response has been received so far.

After the return of the delegation from Moscow, the government officials had, however, announced that Russia had agreed in principle to give financial and technical assistance for the pipeline.

“A reminder has been sent to Russia in this regard and it is to reply by April 30,” the official said. Petroleum Secretary Ijaz Chaudhry also confirmed that Russia had not yet responded to the proposal.

Pakistan approached Russia after a Chinese bank hinted at its inability to push ahead with financing the project amid increasing US pressure. Russia offered to finance the entire pipeline during a four-day visit of Foreign Minister Hina Rabbani Khar to Moscow in February.

Moscow linked the proposal with the award of contract to its energy giant, Gazprom, without bidding. However, to give its consent the government will have to waive Public Procurement Regulatory Authority (PPRA) rules, designed to ensure transparency in government dealings.

“Funds will be generated through infrastructure gas development cess and EPC contractor will also be asked to extend some financing,” the official said, adding the government would make it part of the tender for EPC contract....

tribune.com.pk/story/369493/ip-pipeline-govt-considers-alternative-as-russia-caves-in-to-pressure-business/

Pakistan Petroleum profits rose 33% to Rs32.27 billion in the period from July 2011 to March 2012 amid better performance across the board.

The growth arises from increasing price and volumes coupled with contribution from higher other operating income, said analysts. Higher Arab Light oil prices made the explorer’s assets more valuable and increased margins, added analysts.

Net sales expanded by 23% to Rs71.51 billion in the first nine months of fiscal 2012 backed by higher realised prices and increasing volumes.

Gas production has remained flat while oil production went up by 20% on a yearly basis on the back of 85% and 36% higher production from Nashpa and Adhi, respectively, during the third quarter.

In addition to higher oil production, realised price for gas has shot up by an estimated 22%, while oil is believed to have risen by 16% on a yearly basis.

Furthermore, the company’s other income grew by 66% to stand at Rs5.2 million as against Rs3.1 million in the same period last year. This is due to growing cash balances as the company has booked higher interest income on bank placements and T-bills investment

In the third quarter alone, profits swelled 57% posted an earnings per share of Rs9.25 from Rs5.8 in the same quarter last year.

In line with its payout history, PPL did not announce any cash dividends alongside its third quarter result.

The country’s second largest oil and gas explorer’s stock value rose Rs1.69 to close at Rs197.20 during trade at the Karachi Stock Exchange.

http://tribune.com.pk/story/369987/pakistan-petroleum-profits-soar-33-to-rs32-billion/

The World Bank’s Board of Directors approved two projects totaling $550 million aimed at supporting Pakistan’s effort to strengthen the education and natural gas sectors, which are critical to Pakistan’s growth and development.

The $350 million Second Punjab Education Sector Project would support the Government of Punjab’s education sector reform program designed to increase child school participation and student achievement.

The $200 million Natural Gas Efficiency Project aims to enhance the supply of natural gas in Pakistan by reducing the physical and commercial losses in the gas pipeline system.

Significant shortfalls persist in both school participation and student achievement in Punjab. To address these challenges, the Government of Punjab is implementing the Punjab Education Sector Reform Program (PESRP), which aims to improve schooling outcomes through institutional development and strengthening, improved monitoring, and enhanced governance and accountability. The Bank has supported this program since 2008. During this time, the reform over 850,000 additional students - more than half of them girls – are now enrolled in low cost private schools supported under government subsidies tied to minimum school quality standards; some 400,000 female students receive quarterly stipends tied to school attendance; and free textbooks are provided to all students in public schools. The new results-based project will build on these achievements and support the second phase of the reform program over the period 2012-2015.

Rachid Benmessaoud, World Bank Country Director for Pakistan said that with a target school-aged population of over 12 million children, 30 percent of who remain out of school and with relatively low levels of learning, continuation of our support to the government’s reform program is critical. He said that the second phase of the program aims to take the next evolutionary step and zero in on improving service delivery performance at the school level. A key focus will be improving teacher quality and performance, which is critical for better school quality, and, thereby helping retain students in school and attract new children to school.

The challenges in the gas sector are also significant. Pakistan faces severe scarcity of gas, with production failing to keep pace with demand. Other critical challenges include inadequate allocation of gas, inefficient end-use of gas, and high levels of unaccounted-for gas (UFG). More than 10 percent of gas supplied in Pakistan is unaccounted for, which is unaffordable and a major contributor to the current gas supply crisis. UFG is typically at 1-2 percent in OECD countries.

The main focus of the Natural Gas Efficiency Project is to reduce UFG to about 5 percent by 2017 in distribution areas served by the Sui Southern Gas Company Limited (SSGC). This includes Karachi, interior Sindh, and Balochistan.

Bjorn Hamso, World Bank Senior Energy Economist and project team leader said that Results will be achieved through pipeline rehabilitation, use of cathodic protection to halt corrosion, and installation of automatic pressure management systems and advanced consumer metering systems. He further said that Key to the project’s success is to install hundreds of wholesale meters in the distribution network in such way that network activity can be monitored on a localized level and investments can be put to use where the leakage problem is the largest and the theft problem the most severe.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-online/business/27-Apr-2012/wb-approves-550-million-loan-for-pakistan

Pakistan has once again asked China to finance the Iran-Pakistan (IP) gas pipeline project, as Beijing appears to be least interested in the face of pressure from the United States.

“No Chinese government official gave assurance about participation in the project,” a participant of a meeting of the Pak-China Joint Energy Working Group told The Express Tribune.

The final round of the working group, which concluded here on Tuesday, was held under the chairmanship of Water and Power Minister Naveed Qamar and Chinese delegation head Wu Guihi, which reviewed financial and other aspects of energy projects and cooperation between the two sides.

In the meeting, private oil and gas exploration company United Energy Group (UEG), however, expressed interest in participating in the IP gas pipeline project. A representative of UEG, which has recently acquired assets of British Petroleum (BP) in Pakistan, said the company was willing to participate in the project.

Sometime ago, the Industrial and Commercial Bank of China (ICBC) had been given the role of financial adviser for the project, but it backed out apparently due to US pressure.

In remarks made at the conclusion of the meeting, the head of Chinese delegation said the energy crisis in Pakistan could be resolved through cooperation between the two sides.

Discussing concerns of Chinese enterprises, he stressed the need for infrastructure development for ongoing and forthcoming energy projects for easy transportation of machinery and equipment to the project site.

It was proposed to set up an infrastructure fund to finance power projects. “Banks may contribute to this fund from where investors will be able to get financing,” Naveed Qamar told the media after the meeting.

