China's Checkbook Power

As President Obama plans to meet Latin America's leaders this weekend, China has recently negotiated deals to double a development fund in Venezuela to $12 billion, lend Ecuador at least $1 billion to build a hydroelectric plant, provide Argentina with access to more than $10 billion in Chinese currency and lend Brazil’s national oil company $10 billion. The deals largely focus on China locking in natural resources like oil for years to come, according to the New York Times.

As a result of rapidly growing ties and trade, China has already become Latin America's second largest trading partner after the United States.

Beyond locking in the natural resources for its growing industries and developing new export markets, China is also focusing on expanding its own internal consumption of products it produces. Already, China has surpassed the United States as the largest automobile market in the world. In comparison with the rest of the world, the Chinese market for automobiles appears to be relatively robust. Monthly auto sales in China surpassed those in the U.S. for the first time in January, but automakers and industry watchers say the news may tell us more about the troubles in the U.S. than about China's growing car market, says a report published in San Francisco Chronicle.

Data released in February by the China Association of Automobile Manufacturers shows 735,000 new cars were sold in China last month, down 14.4 percent from the record of 860,000 set in January 2008. U.S. sales, meanwhile, fell 37 percent to 656,976 vehicles — a 26-year low. Some analysts believe U.S. sales may fall to about 10 million vehicles this year.

Worrying about the shifting balance of power in Latin America while the US is preoccupied with crises in Afghanistan and the Middle East, David Rothkopf, a former Commerce Department official in the Clinton administration, told the New York Times, “The loans are an example of the checkbook power in the world moving to new places, with the Chinese becoming more active.”

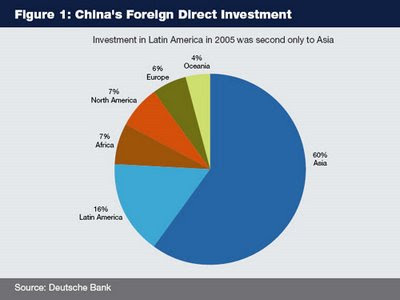

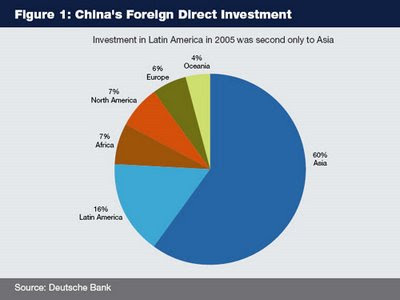

While the Chinese have been actively engaged for years in raising their profile and influence in Asia and Africa, the rising Chinese presence in Latin America seems too close for comfort for the US.

It is estimated that the continuing trade surpluses for years have helped China amass a whopping two trillion US dollars in dollar-denominated assets. Last year alone, China added US$450 billion to its reserves at a rate of over a billion dollars a day. About half of the Chinese US dollar-based assets are in the form of US treasury bonds that fund the ballooning US deficits.

Gao Xiqing, president of the China Investment Corporation, recently told James Fallows of the Atlantic Monthly, "Be nice to the countries that lend you money". Gao was clearly hinting at this new reality of " balance of financial terror" shifting in China's favor.

If history is any guide, the power of the lender over debtor nations is not just theoretical. The key moment when the world leadership passed from Britain to the United States came during the Suez crisis of the 1950s as a result of Britain's large WWII debt owed to the United States. When Britain, France and Israel invaded Egypt to take control of the Suez canal, the US President Eisenhower warned the British that unless they withdrew, he would order the sale of the United States' currency reserves of British Pounds and Sterling Bonds; thereby precipitating a collapse of the British currencies' exchange rate. Eisenhower in fact ordered his Secretary of the Treasury, George M. Humphrey to prepare to sell part of the US Government's Sterling Bond holdings. The British withdrew and ceded the control of the Canal to Egypt.

“This is China playing the long game,” said Gregory Chin, a political scientist at York University in Toronto. “If this ultimately translates into political influence, then that is how the game is played.”

Related Links:

China Sees Opportunities Where Others See Risk

Chinese Do Good and Do Well in Developing World

Can Chimerica Rescue the World Economy?

As a result of rapidly growing ties and trade, China has already become Latin America's second largest trading partner after the United States.

