Goldman Sachs' Jim O'Neill Long Term Bullish on Pakistan

In his recently published book "The Growth Map", Goldman Sachs' Jim O'Neill of BRIC fame has reiterated Pakistan's long term growth prospects as part of the Next 11 (N-11) group of nations which includes Bangladesh, Egypt, Indonesia, Iran, Mexico, Nigeria, Pakistan, Philippines, Turkey, South Korea, and Vietnam.

Goldman Sachs has recently launched an N-11 equity fund (GSYAX) to enable investors to take advantage of growth in the Next-11 group of nations.

Answering a reporter's question about the growth prospects of GCC (oil-rich nations of Gulf Cooperation Council) at a recent investment conference in Dubai, he said: "Some GCC countries are well placed to be hubs for the BRIC and N-11-influenced world. I often think of Dubai as a kind of N-11 center, even the capital of the N-11 world, given its business adjacency to Egypt, Pakistan, Iran, Turkey, and, of course, India and Russia."

While the primary criterion used by Goldman Sachs for membership of a developing nation in BRIC and N-11 is the size of its population, the firm also considers what it calls Growth Environment Score (GES) of each nation. The 13 variables which make up growth environment score are inflation, fiscal deficit, external debt, investment rate, openness of the economy, penetration of phones, penetration of personal computers, penetration of internet, average years of secondary education, life expectancy, political stability, rule of law and corruption.

Goldman Sachs has given Pakistan a low GES score which puts the country among the bottom third of Next-11 nations. However, this score is rising, and Goldman forecasts that Pakistan will be among the top 20 world economies by 2025.

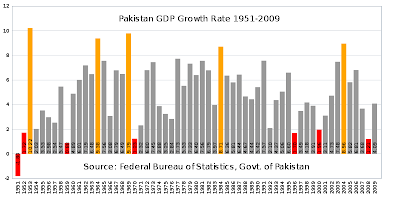

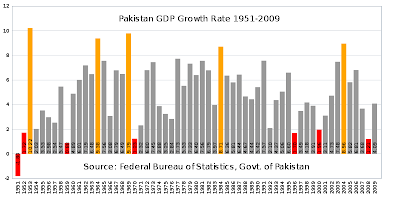

It seems to me that Goldman Sachs' assessment of Pakistan's growth prospects are too heavily influenced by the current crises the country faces. It is too conservative and does not fully reflect its future potential based on the nation's economic history over the last 64 years. For example, Goldman assumes a future growth rate that is less than the average of over 5% a year which Pakistan has seen over the last 64 years.

My view is that Goldman Sachs' forecast should fully reflect the fact that Pakistan's per capita GDP increased by 60% to $3,000 in the last decade. Even if it is assumed that there is no demographic dividend and the country's gdp growth rate will not accelerate, its per-capita income should still rise to nearly $20,000 by 2050, well above the Goldman Sachs' forecast of $15,066.00.

It is unrealistic to assume that Pakistan's economy will not benefit from its very young population. With half of its population below 20 years and 60 per cent below 30 years, Pakistan is well-positioned to reap huge demographic dividend, with its workforce growing at a faster rate than total population. This trend is estimated to accelerate over several decades. The average Pakistanis are now taking education more seriously than ever. Youth literacy is about 70% and growing, and young people are spending more time in schools and colleges to graduate at higher rates than their Indian counterparts in 15+ age group, according to a report on educational achievement by Harvard University researchers Robert Barro and Jong-Wha Lee. Vocational training is also getting increased focus since 2006 under National Vocational Training Commission (NAVTEC) with help from Germany, Japan, South Korea and the Netherlands.

The fact is that equity markets in Pakistan have already produced much higher returns than BRICs' markets have over the last decade.

Pakistan's main stock market ended 2010 with a 28 percent annual gain, driven by foreign buying mainly in the energy sector, despite concerns about the country's macroeconomic indicators after summer floods, according to Reuters. Although it was less than half of the 63% gain recorded in 2009, it is still an impressive rise in KSE-100 index when compared with the performance of Mumbai(+17%) and Shanghai(-14.3%) key indexes. Among other BRICs, Brazil is up just 1% for the year, and the dollar-traded Russian RTS index rose 22% in the year, reaching a 16-month closing high of 1,769.57 on Tuesday, while the ruble-based MICEX is also up 22%.

Pakistan's key share index KSE-100 dropped about 5% in 2011, significantly less than most the emerging markets around the world. Mumbai's Sensex, by contrast, lost about 25% of its value, putting it among the worst performing markets in the world.

Given the historical economic data I have shared in this post, I remain optimistic that Pakistan can and will easily beat Jim O'Neill's current forecast in the coming decades.

Related Links:

Haq's Musings

Pakistan's 64 Years of Independence

Goldman Sachs & Franlin-Templeton Bullish on Pakistan

Emerging Market Expert Investing in Pakistan

Pakistan's Demographic Dividend

Genomics & Biotech Advances in Pakistan

The Growth Map by Jim O'Neill

Pakistan Rolls Out 50Mbps Broadband Service

More Pakistan Students Studying Abroad

Inquiry Based Learning in Pakistan

Mobile Internet in South Asia

Online Courses at Top International Universities

Goldman Sachs has recently launched an N-11 equity fund (GSYAX) to enable investors to take advantage of growth in the Next-11 group of nations.

Answering a reporter's question about the growth prospects of GCC (oil-rich nations of Gulf Cooperation Council) at a recent investment conference in Dubai, he said: "Some GCC countries are well placed to be hubs for the BRIC and N-11-influenced world. I often think of Dubai as a kind of N-11 center, even the capital of the N-11 world, given its business adjacency to Egypt, Pakistan, Iran, Turkey, and, of course, India and Russia."

While the primary criterion used by Goldman Sachs for membership of a developing nation in BRIC and N-11 is the size of its population, the firm also considers what it calls Growth Environment Score (GES) of each nation. The 13 variables which make up growth environment score are inflation, fiscal deficit, external debt, investment rate, openness of the economy, penetration of phones, penetration of personal computers, penetration of internet, average years of secondary education, life expectancy, political stability, rule of law and corruption.