Qamar said China was also willing to contribute equity to the Diamer-Bhasha dam and power project. Private parties of China could assist in setting up power houses, he said.

In the past, Chinese wanted contracts for projects like Guddu and Uch power plants. “But now these companies have agreed to participate in the bidding process in line with Public Procurement Regulatory Authority (PPRA) rules,” he added.

Qamar stressed that matters relating to Nandipur power project had been resolved six months ago. “Now, there is an issue of demurrages and the government is mulling over to waive them,” but the penalty issue would be resolved through dialogue.

Later, a signing ceremony was held for three wind energy projects. These included signing a letter of intent (LoI) for 150MW project between United Energy Pakistan and China Development Bank Cooperation and inking a memorandum of association for 350MW project between Three Gorges and Pakistan. A document was also signed between Dawood Power and Hydro China Engineering Company for a 50MW project.

http://tribune.com.pk/story/376031/once-again-pakistan-asks-china-to-finance-ip-gas-pipeline/

Pakistan has become self-sufficient in meeting local demand of the liquefied petroleum gas (LPG) and the dividend of exploiting this locally-produced fuel has started benefiting the end-consumers in the shape of drastic reduction in its prices, making it a viable auto fuel, as well, industry sources said on Friday.

As domestic production of LPG is up by 25 percent since the start of the year 2012, its price has also seen continuous decline lately.

The present demand of 1,200 tons per day is being met through locally-produced LPG, the sources said.

“After three years, we have once again become self-sufficient in meeting our local demand of LPG through domestic sources,” an industry official said.

It is expected that the local component of LPG will grow further by end of this year to 1,475 tons per day. After a gap of five years, LPG has now become cheap fuel if it is compared with petrol, the source added.

Besides initiative taken by the government to explore local LPG reserves, glut in market and illegal import of cheap commodity through Iran have been described as the main factors for this price cut. Nevertheless, various categories of consumers will indeed welcome this price decline amid prevalent severe energy crisis.

The latest LPG price cut was announced by the state-owned Oil and Gas Development Company Limited (OGDCL) as it reduced its base stock price of LPG for the third time this month to Rs58,000 per ton exclusive of duties and taxes.

The latest price reduction of Rs7,000 per ton came in the wake of piles of unsold stocks and a mounting domestic production, which is up by 25 percent since the start of the year.

“LPG demand typically begins to slacken with the onset of summer. However, this year the demand has also been affected by an over supply of product both locally and from cheap and under-invoiced Iranian imports,” said Belal Jabbar, the spokesman for the LPG Association of Pakistan.

The current producer price is $225, or Rs20,000 per ton below the Saudi Aramco contract price with which LPG prices have remained indexed.

The drastic reduction in price is effectively a de-linkage from the international price benchmark and augurs well for the LPG industry, as the product has become cheaper than petrol, diesel and even CNG.

“In the light of the increasing domestic production, which has made imports altogether redundant, we urge the honourable federal minister Dr Asim Hussain to immediately notify de-linking of LPG producer prices from Saudi Aramco CP as this will keep the product affordable for the common man,” said Belal.

The revised price of LPG companies for their distributors will be Rs970 for domestic and Rs3,732 for commercial cylinders. Similarly distributor price for the consumers will be Rs1,125 for domestic and Rs4,320 for commercial cylinders.

Retail prices in various parts of the country are expected to be as follows; Sindh and Balochistan Rs90 per kilogram, Punjab Rs95 per kilogram, Khyber-Pakhtunkhwa Rs100 per kilogram, AJK Rs105 per kilogram and Northern Areas Rs115 per kilogram.

http://www.thenews.com.pk/Todays-News-3-107727-Pakistan-becomes-self-sufficient-in-meeting-LPG-demand

Pakistan’s economy requires immediate reforms to overcome the challenges because any more delay in initiating much-needed sector-specific reforms would further aggravate the situation.

USAID Economist Thomas Morris at the Lahore Chamber of Commerce and Industry (LCCI) on Tuesday indicated the country’s fiscal position was fast deteriorating as numbers suggest the gap was widening with every passing day.

He highlighted a major chunk of taxpayers money was being eaten away in defense expenditures, subsidies and interest payments.

After spending huge sums of money on non-development expenditure, the government had left with no money to spend on hard pressing energy shortage and social development.

He pointed out in 2008-09 Pakistan was paying around Rs 99,000 million on account of subsidies, but this figure jumped up to Rs 284,827 million in 2010-11.

There was dire need to correct the energy mix of the country as any change in petroleum products prices adversely affect the government’s budgetary estimates.

He pointed out in 2008-09, the government allocated Rs 77,000 million for electricity subsidies, but it had to spend Rs 99,000 millions when oil prices in the international market were below $80.

On the other hand, in 2010-11 budget, the government earmarked Rs 32,000 million for electricity subsidy, but it had to spend Rs 284,827 million as oil prices had crossed $100 per barrel barrier.

He said the GDP growth would remain 3 percent contrary to government’s claim of four percent.

He said during the global recession Pakistan’s economy remained positive which shows its strength. Therefore, he said the government should focus on curtailing expenditure by cutting non-development expenses.

He said Pakistan should further strengthen its economic relations with the United States by signing new trade agreements.

Agriculture sector in Pakistan is constrained by insufficient investment over many years as its share in the GDP in 1960 was 46.2 percent and in 2010 it was only 20.8 percent.

LCCI President Irfan Qaiser Sheikh said the Chamber was ready to collaborate with USAID in carrying out projects in energy sector for the sake of economy and in the best interest of Pakistan and its nationals.

About the condition applied by US Congress Committee to link economic and military aid to NATO supply resumption, he said it was not justified considering the present situation of Pakistan which has already suffered losses of well over $65 billion due to its frontline role in war against terror. He said the role of USAID in various sectors ranging from energy, education, health, humanitarian assistance and etc needs to be expanded to more areas and with wider scope.

http://www.dailytimes.com.pk/default.asp?page=2012\05\16\story_16-5-2012_pg5_7

Dubai: Talks with India and Iran on power exports are under way and likely to be settled soon, Pakistan's Minister for Water and Power Syed Naveed Qamar, told Gulf News.

Iran currently provides 72 megawatts to Pakistan which is likely to be increased to 1,100MW.

"It is our desire that the modalities, tariff and terms and conditions may be finalised at the earliest so that the project can be started soon."

He said the transmission line between Pakistan and India is around 100 kilometres compared with the Kyrgyz Republic and Tajikistan transmission lines which are around 1,000km.