Beyond locking in the natural resources for its growing industries and developing new export markets, China is also focusing on expanding its own internal consumption of products it produces. Already, China has surpassed the United States as the largest automobile market in the world. In comparison with the rest of the world, the Chinese market for automobiles appears to be relatively robust. Monthly auto sales in China surpassed those in the U.S. for the first time in January, but automakers and industry watchers say the news may tell us more about the troubles in the U.S. than about China's growing car market, says a report published in San Francisco Chronicle.

Data released in February by the China Association of Automobile Manufacturers shows 735,000 new cars were sold in China last month, down 14.4 percent from the record of 860,000 set in January 2008. U.S. sales, meanwhile, fell 37 percent to 656,976 vehicles — a 26-year low. Some analysts believe U.S. sales may fall to about 10 million vehicles this year.

Worrying about the shifting balance of power in Latin America while the US is preoccupied with crises in Afghanistan and the Middle East, David Rothkopf, a former Commerce Department official in the Clinton administration, told the New York Times, “The loans are an example of the checkbook power in the world moving to new places, with the Chinese becoming more active.”

While the Chinese have been actively engaged for years in raising their profile and influence in Asia and Africa, the rising Chinese presence in Latin America seems too close for comfort for the US.

It is estimated that the continuing trade surpluses for years have helped China amass a whopping two trillion US dollars in dollar-denominated assets. Last year alone, China added US$450 billion to its reserves at a rate of over a billion dollars a day. About half of the Chinese US dollar-based assets are in the form of US treasury bonds that fund the ballooning US deficits.

Gao Xiqing, president of the China Investment Corporation, recently told James Fallows of the Atlantic Monthly, "Be nice to the countries that lend you money". Gao was clearly hinting at this new reality of " balance of financial terror" shifting in China's favor.

If history is any guide, the power of the lender over debtor nations is not just theoretical. The key moment when the world leadership passed from Britain to the United States came during the Suez crisis of the 1950s as a result of Britain's large WWII debt owed to the United States. When Britain, France and Israel invaded Egypt to take control of the Suez canal, the US President Eisenhower warned the British that unless they withdrew, he would order the sale of the United States' currency reserves of British Pounds and Sterling Bonds; thereby precipitating a collapse of the British currencies' exchange rate. Eisenhower in fact ordered his Secretary of the Treasury, George M. Humphrey to prepare to sell part of the US Government's Sterling Bond holdings. The British withdrew and ceded the control of the Canal to Egypt.

“This is China playing the long game,” said Gregory Chin, a political scientist at York University in Toronto. “If this ultimately translates into political influence, then that is how the game is played.”

Related Links:

China Sees Opportunities Where Others See Risk

Chinese Do Good and Do Well in Developing World

Can Chimerica Rescue the World Economy?

Comments

WASHINGTON — The United States has discovered nearly $1 trillion in untapped mineral deposits in Afghanistan, far beyond any previously known reserves and enough to fundamentally alter the Afghan economy and perhaps the Afghan war itself, according to senior American government officials.

The previously unknown deposits — including huge veins of iron, copper, cobalt, gold and critical industrial metals like lithium — are so big and include so many minerals that are essential to modern industry that Afghanistan could eventually be transformed into one of the most important mining centers in the world, the United States officials believe.

An internal Pentagon memo, for example, states that Afghanistan could become the “Saudi Arabia of lithium,” a key raw material in the manufacture of batteries for laptops and BlackBerrys.

The vast scale of Afghanistan’s mineral wealth was discovered by a small team of Pentagon officials and American geologists. The Afghan government and President Hamid Karzai were recently briefed, American officials said.

While it could take many years to develop a mining industry, the potential is so great that officials and executives in the industry believe it could attract heavy investment even before mines are profitable, providing the possibility of jobs that could distract from generations of war.

“There is stunning potential here,” Gen. David H. Petraeus, commander of the United States Central Command, said in an interview on Saturday. “There are a lot of ifs, of course, but I think potentially it is hugely significant.”

The value of the newly discovered mineral deposits dwarfs the size of Afghanistan’s existing war-bedraggled economy, which is based largely on opium production and narcotics trafficking as well as aid from the United States and other industrialized countries. Afghanistan’s gross domestic product is only about $12 billion.

“This will become the backbone of the Afghan economy,” said Jalil Jumriany, an adviser to the Afghan minister of mines.

American and Afghan officials agreed to discuss the mineral discoveries at a difficult moment in the war in Afghanistan. The American-led offensive in Marja in southern Afghanistan has achieved only limited gains. Meanwhile, charges of corruption and favoritism continue to plague the Karzai government, and Mr. Karzai seems increasingly embittered toward the White House.