Goldman Sachs has given Pakistan a low GES score which puts the country among the bottom third of Next-11 nations. However, this score is rising, and Goldman forecasts that Pakistan will be among the top 20 world economies by 2025.

It seems to me that Goldman Sachs' assessment of Pakistan's growth prospects are too heavily influenced by the current crises the country faces. It is too conservative and does not fully reflect its future potential based on the nation's economic history over the last 64 years. For example, Goldman assumes a future growth rate that is less than the average of over 5% a year which Pakistan has seen over the last 64 years.

My view is that Goldman Sachs' forecast should fully reflect the fact that Pakistan's per capita GDP increased by 60% to $3,000 in the last decade. Even if it is assumed that there is no demographic dividend and the country's gdp growth rate will not accelerate, its per-capita income should still rise to nearly $20,000 by 2050, well above the Goldman Sachs' forecast of $15,066.00.

It is unrealistic to assume that Pakistan's economy will not benefit from its very young population. With half of its population below 20 years and 60 per cent below 30 years, Pakistan is well-positioned to reap huge demographic dividend, with its workforce growing at a faster rate than total population. This trend is estimated to accelerate over several decades. The average Pakistanis are now taking education more seriously than ever. Youth literacy is about 70% and growing, and young people are spending more time in schools and colleges to graduate at higher rates than their Indian counterparts in 15+ age group, according to a report on educational achievement by Harvard University researchers Robert Barro and Jong-Wha Lee. Vocational training is also getting increased focus since 2006 under National Vocational Training Commission (NAVTEC) with help from Germany, Japan, South Korea and the Netherlands.

The fact is that equity markets in Pakistan have already produced much higher returns than BRICs' markets have over the last decade.

Pakistan's main stock market ended 2010 with a 28 percent annual gain, driven by foreign buying mainly in the energy sector, despite concerns about the country's macroeconomic indicators after summer floods, according to Reuters. Although it was less than half of the 63% gain recorded in 2009, it is still an impressive rise in KSE-100 index when compared with the performance of Mumbai(+17%) and Shanghai(-14.3%) key indexes. Among other BRICs, Brazil is up just 1% for the year, and the dollar-traded Russian RTS index rose 22% in the year, reaching a 16-month closing high of 1,769.57 on Tuesday, while the ruble-based MICEX is also up 22%.

Pakistan's key share index KSE-100 dropped about 5% in 2011, significantly less than most the emerging markets around the world. Mumbai's Sensex, by contrast, lost about 25% of its value, putting it among the worst performing markets in the world.

Given the historical economic data I have shared in this post, I remain optimistic that Pakistan can and will easily beat Jim O'Neill's current forecast in the coming decades.

Related Links:

Haq's Musings

Pakistan's 64 Years of Independence

Goldman Sachs & Franlin-Templeton Bullish on Pakistan

Emerging Market Expert Investing in Pakistan

Pakistan's Demographic Dividend

Genomics & Biotech Advances in Pakistan

The Growth Map by Jim O'Neill

Pakistan Rolls Out 50Mbps Broadband Service

More Pakistan Students Studying Abroad

Inquiry Based Learning in Pakistan

Mobile Internet in South Asia

Online Courses at Top International Universities

Comments

THE MENTION OF PAKISTAN

PROMPTS MEMORIES OF OSAMA BIN LADEN and worries about current instability more readily than it does investment opportunity. “But a large portion of Pakistan is relatively stable, and it’s a country that’s growing rapidly almost in spite of itself,” says Paul Herber, portfolio manager of the Forward Frontier Strategy Fund.

Pakistan’s local oil and gas companies are a promising investment play. Unlike other N11 nations, where these resource companies are government-owned and give investors little access, “a lot of Pakistan’s oil and gas companies are public,” Herber says. The country is by no means a big global oil producer, but with 170 million people—more than Russia— growth in domestic demand is likely to boost the domestic industry, Herber says.

http://www.goldmansachs.com/gsam/pdfs/USTPD/education/092911_WO13_Goldman_Sachs_PDF.pdf

Mr. Singh met Pakistan Prime Minister Yousuf Raza Gilani briefly on the sidelines of a nuclear summit in Seoul on Tuesday. He told reporters Wednesday that he’d thanked Mr. Gilani for recent trade concessions and offered to make an official visit to Pakistan.

“I had a good meeting with him. I thanked him for the trade concessions that they have announced. He said when are you coming there (Pakistan). So, I said let us do something solid so that we can celebrate,” the Press Trust of India quoted him as saying. Mr Singh also said he told M. Gilani that he would “look into” the Pakistani leader’s request for India to supply power.

The chumminess of this encounter is likely to annoy India’s Pakistan hawks, who see no reason to make gestures toward Pakistan. Islamabad has failed to push ahead with the trials of the seven men it has charged with attacks on Mumbai in 2008 which killed more than 160 people and should be shunned until it does so, they argue.

Mr. Singh has taken a different approach.He invited Mr. Gilani to watch a World Cup cricket match between India and Pakistan a year ago, an act which sparked hopes of cricket diplomacy.

Although no breakthroughs have happened on the big issues that bedevil relations, like over the disputed Himalayan region of Kashmir or what India says is Pakistan’s continued support of militant groups, India and Pakistan have edged forward in recent months on other, smaller issues, like trade.

Last month, Pakistan agreed to normalize trade with India by the end of the year, a move which is part of a strategy to build confidence without yet touching issue like Kashmir.

This is a strategy dear to Mr. Singh’s heart. He’s said in the past that building economic ties with Pakistan is crucial to achieve peace but also to give India access to trade through Central Asia and beyond.

But the focus on trade has angered some in India, who see it as obfuscating the goal of getting Pakistan to crack down on militant groups. In Pakistan, too, there has been some opposition to normalizing trade with India. Mr. Gilani told Mr. Singh getting domestic support for the move was not “entirely easy,” PTI reported.

http://blogs.wsj.com/indiarealtime/2012/03/28/singh-says-hes-willing-to-visit-pakistan/

While there is no denying the fact that Pakistan’s economic health, its global ratings and image per se are all taking a serious dent and, of course the recent (released in February 2012) IMF report on the state of the Pak economy notwithstanding, the reality also is that it has a very resilient and robust side that continues to surprise. A picture that depicts the glass to be at least half full, points to the sectors that are consistently growing and adding value and, more importantly, exposes the huge underlying economic potential which despite poor governance keeps taking the national economic activity to the next level. Amidst great adversities and serious financial challenges, there does exist a silver lining on how the economy has performed over the last 12 months and some of the positives going forward.