"As we look into the future, the power demand is going to be robust coupled with the growth in the economy. The electricity trade with India is beneficial for both countries and it will open new avenues of economic ties," Qamar said.

Pakistan may import up to 500MW which may be supplied with the construction of small transmission lines from both sides.

Wind projects

He said that the major share of power production is through oil which is expensive, and therefore the government is considering running the power plants on coal. Special attention would be given to the power sector and in this regard more funds would be allocated for the power sector during the coming development budget.

The government has plans to produce 1,000MW of cheaper power from wind projects next year, Qamar said.

"Russia, Uzbekistan and Turkmenistan have also offered Pakistan to export their surplus power to Pakistan," A.U. Rahman, acting executive director of Central Asia, South Asia (CASA-1000) project, told Gulf News.

He said Russia is also keen to join the project.

Pakistan has an installed capacity of around 20,000MW, but the production capacity is around 16,000MW. Right now "the shortage of power is around 4,500MW," Rahman said.

He said the current load shedding will be "reduced gradually" with the new projects expected to come online soon.

In certain parts of the country current load shedding continues for more than 12 hours.

http://gulfnews.com/business/economy/pakistan-negotiates-for-indian-and-iranian-power-1.1025096

Coal India is expecting to resolve the fuel supply agreement (FSA) deadlock in next two weeks.

While 14 private and public sector units have already entered the long-term pact, the largest power producer NTPC is yet to sign an agreement.

A total of 48 thermal power units, commissioned between April 2009 and December 2011, are scheduled to enter supply pacts with the coal major in the current round.

“We are expecting to complete signing FSAs latest by the first week of June,” a senior company official told Business Line.

Though some of the private players are also yet to sign the agreement, CIL is currently more focussed on settling issues with NTPC. The public sector power major – which is reportedly enjoying 65-70 per cent of coal supplies for the respective units against existing memorandum of understandings – has raised primarily two sets of arguments on the FSAs.

On one hand, NTPC wants the recent round of FSAs to have similar penal and force majeure conditions as was in the pacts signed till March 2009.

The CIL board, while clearing the draft on April 16, diluted the penal provisions for supplies below the minimum assured 80 per cent of requirement to negligible. The coal major also imposed stricter force majeure clauses passing the buck on the buyer even for CIL's failure to procure spares and others.

“NTPC now wants us (CIL) to set varying penalty clauses for supplies less than 80 per cent. For example 50-80 per cent of supplies may attract a lower penalty when compared to supplies less than 50 per cent of requirement,” a source said.

However, any such change in FSAs may not be possible without some binding order to the board by the Government. And, there is no clarity as yet if the Government would repeat the precedence of Presidential Order.

Till that happens CIL is working on ironing out NTPC's other grievances which include demand for a more disciplined sampling procure so as to ensure the quality of coal.

“This is a fair demand from a buyer and is doable. We are hopeful to resolve such issues in a week or so,” the company source said.

On the private sector, the coal major feels that while the companies which are in need of coal and have the requisite power purchase agreements (PPAs) in place, have either initiated the process of signing FSAs or have already entered the pact.

These include Lanco, Reliance Power, CESC Ltd and Bajaj Energy. Adani Power, which requires supplies for nearly 1500-2000 MW, is yet to enter into a pact.

http://www.thehindubusinessline.com/companies/article3439563.ece?homepage=true&ref=wl_home

British universities have experienced a fall of more than 30 percent in Indian enrolments while the percentage of the number of enrolments and visa grants for Australia is reported to be in three figures.

The number of Indian student visa applications for Australia has gone up by a whopping 120 percent in the last nine months while the number of visa grants has also improved by nearly 80 percent in the same period.

Eric Thomas, president of Universities UK - the representative organisation for Britain's universities - has reportedly written to British Prime Minister David Cameron, warning that the immigration changes could cost the country as much as five billion pounds ($8 billion) in tuition fees alone.

The recent immigration crackdown is reported to have led to Indian students shunning British universities.

Besides Australia, the Canadian and European universities and vocational training institutes are also benefitting from international students looking for overseas options other than Britain.

In a similar scenario a few years back, Indian students had shunned Australian education providers after the country tightened immigration rules.

The massive decline in Australia's number two source for international students, India, led to the Australian government ordering a review of the enrolment and student visa process.

Among other recommendations, a former New South Wales minister, Michael Knight, had pressed for a post-study work visa for international students in his "Strategic Review of the Student Visa Programme 2011" report.

British authorities, on the other hand, have abolished Post Study Work Scheme for international students. Many critics of the immigration curbs consider this as the single-most damaging of a "multitude of recent policy changes".

Indian students seem to be have reacted negatively to the denial of work rights in Britain as the number of applications for British student visas from India and other South Asian countries is on a sharp decline.

To make it worse for international students interested in working while studying in Britain, the Cameron government has also removed work rights for most private college students. Work rights for other students were also reduced to just 10 hours a week.

Australia and other countries under the Organisation for Economic Co-operation and Development (OECD) wooing international students are much more liberal as far as work rights for international students are concerned.

The ongoing economic gloom affecting Britain and other European countries is also forcing some Indian students to study in safer havens like Australia and New Zealand where unemployment rates are much lower.

http://in.news.yahoo.com/tight-british-visas-driving-indian-students-australia-094232488.html

Pakistan’s oil import bill soared by 43.52 per cent to reach $12.583 billion during the first ten months (July-April) of the outgoing financial year 2011-2012 against $8.768 billion in the same period of last year (2010-211).

According to the latest figures released by Pakistan Bureau of Statistics (PBS) on Monday, the break-up of $12.583 billion oil import revealed that country imported petroleum products worth of $8.355 billion in July-April 2011-2012, up by 69.81 per cent if compared with $ 4.920 billion of July-April 2010-2011. Meanwhile, the import of petroleum crude increased by 9.89 per cent to $ 4.228 billion during the period under review against $3.848 billion of the corresponding period of the last year.

It might be mentioned here that country’s exports had recorded negative growth of over three per cent during the first ten months of the outgoing financial year, as these were recorded at $19.393 billion in the period under review against $20.092 billion of same period last year. On the other hand, country’s imports increased by 14.81 per cent in one year, as these were recorded at $37.042 billion in July-April 2011-2012 against $32.263 billion of July-April 2010-2011. Therefore, the trade deficit remained higher at $17.649 billion in July-April period of 2011-2012 against $12.171 billion of same period last year.

Meanwhile, the break-up of imports further revealed that import of food items recorded a minor decline of 1.73 per cent and reached $4.231 billion in July-April period of the year 2011-12 against the $4.305 billion in July-April period of the year 2010-11.

