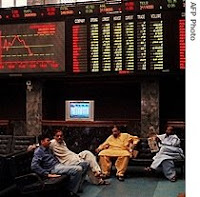

Karachi Stocks Poised for Major Crash

Karachi stock market is fearing the worst as the authorities contemplate removing an artificial floor of 9144 for KSE-100 imposed on August 27, 2008.

Karachi stocks have remained unscathed through the meltdown of major stock market indices around the world in the last few weeks. This has happened in spite of the precipitous drop in Pakistan rupee and the widely feared default on sovereign debt by Pakistan.

The reason why Karachi stocks have not suffered has nothing to do any "strong" fundamentals seen by astute investors. It is because of an artificial floor imposed on KSE-100 by the authorities. Fearing a complete meltdown of stock prices at Karachi Stock Exchange, Pakistan's Securities and Exchange Commission imposed a floor of 9144 for the market's benchmark KSE-100 index. The index closed at 9144 level on Wednesday, Aug 27, the day the KSE and SEC announced their decision to not allow the KSE-100 to trade below this arbitrary level. This extraordinary action, the first of its kind since the exchange opened its doors in 1948, came after investors pushed down the index to its lowest level in more than two years. Since this highly unusual action, the trading volume at Karachi has been extremely low. Daily trading volume dropped to a record low level last week to less than a million shares.

As a precaution before the KSE-100 floor is removed and to soften the blow for investors, the government is offering a Rs. 50 billion fund to bail out the shareholders. The fund will likely be used to offer "put options" worth Rs 30 billion to foreign investors. Pakistani stock brokers like the idea but they want at least Rs. 15 billion to cover losses by their Pakistani clients, according to media reports.

While Pakistan's Rs. 50 billion bailout package is laudable, it will be no more than a band-aid for a much more serious problem in Pakistan: Major loss of investor confidence. Unless the national leadership takes steps to get the economy on the right track and restore investor confidence, the rupee, the stock market and credit market and the whole financial system will continue to verge on collapse.

Comments

Pakistan extended trading restrictions on its stock market for the third time in a month to prevent a further slide.

``Some time is still required for the implementation of market stabilization measures,'' Adnan Afridi, managing director of the Karachi Stock Exchange told reporters today. Shaukat Tarin, the Prime Minister's finance adviser will visit the exchange on Oct. 31, after which a decision about ending curbs will be taken, he said.

The Karachi Stock Exchange's benchmark KSE 100 Index has lost more than one-third of its value this year. Board members met over the weekend to discuss extending the curb, which was scheduled to be lifted on Oct. 27. The board also discussed ways to prevent possible violence by angry investors.