On the back of a slowly but surely evolving middle class, there exists a visible consumption boom in the economy where companies are going through a period when domestic sales have never been higher. An exceptionally high percentage of young employable youth is unearthing new dynamics, as these fresh minds strive to create their own opportunities, thereby unleashing a wave of innovative entrepreneurial benefits. For example, the quality and speed at which the Pak urban consumer and service sectors (fashion wear, eateries, home decor, healthcare centres, private education, beauty salons, leisure and entertainment etc) are growing has but a few parallels in the world.

The inflow of foreign exchange remittances by Non-Resident Pakistanis (NRP) has never been stronger and provided its current rate of growth does not stall, the government envisages that the final figure is well on course to touch the $18 billion per annum level. Add to this, the fact that our exports registered $25 billion in 2011 and the possibility that if we can somehow supplement these inflows from NRP remittances and national exports, by re-attracting the presently dried up Direct Foreign Investment, there actually exists a strong case for successfully balancing our current account status - Pakistan as we know (even with the oil prices are high) is an economy that traditionally imports between $35 and $38 billion per annum.

The reserves in the meanwhile have held their ground at around the $17 billion mark and when doing a regional comparative analysis on parity with the US dollar one finds that the Pak rupee has also fared better than most of its neighbours. In fact, against the European currencies, like the Euro and the Sterling, the Pak rupee has gained in value when comparing its parity during the pre- and post-European crisis periods.

Further, according to the latest data released by the FBR, the revenue collection this year is on target and is likely to cross the Rs2,000 billion mark for the first time in history. ...

-------------

Large Scale Manufacturing (LSM) has begun to turn the corner by registering a 1.50 percent growth from negative 0.80 percent in 2011, more than 1.50 million motorcycles were sold last year and Automobile Sector’s sales are about 30 percent above from the fiscal year 2004-05 (regarded by auto pundits to be their best year). Companies and banks in general have announced healthier profits with especially the consumer goods companies leading the pack by churning out some unprecedented results. This coupled with the new policy announcement on investment in the shares markets has given a boost to the stock markets with the KSE (Karachi Stock Exchange) Index climbing to near 14,000 points. If the returns can continue to be interesting, such an opportunity is bound to even lure back foreign investment into the Pakistani markets.

http://www.nation.com.pk/pakistan-news-newspaper-daily-english-online/columns/28-Mar-2012/pakistan-s-economy-some-positives

South Asia is among the least economically integrated regions of the world, in part because partition cleaved apart various natural economic communities. Regions, such as Bengal, which had been well integrated historically, suffered considerable economic ill effects. And post-1947 policies have only exacerbated the problem through tariffs, production restrictions, and various trade controls.

---------

So it’s interesting that Indian foreign policymakers seem, in various ways, to be reemphasizing the economic dimensions of their country’s strategy. At a conference in New Delhi last week, for example, Shivshankar Menon, India’s savvy national security advisor, urged India and its neighbors to refocus on economic integration. Ironically, Menon argued, economic success has raised the costs of not doing business.

---------

This is why it’s encouraging that Menon and others in India seem to be giving regional trade integration new emphasis. After all, India’s size and rapid growth give it some potential to help lead the way.

Here are three areas that bear watching:

The Strategic Consequences of Indian Growth

First, how will India choose to play the strategic consequences of its economic growth?

My friend, Sanjaya Baru, has long argued that India should work not just for India-Pakistan bilateral cooperation or regional cooperation within the South Asian Association for Regional Cooperation (SAARC) but also on a parallel track. Given the slow pace of the former two efforts, Sanjaya has written, “it may be necessary for India to … see if regional economic cooperation can be pursued at a faster pace in a wider South Asian context.”

One vehicle, he has argued, might be an expanded “Bay of Bengal Community.” This would build eastward off the platform of an existing effort, “BIMSTEC,” which involves technical cooperation among Bangladesh, Bhutan, India, Nepal, Sri Lanka, and two Southeast Asian countries—Myanmar and Thailand. And if Myanmar’s process of political opening ultimately proves to be real (and is matched by an economic opening), then India would be well positioned to help forge new patterns of integration between South and Southeast Asia.

Melding Economics into Indian Strategy

Now, flip from the strategic consequences of economic growth to the economic dimensions of Indian strategy.

-----------

Mohsin Khan of the Peterson Institute has argued that Pakistan’s November 2011 decision to grant most favored nation (MFN) status to India could prove especially significant. Of course obstacles remain, but Pakistan has continued to take important and constructive steps—for example, shifting from a “positive” to a “negative list”-based import regime with a February 29 Cabinet decision. India’s trade minister, Anand Sharma, has noted that this step will increase from 17% to about 90% the number of items that India can trade with Pakistan.

There has been movement elsewhere as well—with Bangladesh and Sri Lanka, for example. Over at Ajay Shah’s blog on the Indian economy, there is a good debate about whether and how India’s growth may have spillover effects elsewhere in South Asia.

The bottom line is this: India’s debate about economics and strategy is intensifying. And to my mind, at least, that is a decidedly good thing. After all, India’s success will increasingly depend on how New Delhi (and India’s states) respond to opportunities generated beyond the country’s borders.

http://blogs.cfr.org/asia/2012/03/22/economics-and-indian-strategy/

The leaders of Brazil, Russia, India, China and South Africa announced on Thursday that they would investigate establishing a system that would allow them to bypass the dollar and other global currencies when trading among themselves.

The leaders of the BRICS group of nations also announced that they would explore setting up an alternative to the IMF and the World Bank that would loan to developing countries and bypass the U.S.-European axis of power that has dominated global economic affairs since World War II.