According to the data, import bill of milk products increased by 3.75 per cent, wheat unmilled decreased by 100 per cent, imports of dry fruits and nuts surged by 2.78 per cent, import of tea increased by 4.76 per cent, import of spices reduced by 5.16 per cent, soyabean oil’s imports went down by 30.79 per cent, palm oil import increased by over 18.26 per cent, sugar import declined by 97.89 per cent, import of pulses went down by 7.06 per cent and import of all other food items increased by 32.51 per cent during the period under review.

Apart from oil and food imports, the country imported machinery worth of $ 4.567 billion, transport group imports stood at $ 1.670 billion, textile group $1.980 billion, agricultural and other chemicals $ 5.979 billion, metal group $ 2.297 billion, miscellaneous group imports recorded $ 772 million and all other items imports were recorded at $ 2.962 billion during July-April period of 2011-12 against July-April period of 2010-11.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-online/business/22-May-2012/oil-import-bill-soars-to-12-58b

Iran has linked the price for export of 1,000 megawatts of electricity with international crude prices and the rate will fluctuate in the range of 7 to 11 cents per unit.

Pakistan and Iran have already signed a memorandum of understanding (MoU) for electricity supply. According to a government official, the two sides have also agreed on the price which will be in the range of 7 to 11 cents per unit.

An official of the Ministry of Water and Power said gas prices in Iran were linked with global oil rates, therefore, it based the power price on crude oil prices in the international market.

According to the price formula, Pakistan will be paying a maximum rate of 11 cents per unit of electricity if crude prices reach $110 per barrel and the price range will be reviewed after five years.

“The electricity price has been capped by the time oil rates do not cross the $145 per barrel mark. However, if crude prices rise above that level, the two countries will be bound to review the electricity rate before the end of five-year period,” the ministry official said.

Under the proposed project, Iran will build a powerhouse in Zahedan province bordering Pakistan to generate electricity for export and has also expressed its willingness to provide $800 to $900 million for the project. A 700km transmission line of 500 kilovolts will also be laid from the Pak-Iran border to Quetta.

Some officials suggest that the government should ask Iran to install the power plant in Pakistan in order to avoid expenditure on laying the distribution and transmission line.

Besides the 1,000MW for which an MoU has been signed, Iran has also offered to export a huge quantity of 10,000MW to Pakistan.

However, the ministry official pointed out that Iran, at present, had no power plants to export such a huge quantity. “So the best way is to press Tehran to establish power plants in Pakistan,” the official said, adding Iran had already shown interest in setting up a 200MW plant in Balochistan near the border.

To push ahead with talks on electricity supply, a four-member delegation of Iran’s Mapna group of companies, headed by Abbas Ali Abadi, held a meeting with Federal Water and Power Minister Chaudhry Ahmed Mukhtar at the ministry on Monday.

The delegation expressed great interest in the power sector and discussed the setting up of plants of 1,000MW capacity immediately. The Iranians were also keen on installing smaller plants of 25MW on the ground as well as on barges to help Pakistan overcome the prevailing power crisis.

http://tribune.com.pk/story/406416/electricity-supply-iran-links-power-price-with-world-crude-rates/

The energy crisis has hit Pakistan’s textile industry badly, but not all textile companies are hurt: the largest players are doing just fine, relying on a combination of the advantages of their economies of scale but also government-sanctioned privileges not available to smaller industrial players.

At least part of the reason why the bigger companies are doing better than the smaller ones appears to be the natural advantages that come with being a larger player, such as having a vertically integrated business model.

Kamal Yousaf, CEO of the Kamal Group of Industries, a textile conglomerate based in Faisalabad, says that part of his group’s advantage over smaller rivals in their ability to harness synergies within the group. The weaving, processing and dyeing, garment manufacturing, and trading arms all work as a unit, helping the group weather price hikes in raw material or other issues.

The Nishat Group, meanwhile, benefits from the fact that it owns the fourth-largest bank in the country – MCB Bank – allowing it to avoid cash flow issues and raise capital for efficiency improvement projects. Nishat Textile, therefore, never has a problem in paying wages to its employees and was able to raise Rs1 billion to invest in a 6.2-megawatt power generation unit that runs on biomass. Electricity produced in this manner is expected to be about 6% more expensive than that provided by the grid, but is far more reliable at a time when Punjab’s industry is especially hampered by severe power outages that last several hours a day.

And many larger textile mills are able to purchase large stocks of raw materials that insulate them from price shocks. More than half the cost of producing a piece of clothing is often still the cost of cotton, even for some of the largest players.

Yet at least part of the advantage appears to be built in by the government. One of the biggest reasons why larger textile mills, particularly in Punjab, have been able to do well is that most have installed captive power plants that – despite operating at one-third the efficiency of the grid’s power station – are getting gas supplies to produce power at a marginally lower cost than what they would get from the grid.

However, these captive plants have been getting gas even at the expense of the rest of the grid, meaning that even while the largest and richest textile exporters save a few pennies on their production costs (power accounts for 3% of all costs for the larger firms), all of Punjab is going through massive power outages because the power plants that supply electricity to ordinary citizens and smaller industries are getting less gas, sometimes even no gas.

Meanwhile, smaller textile players have less reliable power from the grid, a supply that is made more intermittent by the fact that the fuel for the grid’s power goes to their larger textile rivals. At the same time, banks charge the smaller players higher interest rates, since they are viewed as bigger risks for not having their own captive power supply.

“The smaller guys cannot afford to run their factories on diesel generators,” said Muzammil Aslam, managing director at Emerging Economics Research....

http://tribune.com.pk/story/426553/while-small-players-get-squeezed-textiles-big-guns-are-doing-just-fine/

..Since Pakistan came into being, people have been facing loadshedding due to shortage of power supply, with frequent outages affecting economy in many ways.

Uncountable working hours have been lost, leading to an increase in poverty and economic loss of billions of rupees to the country. Surprisingly, it is happening despite the fact that only about 60% of the population has access to electricity. According to the World Energy Statistics 2011, published by the International Energy Agency (IEA), Pakistan’s per capita electricity consumption is one-sixth of the world average.

World average per capita electricity consumption is 2,730 kilowatt hours (kwh) compared to Pakistan’s per capita electricity consumption of 451 kwh.

According to the Pakistan Energy Year Book 2011, the country’s installed power generation capacity is 22,477 megawatts and demand is approximately the same. The country needs to redesign the electricity portfolio and substitute oil and gas with an abundantly available indigenous fuel source. It must develop indigenous energy resources to meet future electricity needs and can overcome energy crisis by utilising untapped coal reserves.