In a story on the stakes and the obstacles before the BRICS nations, our colleague Jim Yardley explained that the group had not accomplished very much before this, their fourth summit meeting, in New Delhi. But Jim wrote that they were expected to come away with at least one concrete product this time:

They are expected to announce agreements that would enable the nations to extend each other credit in local currencies while conducting trade, sidestepping the dollar, a substantive move if not yet the kind of game-changing action once expected from BRICS.

But that raises the questions:

Do you expect the BRICS to change the global game? What is their potential as a bloc or an alliance? Indeed, are they a bloc at all, or just a list of countries whose growing economic might symbolizes the rise of a world where the United States is no longer solely dominant?

The five countries have very different agendas and forms of government. Does this make forming any kind of unified policy or outlook unlikely? Are they really just a smart catchphrase from a Goldman Sachs economist to encapsulate changing global economics, as Walter Ladwig, a visiting fellow at the Royal United Services Institute, argued in the Opinion pages of the IHT?

The French daily Le Figaro believes that “little by little, the BRICS are asserting themselves.” To what end, it does not say.

In its analysis of the summit meeting, the Times of India concentrates on the group’s political statements urging negotiated resolutions of the conflict in Syria and the West’s nuclear standoff with Iran.

Reuters concentrates on the lecturing and hectoring that BRICS leaders delivered to the profligate West, quoting the customary end-of-summit joint declaration: “It is critical for advanced economies to adopt responsible macroeconomic and financial policies, avoid creating excessive global liquidity and undertake structural reforms to lift growth that create jobs.”

http://rendezvous.blogs.nytimes.com/2012/03/29/what-do-you-think-the-brics-can-build/?scp=1&sq=BRICS&st=cse

Last year I predicted that the Chinese bubble will burst soon, and that it’s unlikely that China will become the biggest economy in the world any time soon, contrary to what most analysts predict (See The great illusion?). Now it looks like India might also disappoint, although for completely different reasons.

The closer we look, the more Indian ills look like a scary combination of European ills and American ills. Start with the budget deficit: India’s economy needs to grow frantically just to pay its debt, which is about 8.5% of GDP. Defense spending increased 10% last year and this year should grow even faster. At the same time, growth is projected to slow down to 6-7%. That sounds a lot like the problem the USA is facing with colossal defense spending that is not justified by the facts on the ground (who’s planning to invade the USA? who’s planning to invade India?)

On top of defense spending, the Indian government also spends billions to provide subsidies to the oil industry and to farmers. Just like the USA. Finally, the Indian parliament resembles the fractured and paralyzed parliaments of Italy and Belgium, in which the governing party is tamed by the tiny allies that it needs in order to claim a majority. Just like Europe, the balance sheet and ridiculous bureaucracy are scaring away foreign investors.

India is famous for a dumb and gargantuan bureaucracy, which was never truly reformed when it moved from pseudo-communism to free-market capitalism, and that bureaucracy recently has been at work to make it difficult for anybody to do business in India. (And even for tourists to visit it: India is the only country in the world that forbids tourists from reentering India for two months).

The social and political problems of India have long been ignored by the world as remote and passing nuisances.

The truth is that many more people are killed by terrorists of various factions in India than in the other emerging powers.

The truth is that India still has a caste-based system that has created incredible social injustice.

The truth is that India, unlike China, Brazil and Russia and virtually any other emerging country, is a federation of linguistically and ethnically different states, a fact that could potentially derail the union.

The truth is that it is the largest Muslim country in the world (or second largest after neighboring Pakistan), a fact that constitutes a perennial threat to its identity.

The truth is that, unlike China, Russia and Brazil, who are unlikely to go to war with any of their neighbors, India is in a constant state of alert along the border with Pakistan, a nuclear enemy.

The truth is that corruption in India is more widespread than even in Russia (see for example for example).

The truth is that this year 27 million babies will be born in India (versus 10 million in China and 4 million in the USA): India needs to create an improbable number of jobs to improve the conditions of its population, or even to keep it where it is and avoid social unrest.

The closer one looks, the less reassuring India looks as a place to invest money.

This would matter little if growth were still exponential and business opportunities were popping up everywhere. However, just like China, India is vulnerable to oil prices and to prices of commodities in general. Those prices are unlikely to come down any time soon, now that the US economy is picking up steam.

Last but not least, India may have run out of Western customers willing to offsource jobs to cheaper English-speaking countries (i.e., to India) and may have to rely on its own domestic market. That market is, in theory, huge. Alas, the World Bank estimates that 300 million of them live under the poverty line, and the others have an average salary which is below $1,000 a month

http://ieet.org/index.php/IEET/more/scaruffi20120330

ISLAMABAD: The German embassy in cooperation with the Pakistan German Business Forum (PGBF) and German-linked companies and institutions active in Pakistan held an exhibition titled ‘Germany on the Road’ in Multan. Germany on the Road has been designed to present the multitude of linkages between Germany and Pakistan by giving German companies, Germany-linked companies and German institutions the opportunity to display their activities in Pakistan in a concise and vivid manner. During the exhibition up-to-date information about Germany as well as appealing give-away were handed out and a buffet dinner was offered. The event was sponsored by BASF Pakistan, CEI Logistics, EXCEL Group/PrintSol, GWE German Water and Energy, KSB Pumps, Küppersbusch/Teka Pakistan, MAN Diesel Pakistan, METRO Cash and Carry Pakistan, Nordex SE Germany, SAAS Synergie/Alno and SAP Pakistan.

I am surprised that Siemens Pakistan is not at the event.

http://www.dailytimes.com.pk/default.asp?page=2012\04\01\story_1-4-2012_pg5_15

You would never think that a company that was giving Alibaba.com – the world’s largest business-to-business portal – a run for its money around the world was based out of Karachi and yet there it is. Tucked away in an office suite on Sharae Faisal, the global headquarters of Tradekey.com look rather unremarkable, until you start asking the executives what they have achieved and what they plan on doing next.

“We want to be one of the world’s biggest companies,” says Junaid Mansoor, the founder and CEO of Tradekey, in a rather matter-of-fact tone of voice. “We want to be in businesses that affect the largest number of people.”

Tradekey.com, the world’s third largest B2B portal, is certainly an impressive beginning by the 32-year-old Mansoor, though by no means his first venture into the world of web-based start-ups. The serial entrepreneur created his first company when he was just 15 years old: a web-based e-mail service that promised to share its revenues with its users. (The site – moneywithmail.com – went bust when the dotcom bubble burst in 2001).

Tradekey.com has about 5.8 million members, of whom only about 5,000 have paid subscriptions, the source of the bulk of the company’s revenues, though the company also offers advertising services. While it does not release financial information about itself, based on the company’s fee for its two levels of premium services, Tradekey’s revenues are estimated to exceed $3 million a year.

Crucially from the company’s perspective, however, it has been growing at a rate of more than 86% a year (Tradekey did not offer a precise number). According to Mansoor, an analysis conducted by a third-party expert valued the company at around $700 million......

http://tribune.com.pk/story/275463/tradekey-a-pakistani-david-taking-on-a-chinese-goliath/

(Reuters) - Pakistan stocks rose almost 1.8 percent to a new four-year high on Wednesday, led by blue chips on hopes of progress on capital gains tax (CGT) reforms, dealers said.

The Karachi Stock Exchange (KSE) benchmark 100-share index ended up 1.79 percent, or 244.83 points, at 13,945.30 points, its highest close since May 2008.

Volume rose to 409.3 million shares, compared with 318.14 million shares traded on Tuesday.

"Investors remained interested in blue-chip stocks as volumes climbed to 9 billion rupees ($99 million)," said Samar Iqbal, a dealer at Topline Securities Ltd.

Among heavyweight companies, the National Bank of Pakistan ended 5 percent higher at 49.40 rupees, Pakistan Telecommunication Co Ltd closed up nearly 1 percent at 12.61 rupees and Oil and Gas Development Co Ltd rose 2.5 percent to 168.15 rupees.

In the currency market, the rupee ended firmer at 90.30/35 to the dollar, compared with Tuesday's close of 90.49/54 to the dollar amid a lack of import payments.

The rupee has also been supported recently by remittances from overseas Pakistanis, rising by nearly a quarter to $8.59 billion in the first eight months of the 2011/12 fiscal year, compared with $6.96 billion in the 2010/11 period.

In February, remittances totaled $1.16 billion.

In the money market, overnight rates fell to 9.10 percent, compared with the previous day's close of 9.75 percent amid increased liquidity in the interbank market.

http://uk.reuters.com/article/2012/04/04/financial-pakistan-idUKL3E8F450L20120404

KARACHI: Teledensity in Pakistan crossed the 70 percent mark by end of February 2012 mainly on the growing subscriptions of cellular mobile phone companies in urban and rural areas of the country, Pakistan Telecommunication Authority (PTA) data said on Saturday.

The teledensity of cellular phone stood at 67.2 percent; wireless sector teledensity reached at 1.8 percent and landline teledensity settled at 1.6 percent, making overall teledensity at 70.6 percent.

Pakistan’s teledensity is the second highest in South Asia after India that reached 78.10 percent. It remained on top among the region till January 2011 with modest annual growth, however corrective measures and saturated markets slowed down its growth.

The teledensity is defined as the number of customers per 100 people. Hence it is roughly said that 70 percent of the population own and avail telephony services through different technologies.

The mobile phone connection has risen to 116 million on different networks, constituting the lion’s share in the field of telecom sector in terms of subscribers and their technology selection.

Similarly, the wireless phone companies have increased their number of connections to 2.7 million by February whereas the landline connections decreased to stand at 2.9 million in the country.

In the cellular sector, Mobilink grabbed the largest subscribers’ base with 35.2 million. It was followed by Telenor and Ufone with 28.8 million and 22.4 million connections, respectively. The subscribers’ number of Zong and Warid stood at 14.9 million and 14.6 million users, respectively.

Analysts in the telecom sector said that the growth in cellular subscribers’ base showed the penetration of the mobile phone operators in the rural and small areas besides the metropolis.

They said that mobile phone users of multiple SIMs have been on the rise for availing on-net calls and SMS packages of different networks for affordability and increasing services utility.

Besides, there are millions of connections inactive for months but the cellular operators try to reactivate them by offering free balance to subscribers. In this regard, the cellular operators have introduced several prize schemes to attract new and retaining customers to maintain their growing base.

In the wireless sector, Pakistan Telecommunication Company Ltd (PTCL) and TeleCard are market leaders with 1.43 million and 0.743 million, respectively. In the landline sector, PTCL and NTC are market leaders with 2.7 million and 104 million connections, respectively.

The wireless operators’ competitive packages in the limited cities witnessed gradual growth particularly on daily consumption against fixed charges. On the contrary, the landline sector witnessed constant decline in connections on the services issues, high tariff and line rent.

http://www.dailytimes.com.pk/default.asp?page=2012\04\15\story_15-4-2012_pg5_8

http://www.pta.gov.pk/index.php?option=com_content&task=view&id=269&Itemid=658

...China’s economic growth has slowed to its lowest rate in three years. Brazil’s economic growth has fallen to under 3% from around 7.5%. Russia’s economy is heavily dependent on oil and energy prices.

And India? It seems destined to never fulfill its economic potential.

-----------

Over the last two decades, India’s economy has almost quadrupled in size, growing at an average rate of about 7% per annum. India’s GDP rose by 43% between 2007 and 2012, slightly less than China’s, which increased by 56%, but much faster than developed economies that grew only 2%.

In late 2011, the Indian government’s 12th five-year plan forecast growth of 9% between 2012 and 2017. Yet by early 2012, India’s growth had slowed to around 6%, high by the standards of developed countries but well below the levels required to maintain economic momentum and improve the living standards of its citizens.

----------

ncreasingly, India’s problems — poor public finances, weak international position, structurally flawed businesses, poor infrastructure, corruption and political atrophy — threaten to overwhelm its potential.

In recent years, India has consistently run a public sector deficit of 9%-10% of GDP, including the state governments and off-balance-sheet items. The problem of large budget deficits is compounded by one major cause — poorly targeted subsidies for fertilizer, food and petroleum which may amount to as much as 9% of GDP.