Fortunately, Pakistan has a very inexpensive source to get energy through coal. Coal is economically viable and a long-term solution to balance the demand and supply chain of electricity in the country, which has the fifth largest coal deposits in the world.

According to last estimates made in 2011, coal deposits in the country are up to 185 billion tons. The largest deposits are in Thar desert, which is about 850 trillion cubic feet spanning over 10,000 square kilometers, surprisingly more than the oil reserves in Saudi Arabia having a collective quantity of approximately 375 billion barrels.

At present, 40.6% of world’s electricity is being generated from coal and it is the single largest contributor to world electricity generation. By looking at the electricity generation mix of the countries that are blessed with coal, it is evident that coal is the largest contributor.

Countries like Poland, South Africa, China, India, Australia, Czech Republic, Kazakhstan, Germany, USA, UK, Turkey, Ukraine and Japan are generating 96%, 88%, 78%, 78%, 77%, 72%, 69.9%, 52.5%, 52%, 37%, 31.3%, 27.5% and 22.9% of electricity from coal respectively. In comparison, Pakistan generates only 2.27% of electricity through coal.

However, coal reserves of only Thar can generate 20,000MW of electricity for the next 40 years without loadshedding and at a rate Rs4 less than the current cost of electricity production. The government has given the task to experts to enhance energy efficiency by focusing on coal and ensure large scale power generation through this resource.

--

At the International Coal Conference 2011, Pakistan had invited investors from around the world, encouraging them to pour money into coal power projects as the country initially requires $1.2 billion to build power generation infrastructure in Thar. Japan is keen to finance transmission lines from the Thar coalfield to the national grid and Chinese companies have expressed interest in developing coal-based power plants in Thar and Badin.

http://tribune.com.pk/story/467668/coal-powered-energy--the-best-substitute/

ISLAMABAD:

Engro Corporation President and CEO Muhammad Aliuddin Ansari has stated that the Asian Development Bank (ADB) does not object to financing the switchover of thermal power plants to Thar coal.

“The directors of ADB have met me and the chief minister of Sindh and said that they had no objection to the conversion of power plants to Thar coal and are ready to finance [such projects],” he told The Express Tribune.

The revelation comes on the heels of the Ministry of Water and Power’s claim that the ADB is not ready to finance the conversion of power plants to Thar coal, and that the lending authority would finance power plants that run only on imported coal.

Ansari also said he is ready to travel to Manila along with a delegation from the water and power ministry to meet ADB officials and negotiate a financing deal for such projects.

Ansari recalled that it had been decided in a special board meeting of the Thar Coal Energy Board (TCEB) on October 3, 2012, chaired by the prime minister of Pakistan, that existing oil-based power plants should be modified and redesigned to Thar coal specifications, and that new coal-based plants should also be designed keeping the same specifications in mind.

It was also decided in the meeting that agreements would be signed between power generation companies and the Sindh Engro Coal Mining Company (SECMC) for the supply of coal for an existing 420 megawatt (MW) power plant in Jamshoro, as well as a new 600MW power plant to be built in the same location. These agreements were to be finalised and signed within a week, but never materialised.

Ansari said that Pakistan was facing a circular debt issue due to the poor energy mix employed by generation companies, and that conversion of power plants to run on Thar coal could address this issue. He claimed that Thar held the future of Pakistan, and reiterated that all future power plants should be designed on Thar coal specifications.

“Not only has the fuel mix shifted from gas to furnace oil, the price of furnace oil has increased four times in the last five years. This has increased the furnace oil bill by 461%, whereas power generation through furnace oil has increased by only 79%,” said a handout provided by Engro Corp as part of the interview.

Ansari said that Indonesia and India both held coal reserves that were similar in specification to the coal available in Thar. He remarked that India is expected to become a major market for coal by 2016: it already imports significant quantities to meet its needs....

http://tribune.com.pk/story/498215/engro-says-adb-has-no-objections-to-thar-coal-project/

ISLAMABAD:

Giving in to the pressure from an international lender, the government has reversed its decision on consuming domestic coal for power generation as the Council of Common Interests has approved using a blend of imported and Thar coal in power plants.

The move will pave the way for an early sanction of a $900 million loan by the Asian Development Bank that will go for the construction of a 600-megawatt coal-fired power plant at Jamshoro and for switching an existing 600MW power plant to coal.

According to sources in the finance ministry, further discussions on the $900 million loan will be held with ADB Director General of Central and West Asia Department Klaus Gerhaeusser, who was due to arrive on Wednesday.

During his two-day visit, Gerhaeusser will meet Finance Minister Dr Abdul Hafeez Shaikh and Water and Power Minister Ahmad Mukhtar. He will also hold meetings to review communication projects.

Prime Minister Raja Pervez Ashraf had placed a ban on imported coal-powered plants in a bid to encourage consumption of Thar coal in such projects. However, the ADB resisted the move and refused to extend loans for Thar coal-based power plants.

The bank was of the view that higher dependence on lignite would increase pollution, which was against the environmental policy of the lending agency.

Following the ADB’s decision, the federal government placed the case in a meeting of the CCI – a constitutional body headed by the prime minister with all chief ministers as members – on January 23. According to official documents, the CCI decided that “instead of using only Thar coal, a blend of imported and Thar coal will be used in the 600MW Jamshoro plant.”

In this meeting, Sindh Chief Minister Syed Qaim Ali Shah, who actively promotes mining and consumption of Thar coal, was also present.

CCI also decided that the Ministry of Water and Power would work out further details in deliberations with representatives of the ADB.

Apart from the ADB, the Japan International Cooperation Agency (JICA) has also expressed interest in constructing power plants in Pakistan, besides laying a power transmission lines from Thar to Matiari.

In the past many years, heavy reliance on furnace oil has disturbed the country’s energy mix. Against a one-third share of thermal power generation earlier, the ratio has increased to three-fourths. The recent emphasis on the shift to coal is aimed at tackling the runaway circular debt that has plagued the entire energy chain, forcing the government to spend billions of rupees every month to prop up the energy system.

According to a government official, it was not yet clear whether Pakistan will again take up the issue of financing the Diamer Basha Dam with the ADB director general.

However, he said these days the dam, costing $11.3 billion, was not the top priority of the government, which has shifted funds meant for the dam to another project, the Neelum Jhelum hydropower plant. An amount of Rs1 billion has also been diverted to the PM’s discretionary funds.

http://tribune.com.pk/story/507021/coal-fired-power-plant-govts-about-turn-paves-way-for-900m-adb-loan/

ISLAMABAD: Pakistan has discovered a new gas reserve in southern Sindh province that would help reduce acute gas shortages for industry and transport, the petroleum ministry said Friday.