In March 2012, India brought down a budget that forecasted a fiscal deficit of 5.9%, well above its previous fiscal deficit target of 4.6%. India’s strong rate of recent growth (an average rate of 14% between 2004-05 and 2009-10) made large deficits, on the order of 10 % of GDP, relatively sustainable. Slowing growth will increasingly constrain India’s ability to run continuing large deficits.

India’s government debt is around 70% of GDP. As its debt is denominated in rupees and sold domestically, India faces no immediate financing difficulty. Instead, the government’s heavy borrowing requirements crowds out private business.

But India is running a current account deficit of over 3% of GDP, and trending higher — among the highest in the G-20. The cause is slowing exports as a result of weakness in India’s trading partners, while imports, mainly non-discretionary purchases of commodities and oil, have increased. India imports around 75% of its crude oil.

-----------

Slowing growth, tighter credit and other economic problems have increased corporate defaults to the highest level in 10 years. Non-performing loans are now around 2.5%-3% of bank assets. Analysts estimate that the major banks have around $25 billion in bad loans, an amount which is increasing.

The Indian government has already moved to recapitalize state-owned banks to ensure their capital position. In the process, the budget deficit and the government borrowing requirements have come under increasing pressure.

India is plagued by inadequate infrastructure. In critical sectors like power, transport and utilities, there are significant shortages. Yet political pressure to keep utility costs low has impeded investment.

In the electricity sector, for example, state-owned utilities that purchase power from producers and sell to residential users have incurred large losses. State governments are unwilling to raise retail consumer rates despite increases in the price that power producers charge the utilities. Attempts to increase rail ticket prices have failed. The Railways Minister’s own party opposed the proposal and demanded he be removed from his job. ...

http://www.marketwatch.com/story/indias-economic-star-is-fading-2012-04-19?link=MW_story_popular

For more than a decade, Pakistan has partnered with the United States to combat the extremism and militancy that threatens the stability of our region and the world. This fight has taken an enormous human toll on our people, with over 37,000 civilians killed and more than 5,000 police and soldiers lost. In addition to the enormous human tragedy, this struggle has directly and negatively impacted our economy and the development of our nation.

We have witnessed the loss of more than $100 billion of foreign investment, a tightening of our financial markets, and a freeze on the progress of many social programs. But that trend has now dramatically reversed, and there is an emerging story of a new Pakistan strategically located at the crossroads of the world's most dynamic economies, ready to take its place as a critical emerging market.

We have a consumer base of more than 170 million, a young and educated work force, and a culture of entrepreneurship. The opportunity for our economy to grow is immense. People in the West may not be aware, but the positive change that is sweeping Pakistan as we speak has profound economic and political consequences for the future.

----------

...over the last four years, the Pakistani government has taken difficult but important steps to get our economy back on track. This year real growth in gross domestic product is likely to reach 4%, nearly double last year's rate. During the first nine months of fiscal year 2012, tax collections have surged by 24%, remittances from Pakistanis abroad by 21% (to $9.7 billion), and our exports by 5.5% over last year's base of $25 billion.

Inflation and consumer prices were down in March, easing pressure on small and medium-size companies. The Karachi Stock Exchange KSE100 Index now stands at 14,000, having been at 6,000 in 2008. Pakistan's foreign exchange reserves increased to $18 billion in 2011, the largest in history, and our financial obligations are declining. In 2015, Pakistan's annual repayment to the International Monetary Fund will be a quarter of its 2012 obligation.

Six months ago, Pakistan granted Most Favored Nation trading status to India, a paradigm-shifting policy change driven by the business sectors on both sides of the border. With its complete implementation and the concomitant reduction of India's nontariff barriers, this decision has the power to reconfigure the region's economic landscape and dramatically increase its stability. Today, bilateral trade between India and Pakistan stands at $2.7 billion per year. Business chambers in both countries predict that figure could quadruple to $10 billion by 2015.

----------

Investing in any emerging market has its challenges, but Pakistan is poised for growth. For the first time in our history, a democratically elected government will complete a full five-year term next year. Our judiciary is independent and upholding the rule of law. Our military is working with our civilian government to protect our borders and keep militancy and extremism in check. Our civil society is expanding, and our media are robust and uncensored.

Business contracts have been consistently honored and the return on investment for many investors has been enormous. And though the last decade has taken a toll on our economy and our infrastructure, our resilience is evident and turning the tide. We are building infrastructure and expanding our energy capacity, we are modernizing our agriculture sector, we are a leader in telephone access, our textile sector is one of the largest in the region, and our information-technology companies are some of the best in the world.

http://online.wsj.com/article/SB10001424052702303592404577363903670333254.html

A rapidly depreciating rupee, dipping foreign exchange reserves and strong financial links with the Euro Zone are pushing India against the wall. The over 20 per cent depreciation of the rupee against the dollar in the last one year has hugely increased the repayment burden of Indian companies.

According to the Bank for International Settlements' (BIS) preliminary data for December 2011, international claims on India, payable within the next one year, are $137 billion.. This is 60 per cent of the total claims of overseas banks on India in non-rupee currencies. This can eat up one half of the $293-billion foreign exchange reserves that India now has. European banks account for over 40 per cent of India's total foreign dues. At $132 billion, this is twice India's liabilities towards the US.

But leaving out the UK, India's Euro Zone exposure is about $60 billion. That is close to 3.4 per cent of India's GDP. Any full-blown crisis in Greece could spill over to the other European nations, posing a risk of capital flight from India.

The immediate impact of capital flight and the depreciating rupee would be more pressure on domestic liquidity, says Ms Sonal Varma, Executive Director and India Economist at Nomura. That also means a higher risk of interest rates moving upwards.

International claims, other than rupee-denominated ones, include trade credit and other borrowings. The data on international claims from the BIS, roughly tally with the RBI's data on non-rupee external debt.

http://www.thehindubusinessline.com/industry-and-economy/article3429540.ece

KARACHI: The Karachi stock market crossed 18,900 points level on the last trading day of the week Friday as earnings frenzy continued to encourage investors to go for buying in oil, fertilizer and cement sectors.