Italian energy major ENI with joint venture partners Pakistan Petroleum Limited and Kuwait Foreign Petroleum Exploration Company made the discovery in the Kirthar Fold Belt region 270 kilometres (170 miles) north of Karachi.

"During the production testing gas flowed at 33 million cubic feet per day highlighting an excellent potential for the future for energy needs of the country," the ministry said in a statement.

Officials said that under an early production scheme, gas supply from the new reserve would be possible within three years.

Pakistan's Minister for Petroleum and Natural Resources Sohail Wajahat Siddiqui said that the discovery was "good news for the nation and the energy sector of Pakistan".

The discovery of new oil and gas reservoirs were "vital" to cope with the prevailing energy shortage in the country, Siddiqui said.

ENI has been in Pakistan since 2000 and is the country's largest producer, with an average production of 54,800 barrels of oil equivalent per day in 2011.

Pakistan has had an endemic energy crisis for years, characterized by frequent blackouts, which has crippled the economy.

The crisis is blamed on chronic mismanagement and corruption.

http://www.thenews.com.pk/article-99474-New-gas-reserves-discovered-in-southern-Pakistan

ISLAMABAD: The government disclosed in the Supreme Court on Thursday that about Rs2 billion was being spent daily (Rs749bn a year) on purchase of furnace oil for thermal power generation.

“This Rs749bn is in addition to Rs250bn which the government has to incur in terms of subsidised electricity provided to certain consumers,” Managing Director of the Pakistan Electric Power Company (Pepco) Zarghoon Ishaq Khan informed a three-judge bench headed by Chief Justice Iftikhar Mohammad Chaudhry which had taken notice of the rising electricity loadshedding.

The court regretted that despite spending a huge amount on thermal power generation people continued to endure huge power cuts.

The total electricity shortfall currently stands at about 4,000MW against a demand of 13,800MW. The generating units at present are collectively producing about 9,200MW.

The court directed Pepco, National Transmission and Dispatch Company, generation companies, Indus River System Authority and Alternative Energy Development Board to come up with actual reasons for loadshedding, bottlenecks and difficulties in providing the required electricity to consumers.

http://dawn.com/2013/05/03/rs2bn-being-spent-daily-on-thermal-power/

KARACHI:

Karachi Electric Supply Company and Sindh Engro Coal Mining Company (SECMC) inked a memorandum of understanding to construct a power generation project capable of producing 600 megawatts (MW) at Thar coal field.

According to the agreement, SECMC – a joint-venture between Engro Powergen and the Government of Sindh – will develop a 600MW Mine Mouth Power Plant in Thar field’s block 2, whereas KESC will purchase power from the plant to meet the rising power demand in Karachi and adjoining areas of Sindh and Balochistan, according to a press statement on Wednesday.

Both the parties believe that the agreement will serve as the base for a mutually beneficial partnership for future progress and development of one of largest coal reserves of Pakistan.

The two companies acknowledged that coal from Thar had the potential to address the country’s severe power shortages and bring energy security which is indispensable for economic growth.

The Thar Coal Power Project aims to provide affordable and sustainable electricity to consumers using domestic resources. Reliance on indigenous fuel is likely to save billions of dollars in foreign exchange currently spent on import of the expensive alternative furnace oil, cutting the overall cost of power generation.

---------

After the signing ceremony, Sheikh said, “Thar coal is a project of national security as it will bring much-needed energy security to propel the nation into an era of prosperity and development. SECMC’s Thar block 2 alone can produce 5,000MW for the next 50 years, amounting to an estimated foreign exchange savings of $50 billion throughout the life of the project. This project will demonstrate maturity and capability of corporate sector to join hands and synergise on national level.”

http://tribune.com.pk/story/546207/kesc-engro-team-up-to-build-600mw-power-plant-at-thar/

Electricity-starved Pakistan is close to signing a deal with Qatar worth as much as $2.5bn a year for the supply of liquefied natural gas (LNG) from the Gulf emirate to fuel Pakistan’s power grid, according to senior officials in Islamabad.

“This will be the last winter of discontent,” said Shahid Khaqan Abbassi, Pakistan’s petroleum minister, in a reference to the long power cuts that have for years angered Pakistani industrialists and householders. He promised a “major improvement” in gas supplies next year after particular severe shortages this winter.

Mr Abbassi is close to signing an agreement for the import of LNG from early 2015. Although the government has yet to name a supplier formally, Mr Abbassi and other officials from his ministry said that Qatar was the expected seller.

“If we can provide gas to those of our power generation plants that run on gas, [electricity cuts] will go down by half,” said Mr Abbassi. Demand for natural gas in Pakistan, a country of 180m people, is estimated at 8bn cubic feet per day, double the amount produced locally from gas fields in the south of the country.

Pakistan has also negotiated an agreement to buy gas to be piped from neighbouring Iran, but implementation of the project has been has been hampered by lack of financing and by US opposition.

Mr Abbassi expects Pakistan to buy some 3.5m tonnes of LNG a year from Qatar, meeting only part of the country’s shortfall.

Before the winter, Mr Abbassi alarmed his cabinet colleagues when he told them that for the first time in Pakistan’s history gas supply this year would not be sufficient to meet the needs of domestic consumers – even if supplies to commercial and industrial buyers were suspended.

Nawaz Sharif, prime minister, ordered Mr Abbassi to “take emergency steps” to tackle the situation, according to a senior official working with Mr Sharif. “Failure to provide gas will only enlarge the political risk [to the government],” the official said.

Growing energy shortages in recent years have prompted street demonstrations that only add to political instability in Pakistan.

Some critics have questioned Pakistan’s ability to keep up with the payments for future LNG supplies given the country’s weak finances, although the gas would partly replace oil used for power generation. “That may spare foreign exchange and allow the authorities to pay for at least part of the gas imports,” said Sakib Sherani, a former finance ministry adviser

The discussions with Qatar have deepened uncertainty over an earlier plan by Pakistan to build a pipeline to the Iranian border to import gas from Iran’s South Pars gas field. Mr Abbassi refused to comment on that project, and said only that “Pakistan will need more gas even after the LNG project. We are looking at all possible avenues.”

http://www.ft.com/intl/cms/s/0/82b74180-8c79-11e3-9b1d-00144feab7de.html

ISLAMABAD—Pakistan is close to striking a long-term deal worth potentially $22.5 billion or more to import liquefied natural gas to help fuel the country’s power stations and ease its crippling electricity crisis, Pakistan’s top energy official said.