The Karachi Stock Exchange (KSE) 100-share index gained 32.10 points or 0.17 percent to close at 18,917.71 points as compared to 18,885.61 points of the previous session. The KSE 30-share index was up by 10.81 points to close at 14,584.18 points as compared with 14,573.37 points.

“Mixed activity was seen at the market with corporate results season almost coming to an end,” said Topline Sec dealer Samar Iqbal. “Mixed March quarter results were announced today.”

Once again TRG came in the limelight as it closed at its upper cap with 27.5 million shares, she said and added that Engro Corporation and Foods saw some profit-taking ahead of the weekend.

The market turnover went down by 3.53 percent and traded 206.02 million shares as against 213.57 million shares of the previous session. The overall market capitalisation rose 0.34 percent and traded Rs 4.649 trillion as against Rs 4.633 trillion. Gainers outnumbered losers 204 to 146, while 17 stocks were unchanged.

“Stocks closed higher led by second-tier stocks on strong valuations,” said Arif Habib Corporation Director Ahsan Mehanti. “Index remained in a narrow range amid concerns over security unrest in the city, economic uncertainty and rupee fall despite recovery in global commodities and record quarter-end earnings announcements in oil, fertilizer, textile and cement stocks.”

The KMI 30-share index gained 36.24 points to close at 32,930.01 points from its opening at 32,893.77 points. The KSE all-share index closed with a gain of 48.06 points to 13,455.50 points as compared to 13,407.44 points of the previous session.

“The market closed in the green zone with intraday gains clipped by selling pressure in Engro Chemicals and Pakistan Petroleum,” said JS Research analyst Ovais Ahsan. “The banking sector gained led by MCB Bank and UBL as the sector continued to limp out of a long spell of underperformance.”

Adamjee Insurance corrected overbought momentum after a weeklong rally.

“Bulls reined the final session of the week as index came close to 19,000 points level during intraday trade,” said Habib Metropolitan Finance Corporation Salman Vidhani. “Selling pressure in Engro dampened overall sentiment as some stocks also registered a negative close.”

TRG Pakistan Ltd was the volume leader in the share market with 27.54 million shares as it closed at Rs 11.30 after opening at Rs 10.30, gaining Re 1. Lotte Chemical traded 16.43 million shares as it closed at Rs 7.54 from its opening at Rs 7.35, rising 19 paisas. Maple Leaf Cement traded 11.81 million shares and closed at Rs 18.95 as compared to its opening at Rs 19.36, shedding 41 paisas. Pervaiz Ahmad traded 11.50 million shares as it closed at Rs 3.29 as against its opening at Rs 2.57, increasing 72 paisas.

http://www.dailytimes.com.pk/default.asp?page=2013\04\27\story_27-4-2013_pg5_17

Hindi, Bengali, Urdu and Indonesian will dominate much of the business world by 2050, followed by Spanish, Portuguese, Arabic and Russian. If you want to get the most money out of your language course, studying one of the languages listed above is probably a safe bet.

The Chinese dialects combined already have more native speakers than any other language, followed by Hindi and Urdu, which have the same linguistic origins in northern India. English comes next with 527 million native speakers. Arabic is spoken by nearly 100 million more native speakers than Spanish, which has 389 million speakers.

Of course, demographic developments are hard to predict. Moreover, the British Council only included today's growth markets, which says little about the growth potential of other nations that are still fairly small today. Also, Arabic and Chinese, for instance, have many dialects and local versions, which could make it harder for foreigners to communicate.

Despite all that, the chart above gives a broad look into which linguistic direction the business world is developing: away from Europe and North America, and more toward Asia and the Middle East.

You want to speak to as many people as possible? How about Chinese, Spanish or French?

German linguistic expert Ulrich Ammon, who conducted a 15-year-long study, recently released a summary of his research. In his book, Ammon analyzes the languages with the most native speakers and the most language learners around the world. Especially for the latter aspect, there is little original data available, which is why Ammon does not provide predictions of exact numbers of speakers per language.

Here's his top three of the languages you should learn if you want to use the language as often as possible, everywhere in the world. If you do not have time, however, don't worry too much: English will continue to top all rankings in the near future, according to Ammon.

1. Chinese. "Although Chinese has three times more native speakers than English, it's still not as evenly spread over the world," Ammon said. "Moreover, Chinese is only rarely used in sciences and difficult to read and write."

2. Spanish. Spanish makes up for a lack of native speakers — compared with China — by being particularly popular as a second language, taught in schools around the world, Ammon said.

3. French. "French has lost grounds in some regions and especially in Europe in the last decades," Ammon explained. "French, however, could gain influence again if west Africa where it is frequently spoken were to become more politically stable and economically attractive."

Goldman Sachs analysts said slower population growth will present “a number of economic challenges,” such as how nations will pay for rising health costs of their aging populations.

https://www.law.com/dailybusinessreview/2022/12/06/heres-goldman-sachs-take-on-world-economy-through-2075/?slreturn=20221107110634

Goldman Sachs Group Inc. economists have taken a stab at predicting the path of the world economy through 2075.

Two decades since they famously outlined long-term growth projections for the so-called BRIC economies, the economists, now led by Jan Hatzius, expanded their projections to encompass 104 countries over the next half-century.

The results:

Global growth will average just under 3% a year over the next decade, down from 3.6% in the decade before the financial crisis, and will be on a gradually declining path afterwards, reflecting a slowing of labor force growth.

Emerging markets will continue to converge with industrial nations as China, the U.S., India, Indonesia and Germany top the league table of largest economies when measured in dollars. Nigeria, Pakistan and Egypt could also be among the biggest.

The U.S. is unlikely to repeat its relative strong performance of the last decade, and the dollar’s exceptional robustness will also unwind over the next 10 years.

While income inequality between countries has fallen, it will continue to rise within them.

Economists Kevin Daly and Tadas Gedminas saw protectionism and climate change as risks that are “particularly important” both for growth and the convergence of incomes.

------------

Pakistan projected to be among largest economies in the world by 2075: Goldman Sachs

https://www.dawn.com/news/1725141

A research paper published by Goldman Sachs on Tuesday projected Pakistan to be the sixth largest economy in the world by 2075 given “appropriate policies and institutions” are in place.