“We are negotiating with Qatar and a few other sources,” said Pakistani Petroleum Minister Shahid Khaqan Abbasi in an interview with The Wall Street Journal. “The deal will be very competitive and very beneficial for Pakistan.”

An agreement with Qatar is expected by early March, Pakistani officials say.

---

The deal with Qatar would provide supplies over 15 years, Pakistani officials say. Pakistan is looking to import 3 million tons of LNG a year, beginning this year, with much or all of that coming from Qatar.

The country’s overall LNG imports are expected to rise to around 7 million tons annually within three years. It isn’t clear as yet how much of that higher total would be provided by Qatar.

Importing 3 million tons of LNG would cost around $1.5 billion annually, or some $22.5 billion over 15 years, given current global oil and gas prices, analysts say. That cost will fluctuate with the price of oil, which is also used to price LNG.

The Pakistani conglomerate Engro has built a terminal to import LNG at Port Qasim, on the edge of the southern city of Karachi, set to become operational at the end of March, officials say. Bidding is now under way to construct a second LNG terminal at Port Qasim.

Pakistani officials have been negotiating for months with state-owned Qatar Gas. The government of Qatar and Qatar Gas didn’t respond to requests for comment.

Pakistan’s electricity crisis has been caused partly by its reliance on importing furnace oil and diesel to fire its power stations, both relatively expensive fuels that will be replaced by the LNG. “LNG is more efficient and cleaner for the environment than the alternatives,” Mr. Abbasi said. “This is a major shift in our energy mix.”

According to Mr. Abbasi, LNG imports of 3 million tons would yield cost savings worth an annual $300 million. By using LNG, Pakistan will be able to between 7% and 9% more power, as a result of its greater efficiency and by bringing currently dormant gas-fired power stations back to work, Mr. Abbasi said.

Pakistan’s electricity shortage results from a failure to build power stations to keep pace with demand, a dependence on burning relatively expensive fuels and the swelling of debt in the sector that has led to some plants being shut down.

The deal would mark the first time that Pakistan will import natural gas. It would be the biggest financial commitment made by Pakistan to date, analysts say.

----

“This would be a positive development for Pakistan’s energy security. Qatar is a reliable and credible supplier,” said Anthony Livanios, head of oil and gas consultancy Energy Stream CMG. “For Qatar, this will help it diversify its customer base. So it’s a win-win situation for both countries.”

Qatar is the world’s biggest producer and exporter of LNG.

Pakistan is also considering shorter-term deals and open-market transactions to source some of its LNG needs from other countries, including Brunei, Malaysia and China, which isn’t a producer but may have excess imports that it can resell.

Nicholas Browne, a senior manager at Wood Mackenzie, an oil and gas consultancy, said typical pricing for Qatari LNG would be 14% to 15% of the price of oil. At 14%, Pakistan would be acquiring the fuel at $7 per million BTU, an attractive price, said Mr. Browne.

“From a buyer’s perspective, it is a great time to be in the market for LNG, in terms of both price and availability,” said Mr. Browne, because the price of oil has fallen and there is a substantial increase in supply expected in the next couple of years, as Australia and the U.S. bring new output onto the market.

http://www.wsj.com/articles/pakistan-close-to-deal-for-lng-supplies-from-qatar-for-power-plants-1424197572

Sources suggest that Qatargas has sold the LNG to Pakistan at approximately US$8 – 9/million Btu.

The government of Pakistan is keen to secure supplies of LNG from Qatar to help ease the energy crisis that is currently plaguing the country. Last year, Engro Corp.’s subsidiary, Elengy Terminal Pakistan Limited (ETPL), won the contract to develop Pakistan’s first LNG import infrastructure within a 335-day deadline.

Engro Corp. prepared an exclusive article discussing the regasification project for the March 2015 issue of LNG Industry. In the article, Engro explained the extent of the energy crisis in Pakistan:

Pakistan’s demand for gas [is] expected to double in the next 10 years and current gas production at 4 billion ft3/d was less than the required 6 billion ft3/d. At the current rate of growth, the demand could touch 13 billion ft3/d by 2020.

If this happens, the energy conundrum in the country could well become an energy catastrophe. Towns and rural areas will be in perpetual darkness, and a majority of the industrial units will be forced to shut down or remain uncompetitive. Consequently, unemployment will increase, a greater majority of Pakistanis will fall below the poverty line, food inflation will become rampant, and social indicators will be well below that of sub-Saharan countries.

By this time, Pakistan will only be able to meet 41% of its energy requirements and will have an energy import bill of US$52 billion. With no end in sight, the repercussions of Pakistan’s ongoing energy crisis are severe and go well beyond threats to the country’s economic well-being and stability.

Hence, it is imperative to look for an alternative source of gas in Pakistan. Importing LNG will enable the government to save significant foreign exchange through import substitution of oil, and will alleviate the energy crisis plaguing the country.

http://www.lngindustry.com/regasification/23032015/Pakistan-set-for-first-LNG-shipment-464/

The plant is to feature two 660 MW supercritical units and will be built in Karachi, at Pakistan’s second-largest port, Port Qasim. The bulk of the fuel is to be shipped in from Indonesia. Power Construction Corporation, which is set to build the project, aims to complete it in 32 months.

Of the $521m project capital, 51 per cent is to be invested by Power Construction Corporation and 49 per cent by Al Mirqab Capital, with the remaining $1.56bn to come from loans. The companies said the plant will be constructed and run on a build-own-operate model.

In a statement, Power Construction Corporation said: “The Pakistan Port Qasim power project is a large energy project of great political and economic importance between the two countries, as a high-priority project of the China-Pakistan Economic Corridor. This project fits the company’s development strategy and investment direction”.

Pakistan currently suffers from an energy shortfall of around 5 GW. The 3000 km, $45.6bn Economic Corridor project, which aims to connect Pakistan’s southern Gwadar Port with China’s northwestern Xinjiang region, includes plans for a gas pipeline from Iran to Pakistan, on which construction work has already begun although a formal deal won't be signed until later this month. According to reports, the pipeline could eventually provide Pakistan with enough fuel to generate around 4.5 GW of power.

In February Pakistan shelved a planned 6.6 GW coal-fired power project after Chinese investors backed out, citing lack of adequate infrastructure.

http://www.powerengineeringint.com/articles/2015/04/chinese-and-qatari-firms-to-build-coal-power-plant-in-pakistan.html

In a report prepared for Gastech 2015, Wood Mackenzie outlines the key levers which will determine the global gas floor price as the market absorbs a wave of LNG. With 130 million tonnes per year (mmpta) of additional LNG supply set to reach market over the next five years, coincident with faltering China demand, Wood Mackenzie asserts that new local floors for spot prices will be tested, unlocking new demand and curtailing supply, with global pricing implications.

Mr Noel Tomnay, Head of Global Gas & LNG research for Wood Mackenzie sets the scene: “The last LNG oversupply between 2008-10 came about when Qatar ramped up its LNG output and the market had to absorb 50 mmtpa of new LNG, at a time when demand growth had slowed. As a result, gas spot prices in Europe traded under US$4 per million British Thermal Unit ($/mmbtu) through the summer of 2009 and with no market in Asia, those prices were still enough to attract LNG cargoes to Europe, including from Australia.”

“The LNG market is facing another oversupply which is likely to be deeper and will persist for some years. Prices in Asia will be lower than in Europe, and at their worst, between 2017-19, while prices in Europe will not reach a low point until 2020. The key question the industry is wrestling with is: how low will prices go?” Mr Tomnay asks.

Wood Mackenzie’s report , titled ‘Global gas prices – what will set the floor?’ asserts that China’s market policies will be key. While more new LNG markets will emerge with lower gas prices, particularly if oil prices climb, more liberalised market conditions in China could enable it to absorb a lot more LNG, mitigating the impact of the LNG oversupply on price. This includes improved regasification infrastructure access, reductions in regulated gas prices and allowing the curtailment of high cost indigenous gas. Mr Tomnay elaborates: “It is likely that output from some high cost gas will be curtailed but protectionist measures will restrict China’s willingness to fully replace indigenous gas with lower priced LNG, dampening the potential supply response.”

New demand for gas and LNG could be created through the displacement of coal in power generation, a theme which will be central to Mr Tomnay’s presentation at Gastech 2015’s Market Outlook session on Wednesday. The gas price at which coal will be displaced, a soft floor for gas prices, will be determined, in part, by the price of coal. “Assuming higher ARA coal prices in Europe of US$70/tonne and Japanese coal prices of US$80/t (CFR), a floor price for gas in Europe and Asia should be maintained at prices above US$5.00/mmbtu. This should be sufficiently high to avoid US LNG being shut-in,” Mr Tomnay explains.

However, lower coal prices, possibly a consequence of reduced demand through displacement by gas, risks pulling both gas and coal prices down further Wood Mackenzie says. “At prevailing ARA coal prices of US$50/t and Japanese coal prices of US$60/t CFR, a floor price for gas in Europe and Asia could go down to prices at which many US LNG exports fail to cover cash costs, around US$4/mmbtu. This would force US LNG exporters to consider shutting-in for periods, a move which would depress US gas prices,” Tomnay adds.

Lastly Mr Tomnay explains why the behaviour of major suppliers, most notably Russia, will be key: “We could see major suppliers withdraw gas from the market, thereby supporting LNG spot prices. It was Gazprom’s withdrawal of 20 bcm per annum of pipe gas from Europe between 2008-10, equivalent to 15 mmtpa of LNG, that prevented spot prices from remaining low. At periods of severe oversupply, Russian gas supply behaviour will again be key to gas price formation in Europe – and this time in Asia and even the US too.”

Source: Wood Mackenzie

Falling solar and wind prices have led to new power deals across the world despite investment in renewables falling

https://www.theguardian.com/environment/2017/jun/06/spectacular-drop-in-renewable-energy-costs-leads-to-record-global-boost

Renewable energy capacity around the world was boosted by a record amount in 2016 and delivered at a markedly lower cost, according to new global data – although the total financial investment in renewables actually fell.

The greater “bang-for-buck” resulted from plummeting prices for solar and wind power and led to new power deals in countries including Denmark, Egypt, India, Mexico and the United Arab Emirates all being priced well below fossil fuel or nuclear options.

Analysts warned that the US’s withdrawal from the Paris climate change agreement, announced last week by Donald Trump, risked the US being left behind in the fast-moving transition to a low-carbon economy. But they also warned that the green transition was still not happening fast enough to avoid the worst impacts of global warming, especially in the transport and heating sectors.

The new renewable energy capacity installed worldwide in 2016 was 161GW, a 10% rise on 2015 and a new record, according to REN21, a network of public and private sector groups covering 155 nations and 96% of the world’s population.

The new record capacity cost $242bn, a 23% reduction in investment compared to 2015, and renewables investment remained larger than for all fossil fuels. Subsidies for green energy, however, are still much lower than those for coal, oil and gas.

New solar power provided the biggest boost – half of all new capacity – followed by wind power at a third and hydropower at 15%. It is the first year that the new solar capacity added has been greater than any other electricity-producing technology.

“A global energy transition [is] well under way, with record new additions of installed renewable energy capacity, rapidly falling costs and the decoupling of economic growth and energy-related carbon dioxide emissions for the third year running,” said Arthouros Zervos, chair of REN21.

https://financialpost.com/pmn/business-pmn/china-push-sees-coal-fired-generation-rise-to-record-in-pakistan

Coal’s surge in the South Asian nation is symbolic of the difficult choice that the region’s developing countries face as they seek affordable energy to support economic growth while trying to limit chronic air pollution. Asian demand is expected to support the commodity as its usage drops in most of the developed world in a transition to cleaner or renewable energy sources.

Is Canada's real estate forecast too optimistic?

Pakistan’s coal-fired power generation jumped 57% to a record in the fiscal year through June, according to data from the government’s National Electric Power Regulatory Authority. Coal accounted for about a fifth of total output, backed by supplies from the country’s first coal mine in its Thar region, developed as part of China’s Belt and Road plan.

Coal is set to expand further as China pushes funds into building more power plants in the country and mines to feed them. Pakistan is one of the flagship markets for China’s Belt and Road initiative, with more than $70 billion of projects including coal and liquefied natural gas fired power plants helping the nation end decades of electricity shortfalls.

“China has been cutting back on coal at home but it has no compunction about using coal in things that it funds outside of China,” said James Dorsey, a senior fellow at the S. Rajaratnam School of International Studies in Singapore. “Chinese can be willing but they need a partner to go along with them. In this case it’s the Pakistani government.”

Belt and Road progress has slowed recently with overseas energy spending last year dropping to the lowest in a decade, dogged by accusations that China is luring poor countries into debt traps for its own political and strategic gain. China’s President Xi Jinping has publicly urged more clean energy as part of the program, and the plan found new life in Pakistan recently with an agreement to build two hydro-power generation projects.