Authored by economists Kevin Daly and Tadas Gedminas and titled ‘The Path to 2075’, the paper projected that the five largest economies by 2075 will be China, India, the US, Indonesia and Nigeria.

Goldman Sachs has been projecting long-term growth of countries for almost two decades now, initially starting out with BRICs economies, but for the past 10 years they have expanded those projections to cover 70 emerging and developed economies.

Their latest paper covers 104 countries with projections going as far as 2075.

https://www.southasiainvestor.com/2022/12/goldman-sachs-projects-pakistan-economy.html

---------

The Path to 2075

https://www.goldmansachs.com/insights/pages/gs-research/the-path-to-2075-slower-global-growth-but-convergence-remains-intact/report.pdf

Country GDP % Growth Rate by decades 2000-2009 to 2070-2079

Pakistan 4.7 4.0 5.0 6.0 5.9 5.3 4.7 4.0 3.4

China 10.3 7.7 4.2 4.0 2.5 1.6 1.1 0.9 0.5

India 6.9 6.9 5.0 5.8 4.6 3.7 3.1 2.5 2.1

Korea 4.9 3.3 2.0 1.9 1.4 0.8 0.3 -0.1 -0.2

Bangladesh 5.6 6.6 6.3 6.6 4.9 3.8 3.0 2.5 2.0

---------------------

Country GDP in Trillions of U$ from 2000 to 2075

Pakistan 0.1 0.2 0.3 0.6 1.6 3.3 6.1 9.9 12.3

China 1.8 7.4 15.5 24.5 34.1 41.9 48.6 54.8 57.0

India 0.7 2.1 2.8 6.6 13.2 22.2 33.2 45.8 52.5

Korea 0.9 1.4 1.7 2.0 2.6 3.1 3.3 3.4 3.4

Bangladesh 0.1 0.2 0.4 0.8 1.7 2.8 4.1 5.5 6.3

-------------------

Country Per Capita Income in thousands of US$ by Decade-ends 2000 to 2075

Pakistan 0.9 1.3 1.4 2.2 4.8 9.0 14.9 22.5 27.1

China 1.4 5.5 10.9 17.3 24.7 31.9 40.3 50.4 55.4

India 0.7 1.7 2.0 4.3 8.2 13.3 19.6 27.1 31.3

Korea 18.7 28.8 33.0 39.3 53.6 67.7 81.8 95.2 101.8

Bangladesh 0.7 1.1 2.3 4.4 8.4 13.5 19.7 26.9 31.0

https://www.southwestjournal.com/largest-economies-in-the-world/

Complete List

Country Projected GDP at PPP (in trillion)

Vietnam $3.18

Philippines $3.34

South Korea $3.54

Iran $3.90

Pakistan $4.24

Egypt $4.33

Nigeria $4.35

Saudi Arabia $4.69

France $4.71

Turkey $5.18

United Kingdom $5.37

Germany $6.14

Japan $6.78

Mexico $6.86

Russia $7.13

Brazil $7.54

Indonesia $10.5

United States $34.1

India $44.1

China $58.5

---------

In our exploration of the future, we’ve delved into the fascinating realm of global economic dynamics, forecasting the 20 largest economies by the year 2050. But if you’re eager to cut to the chase, feel free to jump straight to our top 5 predictions.

Our journey begins in the heart of London, at the headquarters of our own professional services network.

We’re proud to stand among the world’s leading accountancy firms, and in 2017, we embarked on a bold project: The World in 2050. This report was our attempt to gaze into the crystal ball of the world’s economic future, three decades down the line.

Our projections suggest a seismic shift in the global economic landscape. We anticipate the global economy will surge by 130% by 2050, with China commanding a 20% share of the world’s GDP in purchasing power parity.

------------

Pakistan Forecasted GDP at PPP: $4.24 trillion

Pakistan, the world’s fifth most populous nation, is expected to be among the 20 largest economies in the world by 2050, driven by its youthful population. A Goldman Sachs report from December 2022 even tipped Pakistan to be the sixth largest economy by 2075.

A recent NY Times article by Lauren Leatherby titled "How a Vast Demographic Shift Will Reshape the World" uses charts and graphics to show how the world economic landscape will change during the rest of the century.

It shows that Pakistan will join the top 10 countries with highest share of working age population and lowest dependency ratios.

https://www.nytimes.com/interactive/2023/07/16/world/world-demographics.html

Pakistan will join top 10 countries in working age population in 2050

Bangladesh is already in the top 10 working age population countries today.

https://www.nytimes.com/interactive/2023/07/16/world/world-demographics.html

Countries are categorized as having large working-age populations if people between the ages of 15 and 64, an age group commonly used by demographers, make up at least 65 percent of the total population.

Countries where at least a quarter of the population is under age 15 and where less than 65 percent of the population is working age are categorized as having a large young population. Countries are categorized as having a large old population if those age 65 and older make up more than a quarter of the population.

Unless noted otherwise, graphics include all countries with a population of at least 50,000 people.

The world’s demographics have already been transformed. Europe is shrinking. China is shrinking, with India, a much younger country, overtaking it this year as the world’s most populous nation.

But what we’ve seen so far is just the beginning.

The projections are reliable, and stark: By 2050, people age 65 and older will make up nearly 40 percent of the population in some parts of East Asia and Europe. That’s almost twice the share of older adults in Florida, America’s retirement capital. Extraordinary numbers of retirees will be dependent on a shrinking number of working-age people to support them.

In all of recorded history, no country has ever been as old as these nations are expected to get.

As a result, experts predict, things many wealthier countries take for granted — like pensions, retirement ages and strict immigration policies — will need overhauls to be sustainable. And today’s wealthier countries will almost inevitably make up a smaller share of global G.D.P., economists say.

This is a sea change for Europe, the United States, China and other top economies, which have had some of the most working-age people in the world, adjusted for their populations. Their large work forces have helped to drive their economic growth.

Those countries are already aging off the list. Soon, the best-balanced work forces will mostly be in South and Southeast Asia, Africa and the Middle East, according to U.N. projections. The shift could reshape economic growth and geopolitical power balances, experts say.